The new bottleneck in the AI race

U.S. export controls on chips to China are forcing AMD to rewrite its AI strategy in real time — and slashing $800 million from its margins

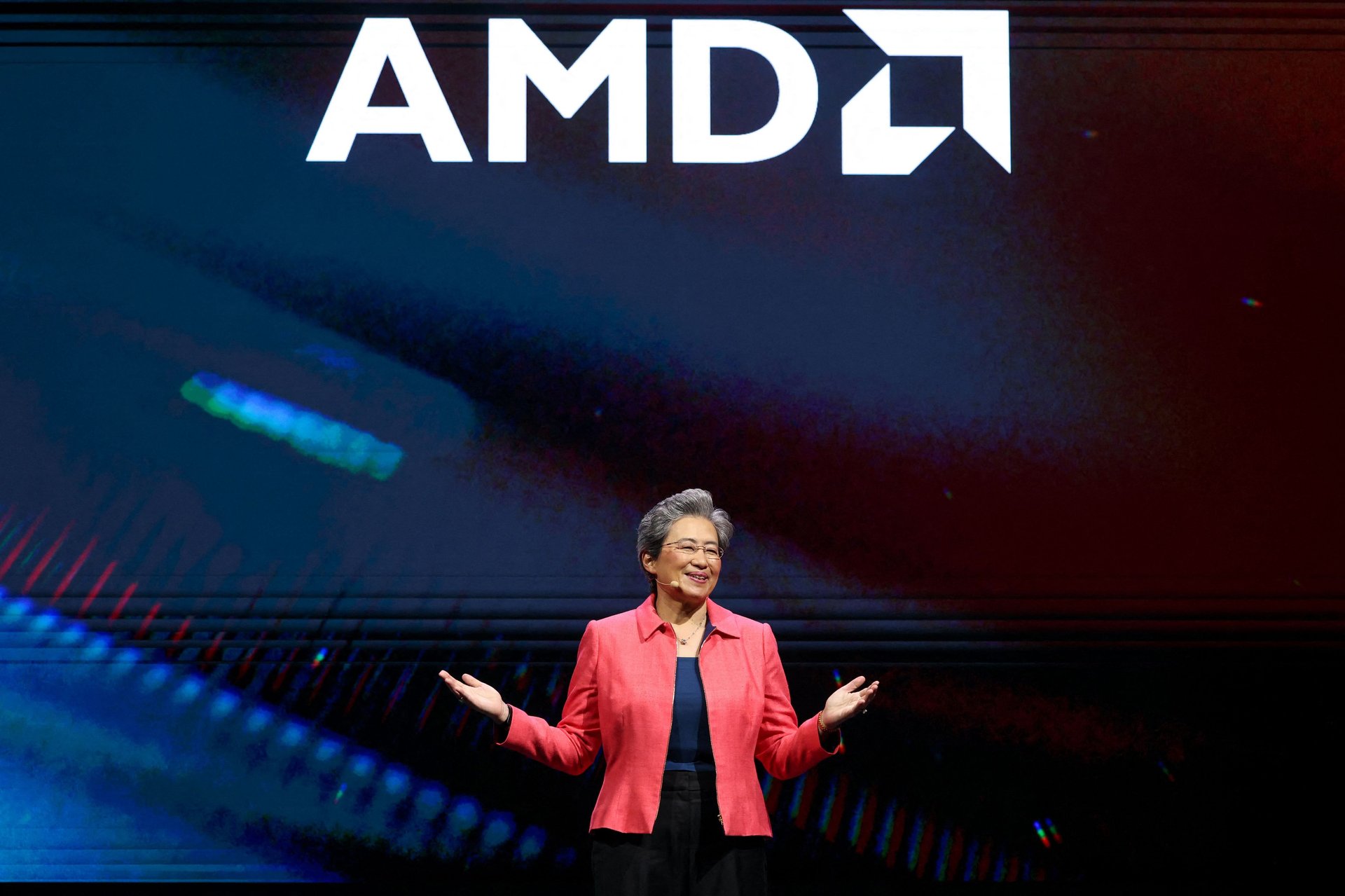

I-Hwa Cheng/AFP via Getty Images

Designing a world-class AI chip? Hard. Getting it out of the country? Harder.

