Target's price hikes, Walmart's China strategy, and Starbucks' tough love: Retail news roundup

Plus, Best Buy's following Walmart's lead, yanking Amazon's playbook

Plus, Best Buy's following Walmart's lead, yanking Amazon's playbook

Target’s CEO Brian Cornell warns that President Donald Trump’s looming tariffs will drive up prices on fruits and vegetables, as the retailer works to recapture the “Tarzhay” vibe. Meanwhile, Walmart is asking Chinese suppliers to absorb the costs of U.S. tariffs. Over at Starbucks (SBUX), CEO Brian Niccol is offering tough love, urging employees to work hard and take accountability for the coffee giant’s financial health.

Target shoppers will soon see higher prices for fruits and vegetables, CEO Brian Cornell warned.

Walmart is reportedly pushing its Chinese suppliers to absorb the costs of U.S. tariffs.

Starbucks CEO Brian Niccol wants corporate employees to work harder and take accountability for the coffee giant’s financial health.

Costco (COST) shoppers are on a bulk-buying spree, snapping up groceries, home furnishings and electronics, as the retailer defies growing concerns over rising tariffs and living costs.

Like Walmart, Best Buy (BBY) is learning from the competition by taking a page out of Amazon’s playbook.

Walmart is thriving among wealthier shoppers, but for lower-income customers, the situation is more challenging, according to CEO Doug McMillion.

Target (TGT) announced in early January that it would be scaling back its diversity, equity, and inclusion (DEI) efforts. Now, it’s facing a 40-day boycott.

The U.S. restaurant industry is bracing for a massive financial hit as a result of the new round of Trump tariffs set to take effect on March 4.

Starbucks is cutting 13 drinks from its menu, but is offering some alternatives for customers who might miss them.

Good morning, Quartz readers! We’re off today for Juneteenth, so there will be no Daily Brief tomorrow. Visit qz.com for coverage, and we’ll be back in your inbox Monday morning.

Still time to rate and see. The Fed announced that it’ll continue to hold interest rates steady as inflation shows signs of cooling but remains above the central bank’s target.

Jerome alone. President Donald Trump remains frustrated with Fed Chair Jerome Powell for not bowing to his longstanding pressure campaign; “I think he hates me,” Trump said.

The U.S. has trust issues. Social Security’s trust fund could soon run out of money — by 2033 — and prompt a benefit cut, jeopardizing benefits unless Congress steps in.

Jet lagging. Airlines are cutting ticket prices as travel from Europe to the U.S. is down, another rough sign for a U.S. travel industry that already faces a multibillion-dollar deficit.

A crude awakening? As the conflict between Israel and Iran worsens, gas prices in the U.S. are rising incrementally, but a supply disruption could soon send costs soaring.

Brains on the blockchain. Sam Altman claimed that Meta has offered OpenAI’s top talent $100 million signing bonuses to jump ship for Mark Zuckerberg’s AI ventures.

Outlook: not great. Microsoft is planning to cut thousands more jobs (mostly in sales) to cut expenses as the company continues to spend heavily on AI investments.

Donald Trump has never been shy about calling his political rivals “communists,” “Marxists,” or — in Kamala Harris’ case — “Comrade Kamala.” But in office, Trump has governed less like Adam Smith and more like a populist in a capitalist costume.

According to the president, he sets the prices. “I am this giant store,” he told Time, likening the U.S. economy to a retail empire under his control. “I own the store, and I set prices.” That philosophy has been more than metaphor: Trump has pressured companies such as Apple and Walmart not to pass on tariff costs to consumers, threatened automakers over offshoring, and handed farmers government bailouts to cushion his trade wars. He’s even dangled executive orders to rein in Big Pharma’s drug prices — a move that might make Bernie Sanders blush.

But the pièce de résistance? Last week, Trump unveiled a perpetual “golden share” in U.S. Steel as part of its sale to Japan’s Nippon Steel. The unprecedented move gives Trump veto power over key business decisions — how much steel is produced, whether jobs stay in the U.S., and more — long after the deal closes. “We have a golden stock… which I control,” he bragged.

That level of government control over a private company’s production, hiring, and future is rare in the U.S. — and not something typically championed by a self-described capitalist crusader. “This is, in a very elaborate way, nationalizing U.S. Steel,” said Douglas Holtz-Eakin of the American Action Forum. “That’s a lot like being a Peronista from Argentina.”

