Quartz's Predictions for 2024

Plus: How did we do on our predictions for 2023?

Hi, Quartz members,

A year ago, we gave ourselves an out: “forecasting the future is a mug’s game,” we warned at the very start of our Weekend Brief from Dec. 31, 2022. But then we played anyway. Five Quartz reporters laid out the big stories they expected to cover through 2023. The first week of 2024 is the best possible time to see how those predictions turned out—and to play the game again, making five fresh predictions for the year ahead.

First up: grading our prophecies. In 2023, did we...

🚢 ...forget about the supply chain?

Grade: A. Almost all the pandemic-induced snarls in global supply chains eased through the year. By October, the New York Federal Reserve’s Global Supply Chain Index touched a 26-year low, indicating that goods were moving more smoothly and easily than they had since 1997. The Drewry World Container Index as of November was lower than its pre-pandemic (2019) average. Admittedly, some of this easing was the result of weakening global demand; in mid-2023, HSBC noted that developed economies were experiencing a 2.5% drop in global trade. And as the recent difficulties in the Red Sea have shown, shipping remains vulnerable to sudden geopolitical developments. But no one’s worrying much about supply chains anymore, which can only be a good thing.

📈 ...fret about high rates?

Grade: C. To be sure, the Federal Reserve’s rate-hiking regimen, which lasted until July 2023, pinched the US economy. Borrowing grew progressively more expensive. Mortgage rates doubled over the 18 months ending in October 2023, to 7.79% on 30-year fixed rates. The US government’s own interest costs soared—to $659 billion in the year ending Sep. 30, 2023, up 39% from the previous year. But at least for the duration of 2023, US companies managed to keep their own interest payments low. And despite the Fed’s rigor, the economy has thus far avoided a recession even as inflation declined. The Fed hasn’t hiked since last July, and experts now expect cuts in mid-to-late 2024.

🚗 ...watch Tesla fade away?

Grade: D. At the close of trading on Jan. 3, 2023, Tesla’s stock price stood at $108.10. A year later, on Jan. 2, 2024, Tesla closed at $248.42. The company launched its long-awaited, long-delayed Cybertruck; delivered a record 484,500 vehicles in the final quarter of 2023; and registered 20% more sales through those three months than in the same quarter the previous year. Tesla bulls, you stand vindicated—at least insofar as 2023 is concerned. But staunch Tesla bears like Gordon Johnson, an investor who has been shorting Tesla for years, still insist the business is overvalued. The Chinese manufacturer BYD sold more electric vehicles than Tesla in the last quarter of 2023, and it is also catching up to Tesla’s pure profit per vehicle sold. With all its price cuts, Tesla’s average profit per car in November 2023 was around $4,260, down from over $9,500 a year earlier. Tesla certainly didn’t fade away in 2023—but its troubles haven’t either.

🏠 ...live differently?

