The Nasdaq's record, Salesforce stock's bad day, GameStop spikes again: Markets news roundup

Plus, a guy got $3 million in Bitcoin back after he lost an 11-year-old password

2 / 11

A man in Europe recently recovered nearly $3 million in Bitcoin after thinking his password was lost forever.

The anonymous man, dubbed “Michael,” hired a team of security researchers who were able to unlock his Bitcoin wallet and retrieve 43.6 Bitcoin.

3 / 11

The costs associated with owning a home have skyrocketed over the past few years, especially in the aftermath of the pandemic, as mortgage rates continue to rise and home prices stay elevated.

4 / 11

Thursday was a big day for Salesforce — but not in a good way. Salesforce’s stock price fell nearly 20% on Thursday, its largest single-day drop in share price since 2004.

5 / 11

The Dow plummeted more than 375 points Wednesday morning. Airline stocks were in the red after American Airlines showed a weak guidance report on Tuesday.

6 / 11

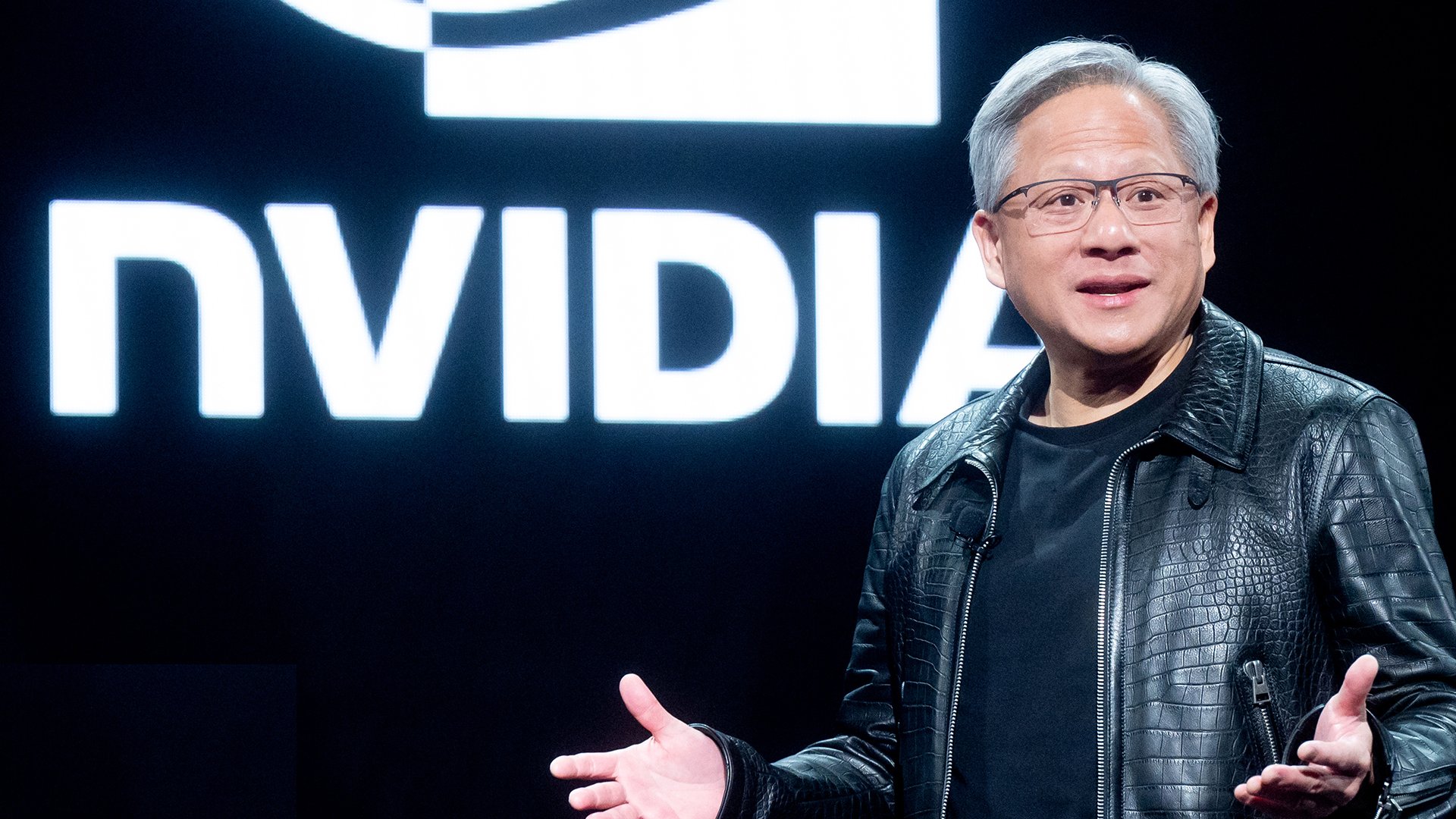

The tech-heavy Nasdaq climbed above 17,000 points Tuesday morning as AI stock Nvidia continued to rise. With this move, the index has made a record for the third consecutive week.

7 / 11

After rising to over $70,000 on Monday, the price of Bitcoin dropped below $68,000 Tuesday morning as the now-defunct Bitcoin exchange Mt. Gox transferred more than $9 billion worth of Bitcoin to an unknown wallet, possibly to repay its creditors.

8 / 11

GameStop stock climbed more than 30% in afternoon trading on Tuesday, following the completion of its latest share sale.

The company said Friday that it sold 45 million shares of common stock for approximately $933.4 million. It had disclosed that it would be carrying out an “at-the-market” equity offering, meaning that its newly issued shares were sold at market prices. Read More

9 / 11

A Chinese national has been arrested by the U.S. Treasury Department for allegedly running 911 S5, a service that has been the cheapest and easiest way to send e-mail through malware-infected machines for many years.

10 / 11

Gus Scacco of Hudson Valley Investment Advisors breaks down how lower interest rates and strong earnings will keep markets churning higher into the next year

11 / 11

Gus Scacco of Hudson Valley Investment Advisors says the next phase of the AI boom will keep profits flowing for the chipmaker