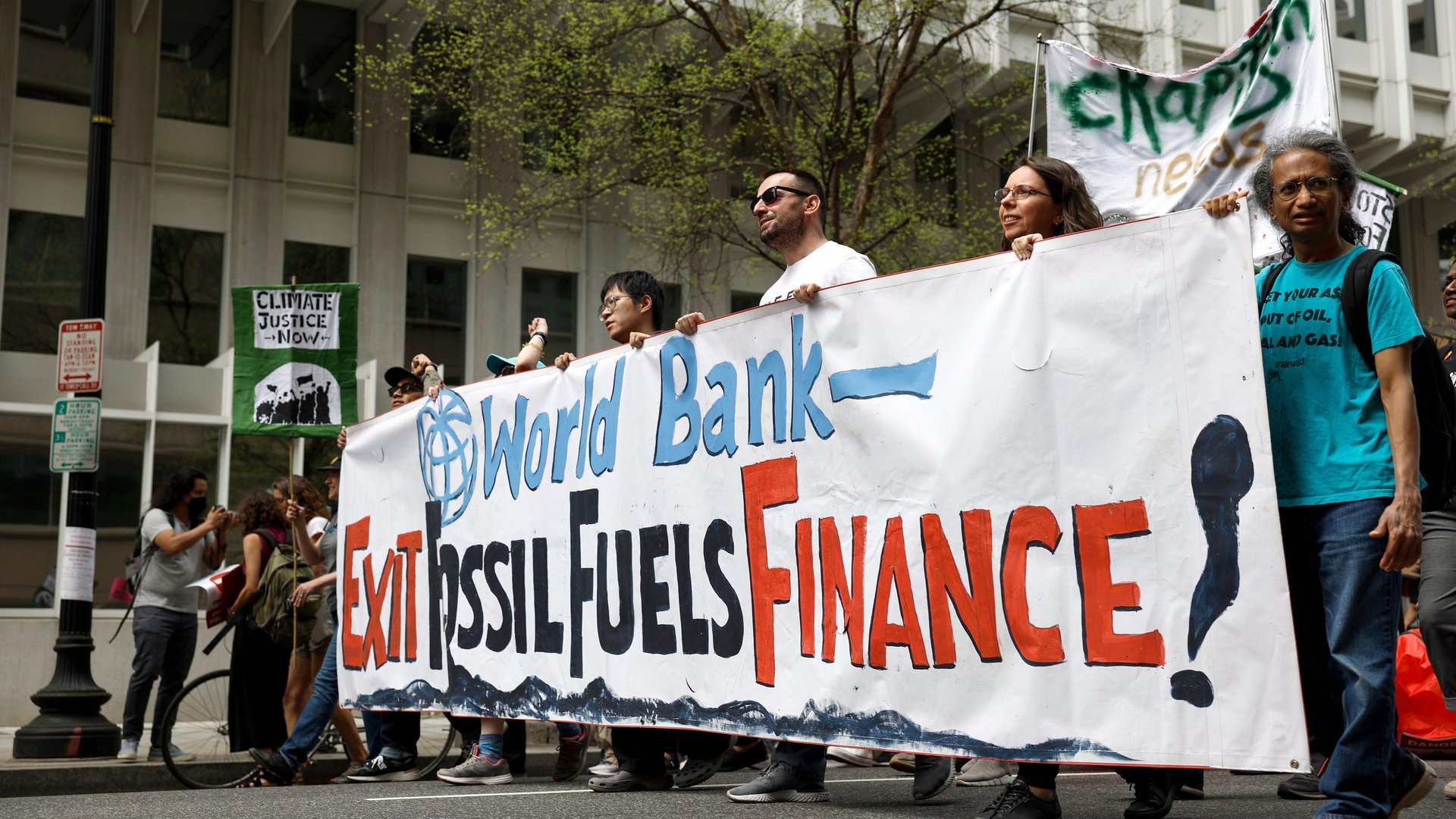

The World Bank is talking climate but funneling billions into oil and gas projects

In 2022, the World Bank supplied nearly $3.7 billion in trade finance that likely ended up funding oil and gas developments

The World Bank is pumping record funding into climate financing. But at the same time, it’s also funneling billions into fossil fuel projects.

