The five best Wall Street trades of 2014

We already gave you the the bad news, so here’s the good. Again, we presume somebody made money on all these moves, though that depends on when they bought, when they sold and how much they paid for the opportunity. They were not paying us, that’s for sure. But biggest the gains of the year can tell you a lot about what’s going on in the world. So that’s what we’re giving you in lieu of sweet, sweet returns.

We already gave you the the bad news, so here’s the good. Again, we presume somebody made money on all these moves, though that depends on when they bought, when they sold and how much they paid for the opportunity. They were not paying us, that’s for sure. But biggest the gains of the year can tell you a lot about what’s going on in the world. So that’s what we’re giving you in lieu of sweet, sweet returns.

1. Beef Lattes

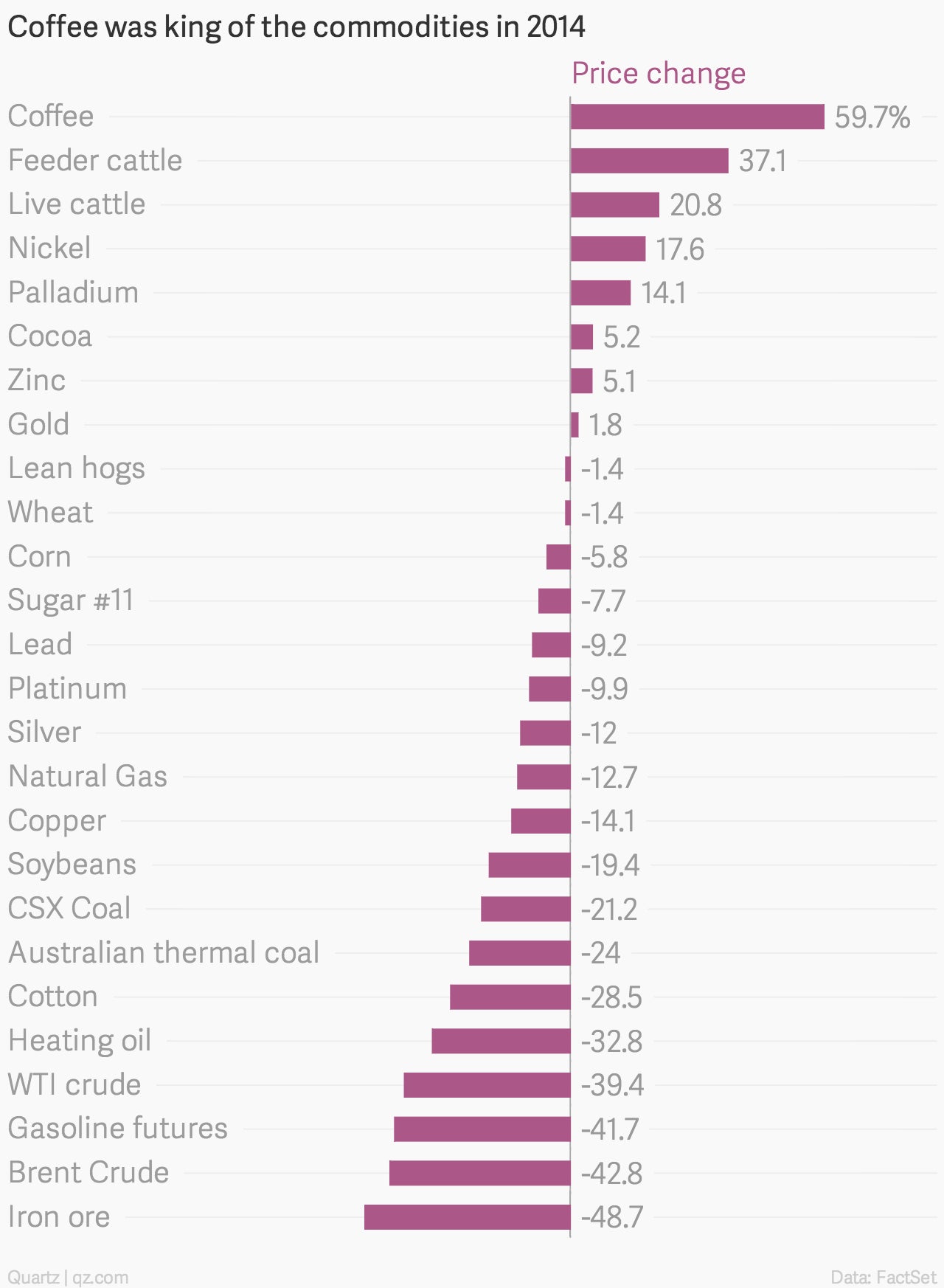

That’s not a real thing. But severe droughts in Brazil and the western US did cut down dramatically on the supply of both coffee and beef. And if you managed not to fall asleep during your Econ 101 lectures, you know that means prices go up! Which is exactly what happened.