Trump’s economic doctrine isn’t socialism as Karl Marx imagined it, but it is a brand of economic interventionism more common in places like China and Brazil, where governments hold “golden shares” in strategic sectors. And while traditional socialism focuses on redistributing wealth downward, Trump’s policies — from tariffs to tax cuts — appear to have the opposite effect. Quartz’s Joseph Zeballos-Roig has more on Trump’s invisible hand — now with more micromanaging.

Congratulations to the Class of 2024: Over 1,000 Americans became millionaires every single day last year, per the just-released UBS Global Wealth Report. Fueled by a record-breaking stock market and the ever-rising tide of asset prices, global wealth rose 4.6% overall — but North America did the heavy lifting.

The U.S. alone saw an 11% gain in household wealth, powered by a 25% jump in the S&P and a Nasdaq rally that put 2021 to shame.

The fastest-growing cohort? “Everyday millionaires,” or EMILLIs — UBS’ shorthand for people with $1–$5 million in assets. There are now 52 million of them globally, up fourfold since 2000 and holding a collective $107 trillion. That’s nearly as much as the entire ultra-rich club (those with over $5 million), who collectively hold $119 trillion.

Even the billionaire club bulked up slightly, with UBS counting just under 3,000 worldwide. But the real money movement is coming. The long-heralded “Great Wealth Transfer” — roughly $83 trillion in assets expected to change hands over the next two decades — has already begun, and it’s likely to shift financial power dynamics in a major way. One early winner: Women, who are set to inherit at greater rates due to longevity and double-dip inheritances (from spouses and parents).

It’s yet another reminder that income doesn’t equal wealth. In fact, many countries with higher average salaries rank surprisingly low in wealth, thanks to limited asset accumulation. The report suggests that wealth-building is less about a paycheck and more about what you inherit — or how early you bought into Apple. Quartz’s Catherine Baab has more on the rich getting richer — and slightly more common.

