Chipotle isn't worried about Trump's tariffs — or guacamole

The burrito maker says only 50% of its avocados come from Mexico

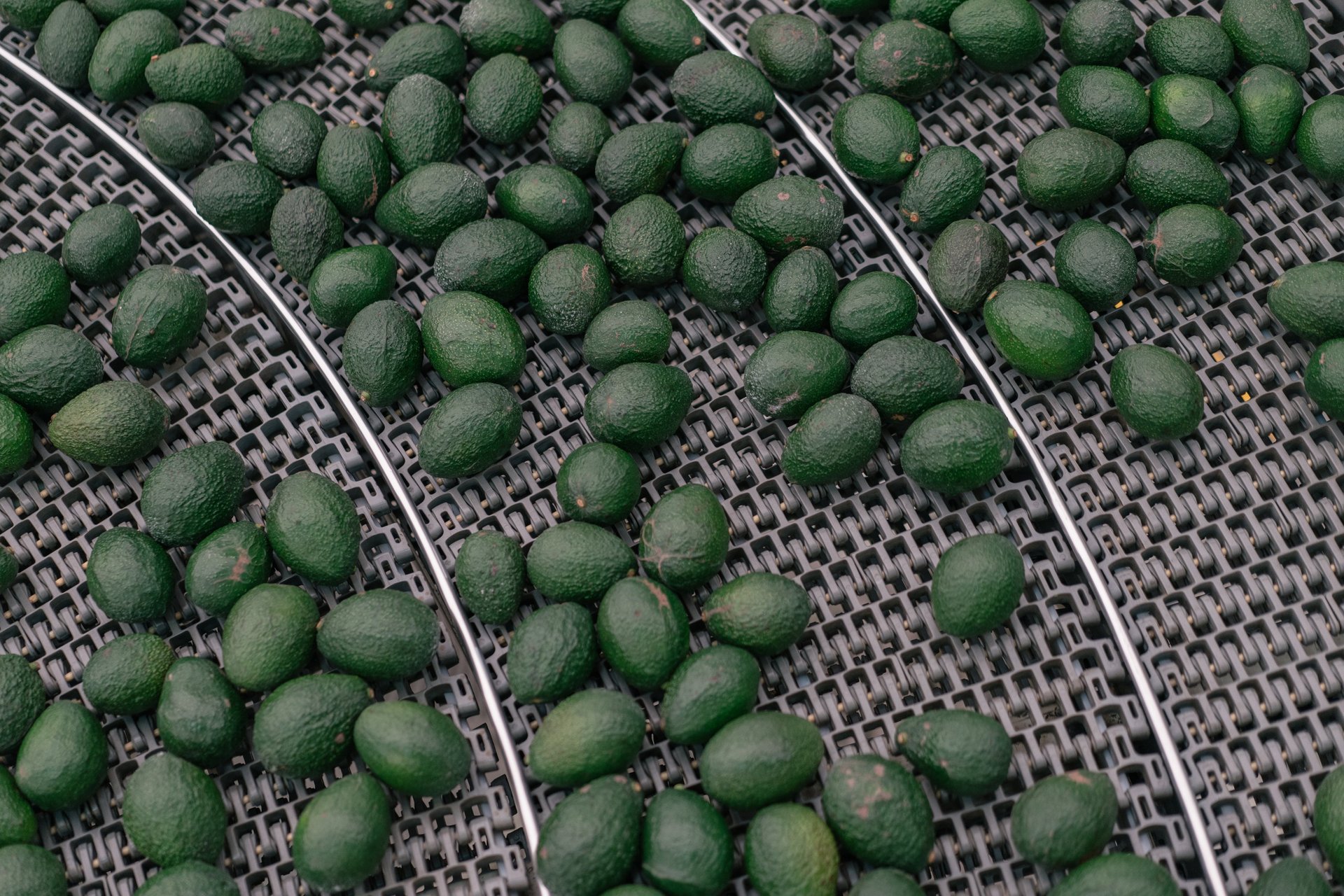

Chipotle downplayed concerns about potential tariff hikes on imported ingredients like avocados and chicken during the company’s Feb. 4 earnings call.

Suggested Reading

Despite the possibility of tariffs on goods from Mexico, Canada, and China, the burrito chain believes it will not face a major cost increase. This is largely due to its diversification of avocado sourcing.

Related Content

“We source from Colombia, Peru, and Dominican Republic,” CEO Scott Boatwright said. “Only about 50% of our avocado supply today is coming out of Mexico.” This strategy helps mitigate risks if tariffs on key imports go into effect, he added.

President Donald Trump recently delayed a planned 25% tariff on Mexican and Canadian imports for one month, but if the tariffs are ultimately implemented, some of Chipotle’s (CMG) ingredients like avocados, tomatoes, limes, and peppers could become more expensive.

Adam Rymer, Chipotle’s CFO, stated that, “If the recently announced tariffs go into full effect, it would have an ongoing impact of about 60 basis points on our cost of sales,” which translates to roughly 0.6%. However, the company’s guidance for the coming quarter does not account for the potential effects of the tariffs. Less than 2% of Chipotle’s sales come from Mexico, and less than 0.5% from Canada and China combined, Rymer added.

Beyond tariffs, Chipotle has continued to invest in automation to streamline operations and meet increasing demand at some of its busier locations. In Sept. 2024, the company introduced two new robots, including “Autocado,” a machine that can cut, core, and peel avocados in just 26 seconds. It’s “Augmented Makeline,” helps assemble bowls and salads, which account for about 65% of digital orders. However, not all of Chipotle’s automation efforts have been successful. The company removed “Chippy,” a tortilla-chip making robot, after employees found it too cumbersome to clean.

Despite raising menu prices by 2% in Dec. 2024, Chipotle posted strong fiscal earnings, fueled by customer traffic. However, the company expects a slight decline in same-store sales growth for 2025.

Scott Boatwright, who took over as CEO in Nov. 2024 after Brian Niccol’s departure, now faces the task of managing costs and continuing to innovate with technological investments to keep the brand resilient.

For now, Boatwright says the company’s supply chain team has done well in diversifying vendors and reducing its dependence on Mexican imports.