Coffee prices spiked earlier this year, forcing chains like Starbucks and Dunkin Donuts to pass the hike onto customers. Brazil got some rain this fall, so the java jump is over. But the much of the American West—until this week, at least—is still a vast, arid expanse (paywall), so cattle herds are still small and prices are high enough to bring back cattle rustling.

2. Billionaire dollar store whimsy

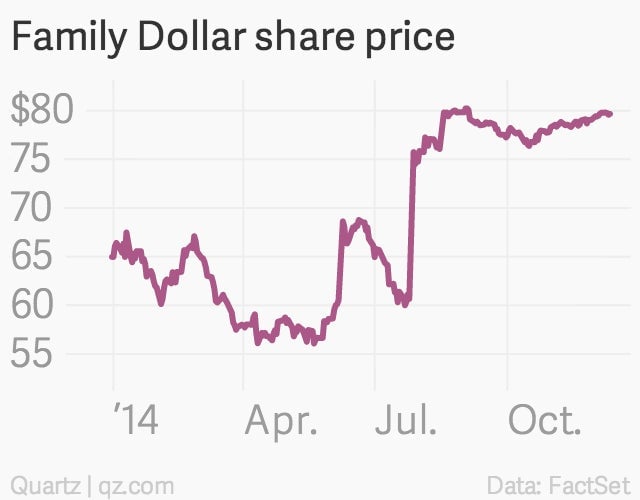

Carl Icahn is an activist investors, which means he buys big chunks of public companies, harangues them into making changes and profits on the resultant stock gains. He did just that earlier this year with Family Dollar, announcing in June a 9.4% stake in the low-cost retailer. He proposed that the company put itself up for sale, which it did. That turned into a bidding war between Dollar Tree and Dollar General. As of now, Family Dollar is sitting on an $8.5 billion offer from Dollar Tree, though the matter seems far from settled. But none of that matters for Icahn. His work done when the stock surged, he jumped out of the stock months ago for a reported gain of $200 million.

