For Quartz members—The $100 billion payment company?

Hi [%first_name | Quartz member%],

Hi [%first_name | Quartz member%],

Unless you too achieved billionaire status in your 20s, Patrick and John Collison might make you feel like an underachiever. The Irish brothers’ 10-year-old payments platform, Stripe, today underpins billions of dollars of commerce. But in typical Silicon Valley fashion, Stripe doesn’t just want to be a mega payment company; its mission is “to increase the GDP of the internet” and build the “economic infrastructure” of the online world…as long as that infrastructure doesn’t include PayPal.

First, a recap: Facebook’s antitrust problems are jeopardizing its WhatsApp plans, Beijing fired an antitrust salvo at China’s tech giants, and Europe’s new antitrust rules will mostly annoy Big Tech. The US crackdown on a Chinese cotton producer has the fashion industry scrambling, and Paris was fined for putting too many women in charge. Are Republicans still the party of business? Is a US tech-stock bubble upon us? Who’s ready for a 29-hour virtual office party? Asked and answered, all.

Your most-read story this week: This is the year Hong Kong began speaking the Communist Party’s language. And most relatable member goes to whoever is reading Seriously, you should date your best friend. Just tell them how you feel!

Okay, put on your coding hoodie and practice your Irish. We’re talking about Stripe.

Racing stripe

Patrick (32) and John (30) Collison have the kind of pedigree that Silicon Valley legends are made of: Immigrants? ✅ They hail from Dromineer, Ireland. College dropouts? ✅ Both left top-tier universities to start tech companies. White guys? ✅✅

Patrick has said one reason he and his brother became entrepreneurs is because “whatever your parents do, you just think it’s normal.” The Collisons’ father ran a hotel, and their mother started a corporate training company. “When John and I used to play outside, we used to play running a company,” Patrick said in an interview with LinkedIn co-founder Reid Hoffman. Today they are running a company with millions of global users, more than 40 of whom do $1 billion-plus a year in transactions using Stripe.

The brothers became two of the world’s most successful entrepreneurs by starting a payments company aimed at pleasing developers—the coding carpenters of the internet’s landscape. Stripe was a hit with startups, soothing as it did the headaches that come with getting paid over the internet. Since then, the company’s pitch has evolved to include multiple services that make it more of a one-stop-shop for running a business. Customers can use Stripe’s credit card fraud detection service, or its Atlas product to form a company in Delaware. This month, Stripe launched its Treasury product in partnership with the likes of Goldman Sachs; platform companies like Shopify, an e-commerce firm, can use it to offer bank accounts to their merchants.

