Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

Larry Fink has gone from the target of climate protests to something of a protestor himself. This week BlackRock’s CEO was in Davos talking about climate change as an investment risk, and before that he published letters to execs and clients saying the company will make sustainable investments a standard offering. (He also told some Davos attendees that he feared a backlash to the letters. So fearful in fact that BlackRock has been promoting the letters in Google’s search results.)

There’s a limit to how far the world’s biggest asset manager will go on these issues. BlackRock is a conduit for the $7.4 trillion in assets it oversees, but investors are the ones who decide which funds to put their money in, as the company’s website makes clear: “The investments we make on their behalf will always represent their preferences, timelines and objectives.”

BlackRock isn’t necessarily going to strip out investment options purely because of their record in the Amazon rainforest, as activists have hoped, and the New York Stock Exchange isn’t going to delist companies just because of their carbon footprint either.

These financial titans have deferred to investors. And some investors have taken up the mission. British billionaire Chris Hohn is going to use his $30 billion hedge fund to try to get companies to cut their greenhouse emissions and disclose more about how much carbon they produce, according to this Bloomberg profile. He will agitate for management changes and sell his stakes if he doesn’t get his way.

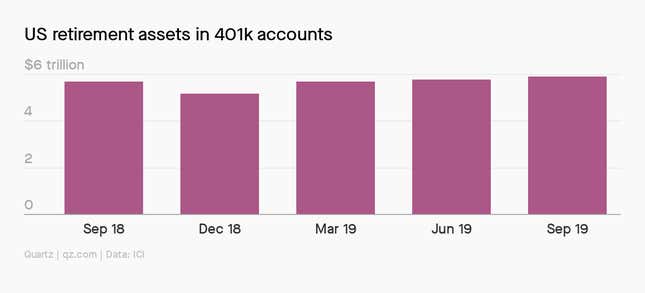

If you’re concerned about these issues, you can be one of those investors! Much of the money that BlackRock and others oversee belongs to ordinary savers and is held in their retirement accounts. There’s a big block of money that’s self-directed by regular people—in the US alone, 401k accounts contain $5.7 trillion in assets, which isn’t that far off from BlackRock’s AUM.

It may get easier over time to avoid investing in companies that do things we don’t like. Funds that cater to environmental, social, and corporate governance (ESG) already exist, and BlackRock plans to launch a sustainable version of its iShares ETF and target date retirement funds. The trick, of course, is making sure these standards aren’t gamed or watered down. A Vanguard ESG fund that purported to avoid fossil fuel companies contained shares of a crude refiner, the Financial Times reported (paywall) last year.

Another problem is that, as economist Allison Schrager puts it, there aren’t that many companies that are “unambiguously evil when it comes to climate.” Some energy companies make money on fossil fuels and are also investing in renewables, for example.

It’s also questionable whether taking Amazon burners out of an index fund will punish them, or just reward a clever money manager. If a controversial stock declines but the company remains profitable, that could make it a lucrative opportunity for an investor who doesn’t care about such matters.

Public outcry could make a difference. Schrager, a senior fellow at the Manhattan Institute and Quartz contributor, points out that even rich financiers like to be liked, and so popular opinion could outweigh the lure of juicy returns. “It depends how bad the social stigma becomes for being invested in this stuff,” she said.

If BlackRock’s initiatives are any indication, the social pressure is working. But that will only go so far. Investors are going to remain the ultimate decider of which companies get financing. Fortunately, you and I are among those investors.

This week’s top stories

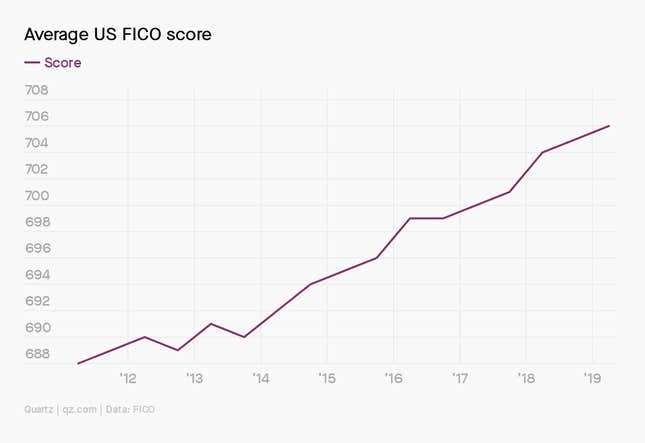

1️⃣ FICO is changing how its credit scoring algorithms are calculated, according to the Wall Street Journal (paywall), likely making it harder for some Americans to borrow. It’s a reversal from changes in recent years that tended to increase scores.

2️⃣ Central banks have started a group to discuss making digital currencies. Some experts were increasingly dismissive of these projects until Facebook and China decided to start one.

3️⃣ Banks are pouring money into technology, but it’s highly uncertain how much of that money is just maintaining old, inefficient systems. Some 37% of the shareholders surveyed by Oliver Wyman said banks’ digital strategies were unclear and not credible.

4️⃣ The creation of wealth management startups is in decline. The number of new robo advisors peaked in 2014, according to Business Insider, citing Deloitte, suggesting the market is crowded with limited opportunities.

5️⃣ New York lawmakers passed a bill that would require restaurants, stores, and other retail outlets to accept hard cash. The elderly, poor, and people with handicaps can be unprepared when notes and coins aren’t accepted.

The future of finance on Quartz

Banks that spent more on IT had fewer loan defaults during the 2008 crisis and provided more credit after the crunch began. An IMF working paper suggests that financial technology investment could improve stability.

A week after Visa acquired Plaid for $5.3 billion, Sweden’s Tink raised €90 million ($100 million). The deals signal sizzling demand from investors for companies that provide the digital plumbing between personal bank accounts and fintech apps.

Isabel dos Santos, Africa’s richest woman and the subject of a major media investigation, became toxic to Western financial firms. She sidestepped the crackdown by buying large stakes in several banks for herself.

Elsewhere on Quartz

A third of the world plays video games. About 60% of Americans say they play them daily. And as the global gaming industry grows, it’s influencing much more than how we spend our free time. From entertainment to government to health care, industries are trying to distill and deploy gaming’s immersive power. In this week’s field guide, contributor Mary Pilon covers everything you need to know about the state of gaming and its impact on our lives.

Always be closing

- AvidXchange, an accounts payable company, raised $260 million.

- Monese, a neobank targeting underserved consumers, is looking to raise £100 million ($131 million), the Financial Times (paywall) reported.

- Qonto raised $115 million, led by Tencent and DST Global. The company is a challenger bank based in France.

- Liberis got £32 million in funding. The small-business financier’s deal was led by FTV Capital.

- City of London grandee Michael Spencer is contributing £25 million (paywall) to fintech fund Element Ventures, according to the Financial Times.

- Neocova, a banking technology platform for community banks, received $9.5 million in investment.

- Bank BNP Paribas is among French companies starting an innovation center in Brazil.

- WealthKernel, a wealth management startup, got £4.5 million in funding.

I hope your week has been a profitable one (pick your own metric). Please send unambiguously not-evil investment advice, tips, and other ideas to [email protected].