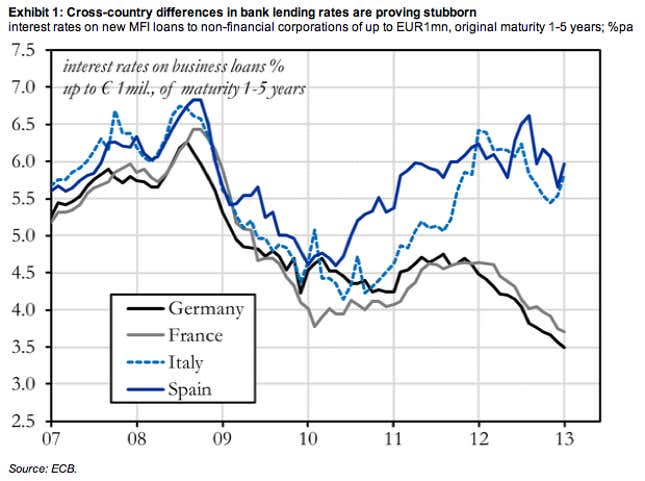

Wall Street is aflutter with chatter that the European Central Bank (ECB) could adopt new measures to help small- and medium-sized enterprises (SMEs) access cheaper funding. As we pointed out last month, small businesses have been the real losers of the euro crisis. Italian and Spanish banks are increasingly afraid to lend because more and more of their customers aren’t paying back their loans, and regulations forcing banks to hold on to more capital aren’t helping matters.

So while banks will bend the rules for big companies that are less likely to fail, they’re spurning small companies. Less cashflow and more susceptibility to regional and industry-specific or personal shocks make SMEs a bad bet for banks. ECB President Mario Draghi cited the lack of lending to SMEs in peripheral Europe as a key problem facing the euro area.

If it does anything, the ECB would probably start accepting packages of loans to SMEs (called asset-backed securities, or ABS) as collateral against which banks can borrow from the ECB’s virtually unlimited coffers. Theoretically, an ongoing ABS program of this sort would incentivize banks to issue more loans to SMEs. European banks charge business owners, say, 6% to borrow. If these banks use this collateral at the ECB, the central bank will lend them money at a far cheaper rate, say 1%. Therefore, European banks would make the carry, or difference, between the price they charge (6%) and the price at which they can access cash to use for other purposes (1%).

Sound familiar? This is more or less the same theory that drove banks to buy up peripheral European sovereign debt in late 2011 and early 2012 in two three-year long-term refinancing operations (LTROs). Banks took the advantage of making the difference between the yield governments were paying to borrow (as high as 7% or more) and the cost at which they could borrow from the ECB (as low as 1%).

Admittedly, loans to SMEs are generally much riskier than those to sovereigns, so any program would probably require guarantees from somewhere safe (ahem, Germany) that would prevent local banks and the ECB from taking losses on these loan packages if the euro economy continues to go south. Otherwise, lending to risky businesses is a dangerous game for both parties.

In a note published last month, Rhodium Group analyst Jacob Funk Kirkegaard considered how this would work:

The euro area needs to kick-start non-bank intermediated credit to its non-financial sectors, and to establish deeper corporate bond markets, because banks are now less able to do so. Perhaps the European Commission or national governments could offer partial fiscal guarantees to ABS made up of SME loans (a bundle of loans from small and unrated SME borrowers) to induce the ECB to step in. With Frankfurt backing this up, real money investors like pension funds and others should be willing to enter, too, and thus rekindle such a credit market.

A program like this could be a watershed, if it were actually carried out. An operation that would encourage banks to lend to small businesses with little risk would put a floor on the crisis in economic terms. It’s a means of combatting austerity policies which have pushed the euro zone (and particularly, the euro periphery) into a recession. It would also pull banks farther away from struggling sovereigns because the fate of governments would have less of an effect on whether SMEs—really, pillars of the economy—can fund their operations. Last but not least, it would “give more liquidity support to the weakest banks that may lack eligible collateral to obtain cheap liquidity,” writes Nordea Markets analyst Anders Svendsen.

But before you get too excited, it’s not clear that the ECB feels the crisis is bad enough to warrant drastic action yet, and it has used market angst to put pressure on leaders to make progress on reforms in the past. Like the LTRO programs, it may use an SME program as a kind of reward for agreeing upon institutions that will help euro leaders create a more stable fiscal union. Moreover, the bank has repeatedly resisted the most straightforward means of loosening credit: cutting its target interest rate.

Even if it is announced, an ABS program doesn’t necessarily go far enough. It’s likely to be a temporary program, with a handful of opportunities for banks to borrow from the ECB. Like the LTRO, then, the effects of such a program would eventually expire. Moreover, this isn’t like quantitative easing in the US and UK, where central banks have actually purchased mortgage- or asset-backed securities. European banks will eventually end up with these loans back on their balance sheets.

Then again, maybe it’s better than nothing.