The Chinese stock market gold rush continued this week

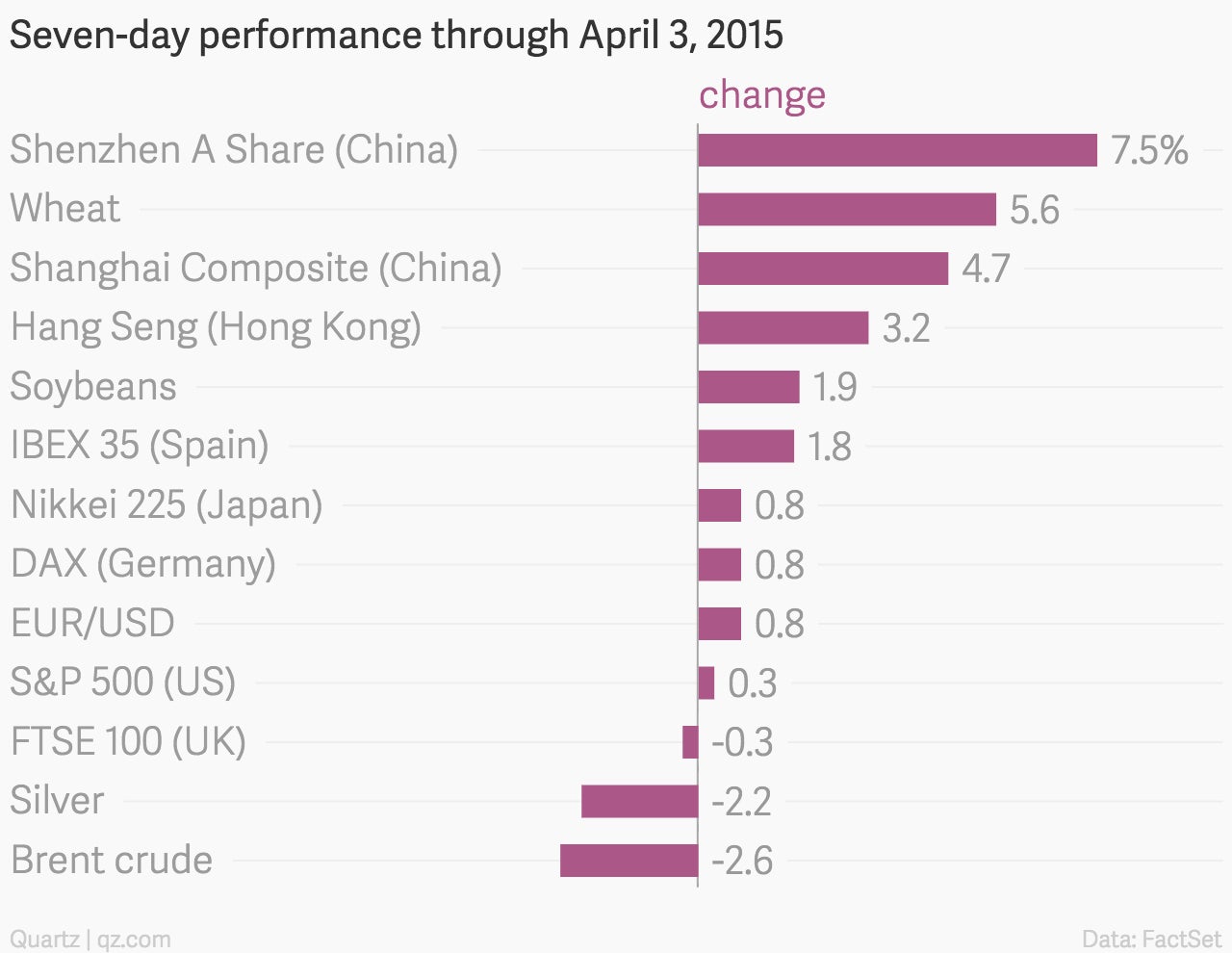

China’s stock market is on fire this year. It’s up more than 47% in just a few short months; that includes a 7.5% surge in the last week alone, making it a standout in world markets.

China’s stock market is on fire this year. It’s up more than 47% in just a few short months; that includes a 7.5% surge in the last week alone, making it a standout in world markets.

That’s the kind of eye-popping performance that invites lots of skepticism, and there’s no shortage of that.

Quartz has noted that:

- Chinese stocks are increasingly divorced from the country’s economic reality.

- Unsophisticated, less-educated investors are flooding into the market.

- Leverage of questionable sustainability is propping up a big portion of the rally for investors and companies alike.

The research firm Capital Economics, in a note to clients, suggests that a big chunk of the action is coming from the People’s Bank of China, which has been cutting benchmark interest rates to spur investment amid an ongoing economic slowdown.

And since things aren’t exactly peachy just yet, the firm said to expect more easing to come. Whether that will translate into a longer rally is another question.