If further proof of the fundamental importance of sports to the US television industry were needed, then consider this: The two most watched programs in the history of cable TV aired last week. They were both college football playoff games.

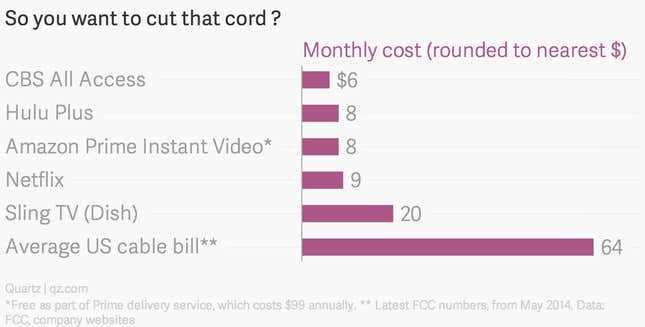

Sport, and specifically ESPN, the biggest cable sports network, is seen as the main thing holding together the existing pay TV paradigm (the “cable bundle,” which typically forces you to subscribe to lots of channels you don’t want, or need). Now Dish Network, a satellite TV provider, has launched a new internet service that will allow people to access ESPN (and a few other channels) without a full cable subscription, for just $20 a month.

The new service from Dish may or may not change the US TV industry forever. But its launch also raises another, more immediate question. If ESPN now effectively costs $20 a month, then how much will another big media company, Time Warner, be able to charge for internet-only access to the jewel in its content portfolio, the insanely popular premium channel HBO?

Setting a price is not as easy as you might think.

Like Dish’s plan for Sling TV, Time Warner says the internet-only HBO product will be targeted at the 10 million (and growing) American homes who don’t subscribe to cable.

Barclays Capital estimated last year that Time Warner currently makes about $8 per month from each HBO subscriber. (The service typically costs consumers $15 a month, but some of that money goes to the cable companies who exclusively distribute it.)

However, Time Warner wouldn’t be able to simply price the new internet-only service at $8 and reap the same financial rewards. Going direct to consumers means the company will have to incur all the costs associated with delivering the service, including upgrading HBO’s (at the moment quite shaky) streaming infrastructure, and shelling out cash to market and advertise it.

What’s more, at $8 a month – the same price as other streaming services that don’t have HBO’s impeccable original content pedigree – Time Warner might quickly discover that demand for an internet-only service would go far beyond just the 10 million homes without broadband. In other words, it would risk cannibalizing HBO’s extremely lucrative core business.

Barclays concluded that HBO’s internet-only price point may be “not too far way” from what it currently costs through cable (i.e around $15, as some media reports suggest it will be). Such a price”is unlikely to completely mitigate cannibalization, but may still be additive overall to the company,” the analysts wrote.

Forrester Research, meanwhile, has suggested that HBO adopt a three-tiered pricing structure, with the following options:

- A $10-a-month basic package, available through existing ISPs (who are also HBOs current cable company distributors) as an add on to broadband access This package would offer access to HBOs shows as they appear on cable, plus limited archive and on-demand content

- A standard $15-a-month package through ISPs or $20 a month directly from HBO offering basically what already exists today – all new and archived content

- Lastly, a new “plus” package, for $20 a month through ISPs, or $25 directly from HBO, offering everything in the standard package, together with additional exclusive content and features.

At a conference in New York I attended last month, Time Warner’s CEO Jeff Bewkes hinted that the company is exploring a multi-tier pricing approach for its internet-only offering. Doing so could be smart. Academic studies have shown that when presented with multiple pricing options, consumers tend to gravitate to the middle option. As The Atlantic’s Derek Thompson explained, there is really no logical basis for this. It’s simply because we “don’t like feeling duped, and we don’t like feeling cheap.” (In marketing lingo, this strategy is known as decoy pricing).

Introducing a premium tier could convince people to opt for the standard package, rather that downsize to the cheapest option. It could also ”test the limits of the audience’s willingness to pay” for HBO, says Forrester, and potentially unlock millions of dollars in additional revenue if it actually becomes popular.

Does the idea of a standalone HBO costing viewers more than twice the cost of Netflix and roughly equal to the cost of ESPN pass the smell test? That really depends upon how much you value (and are prepared to wait for) access to high quality, culturally relevant, dramatic content.

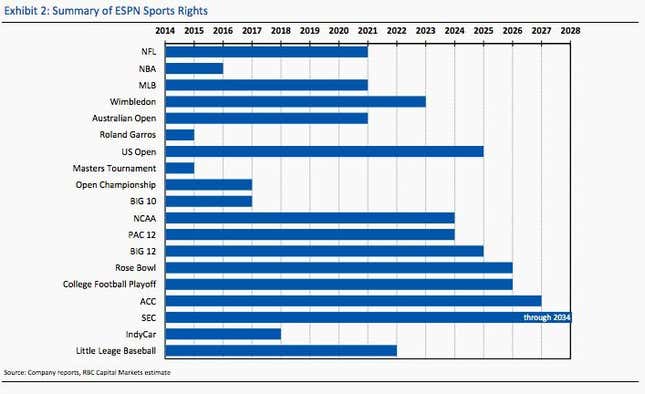

ESPN has a tremendous amount of high quality sports content in its portfolio.

And because of its live nature, sport is something people have long been conditioned to pay for.

Will the same apply for HBO when cost conscious consumers (i.e. underpaid millennials) have a cleaner, simpler way to pay for it? Given HBOs track record of churning out hit shows, and the ever present risk of spoilers on social media, not to mention the fact that the existing method of taking out hefty and opaque cable subscriptions doesn’t appeal to many, perhaps they will.

That said, if you have broad tastes in content (i.e. you are a sucker like me), and you like live sports but also can’t wait very long to watch the hot, new drama, then the cable bundle might end up being the best option after all. As the top chart shows, the cost of getting every streaming service out there (especially once HBO’s new service is confirmed) is rapidly approaching the cost of the average cable bill. And this doesn’t even take into account the cost of a broadband subscription.

One thing is clear. TV’s post-cable future, which not that long ago seemed like a distant dream, is coming much faster than most people thought.