💸 The Senate just passed a major cryptocurrency regulatory bill

⏱️ Trump extended the deadline to sell TikTok’s U.S. business — again

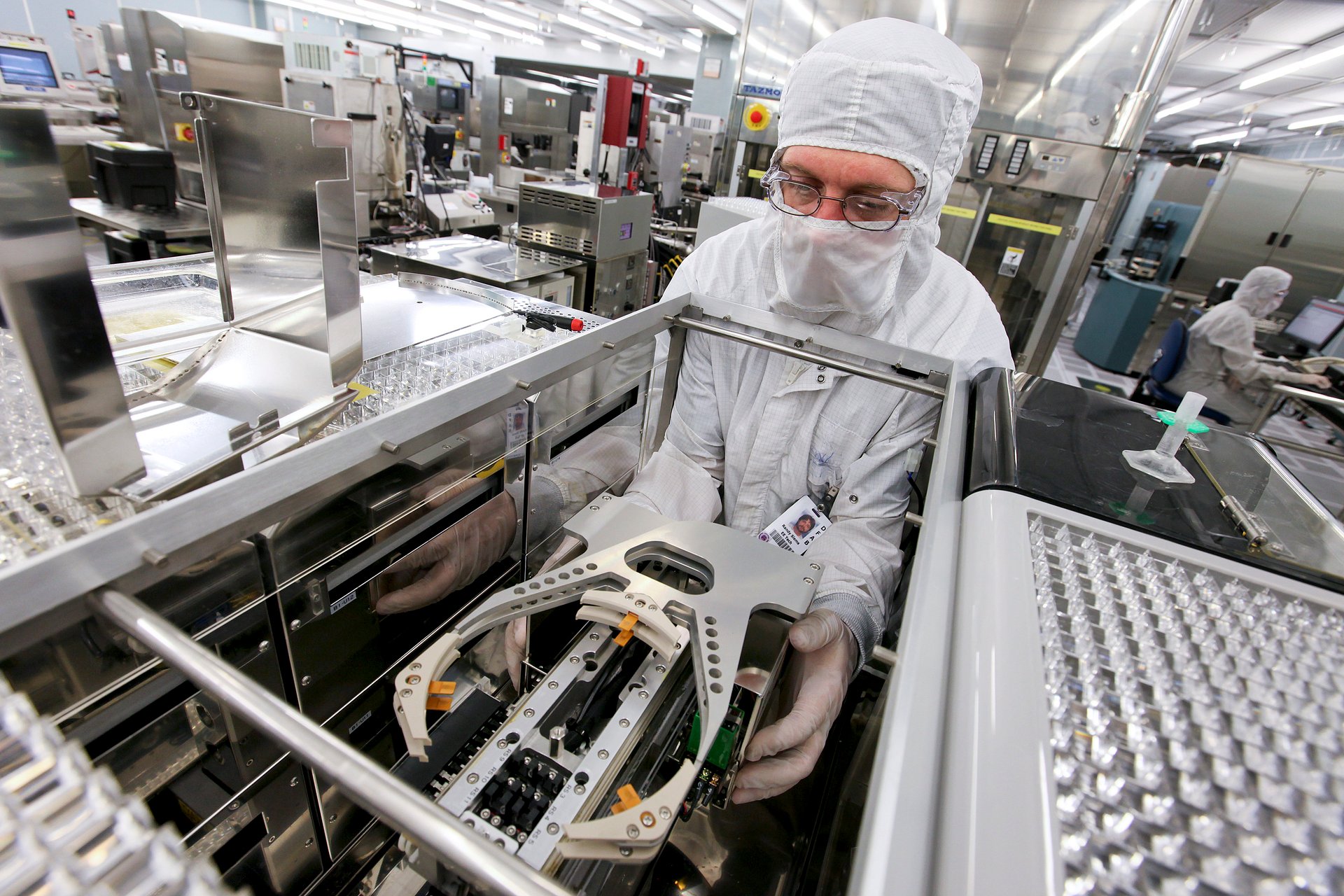

⚡ Texas Instruments will invest $60 billion in domestic chipmaking

🚗 Amazon’s robotaxi competitor, Zoox, has taken a big step forward

⁉️ Workers aren’t happy with Andy Jassy’s suggestion that AI is coming for jobs

🎮 The Nintendo Switch 2 has boosted the company’s market cap by $39 billion

Our best wishes on a safe start to the day. Send any news, comments, and more to [email protected].

The company has been cutting jobs all year while spending big on AI and seeing its stock soar

Thousands of Microsoft sales employees are expected to be laid off next month, according to a new report — during a year in which the company invested heavily in AI.

The software giant is looking to make cuts at the end of its fiscal year in July, Bloomberg reported, citing unnamed sources familiar with the matter. The cuts are expected to hit sales departments heavily, but not exclusively. In June 2024, Microsoft had 45,000 employees in sales and marketing.

Hints first came in March, when the company axed almost 2,000 workers for performance reasons. In April, the writing was on the wall for the sales department: Bloomberg reported Microsoft would rely more on third-party firms to sell to small and mid-sized clients.

A month later, it laid off almost 7,000 employees, or 3% of its entire workforce, with cuts coming mostly from product and engineering positions. At that point, Microsoft said it was working to reduce layers of management and adjust its structure amid ongoing platform shifts.

Microsoft stock hit an intraday record just two weeks ago, on June 5, its highest point since 2024. That followed a series of announcements that signaled how deeply AI is baked into the company's business.

Earlier this year, Microsoft committed to spending $80 billion in fiscal 2025 — most of it on AI-enabled data centers. That’s a figure that suggests CEO Satya Nadella sees AI as Microsoft’s cloud moment all over again. And the market seems to agree.

The marketing department, or what’s left of it, might not.

—Shannon Carroll contributed to this article.

The company will expand its operations in Utah and its home state of Texas

Texas Instruments is investing $60 billion in seven semiconductor fabrication plants, or “fabs,” which the company says is the largest such investment in U.S. history. The seven fabs will be spread across three sites in Texas and Utah, creating 60,000 new jobs.

The move comes as part of the “onshoring” movement, which started under Joe Biden’s administration and continues under President Donald Trump, in response to Asian dominance in the semiconductor industry. Semiconductors are essential components in vehicles, computers, smartphones and other key components of modern life.

Texas Instruments CEO Haviv Ilan said in a press release, “Leading U.S. companies such as Apple, Ford, Medtronic, Nvidia and SpaceX rely on TI’s world-class technology and manufacturing expertise, and we are honored to work alongside them and the U.S. government to unleash what’s next in American innovation.”

Secretary of Commerce Howard Lutnick praised the investment, as did Apple CEO Tim Cook and Nvidia CEO Jensen Huang. Ford CEO Jim Farley said, “At Ford, 80% of the vehicles we sell in the U.S. are assembled in the U.S., and we are proud to stand with technology leaders like TI that continue to invest in manufacturing in the U.S.”

TI currently has two fabs in the Dallas area. The first, in Richardson, dates back to 2009. The company in 2022 broke ground on a new one in Sherman, which will begin production later this year. Three more fabs are planned for Sherman in the coming years. There is currently one fab in Lehi, Utah, just south of Salt Lake City, with a second under construction there.