3. The Almighty Dollar

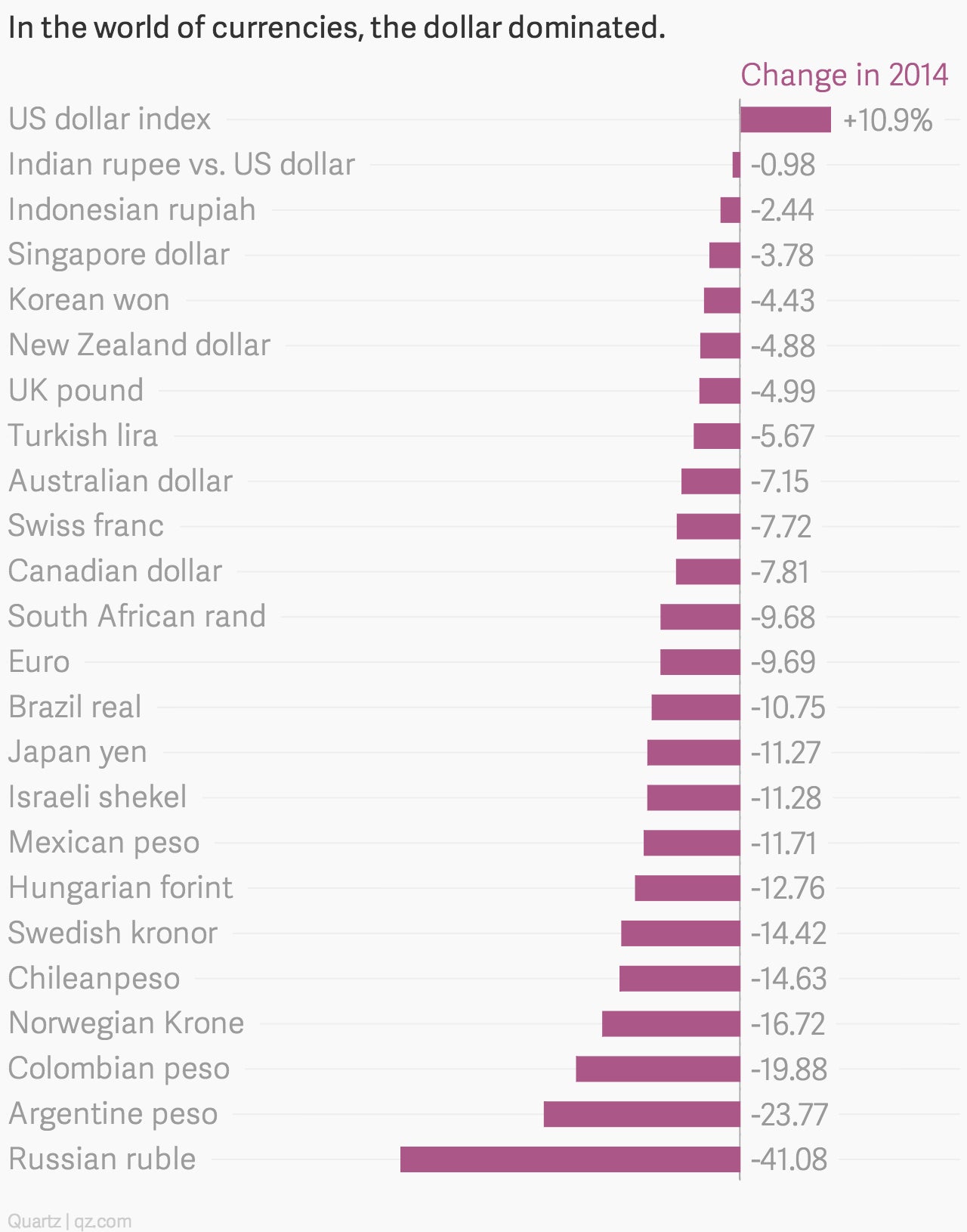

The US is doing almost singularly well among developed economies. And so is the US dollar among major currencies. So investors are flocking into greenbacks to ride out the storm elsewhere.

As the Federal Reserve winds down its bond-buying program, the European Central Bank is attempting to get its own party started and the Bank of Japan is slamming open its own spigots, helping to make those currencies cheaper and driving the dollar to its most expensive level in five years. In many cases, a strong currency hurts economies because it makes exports more expensive. But it makes imports cheaper for American consumers, who are saving money on cheap gas anyway, so go ahead and buy that house you’ve been eyeing on Snapdeal already!

4. Old World Obligations

Speaking of the ECB, foreign exchange traders aren’t the only ones trying to get in on the stimulus action. Bond investors have been bidding up European government debt in the hopes that the ECB (or some other investor) will take them off their hands later if Germany actually allows the whole thing to go through. To be sure, not all eurozone debt is the same (looking at you Greece), but it’s been a pretty broadly hot category this year.

