Giant corporations are confident enough to start feasting on one another again

The mega deal is well and truly back.

The mega deal is well and truly back.

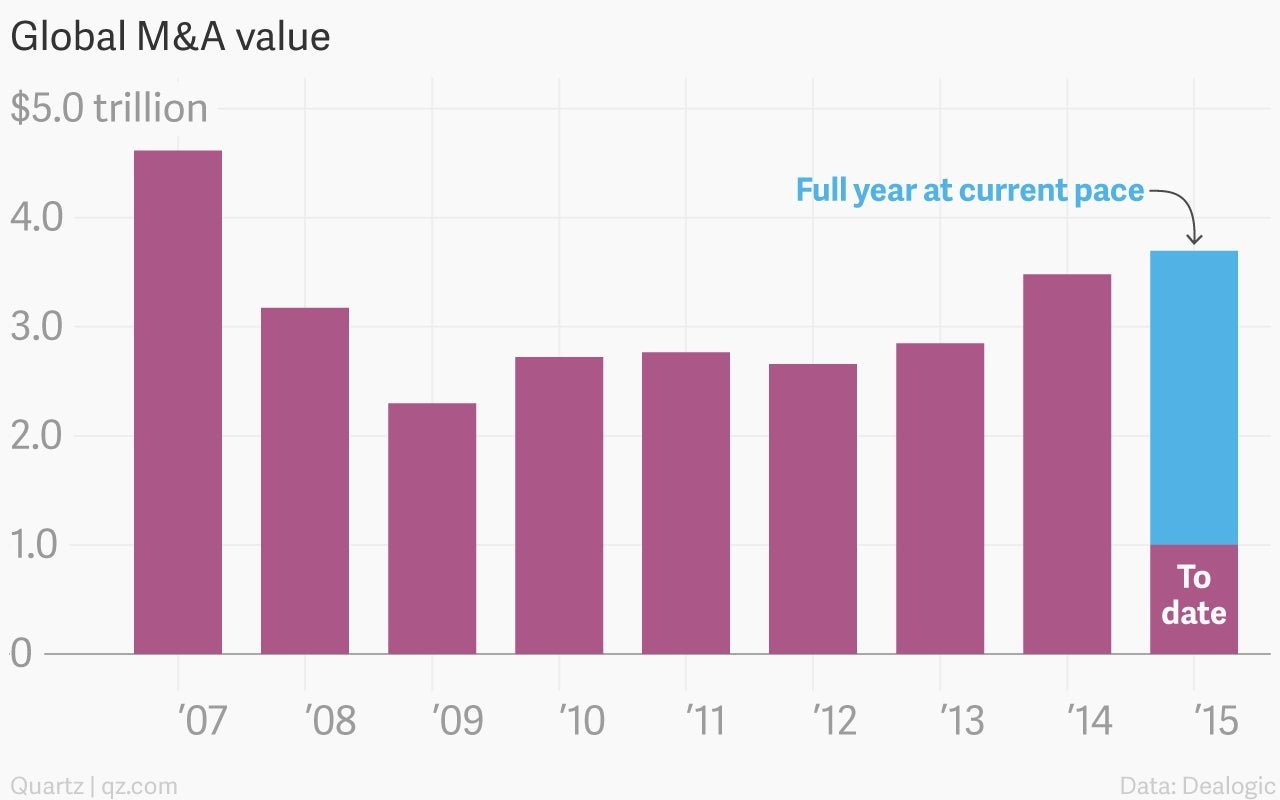

The value of mergers and acquisitions announced globally in 2015 has crossed the $1 trillion threshold, according to Dealogic—and its only April!

Huge mergers announced in recent weeks include processed food company Kraft’s proposed purchase of Heinz for about $40 billion, and oil giant Royal Dutch Shell’s planned acquisition of BG Group for nearly $70 billion.

The first three months of the year represented the best first quarter for M&A since 2007, according to Dealogic. As the Wall Street Journal (paywall) points out, if the frantic pace of companies devouring each other keeps up, it will also be the best year for M&A since then. (That year, 2007, remains M&A’s best on record, with deals worth $4.6 trillion getting done—just before global markets descended into chaos.)

The resurgence in M&A eight years on suggests that corporate boards are finally getting confident again. Borrowing costs are still low, and share prices are strong, making big deals easier to finance. On top of this, the US economy is looking fairly good, and even Europe is improving, offsetting some of the worries about a faltering China.

The return of the mega-deal is great news for M&A bankers, and the Wall Street firms they work for. It is perhaps not so great for shareholders in the companies doing the acquiring; academics have suggested that M&A (particularly large-scale M&A) typically destroys value rather than enhancing it. There are exceptions to every rule of course, and boards will be hoping that the companies they acquire turn out to be the bargains.

As for whether an upswing in M&A means anything for the broader economy, that is not really clear. But if companies are no longer hoarding cash and are ready to spend money devouring others, maybe they will be confident enough to invest in infrastructure, hire people, and boost wages. Now that would really be something.