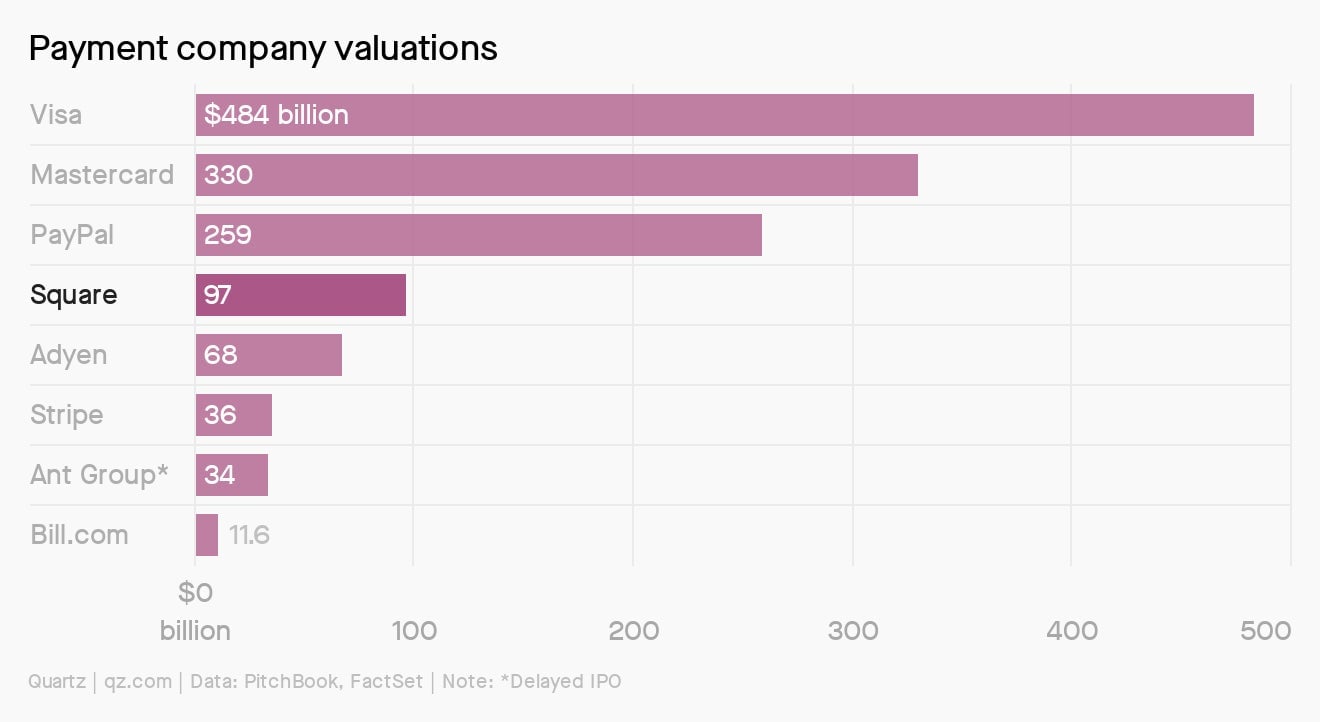

Meanwhile, the Collison brothers are climbing the Forbes list of global billionaires, which currently ranks them around No. 900, worth $3.2 billion each. That accounting may soon be out of date. In a new funding round under discussion, Bloomberg reported Stripe could be valued as high as $100 billion, about triple its valuation in April.