Suggested Reading

AMD posted solid numbers this quarter — revenue climbed 32% to $7.69 billion, driven by strong growth in client and gaming chips. But that momentum collided head-on with a new kind of obstacle: the regulatory kind.

Related Content

The company reported an $800 million charge tied to a halted shipment of AI chips to China; the company’s MI308 accelerator — designed with export compliance in mind — was caught in the dragnet of tightened U.S. export restrictions, forcing AMD to write down inventory, cancel purchases, and cut China out of its revenue forecast.

Gross margin sank to 43%, down from the 54% AMD said it could have delivered if the chips had shipped as planned. The company still beat on revenue and issued better-than-expected guidance for the third quarter. But investors were wary. Shares slid in after-hours and premarket trading — and were down almost 8% as of mid-morning Wednesday, as Wall Street digested what could be a deeper message: In the AI arms race, licensing has become the new latency.

From compute to compliance

The MI308 was built to meet the U.S. government’s earlier performance thresholds for AI chip exports to China. But in mid-April, the Trump administration moved the goalposts. Licensing requirements expanded, the Commerce Department’s backlog ballooned, and AMD’s hardware — just like Nvidia’s H20’s chip — was suddenly stuck in regulatory limbo. AMD’s financial impact was immediate. The strategic consequences may still be unfolding.

On the post-earnings call, CEO Lisa Su told investors that AMD’s license application for MI308 exports is in progress, but approvals could take “a few quarters.” In the meantime, the company is leaning heavily on its MI350 chip, which entered volume production earlier this year and is now the center of its AI strategy. Third-quarter guidance came in above consensus at $8.7 billion, reflecting strength across data center and client segments — but there won’t be any help from China. AMD now estimates a $1.5–$1.8 billion revenue hit for 2025 tied to the restrictions, concentrated in the second and third quarters.

An AI strategy, held up at the gate

While investors wanted undeniable numbers from AMD (a breakout, not a bottleneck), the company’s second-quarter results seem to drill down on a new reality for anyone in the AI chip race: Raw performance no longer guarantees a competitive edge. Companies now have to engineer around policy, not just physics. Export compliance has become a first-order design constraint.

That’s especially risky given the state of the current licensing regime. The Commerce Department is working through what officials have described as the worst backlog in decades. Meanwhile, Chinese tech firms are reportedly using third-party logistics hubs in Southeast Asia to obtain restricted chips. In July, the Trump administration signaled a soft reversal by announcing it would begin reviewing license applications for compliant AI chips. That includes AMD’s MI308 and Nvidia’s H20. Commerce Secretary Lutnick framed the decision as a way to keep China dependent on U.S. technology, rather than accelerate China’s domestic chip push. Tech companies cheered. But the timeline remains murky, and there’s political pressure to impose broader restrictions.

Trade negotiations between the U.S. and China are unfolding amid this tech tug-of-war. In late July, senior U.S. and Chinese officials held trade talks, and semiconductors featured prominently. If the countries reach a broader deal, chip licensing decisions could become recurring concessions tied to broader trade negotiation milestones. But that also raises risks: blurring the line between security policy and economic diplomacy, setting a precedent where strategic guardrails are negotiable rather than fixed.

For now, AMD is pressing forward. Its stock is still up over 30% year to date. Its MI350 chip is positioned for inference-heavy AI workloads, and early demand appears strong. In 2026, AMD plans to launch its MI400 accelerator and a Helios rack-scale AI platform aimed at hyperscale customers. But if the gates to China remain license-locked, AMD’s total addressable market remains artificially constrained — regardless of product quality or price.

The second-quarter results make one thing clear: AMD is doing what it can. The chips are ready. The buyers are waiting. But the next move belongs to Washington. As AI hype races on, the real decider may now sit inside trade paperwork, not lab specs. AMD’s latest quarter lights that path — and warns of a world where microchips are as guided by Washington regulations as they are by Moore’s Law.