The trustees warned that Social Security's depletion date moved up by two years since the previous report

The Social Security trust fund will run out of federal cash in 2033 and prompt a benefit cut without Congress stepping in to fortify the program, per a new trustees' report released Wednesday.

The trustees warned that Social Security's depletion date moved up two years from last year's report, which predicted it would run out in 2035. That's partly due to a bipartisan law signed by outgoing President Joe Biden earlier this year to increase benefits for retired police officers, teachers, and other public-sector officials who held jobs not covered by Social Security. The trustees also projected slower earnings' growth for workers in the next ten years.

The trustees estimated that Medicare trust fund financing hospital insurance will run dry in 2033 — three years earlier than projected last year.

Nonpartisan budget watchdogs said Congress needs to address the looming shortfalls affecting both Social Security and Medicare in the near future to prevent a disruption in benefit payments. If Social Security goes insolvent, retirees face a 23% automatic benefit cut.

"Social Security and Medicare won’t even be able to pay full benefits to current retirees – they will be insolvent when today’s 59 year olds reach the full retirement age and today’s youngest retirees turn 70," Maya McGuineas, president of the Committee for a Responsible Federal Budget, said in a statement. "Where is the sense of urgency?"

Extending the lifespan of the program will likely require a mix of higher taxes and benefit adjustments. Many Democrats favor removing the payroll tax cap, which limits Social Security taxes to the first $176,100 of a person's wages.

Another expert argued for policymakers to intervene sooner rather than later. "Smaller, earlier adjustments can protect vulnerable retirees and preserve the system," Romina Boccia, the director of budgets and entitlement policy at the Cato Institute, wrote on X. "Delay guarantees steeper cuts and heavier tax and debt burdens."

The decision and surrounding reasoning, widely expected by markets, leaves the federal funds target rate at its current range of 4.25% to 4.50%

The Federal Reserve held interest rates steady Wednesday, defying pressure to cut them and sticking to a wait-and-see strategy as inflation shows signs of cooling — but remains above target.

"Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated," the Fed statement read.

The decision and surrounding reasoning, widely expected by markets, leaves the federal funds target rate at its current range of 4.25% to 4.50%. Futures traders going into the meeting priced in less than a 1% chance of a cut so are unlikely to be surprised by the announcement.

Looking ahead, the Fed continues to expect two rate cuts this year.

The Fed’s latest “dot plot” shows a clear shift toward caution, with consensus narrowing and hawkish expectations widening. Just 10 of the 19 officials now foresee at least two interest rate cuts in 2025, down from a greater majority in March. Seven expect no cuts at all, up from just four. At the same time, policymakers revised their inflation outlook higher, projecting that core inflation will remain elevated through year-end.

In his remarks and answers to media questions, Powell noted “trade policy concerns” among officials, said he expects GDP to slow, and spoke of tariffs’ effects as only just beginning to be seen, in part because no one quite knows where the effective tariff level will land. He reiterated that tariffs will push up prices, though “that process is very hard to predict,” and “we’d like to get some more data” before attempting to mitigate price pressures.

Asked directly about insults lobbed by the White House, Powell said that ensuring the health of the American economy is "all that matters to us."

If the Fed’s decision isn’t surprising, the political backdrop remains extraordinary.

President Donald Trump has repeatedly called for immediate rate cuts to support the economy amid trade tensions — and has personally targeted Fed Chair Jerome Powell, whom he had appointed in 2017, calling him a “FOOL” on social media, with further comments on Wednesday.

But Powell and his colleagues have held firm, citing inflation expectations and the still-fragile global outlook. While headline inflation has moderated, it remains above the Fed’s 2% target. And Trump’s various rounds of tariffs since assuming office early this year— announced piecemeal and often unpredictably — has introduced new volatility into supply chains and price forecasts.

“We don’t feel like we need to be in a hurry,” Powell said in May. “We feel like it’s appropriate to be patient.”

That patience, of course, comes with risks. U.S. GDP contracted in Q1 and may do so again in Q2. Job growth is somewhat sluggish. And while the market has bounced back from its April “Liberation Day” lows, consumer sentiment remains uneasy. Meanwhile, Fed officials appear more concerned about reigniting inflation than about being seen as unresponsive.

The central bank’s credibility — and the value of its independence — may be its most powerful tool right now.

The plant will make 10,000 cars annually, taking the self-driving race up a gear.