Suggested Reading

In 2022, the World Bank supplied about $3.7 billion in loans and capital to expedite imports and exports—“trade finance”—that likely ended up funding oil and gas developments, according to Urgewald, a campaign group that tracks global fossil fuel finance. The source of these funds was the International Finance Corporation (IFC), the arm of the Bank that works with the private sector, Urgewald said.

Related Content

“This would more than triple the current annual level of fossil fuel finance attributed to the World Bank and cast serious doubts on Bank claims of alignment with the Paris Climate Agreement,” Heike Mainhardt, the author of the research, warned (pdf). Even this estimate is conservative, Urgewald researchers said, because it doesn’t take into account how the prices of oil and gas spiked as a result of the war in Ukraine. The report also doesn’t cover coal-related trade—another contributor to carbon emissions—because of a lack of reliable information.

The World Bank, the world’s largest lender, pledged in December 2018 to align its spending more closely with the goals of the 2015 Paris Agreement, which seeks to limit annual global warming to 1.5 degrees Celsius above pre-industrial levels. In July, the Bank put its Paris Alignment roadmap into action, aiming for “every” investment to “reduce climate impacts, support low-carbon pathways and help avoid carbon lock in.”

All of its operations would be “vetted to manage and reduce climate risks of a project and to demonstrate that our financing supports the lower-carbon options where technically and economically feasible,” the World Bank said in a July 10 statement. But a loophole persisted: Trade finance wasn’t part of these promises to stop financing coal and upstream oil and gas. They “only apply to direct finance and not to trade finance, which is considered indirect finance,” Mainhardt points out.

Quotable: Aligning with the Paris Agreement.

“The World Bank needs to radically overhaul its Paris Alignment approach so that all fossil fuels, including gas, are considered non-aligned.”

—Sandra Guzman, director of the Climate Finance Group for Latin America and the Caribbean. At the moment, only two activities—electric power generation from coal and peat, and activities directly supporting coal and peat extraction—are universally non-aligned.

Rebuttal: World Bank denies Urgewald’s findings

Urgewald’s report “contains serious factual inaccuracies and grossly overstates IFC’s support for fossil fuels,” a spokesperson for the IFC told the Guardian.

The spokesperson also claimed that IFC “excludes coal from trade financing and only permits oil and gas on a limited basis for distribution purposes only (no production), contingent on development impact,” and that too, only in countries “where energy security is critical.”

By the digits: The World Bank’s climate financing

$31.7 billion: The volume of capital that the World Bank put into climate financing in 2022, a record for the institution. It meant that 36% of the Bank’s total financing for the year went towards climate efforts. It marked a 19% increase from the year prior and surpassed the 35% threshold for climate financing set out in the Bank’s Climate Change Action Plan for 2021-2025. The US Congress has urged the share be increased to 50%.

$14.8 billion: The World Bank’s fossil fuel investments between the adoption of the Paris agreement in 2015 and October 2022, according to Big Shift Global, a coalition of NGOs.

70%: The share of IFC’s trade investments that are distributed in confidentiality, making it hard to keep track of which of these investments end up funding fossil fuel projects

40%: The share of the World Bank’s climate finance that cannot be verified, according to an October 2022 Oxfam audit

Person of interest: Ajay Banga

It won’t take a lot for Ajay Banga, who was appointed president of the World Bank in June, to impress climate warriors. After all, his predecessor, David Malpass, set the bar low by publicly denying the link between fossil fuels and climate change. But will Banga free up the trillions of dollars needed for the climate revolution?

Banga, the former CEO of Mastercard, asked employees to “double down” on development and climate efforts in a memo on his first day on the job. He said he was game to expand the Bank’s financing corpus but acknowledged that “the World Bank cannot do this alone,” calling upon governments, philanthropies, and other multilateral banks to work together.

While he’s more business baron than climate crusader, Banga did steer Mastercard towards being one of the first companies to set net-zero emission targets under the Science Based Targets initiative. In 2021, he also became vice-chairman of General Atlantic’s climate-focused fund Beyond Net Zero in 2021, which aims to “source, execute and support investments in high-growth businesses that ultimately have the potential to combat climate change at scale.”

Related stories

🛢️ The G20 pledged to end fossil fuel subsidies in 2021—and then quadrupled them in 2022