🌏 Copyright fights and bitcoin heights

Plus: Reddit tries its own Wall Street bet.

Good morning, Quartz readers!

Suggested Reading

Here’s what you need to know

Nvidia is being sued by authors. The AI chipmaker is being accused of training its technology on books from a “shadow library,” like OpenAI has been.

Related Content

Bitcoin topped $72,000. The surge followed an announcement from the U.K.’s finance watchdog that it would allow investment exchanges to list crypto-linked exchange-traded notes.

Tesla’s factory in Germany may reopen ahead of schedule. That’d be ideal — the EV carmarker is losing $65.6 million in sales every day that Giga Berlin is closed due to an arson.

But Delta Air Lines thinks it’s definitely not getting its Boeing planes on time. The carrier expects deliveries of the 737 Max 10s it ordered to arrive two years late, in 2027.

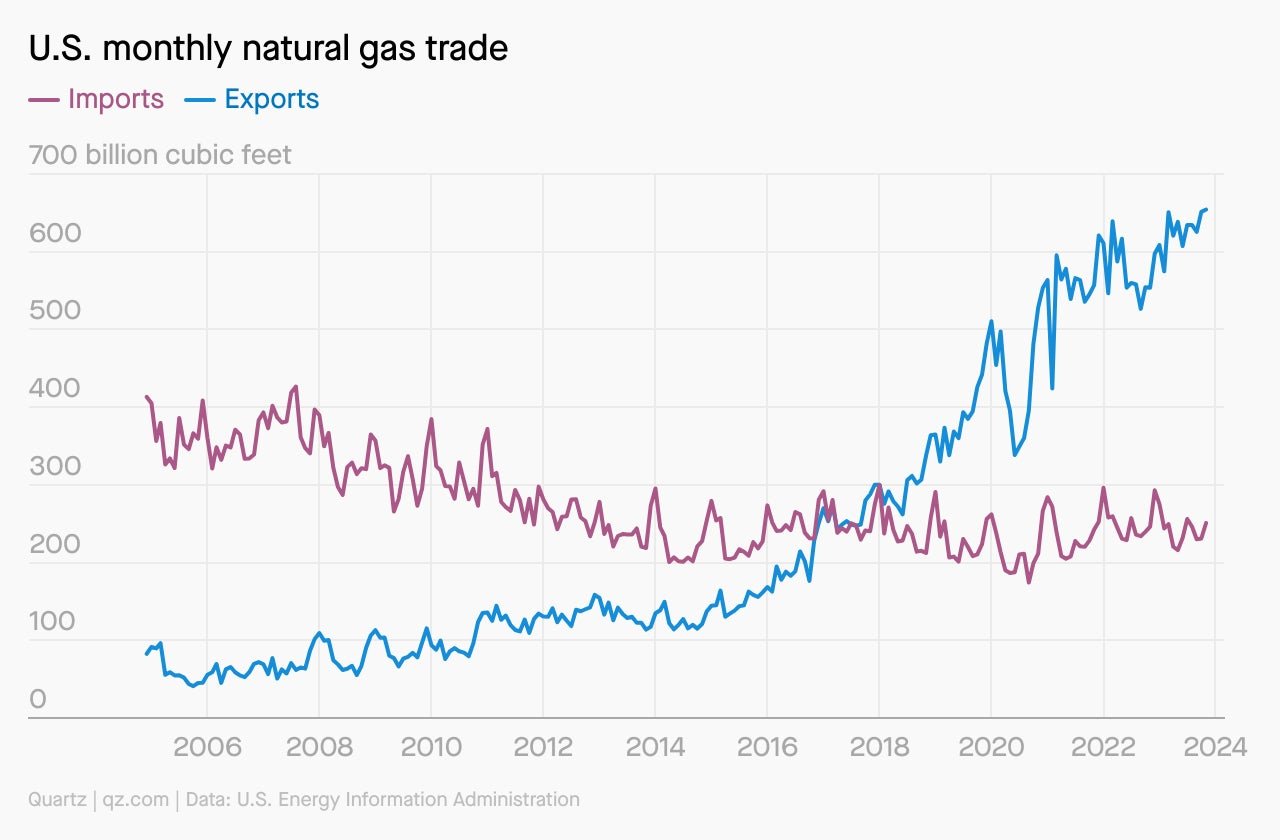

Americans are paying more for gas because the U.S. exports so much of it

The U.S. ships a lot of natural gas around the world, sending 88.9 million metric tons of the stuff abroad last year to become the globe’s biggest supplier. One would imagine that would mean cheaper natural gas for Americans. But it turns out the opposite has become true.

New research from the National Bureau of Economic Research suggests that U.S. dominance of global natural gas markets more than doubles the price of what Americans were paying when the U.S. was keeping much of its natural gas. By 2030, the economists suggest, U.S. prices will be 54% higher than they would have been in a less export-intensive scenario. Here’s why.

Reddit is about to try its own Wall Street bet

The first social media IPO since 2019’s Pinterest is upon us, and it could stand to be the biggest offering of 2024.

Here’s some quick digits to know ahead of the offering, which is expected sometime this month.

$748 million: What Reddit’s looking to raise

$6.5 billion: Its potential valuation

22 million: Shares it’s offering

1.8 million: Shares set aside for Reddit users

JPMorgan analysts aren’t worried about a tech bubble

If you’ve been concerned that a potential tech bubble will burst this year, here’s a bit of news to calm your nerves: JPMorgan Chase analysts actually think the seven Big Tech stocks that dominate the S&P 500 are undervalued.

“There is a concern over the very strong outperformance of the Magnificent Seven, but we note that the group is currently trading less stretched than a few years ago, given earnings delivery,” JPMorgan strategist Mislav Matejka wrote in the note.

Surprising discoveries

Coveted $2.99 Trader Joe’s totes are reselling for $500 on eBay. The mini canvas bags have racked up more than 11 million views on TikTok.

Two new species of pygmy squid have been found. The tiny sea creatures are no bigger than a pinky fingernail.

“Round up for charity” prompts at checkouts are raising millions for causes. People are increasingly saying yes, with $749 million raised in 2022 alone — but it does raise some eyebrows about its philanthropic intentions.

First-time retailers are leading the brick-and-mortar revival in New York. More favorable tenant conditions have made the city an attractive spot for new storefront openings.

A Nebraska woman stole $28,000 worth of gas. She exploited a gas pump software update.

Did you know we have two premium weekend emails, too? One gives you analysis on the week’s news, and one provides the best reads from Quartz and elsewhere to get your week started right. Become a member or give membership as a gift!

Our best wishes for a productive day. Send any news, comments, pygmy squids, and $28,000 worth of gas to [email protected]. Today’s Daily Brief was brought to you by Morgan Haefner.