Weekend edition—Grim guidance, Brexit dilemmas, porta-potty king

Good morning, Quartz readers!

Good morning, Quartz readers!

It’s all downhill from here.

That’s the theme of earnings season thus far, with a majority of companies beating expectations for sales, profits, and much else besides. Some 70% of S&P 500 companies that have reported fourth-quarter financial results in recent weeks surpassed earnings expectations, according to FactSet.

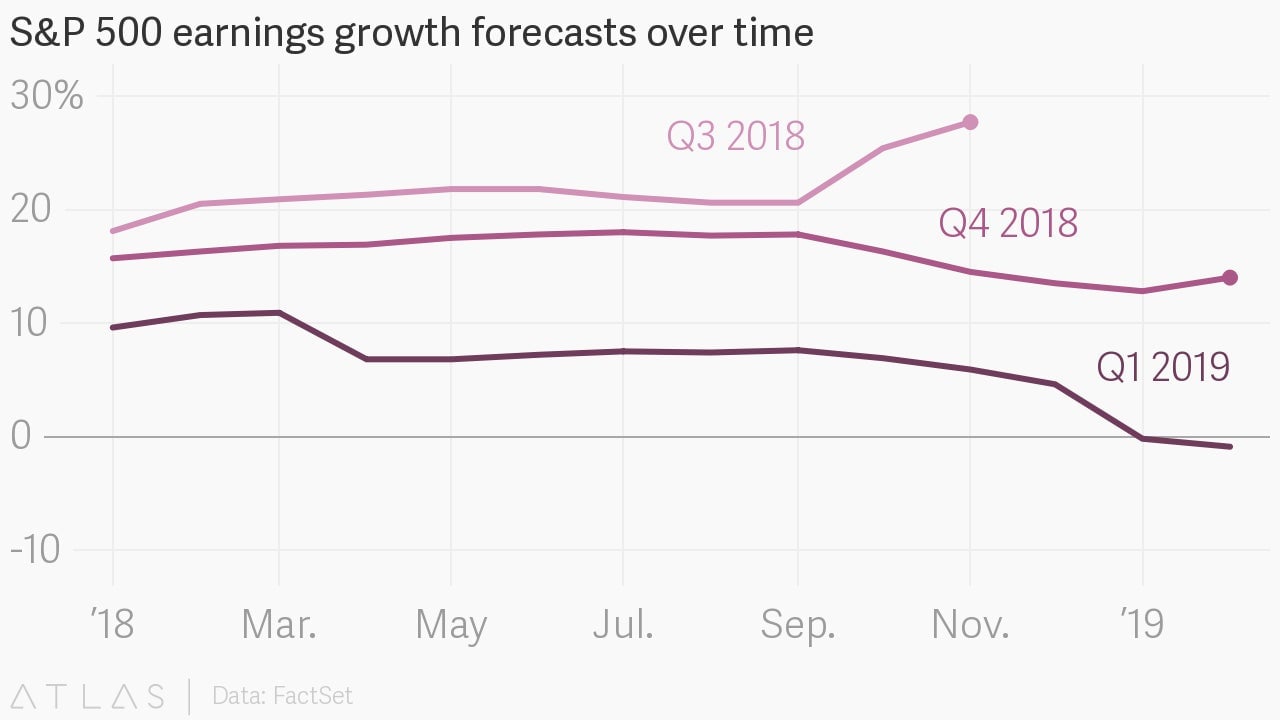

Yet here’s the thing: At the same time, guidance for profits this year has been pretty grim. Three times as many firms have told the markets that first-quarter earnings will come in below expectations than above them. Netflix is a good example of the trend.

For the first time in years, analysts think that corporate earnings growth, in the aggregate, will shrink instead of grow. In part, this is because things have been so good in previous quarters, propelled by strong economic growth, tax cuts (hello, buybacks), and other “constructive” factors, as a sell-side analyst would say.

This time last year, stock pickers figured that the first quarter would continue the streak of double-digit percentage earnings growth recorded over the previous two years. As time went on, doubts crept in. Forecasts were cut and then turned negative around the turn of the year, when Apple dropped a profit warning on unsuspecting markets with a thud.

Since then, instead of the steady growth of previous quarters, the moves have been messy and idiosyncratic. Goldman Sachs is minting it, but Morgan Stanley missed badly (paywall). Facebook had a blockbuster quarter, but investors fretted about Alphabet’s shrinking margins. Similar patchiness can be seen in just about every sector you choose.

