Hi Quartz member,

You’ve been working from your apartment for 342 days, and you haven’t worn real pants in months. But next to you is the being that lights up your life: a small black mutt from whom you’ve been inseparable throughout quarantine. And thanks to Chewy, next to her is a cheese chew stick that prevents any furniture-gnawing, delivered automatically to your doorstep each month. If pets have kept us sane during the pandemic, Chewy is the online pet-supply company that’s kept them happy—and made big money doing it.

But first, a recap: The coronavirus in winter may be worse than scientists thought, Biden wants to fix a broken part of the US fossil fuel economy, and luxury fashion is already on the rebound. China’s Xi Jinping sent a warning to the US at Davos (well, “Davos”), and Elon Musk bought $100 million in publicity for carbon capture. Will the Covid-19 vaccine work on the new variants? What if I don’t get my second vaccine dose on time? Are you an anxious rat or a chill rat? We’ve got it all covered.

Your most-read story this week: Good luck proving Reddit traders did anything illegal by pumping GameStop. And most relatable member goes to everyone signing up for our five-day email course on increasing your personal productivity. Your to-do list will thank you.

Okay, now sit. Stay. We’re talking about Chewy.

Who’s a very good buy?

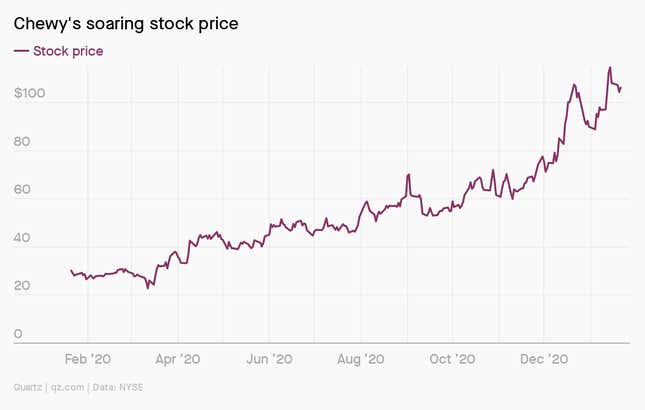

The pandemic boom in pet ownership has been great news for rescue animals, as well as lonely, home-bound humans eager for the company of cats and dogs. It has also made pet supply company Chewy—which as an online-only store sits at the intersection of two major pandemic pastimes—a particularly hot stock, with a $43 billion market cap. As of Jan. 27, Chewy’s share price was up 258% from the same time last year.

Founded in 2011 by entrepreneurs Ryan Cohen and Michael Day, Chewy was acquired by PetSmart for $3.4 billion in 2017. The deal was met with widespread skepticism at the time: How could Chewy compete against Amazon’s infinite supply of pet products and hyper-efficient warehouse system?

The answer, it turns out, lies in customer service. Much like Tony Hsieh’s online shoe store Zappos (which was itself eventually acquired by Amazon), Chewy has made its relationship with customers a crucial competitive advantage. Today, the company boasts a 34% market share of the online pet supply industry, according to retail consultancy 1010data, compared with roughly 50% for Amazon. Now it just needs to start turning a profit.

A brief history

2011: Cohen and Day found Chewy.

2013: Chewy gets its first backer, Volition Capital, which invests $15 million.

2017: PetSmart acquires Chewy for $3.4 billion.

2018: Cohen steps down as Chewy’s CEO and is replaced by Sumit Singh, Amazon’s former head of online groceries and consumables.

2019: Chewy makes its initial public offering, priced at $22/share.

2020: PetSmart’s owner, private-equity firm BC Partners, announces a plan to split Chewy from PetSmart.

Portrait of satisfaction

Chewy added 5 million new customers between November 2019 and November 2020, compared with 2.9 million new customers in all of 2019. But how to ensure they stick around?

One way to win a pet person’s eternal loyalty is to send them a surprise oil painting of their beloved animal, free of charge. Each week, Chewy mails 1,000 pet portraits to unsuspecting customers, commissioned from a network of hundreds of artists across the US. (The paintings are based on photos uploaded to customers’ profiles or emailed to the company directly.) The resulting goodwill leads to valuable social media buzz.

That’s not the only way manifestation of Chewy’s focus on customer service. The company’s phone lines are open 24/7, and Chewy is known for sending pet birthday cards and sympathy flowers. In October, it debuted a pet telehealth service called Connect with a Vet that gives free consultations to all customers signed up for automatic refills. (Such customers made up 69% of Chewy’s net sales in the third quarter of 2020.)