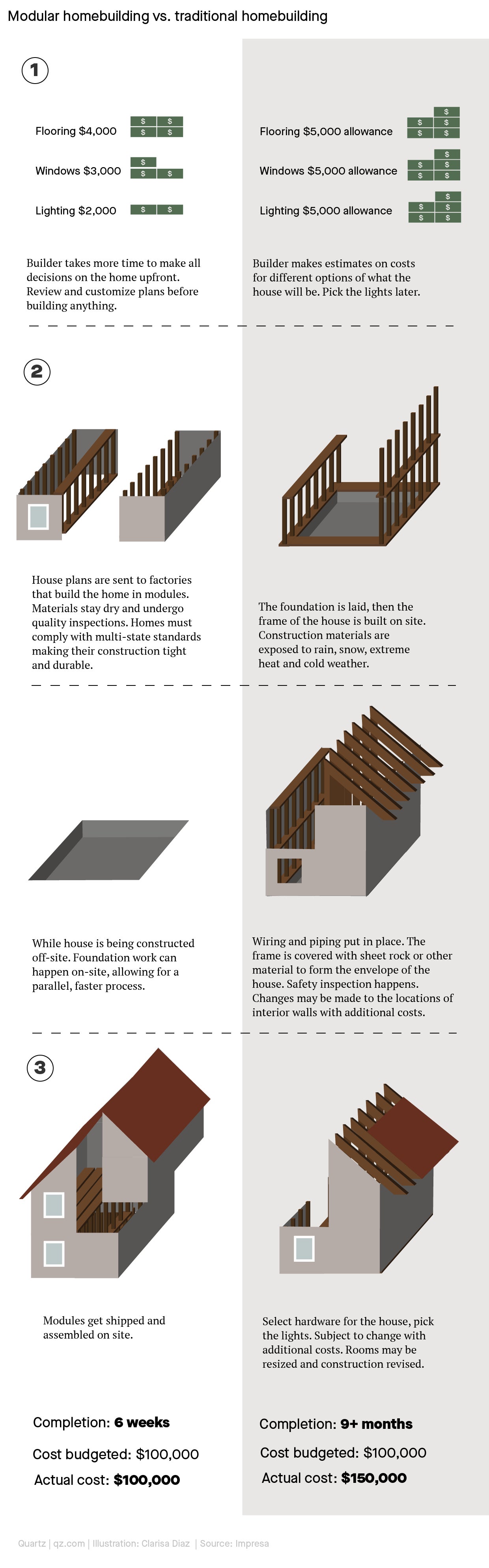

Grade: B-. All right, not all of us are living in modular homes already. But at a time of rising mortgage costs, these homes—which are fabricated off-site in a factory, and can be built in six weeks at a lower cost than building a new house—had a moment in 2022, when shipments reached an all-time high. Last year, after an initial drop, shipments rose for five straight months through August (through the very months the Fed instituted most of its rate hikes in the year). At a time when the US is short around 3.2 million homes, and when most new homes are expensive, modular homes still come up again and again as part of the solution (and not just in the US). But they still have an image problem: Buyers have to be persuaded modular homes are not just low-quality boxes, foisted on the public by deficient housing policies.

⛽ ...start a giant energy transition?

Grade: C. In 2023, India became the world’s most populous country, and it remains the third-biggest source of carbon emissions. As a result, its green energy transition has tremendous implications for climate change. Last year, India became the fourth-largest nation by wind and solar power capacity, and its renewable energy sector attracted nearly $9 billion in investment. Still, this was far less than the $25 billion envisioned by the government in 2022, and although India’s power minister aspires to add 25 gigawatts of clean energy capacity every year, the country added only 14 gigawatts, according to JMK Research. More worryingly, the government now plans to add dozens of gigawatts of new coal power. There is a transition under way, but it isn’t giant yet.

QUARTZ’S PREDICTIONS FOR 2024

🌡️ More alarm over social media.

At least 60 countries, representing half the global population, will go to polls in 2024—and this includes the US, India, the UK, Indonesia, and several others of the world’s most important economies.

And if elections are here, can dirty social media tricks be far behind? Through 2023, companies like X (formerly Twitter) and Meta laid off employees who tackled disinformation, online safety, and hate speech, which leaves the door wide open for politicians and bad actors to lie, stoke fear, or otherwise manipulate the political discourse. Expect chaos.

📉 Continued recession talk

The fact that major economies averted a recession in 2023 doesn’t mean there’s no recession in sight at all. Or at least, that’s what several major Wall Street firms think, as per Bloomberg’s roundup of opinions. (Robeco bluntly called the expectation of a soft landing “nothing short of a fairy tale outcome.”) The reasoning across these firms is remarkably uniform: the effects of central bank rate hikes are still sinking in, inflation won’t slow down nearly as fast as central bankers would like, and consumer spending power will dwindle. And then, of course, there’s the geopolitical risk embedded in the outcome of the US presidential election.

👀 All eyes on copper

Everyone needs it: battery makers, electric vehicle giants, data and power cable manufacturers, the semiconductor industry. And predictably, there isn’t enough of it—at least, not as of now, with disruptions to mining operations in South America. So the price of copper is likely to soar; Goldman Sachs, which expects a supply deficit of half a million tons in 2024, foresees the price of copper hitting $10,000 per ton by the end of the year. The expense of starting new mining projects is high, though; the capital outlay for a new mine can run to $4 billion. The sector is likely to witness a flurry of mergers, acquisitions, and partnerships through 2024, in an attempt to spread these high costs.

🔥 A hot year

By the time the COP29 climate summit convenes in Azerbaijan this November, the world will likely have passed through a landmark year: one in which, for the first time, the average global surface temperature climbs past 1.5° C above the pre-industrial threshold. (In 2023, the warmest year on record, the average between January and October stood at 1.4° C.) This won’t necessarily be a permanent transition; the temperature may be nudged over the threshold by the El Niño effect, which will peak in the months to come. But the effects of this hot year will give COP29 delegates a taste of a world in which climate action fails—and, it is to be fervently hoped, impel them to take more urgent measures to forestall our arrival into that world.

💻The great data crunch

The artificial intelligence revolution will pick up speed through 2024, as companies integrate AI into their products and processes in ways that may not even always be noticeable. (One example: according to a recent survey of corporate human relations executives, 61% planned to invest in AI in 2024.) But AI developers will also increasingly run up against a pressing problem: a lack of quality data on which to train their models.

For one thing, traditional creators of high-quality content, such as newspapers and book publishers, have become vigilant about their work being used without compensation by AI trainers. But AI models also need incredibly vast high-quality data sets to become more versatile, and researchers think (pdf) that the world may not have enough.

One solution may be synthetic data: “artificial” rather than real-world data, created by algorithms to train AIs. (Think about a book written by ChatGPT to train Bard, say.) By the end of this year, Gartner predicts, 60% of all AI training data will be synthetic. But that path is riddled with its own potholes. How reliable or relevant to the real world will synthetic data be? And if algorithms introduce hallucinations into synthetic data, how quickly—and disastrously—will they warp AI models? Until researchers figure out how AI models can use data more efficiently, the industry will need to keep hoovering up the best data available, and to pay more and more for it.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Have a banger of a weekend and a 2024 as clear and shining as crystal,

— Samanth Subramanian, Weekend Brief editor