Japanese car and electronics companies are delighted about the yen’s 20% drop against the dollar over the last six months, thanks to new leader Shinzo Abe’s efforts to wage war on deflation and kickstart the moribund economy by, among other things, boosting exporters’ fortunes.

But for a growing crowd of multinational firms, Japan’s currency weakness is becoming a curse.

Bloomberg reports here that upmarket jewellers Tiffany and Harry Winston are hiking their prices in Japan to compensate for the sliding yen. Louis Vuitton has made a similar move.

And while buyers of expensive bling may not be especially price sensitive, the falling yen is bound to upset Japanese consumers if it leads to price rises across the full range of imported goods.

It is also not just multinationals selling to Japan who are affected by the weak yen. The currency collapse is generating grumbles from car manufacturers the world over because it makes it easier for Japanese companies to compete overseas. Japan’s Mazda, for example, has lowered vehicle prices in Canada and Taiwan, and raised its marketing budget. Other Japanese car makers are boosting promotions.

South Korean car makers are getting especially squeezed, as the Korean won has risen at the same time the yen has fallen. Hyundai’s exports fell 19% in February on the same month a year previously.

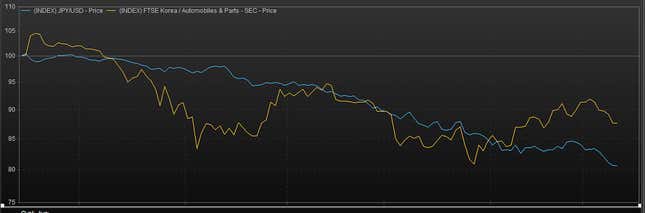

Here is what has happened to share prices of Korean auto and auto parts manufacturers (yellow line) during the last six months, charted alongside the yen’s collapse (blue line).

Meanwhile, US car makers are grousing about the yen eroding their competitiveness and want President Obama to intervene.

We have been here before. Back in 1997 (paywall), when the yen was also very weak, companies including Ford Motors and Louis Vuitton were fretting they had to raise prices of the goods they sold in Japan. The currency decline continued into 1998, when the Economist warned that ”a weak yen….will widen Japan’s trade surplus and so reignite demands in America for protectionist measures.” Plus ça change.