🌏 Tech demand gets glitchy

Plus: The Man United face-off

Good morning, Quartz readers!

Here’s what you need to know

Major Asian economies felt the drop in global tech demand. Japan reported its first-ever trade deficit in electronics for a half-year period, while Taiwan reported January export orders fell 19.3% year on year.

Uber is adding electric cars to its India fleet. The ride-hailing service plans to incorporate 25,000 EVs made by Tata Motors over a three-year period.

Ericsson is laying off 1,400 employees. The Swedish telecoms firm plans to cut costs by $861 million by the end of 2023 amid a dip in demand for 5G equipment.

Maersk sold two logistics facilities in Russia. The Danish shipping giant is handing over the sites to Cyprus-registered IG Development Finance as it winds down its Russia business.

Iran’s currency hit a historic low. The rate fell below 500,000 rials to the US dollar as the EU announced a fresh round of sanctions in response to the government crackdown on protests.

BrewDog is headed to China. The Scotland-based brewery has partnered with Budweiser China to begin production of its craft beer by the end of March.

What to watch for

In Microsoft vs. European Commission, the former is ready to fight for its $68.7 billion bid to buy Activision Blizzard. Top executives from Microsoft, Activision Blizzard, and Sony, as well as representatives from Google, Nvidia, Electronic Arts, and Valve, are expected to appear at a closed-door hearing about the deal today (Feb. 21).

This is not just any horizontal consolidation in the gaming industry—it could change the multiplayer market into a singleplayer game. Snapping up Activision would give Microsoft boss-level control over the video game supply, which it could further leverage by vending products exclusively on its Xbox console.

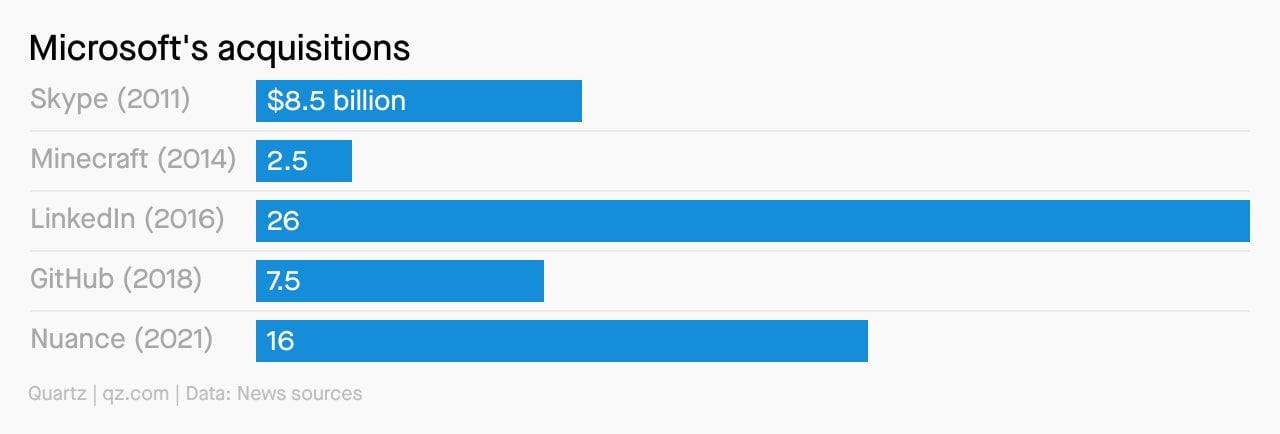

EU regulators are arguing that the deal will quash the competition, while the software giant is expected to counter concerns. Winning this round could help Microsoft’s case in the US and UK. The company has accumulated its fair share of XP from antitrust scrutiny in the past, but previous deals have been dwarfed by the current Activision campaign.

