Forget global conquest. It looks like Alibaba will keep backing the horse it’s been riding: China’s explosion of retail spending.

That long-term growth strategy might seem like a safe bet, with the company predicting that China’s e-commerce market will double in size by 2016. But it’s based on assumptions about the rapid growth of Chinese consumption and the government’s ability to “rebalance” the economy—and both those prospects are pretty iffy.

First, a quick reminder of what that “rebalancing” challenge is about. Since the 1980s, China’s leaders juiced growth by investing like crazy. They got the cash to do that by suppressing households’ wealth, funneling savings to state companies via banks. All that investment created rampant debt. The problem now is that if China is to keep growing at anywhere close to Q1’s 7.4%, it must either keep adding on debt, or “rebalance”—i.e. whip up enough consumer spending to replace investment.

The optimistic market analysis (p.126-7) in Alibaba’s F-1 filing is built on assumptions that growth in Chinese consumption will outpace GDP expansion—in other words, that China’s economy will achieve said rebalancing.

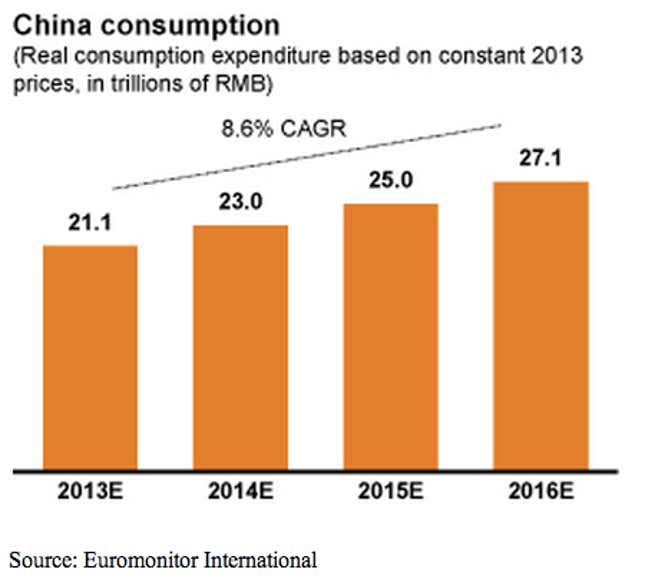

Alibaba seems confident that this will happen. The first factor underpinning Alibaba’s market opportunity is “the rising spending power of Chinese consumers” and the belief that a shift toward higher rates of consumption will drive its business, according to the filing. As a sign that consumers are finally spending more, Alibaba cites projections by Euromonitor International, a consulting company, that real consumption will grow 8.6% each year from 2013 to 2016. Those predictions, as well as data showing that income levels for urban households rose 8.5% annually from 2008 to 2013 (adjusted for inflation) while household savings rates slid, are a big part of why Alibaba’s executives are optimistic that “rebalancing” is already underway.

“As Chinese consumers continue to experience real wage increases, as well as a higher propensity to spend, we expect that the contribution of consumption to overall GDP in China will continue to increase over time and that the growth rate of consumption will continue to outpace GDP growth,” the company says in its filing.

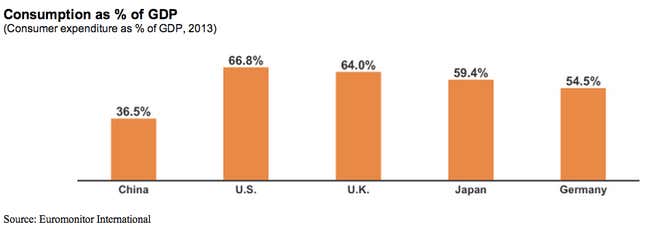

That all sounds good. But this “rebalancing” stuff isn’t an automatic or organic process. Until China’s leaders reform the mechanisms quashing consumption—for example, liberalize interest rates—the pro-investment, anti-consumption forces will endure. In fact, here’s a chart from Alibaba’s F-1 showing just how remarkably well they are enduring:

China’s leaders know this. But liberalizing markets is easier said than done. And it almost certainly means sacrificing growth, at least in the short term. Will that crimp consumption? Probably. And yet even so, Euromonitor’s projections for real Chinese consumption assume China’s GDP will grow 7.4% annually, in real terms:

That seems odd, given the growing consensus that China’s economy is on the brink of sharp decline—Nomura analysts for example, just predicted 2014 growth to be as low as 5.8%. While a gradual slowdown would be good for consumption, in theory, too abrupt a drop risks scaring people away from that happy-go-lucky spending on iPhones and spiffy shoes and all the other things driving Alibaba’s growth.

And the outlook is even grimmer if growth drops because of plummeting property values. Surging home values have helped spur consumption by making people feel wealthy; their fall could easily do the reverse.