Boeing is restarting talks to end a strike some compare to an economic Hurricane Helene

Oxford Economics compares the work stoppage's impact to Hurricane Helene's economic hit

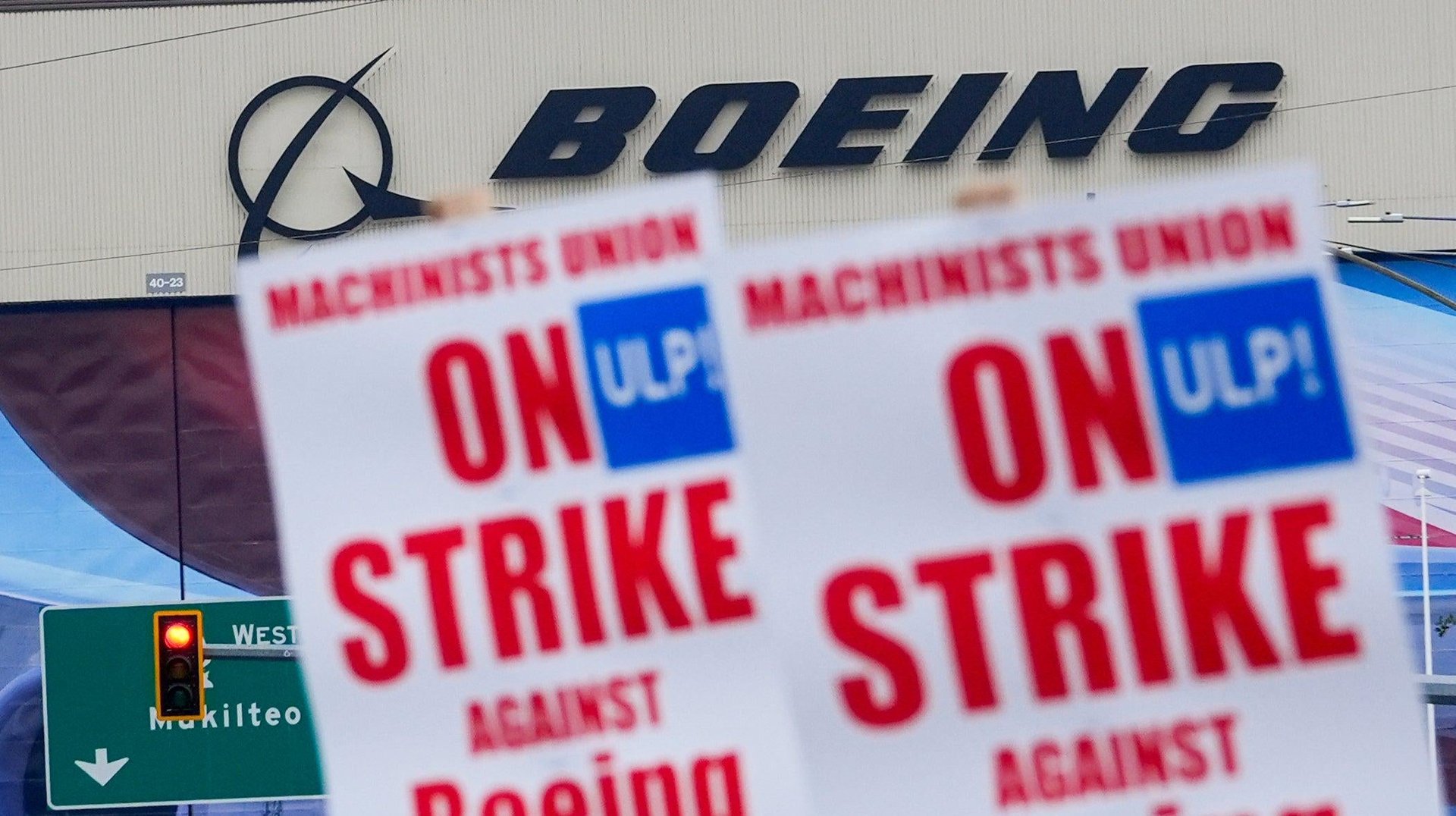

Boeing (BA) is back at the table with the machinists who have been on strike for more than three weeks. Some economy observers are comparing the work stoppage’s impact to that of Hurricane Helene.

Suggested Reading

“There are idiosyncratic factors that can cause swings in GDP from quarter to quarter,” analysts at Oxford Economics wrote in a recent note. “The recent hurricane in Florida and the Carolinas and the Boeing strike have the potential to weigh on GDP growth for the remainder of the year.”

Related Content

As the strike continues, its economic impact grows larger. There’s already some worry that it will throw off the November jobs report. There are more than 30,000 IAM workers off the job plus Boeing-initiated furloughs and other possible follow-on effects at Boeing suppliers.

The union representing the workers, the International Association of Machinists, confirmed Friday that talks are back on to end the strike.

“We want to inform you that your Union Negotiating Committee and Boeing will meet with the Federal Mediation and Conciliation Services (FMCS) to continue mediated negotiations on Monday, October 7, 2024, at 9 AM,” the union told its membership.

The current stalemate between Boeing and the IAM comes down to a few percentage points. During previous negotiations, the union had been seeking a 40% raise for its members. Boeing presented a contract offer with a 25% raise. The union rejected that contract and went on strike. The company came back with a “best and final” 30% bump offer. The union rejected that as well.

Although the two sides met at the bargaining table late last month, discussions quickly fizzled out after talks to revive Boeing’s pension made little progress. The stalemate is proving costly for both sides: Boeing cut off striking workers from their company insurance plans last week; until Boeing can get them back on the factory floor, the company should expect to burn about $50 million a day in cash.

Boeing did not immediately respond to a request for comment.