The Covid effect

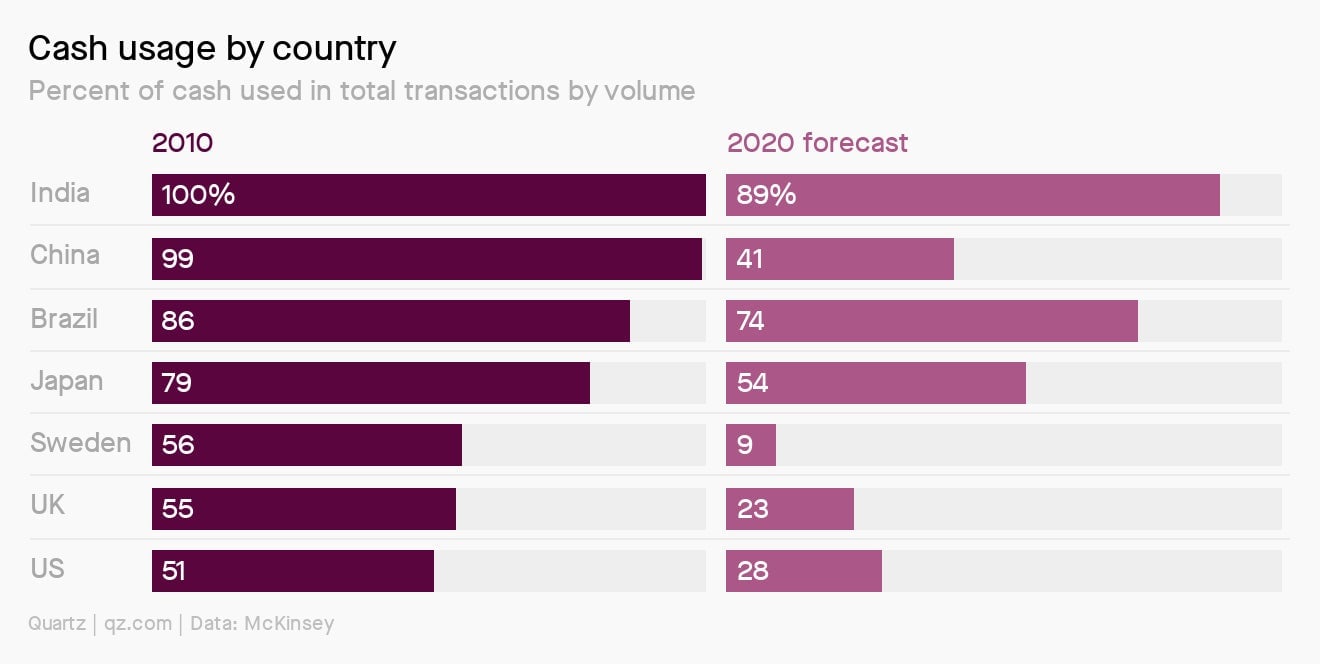

Covid-19 body-slammed most of the global economy, but not Stripe. Lockdowns and social distancing accelerated the shift from cash to digital payments, according to just about everyone, and that benefits companies like Stripe. During the first half of the year, US online retail spending hit $347 billion, according to McKinsey (pdf), a 30% jump from the same period in 2019.

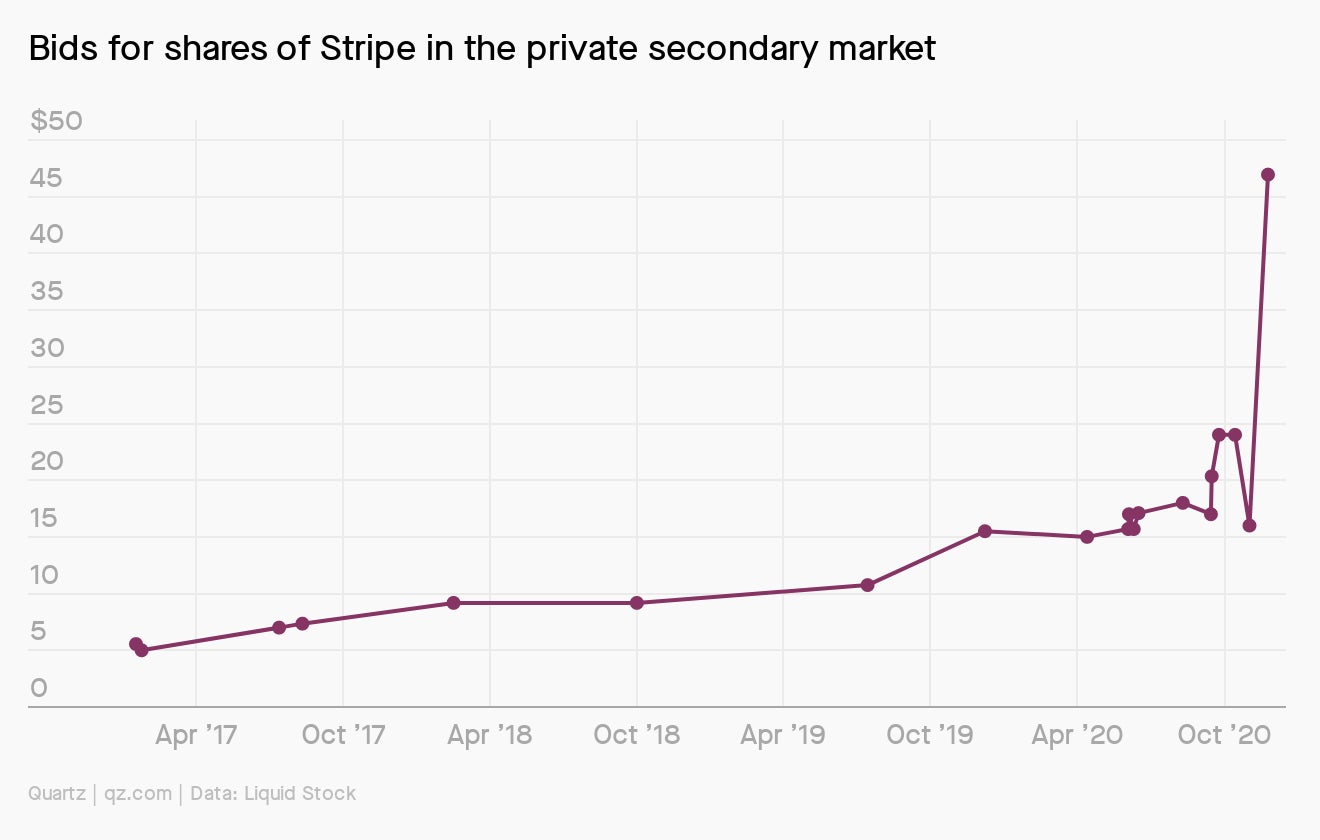

Investors, meanwhile, are rabid for firms that can grow in the online economy, and the US market for tech IPOs has taken off accordingly. Hedge funds and sovereign-wealth funds are scrambling to get in on the action by buying shares in private companies, like Stripe, before they go public: Bids for pre-IPO shares of Stripe in the secondary market have skyrocketed, according to Liquid Stock data.

