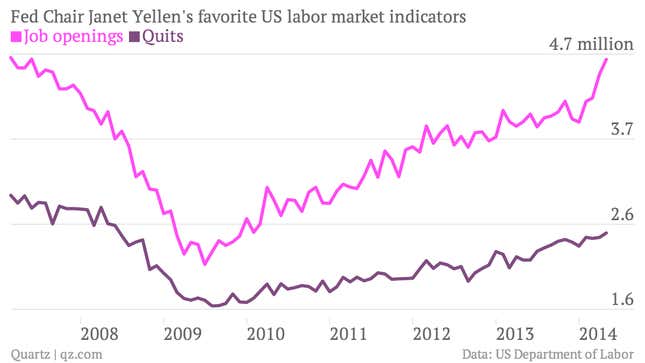

Today the US government released an important assessment of the labor market: The number of job openings compared with the number of people quitting their jobs. In a healthy economy, businesses are hiring more, giving workers enough confidence to leave their current jobs in search of a better opportunity. The opposite happens in a recession—as you can see in 2009 and 2010, when hiring plummeted and fewer people left their jobs.

Today, we learned that in job openings soared up by a seasonally-adjusted 171,000 in May, the largest single increase in years. While this is just a preliminary number and will be revised, a big month of hiring in June suggests that these figures are to be believed. And while we care about this because it’s an important sign, it’s also good to know who else thinks it is important: Fed Chair Janet Yellen, who outlined her labor market dashboard in a speech last year that included both these figures.

The Fed is now on a pace to gradually tighten monetary policy, reducing the size of its bond-buying program, with many board members expecting hikes in interest rates to begin sometime next year. The fear among some observers is that the Fed is getting too hawkish too early, before unemployment really subsides—remember, while the rate today is 6.1% and falling (from a height of around 10% during the worst of the Great Recession in 2009), today’s levels are still about the same as peak unemployment during the previous recession. And long-term unemployment still remains stubbornly high.

Still, if these labor market results bear out, with job opportunities and quits growing as the unemployment rate continues to recede, that could give Yellen and her colleagues at the Fed more confirmation that they are striking the right balance between encouraging employment and keeping prices stable.