Warner Bros. Discovery stock plunged after revealing a $9.1 billion impairment charge

The media company's shares have fallen 70% in the two years since its creation

Warner Bros. Discovery stock dropped more than 11% in pre-market trading Thursday after the entertainment giant reported a whopping $11.2 billion in write-downs and charges.

Suggested Reading

In the second quarter, the company booked a $9.1 billion non-cash goodwill impairment charge tied to its TV networks segment, as well as a $2.1 in costs related to its merger, Warner Bros. Discovery said in its quarterly earnings report Wednesday.

Related Content

The company brought in $9.7 billion in revenues in the three months ended June 30, declining 6% from the same period a year prior and falling short of Wall Street estimates.

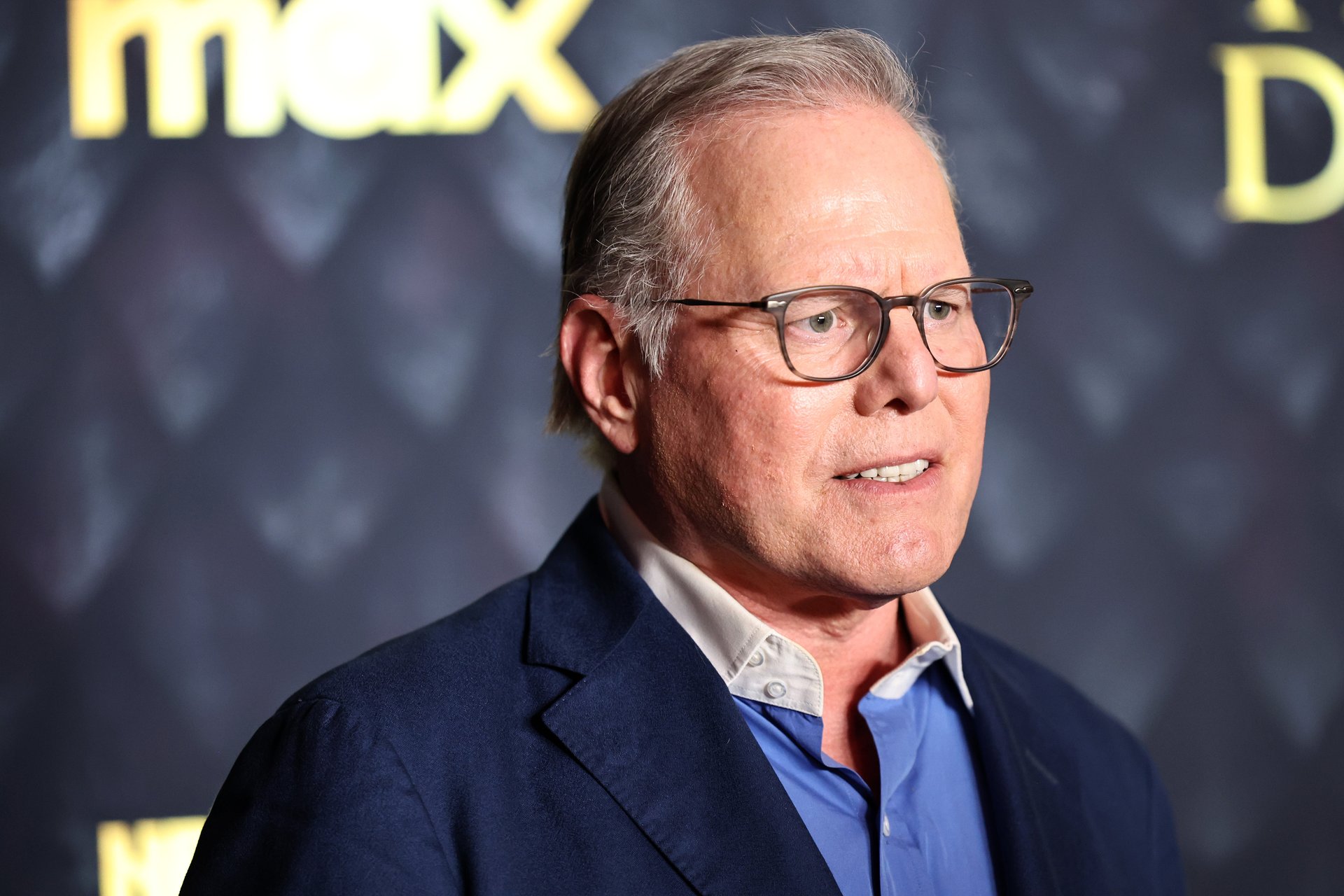

“It’s fair to say that even two years ago, market valuations and prevailing conditions for legacy media companies were quite different than they are today, and this impairment acknowledges this and better aligns our carrying values with our future outlook,” Warner Bros. Discovery chief executive David Zaslav said in a call with analysts Wednesday.

The company’s stock has plummeted 70% since it was created through a merger deal between Discovery and AT&T’s WarnerMedia that was completed in April 2022.

Analysts recently said that the sprawling media giant “is not working,” and that it should consider an asset sale or spin off some of its businesses to help boost its sinking stock. Zaslav has reportedly been mulling splitting the company up to appease shareholders.

Gunnar Wiedenfels, the company’s chief finance officer, pointed to a “number of triggering events, including the difference between our current market cap and the book value of the company, the continued softness in the U.S. ad market, and uncertainty related to affiliate and sports rights renewals” as reasons behind the charge.

“While I am certainly not dismissive of the magnitude of this impairment, I believe it’s equally important to recognize that the flip side of this reflects the value shift across business models,” Wiedenfels said.

Despite the weak performance in its traditional TV business, its streaming services have continued to grow their audience. The company added 3.6 million global subscribers in the quarter, to reach 103.3 million across its HBO, Max, and Discovery+ platforms. Direct-to-consumer revenues still fell 5% from a year earlier to $2.57 billion.

— Bruce Gil contributed reporting.