Stripe execs don’t appear to be in any rush to file IPO paperwork. But the hiring this summer of CFO Dhivya Suryadevara, formerly of General Motors, was fodder for speculation that a listing could come sooner than the Collison brothers are letting on.

QZ&A

Palo Alto-based General Catalyst invested in Stripe in 2010, back when the startup was truly a startup. Here’s managing director Hemant Taneja on his experience with the founders. (Responses have been condensed.)

How did the Collison brothers get your attention?

I met John and Patrick while I was teaching Founder’s Journey, a course that I had co-founded for engineering students at MIT. Greg Brockman and another one of Stripe’s early engineers were students in that class, and I heard about the Collison brothers with great respect from them and their peers on campus.

In the early days of working together, I once asked Patrick, “who’s your ideal customer?” Patrick responded, “They don’t exist yet.” That answer opened my eyes to the unique insight that was driving them about the explosion in developer-led businesses.

But I must say that I wasn’t a big fan of the payments market because it was highly commoditized. We invested because of the audacity of ambition that the Collisons shared. Patrick also told me early on that Stripe will have $100 billion of payments going through the platform and I simply chuckled. Of course, just a couple years later he called me when they crossed $1 billion in payments volume and said “only two orders of magnitude left!”

Were there aspects of Stripe’s business that General Catalyst was less sure about?

Yeah, and I was wrong. Early on I used to wonder why they didn’t build an e-commerce software stack to supplement their payments and commerce platform because of the success that Shopify was having. They deeply viewed themselves as an infrastructure platform and wanted to be great partners to companies like Shopify versus competing with them.

In hindsight, that was exactly the right decision given how well that partnership has worked out for both companies.

By the digits

$5 million: Amount for which the brothers sold their eBay tools company, Auctomatic, in 2008

2,800: Number of Stripe employees as of August 2020

>$2 trillion: Global payments industry’s revenue (pdf) in 2019

$200+ million: What Stripe paid for African tech company Paystack, per TechCrunch

Stripe vs. the world

“Shit, it probably wasn’t such a good idea to tell him that PayPal is terrible,” Patrick says of his (ultimately successful) pitch in Stripe’s early days to PayPal co-founder Peter Thiel for funding.

Stripe doesn’t comment on why Stripe doesn’t accept PayPal, one of the world’s most-downloaded payment apps and a key pioneer of internet commerce. But it seems obvious: The companies are rivals, and, as Patrick’s conversation with Thiel shows, the brothers have targeted the 22-year-old PayPal since their operation’s early days.

One of Stripe’s main competitors is Braintree, which PayPal bought for $800 million in 2013 when PayPal was still part of eBay. The deal included Venmo, an acquisition that gave PayPal a fast-growing mobile-payments service that’s popular with the millennial set. But Braintree’s payment platform was also a gem—it provided transaction plumbing for the latest generation of internet companies like TaskRabbit and OpenTable. Fast forward to 2020 and those companies are counted as customers on Stripe’s website.

Adyen is another big rival. The Dutch payment company was founded in 2006, and its market capitalization of nearly $70 billion—up from $8 billion during after its IPO in 2018—puts it among Europe’s most valuable tech companies. Valuations for Stripe and Adyen have tended to hover in the same territory, and they are increasingly going head-to-head for customers with major global operations.

When it comes to merchant payments, Stripe and Adyen “lead the pack,” according to a report in September by Forrester. The research firm gave Stripe a slight edge when it comes to current offerings and strategy.

Keep reading

- Quartz’s (inaugural) field guide to a future without cash.

- China’s Communist Party is Ant Group’s biggest challenge.

- Patrick Collison talks about Covid-19 and San Francisco’s future to The Information.

- Check out the books about tech and econ published by Stripe Press.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or companies you want to know more about.

Best wishes for an innovative end to your week,