Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

This week I’ve been working on a story about what I’m calling “neobank killers.” The idea comes from venture capitalists who think there’s more opportunity in selling neobank-style cloud software and services to old-school lenders than there is in the new, ultra-hyped digital banks themselves.

It’s something of a contrarian take, so I called Mark Tluszcz, chief executive of self-described contrarian investment firm Mangrove Capital Partners. Tluszcz was the first investor in Skype, and for years he has been publicly skeptical about tech unicorns and financial startups (paywall). I asked whether his views have changed when it comes to pricey fintechs:

“That thesis I developed in 2016 hasn’t changed in any way. People say, ‘Mark, look at all the high valuations.’ I’m like, yeah, let’s see what happens. The truth is always at the end. Valuations don’t mean a whole lot right now, as we’ve learned.

“Generally speaking, there’s no justification for me to be any more optimistic than I was before, because nobody has made any money as investors. It doesn’t really mean anything until there are exits.”

And as my colleague Alison Griswold wrote yesterday, many private investments are re-entering Earth’s atmosphere. WeWork was valued at $47 billion in January, but it got a reality check from institutional investors during its IPO roadshow and is now scrambling to raise funds. PayPal is writing down its investment in Uber, which burned through more than $5 billion during the second quarter. “The private markets are a very inefficient pricing mechanism,” Tluszcz says. “One person defines the price. Not a lot of scrutiny.”

“The judgement day will come and that is when you go public,” he adds.

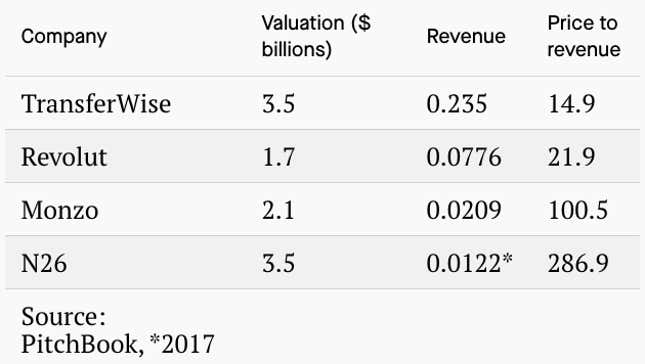

Tluszcz says that day, when it comes, will not be kind to many fintech companies, including the branch-free neobanks. He doubts that a startup will reinvent core banking expertise such as risk management and credit scoring. The digital banks are “offering services that aren’t so special. Things like a better interface to access your account,” he said. “I have a Revolut card, sure. But is that a long-term business? I don’t know.”

He also has doubts about the longevity of cheap or free services. Robinhood made its mark by slashing brokerage fees, and now the more established brokers including Fidelity, Charles Schwab, and Interactive Brokers have followed. Tluszcz thinks entrenched incumbents with other revenue streams can outlast a startup in a price war.

It’s healthy (and entertaining) to listen to the contrarians, and to test their arguments against prevailing views. But this isn’t to suggest that anyone has a crystal ball. Tluszcz put the company Pinterest in his “fakies” category in 2015, and it went on to stage a well-received IPO. He’s been critical of TransferWise, but the money transfer unicorn says it has been profitable for more than two years.

Still, his bearishness on Uber’s valuation looks prescient, and may highlight an important point for the fintech crowd. Tluszcz told the Financial Times (paywall) recently that the ride-hailing company was founded on “loopholes,” referring to its classification of workers as contractors instead of employees. Financial regulators, of course, are not fond of loopholes. The backlash Facebook has faced around the world to Libra, its cryptocurrency project, shows that officials have little patience for regulatory experimentation when it comes to money.

“If you’re dealing with ‘likes’ and all that kind of stuff, does it really matter?” Tluszcz said. “But if you’re dealing with money, imagine if it gets lost.”

So where does a contrarian investor put his money? Tluszcz said he’s betting on companies that provide financial services in developing markets, where there’s less entrenched competition, and he touted his investment in Oriente, which operates in Southeast Asia. He also said it makes sense to back the companies that are selling neobank-style software and services to more traditional companies. (Look out for my story about this next week.)

“I think that’s a terrific play,” he said. “Banks have outsourced innovation to third-parties. So I think it’s a terrific play to put your money there.”

This week’s top stories

1️⃣ Bank of England officials have never (officially) set foot in a cloud provider’s data center, according to a Freedom of Information Act request from Quartz. As the cloud becomes more systemically important, watchdogs risk falling behind.

2️⃣ Deutsche Bank is creating a new division to speed up its technology overhaul. The German lender won’t be able to move to the cloud “overnight,” according to Reuters, and will still have to invest in its legacy systems.

3️⃣ More than 360 million people in the East Asia and Pacific region have a smartphone but no bank account, according to Bloomberg’s guide to fintech. (Also see Quartz’s guides for members on the future of banking, a deep exploration of Ant Financial, and the next chapter for cash.)

4️⃣ Young consumers fear credit cards and some are using installment loans instead. As companies like Affirm encroach on the credit cards’ turf, The Economist (paywall) notes that it remains to be seen how they will fare during an economic downturn.

5️⃣ Wirecard raised its long-term outlook, but Reuters reports that analysts are unconvinced. “Not even the greatest enabler of fintech, Visa, has the confidence to give a more than one-year outlook,” said Neil Campling of Mirabaud.

The future of finance on Quartz

In Denmark, a payment app has more likes than Facebook. As cash dries up, MobilePay has taken the top spot as the most “indispensable” on smartphones.

Robinhood’s “cash management” service shows financial regulation is working. After getting slapped down last year, the new savings feature appears well ensconced within regulatory compliance.

Digital lending through smartphones has enabled a spike in personal loans in Kenya. At least one out of every five borrowers struggles to repay the debt.

Next week Quartz is publishing a deep dive for members about the future of Apple. If you’re not yet a member, support our journalism and get 50% off with promo code JD2912. Also, check out our (free) new app.

Always be closing

- Vista Equity Partners is considering selling a stake in Finastra, potentially valuing the fintech at more than $10 billion, according to Bloomberg.

- Ant Financial may lead a $600 million (paywall) funding round in Indian food delivery app Zomato, the Financial Times reports.

- Next Insurance raised $250 million from German reinsurer Munich Re.

- Wealth manager Rosecut Technologies received investment from QVentures.

- Six Nordic banks agreed to put money into P27, a cross-border payment platform for Europe.

- Kaspi.kz, a Kazakh financial group, pulled its London IPO, citing market conditions.

I hope your week has been a profitable one (pick your own metric). Please send any fakies, tips, and other ideas to jd@qz.com.