If you work at a Chinese bank these days, the thing you’re probably sweating the most is vanishing deposits. Banks are only allowed to lend a certain percentage of their deposit bases. Artificially low government-set deposit rates have driven households and companies to hold their savings instead in higher-yielding products, such as wealth management products (WMPs). Fewer deposits means fewer loans—which means less interest income for banks. (Banks earn commissions off WMPs, so it’s not all bad.)

But, in a trend we flagged in October, the Chinese internet giant Alibaba is now competing against both bank savings accounts and WMPs—and winning. In November, deposits in its investment platform, Yu E Bao, surpassed 100 billion yuan ($16.4 billion), with 30 million users—astonishing growth in just six months of operation.

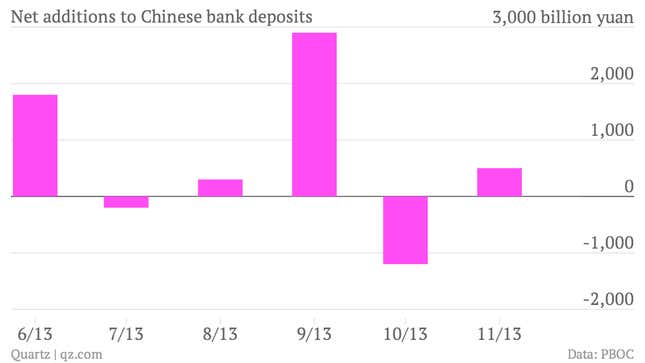

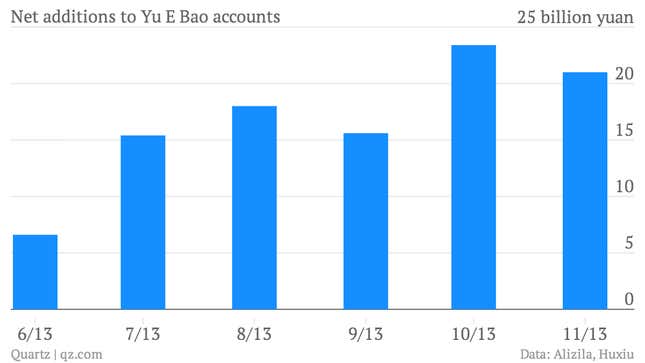

Of course, 100 billion yuan is but a sliver—0.09%—of the amount in Chinese bank deposits, which totaled 103.2 trillion yuan in November. But in months when Chinese banks have lost deposits, Yu E Bao has steadily gained (for ease of comparison, the charts below use billions of yuan as the scale):

And here are net deposits added to Yu E Bao:

When Alibaba launched Yu E Bao—literally, “account balance treasure”—in June, it framed it merely as an account to store the balance leftover on Taobao, Alibaba’s wildly popular e-commerce site. But Yu E Bao offers roughly 5-6% annual interest. And as this recent Financial Times piece (paywall) explains, Chinese investors find it user-friendly as well.

“There’s no point in keeping money in the bank any more. This is just as reliable, more flexible and you can earn a lot more from it,” Li Mingyang, a Shanghai-based editor, told the FT. “This is fun, almost like a computer game.”

We’ve covered in the past how Alibaba isn’t alone in offering this. Baidu launched a similar product in October, attracting one billion yuan on the first day. And now Chinese digital powerhouses Tencent and Netease are joining in. If they pull off even a fraction of Alibaba’s success, things could get even more uncomfortable for Chinese banks.