The Man United bidding war has kicked off

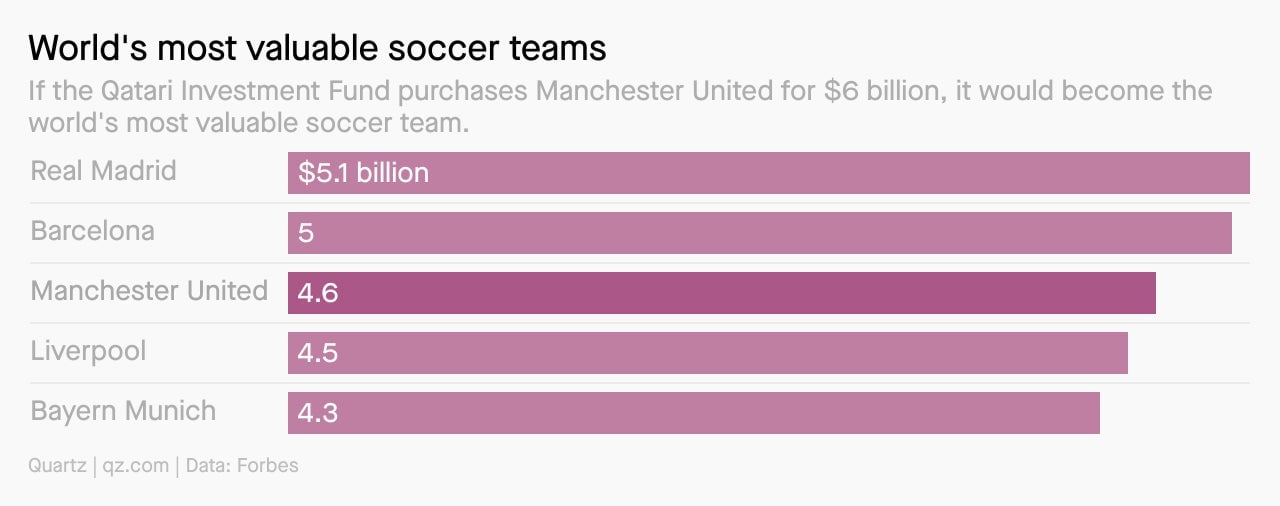

A Qatari royal and one of the UK’s richest people are in a turf war for Manchester United, one of the world’s most successful soccer clubs. Its owners, the US Glazer family, are reportedly valuing the club at $5 billion.

The value of Sheikh Jassim bin Hamad Al Thani’s bid is confidential, but he might offer as much as $6 billion. A competing bid was submitted by Greater Manchester-born billionaire Jim Ratcliffe, CEO of Ineos Chemicals Group.

A deal of this size would be the biggest takeover of a professional sports team ever, beating last year’s record $4.65 billion purchase of the Denver Broncos, an American football team, by the billionaire heir of Walmart. It might attract regulatory scrutiny too—European soccer league rules would prevent Qatar, which already owns Paris Saint-Germain, from owning another team.

India’s got lithium. What next?

India announced the discovery of 5.9 million tons of lithium in Jammu and Kashmir earlier this month. It could be a gamechanger for the country’s green tech industries, especially as Delhi aims to achieve net-zero by 2070.

But for all the lithium hype, extracting the material domestically might still be a long way off. To tap into the resource, India needs know-how, and to get that, technology transfers could be key.

✦ Love stories that connect tech and the economy? Help keep our content free and accessible by picking up an annual membership. We’re offering 50% off.

Surprising discoveries

Looted antiques were recouped from a car boot. Angkorian crown jewelry has been secretly returned from London to Phnom Penh.

Japan’s “monkey mermaid” is neither a monkey, nor a mermaid. It’s got some freaky-looking fish teeth, though.

A World War II submarine’s watery grave was found. The long-lost USS Albacore sank nearly 80 years ago.

Riyadh is game for Nintendo. Saudi Arabia is now the video game company’s largest outside investor.

Beware of Canadian super pigs. Unlike Spider-Pig, they can wreak havoc while remaining “highly elusive.”

Our best wishes for a productive day. Send any news, comments, super swines, and underwater treasures to [email protected]. Reader support makes Quartz available to all—become a member. Today’s Daily Brief was brought to you by Manish Kumar, Ananya Bhattacharya, Diego Lasarte, Sofia Lotto Persio, Julia Malleck, and Morgan Haefner.