Australia has not had a recession since the early ’90s. Its stock market is booming. And businesses feel confident. But the party is winding down. The Reserve Bank of Australia (RBA) said last week that growth will slow to 2.5% this year from 3.5% in 2012. Here’s why:

Mining investment is slowing. Australia powered through the global financial crisis thanks to burgeoning Chinese demand for its iron ore, coal and other resources. But global miners over-invested, and now they are pulling back. The RBA expects mining investment to slow this year (pdf, p. 2), and the Financial Times says miners will soon decide (paywall) whether to halt more than A$125 billion (US$129 billion) worth of mining projects. Chinese iron ore demand has risen so far this year, but Chinese steel mills could be restocking temporarily after letting stocks fall last year when the economy was slowing. Miners also have to grapple with high costs in Australia due to the persistently strong Aussie dollar.

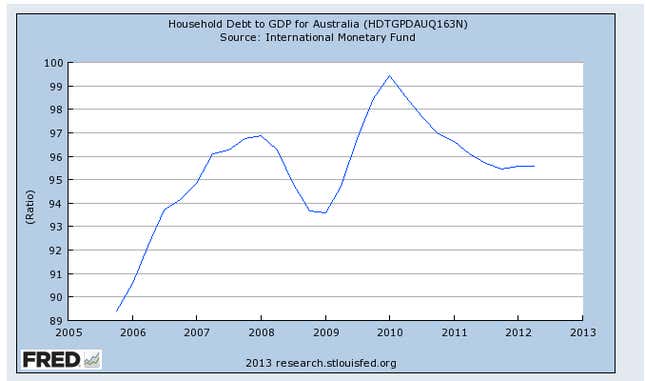

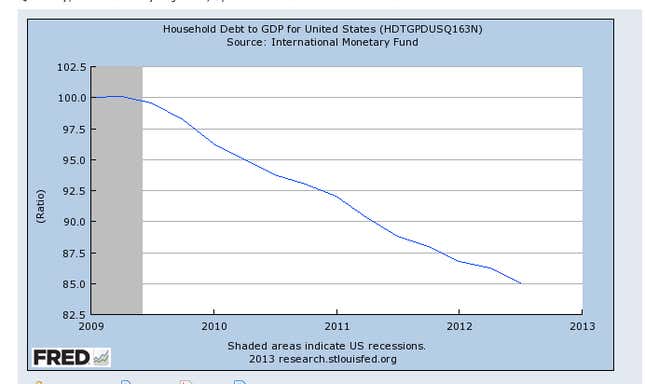

Households have high debts… Having sailed through the financial crisis on that wave of resources demand, Australia’s households weren’t forced to cut credit card and mortgage debt, as America’s were. Australia’s household debt-to-GDP ratio currently stands at 95.5%, compared to 85% for the US.

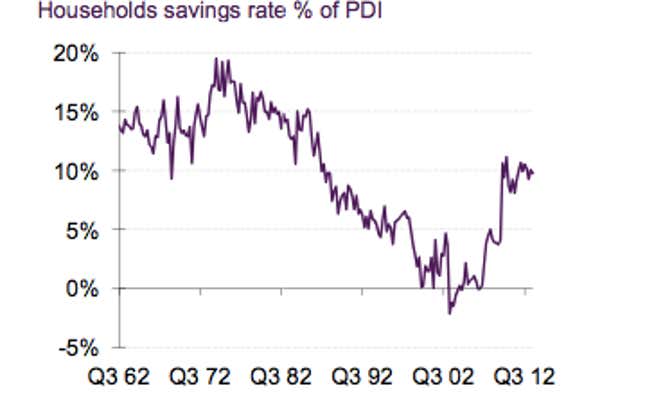

…but they are starting to save again… Lombard Street Research economist Kasia Zatorska wrote recently that Australians now have a “desire to delever”. Household savings have risen to 10% of disposable income, above the country’s ten-year average. In fact, households have been squirrelling cash away for months in a “knee-jerk reaction to uncertainty,” Commonwealth Securities chief economist Craig James said last September. While businesses and stock-market investors remain bullish, Australians are becoming unnerved by softening house prices, which have fallen for two years in a row. Zatorska also notes that new home loans are currently 25% below their 2007 peak.

…as incomes fall: all bad news for consumer businesses.

Australia’s central bank has cut interest rates from 4.5% a year ago to 3% to drive the economy through the slowdown. Zatorska doubts this will work, writing: ”the outlook for private consumption growth continues to be muted, undermined by declining real national income and household de-leveraging.”

Reining in spending is a big change for Australians, hitherto enthusiastic consumers. During the resources boom and subsequent labor shortage, miners especially became extremely wealthy, in some cases earning $200,000 a year. That trend spawned satirical websites, such as “Things Bogans Like“—bogan being Australian slang for unsophisticated blue-collar workers, recently described as ”waterfront-dwelling, Harley-owning, plasma-watching ingrates who… decided to double their yearly power bill by desecrating their front yard with Christmas lights.”

But unfortunately for Aussie retailers, the bogan’s high pay may be falling. In the past few weeks, BHP Billiton, its rival Rio Tinto and mineral sands miner Iluka have all announced job losses.