Zoox—Amazon’s autonomous vehicle subsidiary—has officially launched its inaugural robotaxi production facility in Hayward, California, the company announced Wednesday.

At 220,000 square feet—the equivalent of 3.5 American football fields—the plant will be capable of assembling over 10,000 cars annually.

The Hayward facility marks a pivotal moment for Zoox as it transitions from limited testing to large-scale production—and primes Amazon to vie head-to-head with the established players in the robotaxi arena.

More than 20 Zoox prototypes are currently undergoing testing across U.S. cities, as the company prepares to launch its commercial service in Las Vegas later this year. San Francisco is among its test cities, and it plans to onboard public riders here first.

"This expansion, plus the anticipated demand once rides open up to the general public, and additional market entrances in the coming years warrants this increase in robotaxi production," Zoox said in a statement.

What sets Zoox apart from its rivals is its bespoke vehicle design—animated more like “gondolas on wheels.” The cars forsake conventional steering wheels and pedals, a stark departure from retrofitted models used by Waymo and Tesla.

While the plant notches Zoox's position in the robotaxi race up a gear, it's still miles behind its competitors.

Alphabet’s Waymo, was the first to put a fully driverless taxi on the road. It operates a fleet in multiple U.S. cities, including Phoenix, San Francisco, and parts of Los Angeles and Austin. They’re coming to Atlanta, Miami, Washington, D.C., and even Tokyo soon. As of mid-2025, Waymo is providing millions of driverless rides per quarter, with consistent safety records and publicly available data.

Tesla is also poised to launch its robotaxi service on June 22, starting with modified Model Y vehicles, before later introducing a wheel-free “Cybercab.” Thus, this month's launch isn’t a fully autonomous debut. The Model Y vehicle will be equipped with the company’s full self-driving (FSD) software, and each will be monitored by human operators ready to intervene remotely if things go sideways. This falls short of CEO Elon Musk’s vision for fully driverless Teslas commanded by AI alone.

“The overwhelming focus is on solving full self-driving. That’s essential. It’s really the difference between Tesla being worth a lot of money or worth basically zero,” Musk said in 2022.

However, for all three companies, obstacles persist on the road to a driverless future. Headwinds range from high production costs and regulatory red tape, to federal probes into safety incidents. For example, Zoox issued a voluntary software recall following a non-fatal crash in Las Vegas last month.

After CEO Andy Jassy said in an email that AI would likely drive a workforce reduction, employees took to Slack to express their frustrations

Amazon’s corporate workforce woke up Tuesday to a not-so-cheery note from CEO Andy Jassy: The AI era is here — and your job might not be.

That didn’t go over well internally.

According to Business Insider, white-collar employees pushed back — hard — across internal Slack channels. In messages viewed by the publication, some employees called the message demoralizing; others accused Jassy of prioritizing AI hype over human impact. One employee said there’s “nothing more motivating on a Tuesday than reading that your job will be replaced by AI.”

Another quipped: “At least [Jassy] said the quiet part out loud.”

In a company-wide memo, Jassy had framed generative AI as the engine powering Amazon’s next chapter — from customer service to code writing to warehouse logistics. The technology, he said, is already streamlining operations and enabling new tools such as Alexa+, “Buy for Me,” and a swelling army of over 750,000 warehouse robots. But the efficiency gains, he said, won’t just change how Amazon works — they’ll change who does the work.

“We will need fewer people doing some of the jobs that are being done today,” Jassy wrote, “and more people doing other types of jobs.” That will likely mean headcount reductions on the corporate side; Amazon has already laid off more than 27,000 workers since late 2022.

While a few employees said in messages that middle management could be replaced with AI without consequence — “No one would notice,” someone wrote — the broader sentiment skewed critical. Employees said Amazon is choosing to use AI to reduce staff rather than expand what existing teams can accomplish.

Jassy wrote in his email that research, summarization, anomaly detection, translation, coding, and more will soon be delegated to bots that get smarter over time, leaving humans to “focus less on rote work and more on thinking strategically.”

“Agents will allow us to start almost everything from a more advanced starting point,” he wrote, adding that they’ll “change the scope and speed at which we can innovate for customers.” Jassy encouraged employees to “get more done with scrappier teams,” attend training sessions, and adopt an AI-first mindset. In his words, those who embrace AI and help Amazon build its future will be “well-positioned to have high impact and help us reinvent the company.”

