🌏 Coca-Cola fizzles

Plus: Economists want the Fed to loosen up.

Good morning, Quartz readers!

Suggested Reading

Here’s what you need to know

Coca-Cola stock fell after executives had some choice words for investors. One of them was inflation, which Coke mentioned at nearly eight times the rate its rival PepsiCo did in its own earnings call last week (more on that scary word—inflation—below).

Related Content

An Ivy League school just announced its first AI degree. It’s a sign the labor market is changing, and at the same time, AI talent is scarce.

Paramount is laying off 800 employees. The company just announced a record audience for the Super Bowl—it was the most streamed in history—but it didn’t save those jobs.

Moving to Miami may have saved Jeff Bezos $600 million. Florida has no capital gains tax, and the former Amazon CEO is planning to unload $8.4 billion worth of stock this year.

Corporate America’s economists want the Fed to loosen up

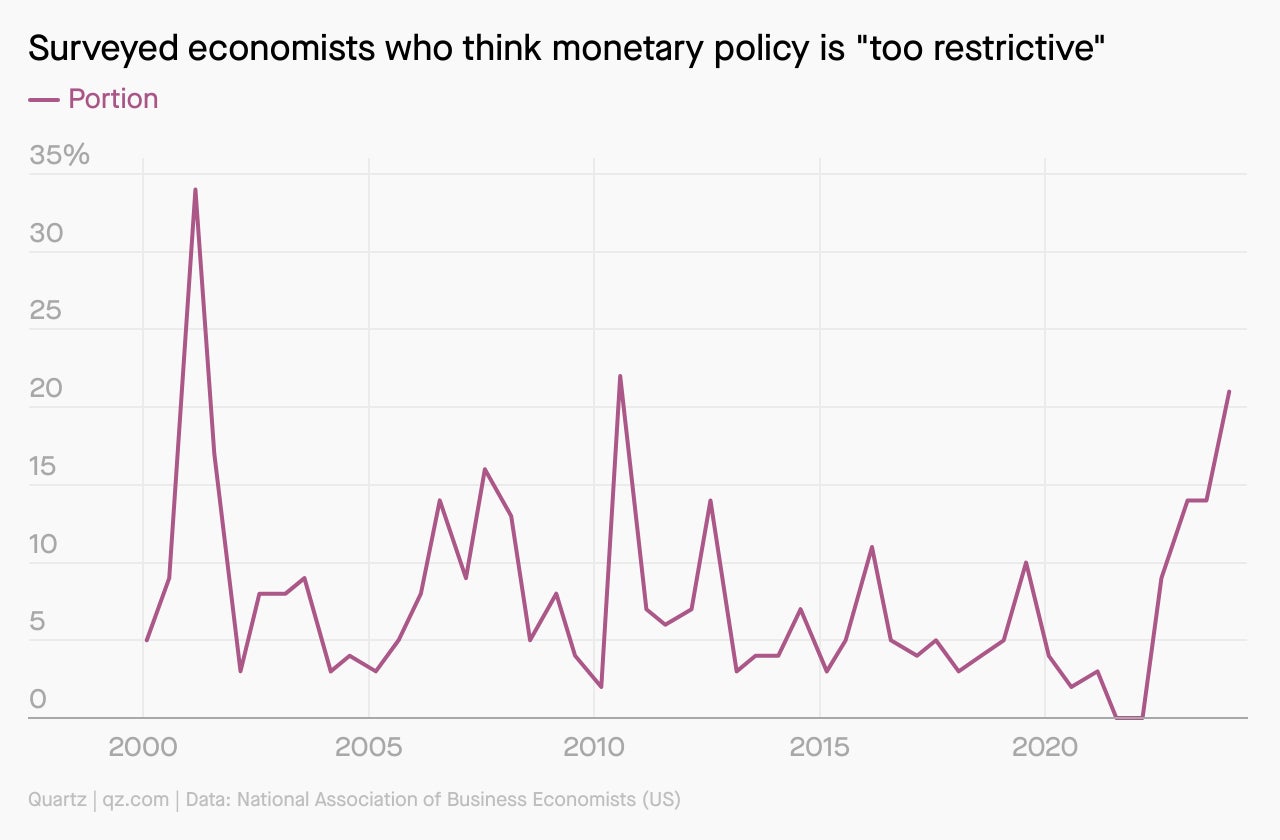

More than a fifth of economists surveyed by the National Association of Business Economics think that US monetary policy is “too restrictive.”

It’s only the third time that large of a percentage has shared that viewpoint since 1995.

But while 1 in 5 economists think the Fed should go ahead and cut interest rates, monetary policy is in a tricky spot—especially when it comes to shelter inflation, the biggest driver of rising prices.

The energy transition would be much pricier without China

The US and European countries may want to decouple their supply chains from China, but doing so for clean energy products would put a hefty price tag on an already expensive transition.

A new analysis by energy consultancy Wood Mackenzie found that the global energy transition would cost an extra $6 trillion (on top of the $29 trillion it estimates would be required through 2050 to reach net-zero carbon emissions) if made-in-China products weren’t used. That equates to an additional 20% of the original energy transition bill.

But as with most exchanges, there are costs and benefits.

🦄 Unicorns aren’t that special anymore ✨

A decade ago, a unicorn company was a rare and remarkable creature—hence the name. But now, as billion-dollar companies become more common, the term doesn’t pack the punch that it used to.

Can you guess how many there are today? Hint: It’s more than 1,000.

More from Quartz

🐝 AI goes from buzz to actually making money as it nears “the end of the hype cycle”

Surprising discoveries

Kissing has been around since the late third millennium BC. There’s no common point of origin—everyone was doing it.

A new dating app in the US is focused on credit scores... Maybe love really is a numbers game?

… while the cost of living single is going up the most in Las Vegas. More the reason to find someone with a good credit score.

There’s a centuries-old pancake race that takes place each year in England. Racers must flip the cake in a skillet at the start and finish.

The US’s biggest saltwater lake has a ton of lithium in it. A startup has raised $145 million to harvest the mineral.

Did you know we have two premium weekend emails, too? One gives you analysis on the week’s news, and one provides the best reads from Quartz and elsewhere to get your week started right. Become a member or give membership as a gift!

Our best wishes for a productive day. Send any news, comments, credit score valentines, and racing pancakes to [email protected]. Today’s Daily Brief was brought to you by Morgan Haefner.