For the first time since paper money was invented some 1,000 years ago, a future where cash is no longer king seems possible. Card and digital payments are on the rise around the world, and consumers are increasingly going cashless for even small-dollar transactions. But a totally cash-free future is far from guaranteed. Central banks are printing more cash than ever, and while some see digital payments as a solution for the world’s underbanked population, others see a cashless economy as inherently discriminatory.

Quartz’s latest presentation reveals the complex forces reshaping how global consumers use cash—from the booming business of fintech to the benefits of paper money that digital payments just can’t beat.

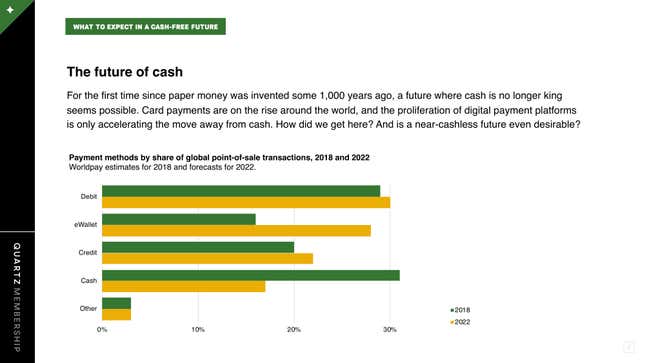

The advent of credit and debit cards in the mid-20th century was the first step in chipping away at the need for cash. More contemporary payment options—mobile wallets, mobile payment apps, and cryptocurrencies—have rapidly expanded the range of transactions that can be completed without cash. For example, mobile payment apps allow friends to instantly repay one another or split shared expenses without cash.

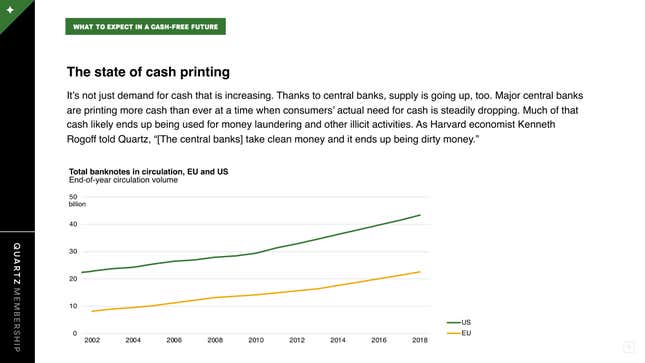

The story of the world’s changing relationship with cash is complicated. On one hand, ATM withdrawals remain high—especially in fast-growing economies—and central banks are printing more cash than ever in both emerging and wealthy economies. But demand for digital payments is rising even more rapidly. Across 23 countries tracked by the BIS, the volume of cashless payments increased 88% between 2012 and 2017.

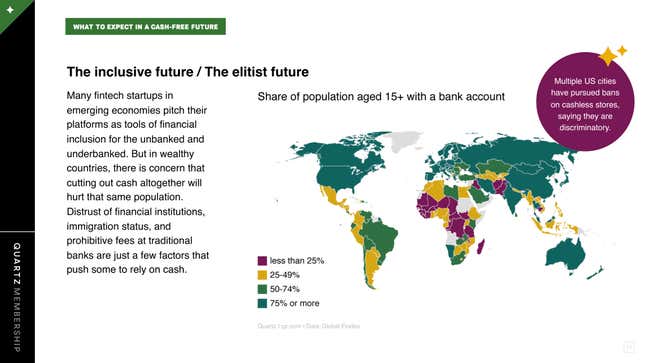

One question looming over the future of cash is whether requiring consumers to abandon paper money is elitist. Nearly half of US small business owners surveyed by fintech company Square say so, and regulators in multiple US cities have passed laws banning cashless stores. At the same time, fintech is emerging as a potential solution for underbanked populations in emerging economies. One pathway for the future is to simply have less cash. Reducing cash circulation—especially large bills—can combat illicit use of cash while still providing consumers with flexibility for their everyday transactions.

To see all of the slides, you can view the PDF version or download the PowerPoint file, which includes our sources and notes. This is one of an ongoing series of member-exclusive presentations, which you can read, reformat, and use as you wish. And if you enjoyed this presentation, sign up for Quartz’s Future of Finance newsletter here.

Please share any feedback about what would make these presentations more useful—or topics you’d like to see us cover—by emailing us at members@qz.com. These presentations are an exclusive benefit for Quartz members. We’d love it if you’d encourage any friends or colleagues who express interest to become a member so they can access them too.