In an annual shareholder letter in April, he had said Amazon needs to operate like “the world’s largest startup,” but in the recent messages, some employees described Amazon’s culture as increasingly focused on cost-cutting, not innovation, and questioned why AI-driven downsizing seems to target the rank and file — not Amazon’s growing executive ranks. “Will it result in less SVPs?” one employee asked.

Another wrote: “This seems to be the [antithesis] of Think Big, and is part of a continual trend that our CEO doesn't seem to have a vision for the company other than ’do what we do today cheaper, and also AI will happen.’”

Amazon didn’t respond to a request for comment.

In the memo, Jassy said employees who embrace the AI-first mindset will be “well-positioned” to help reinvent the company. But the company’s pivot is “dangerous,” one employee wrote, “and it will have real consequences.”

The debate unfolding at Amazon echoes broader tensions in Big Tech. Microsoft, Google, and others are pouring billions into AI while working to reduce their headcount. Startups such as Harvey and Adept are building AI agents meant to handle knowledge work. And leading voices — from Nvidia’s Jensen Huang to Anthropic’s Dario Amodei — have warned that widespread displacement is coming.

At Amazon, that future seems like it could be less theoretical by the day.

The president insulted Powell anew and toyed with installing himself as Fed leader before the central bank again held rates steady

President Donald Trump is still fed up with the Federal Reserve for not bending to his longstanding and extraordinary pressure campaign.

Ahead of the central bank's latest decision on interest rates, Trump on Wednesday renewed his barrage of attacks against Fed Chair Jerome Powell. He insulted Powell and toyed with the idea of installing himself as Fed Chair. He also said that if he were in the position, he would lower interest rates by 2.5 percentage points.

"We have a stupid person, frankly, at the Fed. He probably won't cut today. ... Maybe I should go to the Fed. Am I allowed to appoint myself at the Fed?" Trump said outside the White House.

Trump continued his freewheeling remarks and said nothing he's done to pressure the central bank has been successful at getting it to lower interest rates. "Now we have a man that just refuses to lower the Fed rate, just refuses to do it," he said. "He's not a smart person. I don't even think he's that political. I think he hates me, but that's okay."

Trump continued: "He should, I call him every name in the book trying to get him to do something. I've been nice to him. I do it every way in the book. I'm nasty, I'm nice. Nothing works. He's like a stupid person."

The Federal Reserve did not immediately respond to a request for comment.

Few are expecting an interest rate cut from the Federal Reserve as it wraps up its two-day meeting. The Fed is sitting tight at the moment to better measure the effect of Trump's policies — including the armada of tariffs he's deployed — on the U.S. economy before deciding to lower interest rates. Inflation is still above the Fed's 2% target. The central bank operates independently.

Trump first nominated Powell to the position in 2017. Powell visited Trump at the White House's request last month in a rare meeting. In a statement following the meeting, the Fed said Powell didn't discuss specifics on monetary policy "except to stress that the path of policy will depend entirely on incoming economic information and what that means for the outlook."

The increases are incremental for now, but a supply disruption in the Strait of Hormuz could make costs soar

Death and destruction in the Middle East have meant rising gas prices in the U.S.

Data from GasBuddy, compiled from more than 150,000 gas stations across the U.S., reports that the average price has gone up 1.1 cents to $3.08 per gallon since Israel and Iran started bombing each other on June 13, although that is still 9.5 cents lower than in May and 32.7 cents lower than this time last year. Diesel prices went up four cents in the last week.

Gas is most expensive in California, Hawaii and Washington; it is cheapest in Mississippi, Tennessee and Oklahoma. The biggest increases in the last week were found in Indiana, Virginia, West Virginia, and Pennsylvania. Prices in Florida fell 11.4 cents.

“As long as tensions in the Middle East continue to escalate, the risk of further impacts on oil prices remains high,” said Patrick De Haan, head of petroleum analysis at GasBuddy. “For now, I expect gas prices could rise by 10 to 20 cents, while diesel could climb 15 to 25 cents in the coming days."

De Haan added that “the situation has the potential to worsen at any moment.”

Though both countries have targeted oil refineries, no supply has yet been disrupted. The biggest concern is if Iran were to block access to the Strait of Hormuz, which connects the Persian Gulf to the Arabian Sea, through which one-third of global seaborne oil passes through.

ING analysts predict that this would bump prices by $120 a barrel, though it might not be in Iran’s strategic interest to do so — particularly due to the risk of angering its biggest customer, China.

In the meantime, U.S. consumers will be subject to a “risk premium,” UBS commodities analyst Giovanni Staunovo told GasBuddy. “Risk premia tend to fade if there are no disruptions,” he added.