America’s largest banks will report first-quarter results this week ,and things are starting to look good again: JP Morgan Chase, Citigroup, Wells Fargo, Goldman Sachs, Bank of America, and Morgan Stanley all passed the Federal Reserve stress tests, and were able to boost the amount of cash they can return to their shareholders. The billions of dollars they are collectively spending on compliance and legal costs are expected to start declining—or at least leveling off —and analysts are forecasting signs of a trading recovery.

Still, we’re playing a game of low expectations here. Take Goldman Sachs, for example: first-quarter trading revenue from fixed income, commodities, and currencies might rise this quarter, but Goldman hasn’t posted a year-over-year increase in FICC revenue since 2009. A decline in IPOs and M&A advising this past quarter—which has been on an absolute tear as of late—certainly won’t help results, and worries persist over possible effects of the energy bust.

Banks have been building up capital cushions to protect against future financial meltdowns (and comply with new laws), which has made it harder for them to turbocharge profits. Add in compliance costs and hefty lawsuits, and bank executives face a scenario where cutting costs have become paramount to driving revenue.

“Expectations for earnings growth are relatively low without the tailwind of rising interest rates,” Credit Suisse analysts note. So any “signs of unexpected strength—top line or efficiency driven, would be a plus.”

Four other things to watch out for when banks report earnings this week:

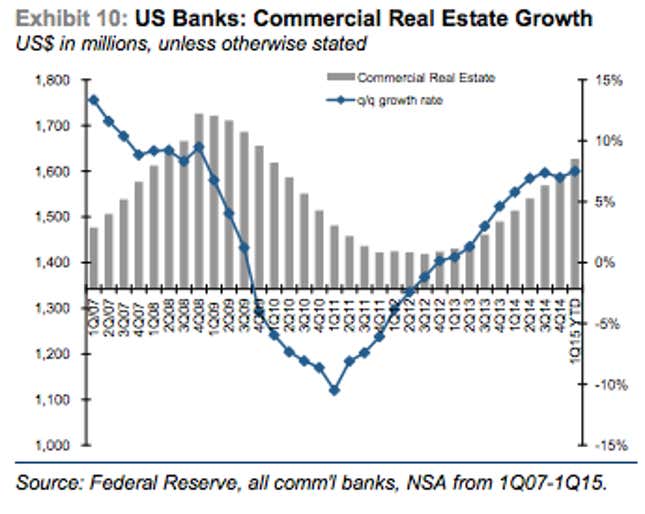

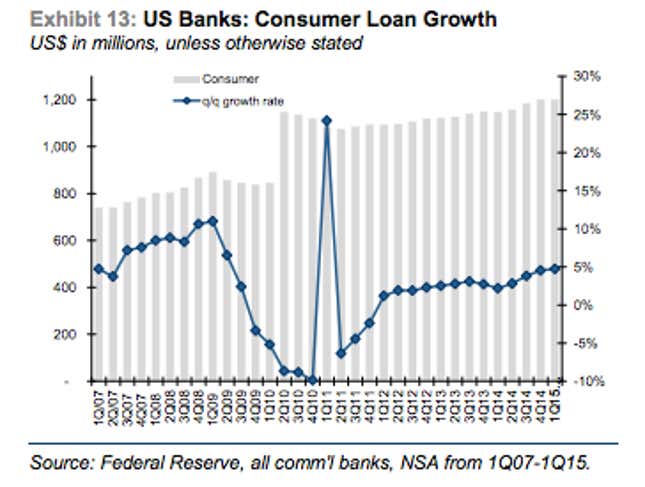

Loan growth: Commercial and industrial loans, as well as commercial real estate, have been driving loan growth lately. We’re looking for any indication that US consumers are also starting to feel more comfortable borrowing money now that we’ve seen some recent signs of life in the mortgage, home equity, and credit card businesses.

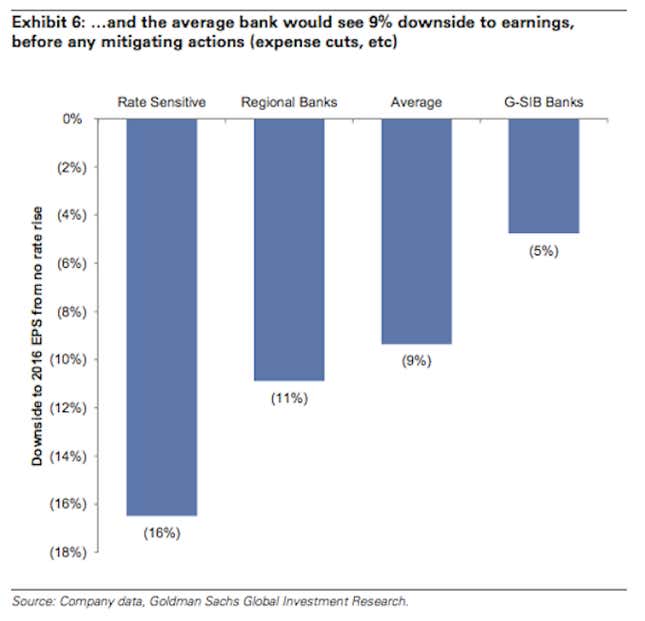

Interest rate risk: Most financial institutions have been banking on the Fed raising interest rates by September. If rates don’t raise this fall, the average bank could see a 9% drop in 2016 earnings, Goldman Sachs estimated in a recent analyst note.

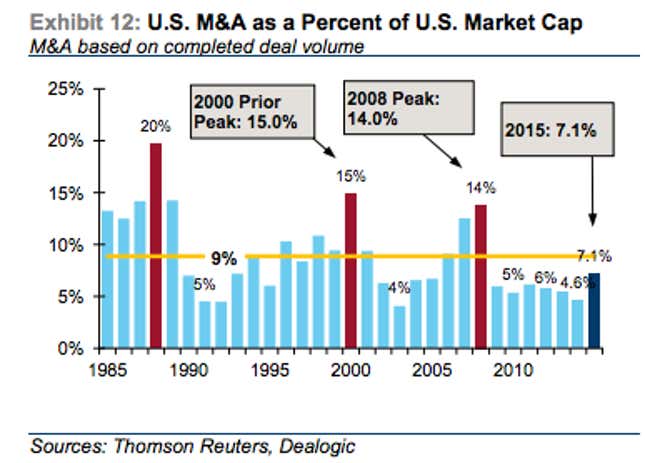

M&A activity: After a knock-out 2014 for IPOs and M&A, things have slowed down. That means less money for the banks that advise, orchestrate, and trade on these deals. But analysts at Credit Suisse say there’s still more room to run. They looked at M&A activity levels as a percentage of overall market capitalization, and found that US activity is running at 7.1% of US 2015 market cap, below its 9% historical average.

Break-up talk: JP Morgan CEO Jamie Dimon recently used his annual shareholder letter to argue—yet again—against breaking up the giant bank. Meanwhile, break-up talk has turned to Bank of America, where the SEC told the mega bank it must allow shareholders to vote on a proposal to spin off its investment banking business.