It feels like an inflection point has been reached. We are past the peak, so the question now is whether we will see a gradual deceleration or a sudden drop. The long stretch of economic expansion and aging bull market are at risk from trade tensions between the US and China, Brexit, rising interest rates, and other “headwinds” (another popular turn of phrase among analysts).

Investors have reacted with relief as the latest batch of earnings have mostly been better than expected. As the cycle turns, what happens if the next group of reports are even worse than feared? —Jason Karaian

Five things on Quartz we especially liked

The problem with Silicon Valley’s favorite growth strategy. Blitzscaling co-author Reid Hoffman argues startups must “achieve massive scale at incredible speed” to seize the ground before competitors do. Early computer luminary Tim O’Reilly notes that often creates massive companies lacking a clear path to profitability—witness Uber and Lyft’s “death spiral.” He presents a more sustainable (and successful) blueprint for entrepreneurs in 2019.

Brexit isn’t a joke for Northern Ireland. Much of the world is shaking its head in bemusement at the UK’s chaotic political wrangling over its exit from the EU. But as Natasha Frost found on a trip to Belfast, the risks are very real. Careful legislation has brought fragile peace to the country, but Brexit threatens to resuscitate a crisis many believed had finally been put to rest.

The “debt-trap” narrative around Chinese loans in Africa. In late December, reports surfaced that Kenya put up a prized port and any state possession as collateral for Beijing to fund a 470-km (292-mile) railway. That added to the growing chorus that Beijing was entrapping nations in debt, and, as Abdi Latif Dahir writes, it also put on display Africa’s weak economic diplomacy.

The parental-leave backtrack. The Bill and Melinda Gates Foundation made a splash when it granted year-long parental leaves. Alas, the policy was found to be too disruptive and didn’t survive. US managers might relate, but as Quartz at Work’s Lila MacLellan points out, long leaves are standard in a lot of other countries, where companies cope just fine.

Feeling sheepish. The current conventional wisdom is that products made from animal materials are bad. Supposedly, to be good people, we should dress with synthetic textiles. However, in her upcoming book Putting on the Dog, author Melissa Kwasny travels around the world researching garb and speaking to businesspeople, farmers, and artisans and concludes otherwise. Ephrat Livni reviews the ethical case for leather, feathers, silk, pearls, furs, and wool.

Five things elsewhere that made us smarter

The tiny sales floor in China generating big profits for Facebook. Chinese who’ve never used Facebook—the service is blocked by China’s “Great Firewall”—can still advertise on it via local ad agencies Facebook partners with. For the New York Times (paywall), Paul Mozur and Lin Qiqing visit one such agency’s sales floor in Shenzhen, complete with sample ads and educational videos. Last year Facebook earned about $5 billion in revenue from China-based advertisers.

The predicament of UK exporters. As a member of the EU, the UK benefits from preferential trading rights with various nations. In the case of a no-deal Brexit on March 29, those rights could be lost immediately. As Richard Partington and Heather Stewart write for the Guardian, that’s already putting UK exporters—whose shipments can take weeks—in a tough spot. Tariffs could be significantly higher when a cargo vessel arrives than when it departed.

The inside story of the USS Fitzgerald’s deadly collision with a container ship. In June 2017, the $1.8 billion US Navy destroyer collided with a much larger container ship off Japan’s coast, killing seven American sailors. ProPublica reconstructs the scenes, revealing the crew’s valor and naval leadership’s failure to provide enough training, staffing and equipment. A few months after the incident, the USS John S. McCain collided with a merchant ship near Singapore.

The pipeline of illegal workers for Trump. In the town of Santa Teresa de Cajon in Costa Rica live many former employees of the Trump National Golf Club Bedminster in New Jersey. According to them, the club’s managers were well aware of their illegal status. The Washington Post visited the town (paywall) to hear their stories and spoke to other unauthorized workers from El Salvador, Mexico, and Guatemala who were also employed at Trump properties.

The porta-potty king of Queens. Portable toilets are a $2 billion business in the US, and one of the best places to find them is New York City. There, one man keeps coming out on top in a dirty business: Charles W. Howard, CEO of Call-a-Head, which boasts more than $35 million in annual revenue. For New York’s Intelligencer, David Gauvey Herbert examines the man, his controversial dealings, and the class-action lawsuit from former workers that could put him out of business.

Our best wishes for a relaxing but thought-filled weekend. Please send any news, comments, postcards from Costa Rica, and generous parental-leave policies to [email protected]. Join the next chapter of Quartz by downloading our app and becoming a member. Today’s Weekend Brief was edited by Steve Mollman.