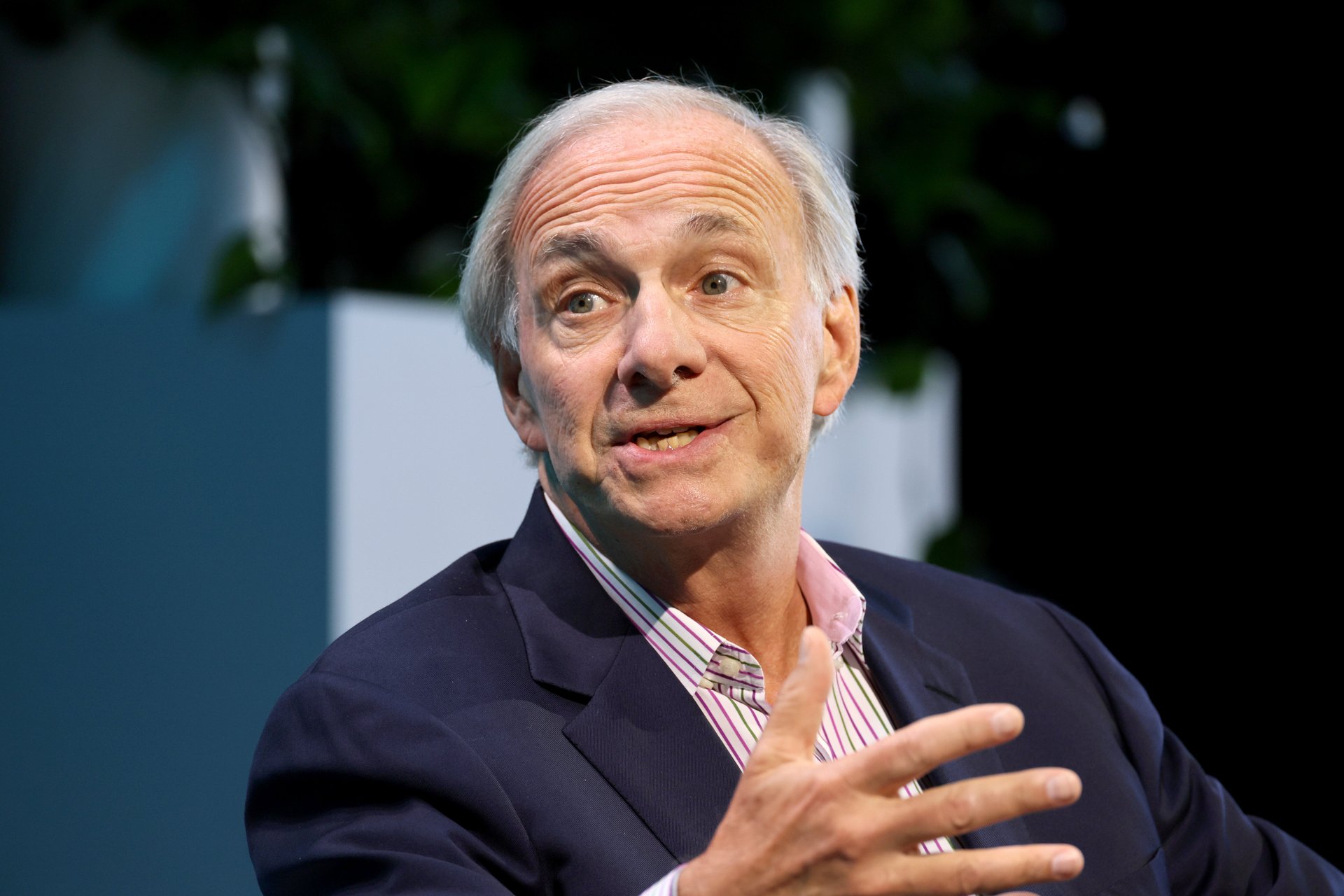

Ray Dalio doesn't like the choice between Kamala Harris and Donald Trump

The billionaire investor warned that neither presidential candidate can fix America's growing debt. “Both of the candidates worry me,” he said

Bridgewater Associates founder Ray Dalio isn’t too thrilled about the prospect of either a Kamala Harris or (second) Donald Trump administration.

Suggested Reading

“Both of the candidates worry me,” Dalio told CNBC in an interview at the Future Investment Initiative conference in Saudi Arabia on Wednesday.

Related Content

“This left, right and fighting each other is a problem as it becomes more of the extremes,” he said. “I think there needs to be a bringing of Americans together, that middle of that, and making great reforms. … There needs to be a strong leader of the middle, I believe, that makes great reforms. ... Neither of the candidates does that for me.”

Dalio, who has previously criticized the worsening divisions in U.S. politics (going so far as to warn that the country may be “on the brink” of a civil war back in May), said he is concerned about a number of issues facing the country that he feels neither candidate is ready to address.

“The debt is concerning, the internal conflict is concerning, the external conflict is concerning, and certainly the climate and the cost of the climate is concerning,” he said.

National debt, which is nearing the $36 trillion mark, has become a major area of concern for Dalio, as well as several other business leaders, including JPMorgan Chase (JPM) CEO Jamie Dimon and BlackRock (BLK) CEO Larry Fink.

“We have a real debt problem,” Dalio said. “I think one man’s debts is another man’s assets.”

Dimon has similarly warned that the debt problem could be a thorn in the side of the Federal Reserve’s efforts to keep inflation down. The JPMorgan chief has said he is “a little more skeptical that inflation is going to go away so easily.” Although inflation has been trending downward, Dimon government deficits as a major inflationary risk that could cause price growth to spike again in coming years.

Although Dalio said Trump will likely be better for domestic capital markets, both candidates’ plans will likely add to the ballooning debt. That’s in line with a recent report from the nonpartisan Committee for a Responsible Federal Budget (CRFB).

The analysis found that both candidates’ proposed economic agendas are almost guaranteed to raise the federal debt by at least a couple trillion dollars — but Trump would add nearly double what Harris would contribute. While Harris would add $3.5 trillion in debt through fiscal year 2035, Trump is expected to add $7.5 trillion, according to the CRFB.

According to a Goldman Sachs (GS) report from September, a Harris win and a Democratic sweep would be the best-case scenario for the overall U.S. economy, noting that her middle-class tax credits would outweigh any downward pressure on investment from higher corporate taxes.