By the digits

5: Chewy CEO Sumit Singh’s current ranking in Bloomberg’s list of best-paid executives

25: Ryan Cohen’s age when he co-founded Chewy in 2011

100: Number of times Cohen pitched Chewy to VCs before he got a bite

67,000: Items available on Chewy

20,000: Products added by Chewy in the past two years

18 million: Chewy customers as of November 2020

$7 billion: Chewy’s projected sales for its current fiscal year

Dog-eat-dog industry

In order to take on Amazon, Chewy copied part of its playbook: prioritizing scale and leaving profitability for later. To keep up with demand, the company grew its network of warehouses and last year opened its first automated center in the hopes of speeding up deliveries while lowering the cost of fulfilling orders by 30%.

But Chewy has also long been haunted by the specter of Pets.com, which infamously burst during the dot-com bubble. The comparison is hardly perfect—customers are much more comfortable shopping online now than they were 20 years ago—but overvaluation is a valid concern. Analysts at UBS recently recommended that shareholders sell their Chewy shares, along with their Peloton stocks, saying that both pandemic winners are “emblematic of a market that values growth over any semblance of valuation that can be justified on a multiple-year view.”

On the other hand: “The pet industry won’t fall off a cliff,” Kathleen Smith, cofounder of IPO investment advisory firm Renaissance Capital, recently told CNN. “We’ll keep our pets when we go back to work.”

That’s why Chewy is also keeping an eye on the competitors nipping at its heels. Petco, which is looking to invest more in e-commerce while leveraging its brick-and-mortar stores for order fulfillments and in-store vet visits, has named Chewy as its primary rival. The company raised $864 million in an IPO this month after 15 years of being privately held.

Walmart is also expanding its network of in-store vet clinics, launching an online pet pharmacy, and peddling pet insurance. And Bark, the parent company of the popular pet-toy subscription Barkbox, announced plans in December to go public through a SPAC deal.

Fun fact

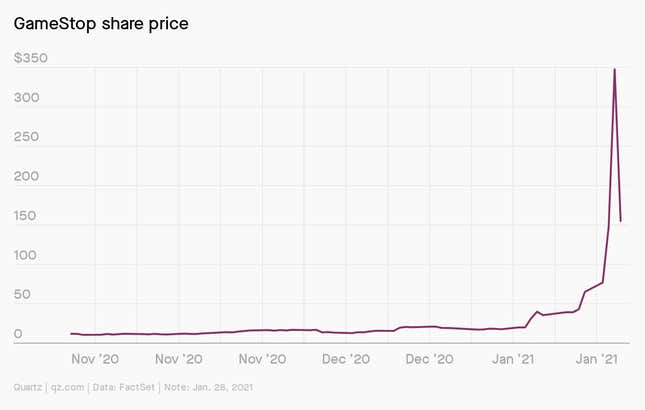

If Chewy founder Ryan Cohen’s name sounds familiar, it may be because of GameStop. In recent months, Cohen has taken on a new role as an activist investor in the video game retailer, investing $76 million for a 13% stake. Cohen has been pushing the Grapevine, Texas-based company to shutter more of its 5,000 physical stores and focus on digital sales.

GameStop shares climbed this month after Jan. 11 news that Cohen would be joining the company’s board, along with two other former Chewy executives. Since then, GameStop’s stock has reached wild new heights thanks largely to the efforts of Reddit users looking to stick it to would-be GameStop short sellers. As of Jan. 28, Cohen’s 13% GameStop stake was worth $2.7 billion, though as Bloomberg’s Matt Levine pointed out, as a board member he can’t really cash out.

Your pandemic pet

Quartz loves pets—we’ve got a chat room for dogs (active, energetic), and another for cats (low-key, snarky). And while we’re all working from home we’re getting more familiar with each other’s pets than ever:

Do you have a furry friend (or feathered! or scaled!) you’d like to share with the class? Please send us a pic.

Keep reading

- Who’s a very good pandemic business? Chewy is. Oh, yes it is (Bloomberg)

- Chewy sends pet portraits to keep customers from straying (AP)

- The lessons of Pets.com (The Indicator from Planet Money)

- What rescue dogs can teach us about vulnerability (Quartz)

- The pet industrial complex (Quartz)

Thanks for reading! And don’t hesitate to reach out with comments, questions, or companies you want to know more about.

Best wishes for a treat-filled end to your week,

Sarah Todd

Senior reporter