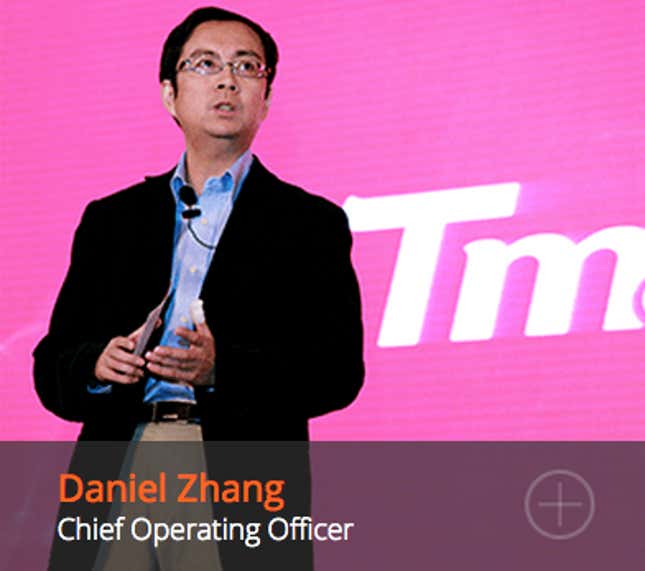

It’s out with the old at Alibaba—quite literally, in fact. In its earnings announcement the Chinese e-commerce giant revealed that it’s swapping out current CEO Jonathan Lu, replacing him with the slightly-younger Daniel Zhang, Alibaba’s COO.

“[T]his marks a future where the post-70 generation will command the troops at Alibaba Group!” wrote Jack Ma, Alibaba’s founder, in a letter to employees, according to the Wall Street Journal (paywall). (The “post-70 generation” is the common Chinese expression for people born in the 1970s, used in the same way “Gen-X” would be in American English.)

Investors seem to be buying it. The NYSE-traded stock is up 7.5% so far today.

Though Zhang is just two years younger than Lu, he squeaks into this generational shakeup, having been born in the early 1970s. The move was part of a bigger managerial rejuvenation plan; In addition to Zhang’s appointment, Ma’s letter also revealed the promotion of four other post-70s employees to the executive team. Lu, who has long been the quietly efficient managerial foil to Alibaba’s charismatic and often outspoken founder, will retain a set on the board.

The beginnings of Ma’s revitalization plan were evident when he picked Lu to replace him as CEO in 2013—even as he seemed to hail Lu as an example of new blood.

“The internet is a world for young people,” Ma said in March 2013 (link in Chinese). “We want to give leadership to ’70s- and ’80s-era colleagues, because we believe they are much better than we are at understanding the future.”

As Quartz’s Jason Karaian has explained, CFOs are often made COOs as part of their grooming for CEO. While little is known about Zhang besides his financial bona fides, those are quite clear. After many years working for top accounting firms, he served as CFO of Nasdaq-listed Shanda Interactive, an online games company, from 2005 until 2007, when Alibaba hired him as Taobao’s CFO. In Sep. 2013, Zhang was named COO.

Age alone might not be the biggest factor behind Zhang’s promotion. It’s possible that investor pressure to improve share price performance prompted Ma to put a heartless number-cruncher in charge of cleaning up Alibaba’s finances.

Just months after Alibaba’s wildly successful NYSE IPO, the stock plummeted, dragging the company’s value down by around $70 billion. This was largely due to a bizarrely public tangle with a Chinese government official over the alleged (but in China, widely assumed) prevalence of counterfeit goods on Alibaba’s consumer-to-consumer marketplace. Then in April, Ma announced a hiring freeze, saying the company had grown too quickly.

In today’s earnings announcement, the Chinese e-commerce giant said it rang up 17.4 billion yuan ($2.1 billion) in revenue for the quarter ended March 31—up 45% from the same period of 2014. Still, there are signs that the fake-goods foofaraw might still have hurt Alibaba. Due to the Chinese New Year holiday, the first quarter’s gross merchandise volume (GMV)—the measure of sales on its platform, which is important because Alibaba makes money from commissions and marketing fees—always comes in less than the previous quarter. However, this year’s quarter-on-quarter drop of 24% was bigger than the corresponding 18% decline a year earlier.