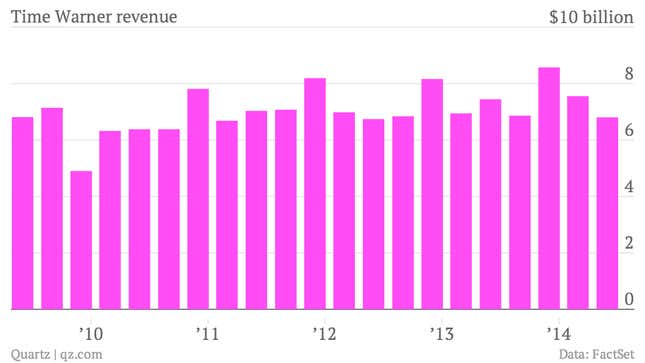

The numbers: A day after 21st Century Fox withdrew its bid to buy it, Time Warner posted $6.8 billion in revenue, up 3% from last year—that is, if you take out the revenue made from its recently spun-off publishing company Time Inc. Profits increased 17% to $1.6 billion, and earnings per share rose 29% to $0.98.

The takeaway: While revenue was lower than Q2 2013, it still narrowly beat Wall Street expectations. That was mostly due to yet another strong quarter from pay-TV powerhouse HBO. Executives at Time Warner decided recently to release HBO numbers separately—they used to be lumped together with Warner Bros. as “Film and TV Entertainment.” But now, partly to draw comparisons to the surging Netflix, the company likes to prop up its most lucrative property in earnings releases. And for good reason: HBO revenues rose 17%, while Turner rose only 5% and Warner Bros. decreased 2%. A good chunk of HBO’s 17% increase is due to the company’s deal with Amazon to license some of its shows on Amazon’s Prime Instant Video service, a direct Netflix competitor. Many observers believe HBO has long been undervalued by investors, and with its expansion into new countries, it soon may be worth even more. And HBO’s sister channel Cinemax wants to elevate its programming.

What’s interesting: While the numbers themselves were relatively uneventful, anticipation is high for when CEO Jeff Bewkes fields questions from analysts in the company’s earnings call. No doubt he’ll get a bevy of questions about the failed merger with Fox. But with after-hours share prices tanking in the wake of Fox pulling its offer, Bewkes also needs to reassure investors about the company’s growth strategy. Though the Fox deal fell through (for now), Time Warner could still be an attractive purchase for another company. And that’s mainly thanks to HBO.