Yeah, yesterday was a bad day. Bonds puked. Gold tanked. Stocks nosedived. (Or nosedove?) Emerging markets submerged. Commodities crumbled. And so on, and so forth, plus whatnot.

But are things really that bad? Might there be reasons for the global investing public to turn their collective frown, as they say, upside down?

We say yea! Of course, there are. It’s natural for the markets to get a little bit jittery after benefitting from so much support from the Federal Reserve. But remember, Ben Bernanke is not just doing this to torture market punters. No, the Fed feels like the world’s largest economy is getting progressively closer to standing on its own two feet. And that’s not exactly a bad thing. So here are a few things to think about.

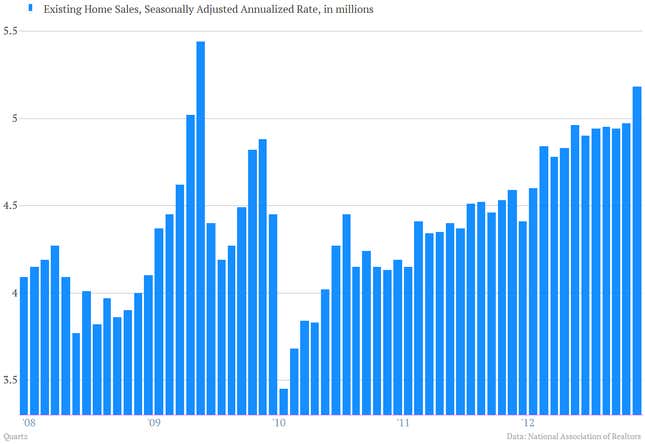

1. The US housing market is really getting better

We’ve made this point again and again and again. But it’s true. The latest evidence is yesterday’s existing home sales report, which showed the annualized pace of purchases surpassing 5 million for the first time in more than three years, thanks in part to the low mortgage rate the Fed has engineered. C’mon, gang, buck up!

2. Interest rates are still ridiculously low

Here’s 25 years worth of daily yields on the benchmark 10-year note, including the spike in yields over the last couple days, which has brought the yield on the 10-year to about 2.42%. We’re pretty sure that an increasingly robust US economy won’t get choked off by these kind of levels.

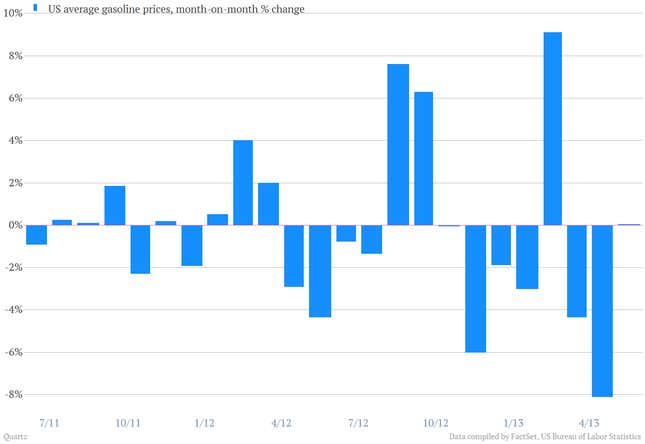

3. Gas prices have been dropping

And that puts money in the pockets of consumers. Woot!

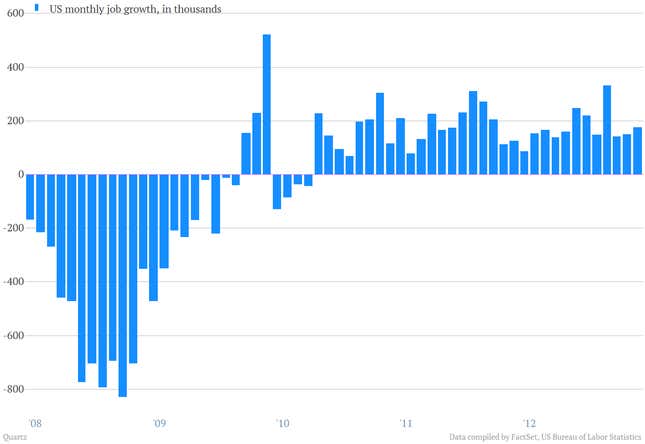

4. Job growth has been pretty decent

The US has averaged 181,000 new jobs a month over the last two years. Not too shabby, and clearly much better than the worst of the recession.

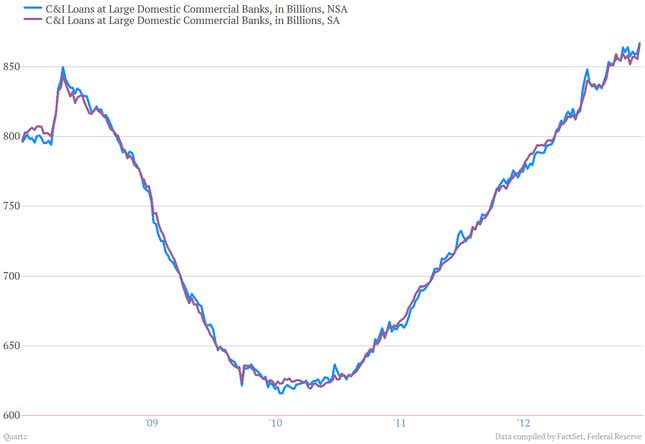

5. Banks are lending

The collapse of the financial system was at the heart of both the deep recession and rout in financial markets that hammered people five years ago. Remember, that was a financial crisis. Capital, the lifeblood of a market economy, had stopped flowing. It was a financial heart attack. Now, the situation is different. Check out the rebound in commercial and industrial lending at large US banks. The point is, we are not—repeat, not—facing any kind of situation similar to the one we saw back in 2008.

6. China may be on the brink of its own crisis

While the world’s largest economy has healed up significantly from its financial crisis, the world’s second largest might be in the early innings of its own banking debacle. Remember Libor, the obscure interbank lending rate that served as an early warning system the global financial panic back in 2007? Well, its Chinese cousin is screaming higher lately, suggesting that something is deeply wrong with the banking system in the People’s Republic. If you want something to be afraid of, it ain’t Ben Bernanke. It’s a Chinese financial meltdown.