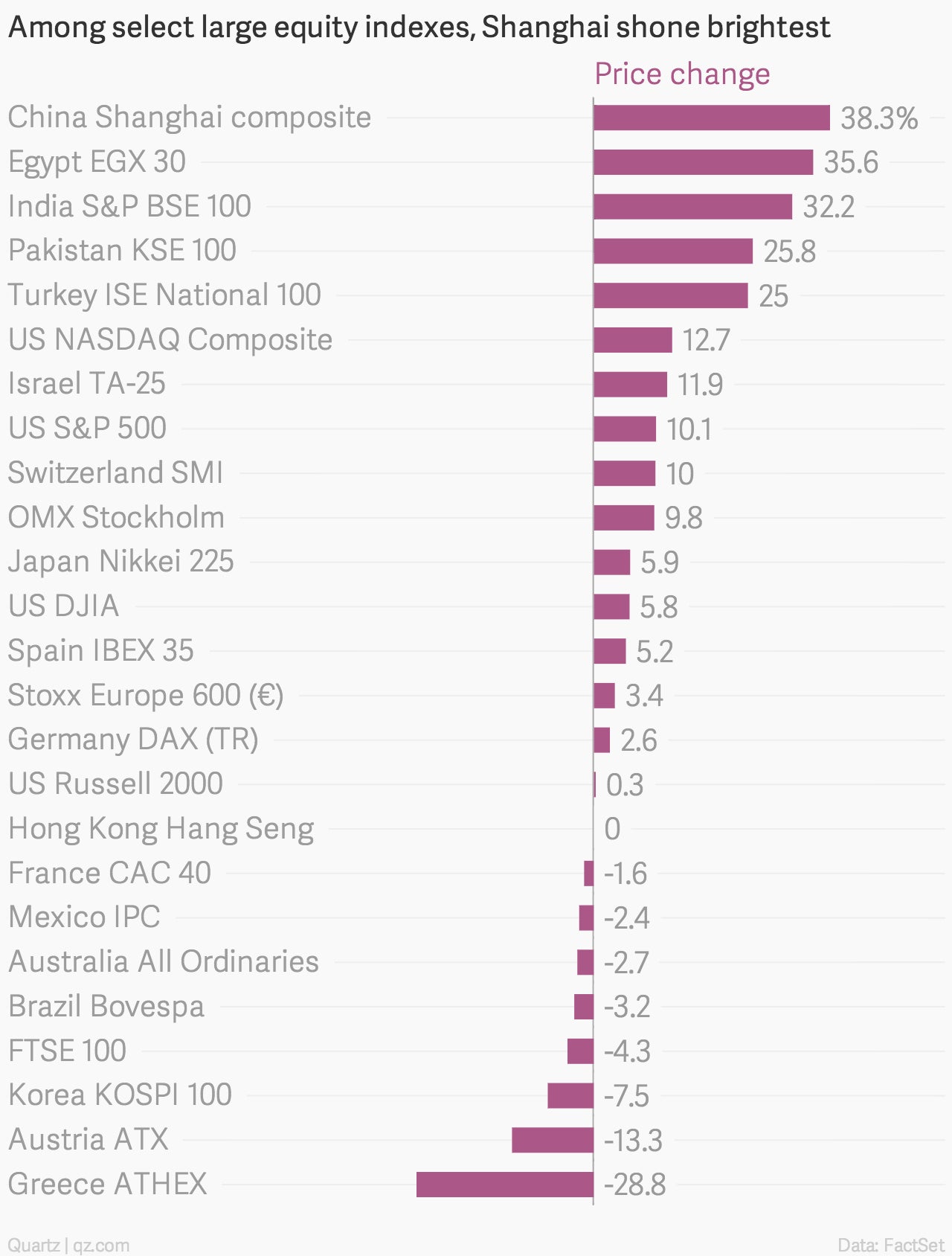

5. Chinese Stocks

The Shanghai Hong Kong Stock Connect, also known as the “Through Train,” has picked up a few passengers since it left the station last month. It was in the works for a while, but Chinese officials delayed its launch amid the Umbrella Movement protests in Hong Kong. This week’s minor meltdown notwithstanding, they still did pretty well for the year.

But it’s curious that a country’s stock market can be doing so well when its underlying economy seems to be going in the opposite direction. Where’s the money coming from? Like in so many other parts of the Chinese economy, the answer is leverage.

Here’s Quartz’s Gwynn Guildford to explain some of that dissonance:

But if leverage has been around for two years now, why are mainland-listed shares only now rallying? Because the Chinese government has been drumming up enthusiasm for stocks, including in its surprise launch of the Shanghai-Hong Kong Stock Connect—which, so far, has boosted A-shares minimally. It has also encouraged investment in its state-run press.

“The government may be hoping, by engineering a buoyant stock market through words and deeds, companies can raise equity (rather than debt) so the whole economy can de-leverage,” writes Cui, adding that a stock boom also should boost consumption by making people feel richer.