Elon Musk's Starlink-Russia connection, Google and Intel's big moves, Nvidia stock perks: Tech news roundup

Plus, the next big tech IPOs to watch, and taking down Nvidia won't be easy for its rivals

It’s been a busy week for the tech industry and AI.

Investors are waiting and watching for big tech IPOs. In the world of AI, Nvidia rivals — including some of its own customers — are advancing their chipmaking efforts and threatening its dominance of the AI accelerator market. And Google and Intel both hosted their annual conferences, where both showed off their latest plays in the ever-evolving field of AI technologies.

Here’s a look at the biggest news in the tech industry this week.

2 / 19

Another major chipmaker is getting a share of the U.S. funding meant to bring advanced chipmaking to American soil. Taiwan Semiconductor Manufacturing Company will get $6.6 billion in grants through the federal CHIPS and Science Act, as well as up to $5 billion in loans to support its first major U.S. chipmaking hub in Phoenix, the Biden administration said.

TSMC already has two chipmaking facilities in Arizona expected to begin production in 2025 and 2028, and will use some of the new funding to build a third facility, increasing the company’s investment from $40 million to $65 million, according to the Biden administration. The new facility will also create more than 25,000 jobs in construction and manufacturing, as well as indirect jobs.

3 / 19

Microsoft is expanding its AI efforts in the U.K. with a new AI hub in London. Microsoft AI London will focus on developing state-of-the-art language models and the infrastructure to support them, as well as “create world-class tooling for foundation models,” said Mustafa Suleyman, Microsoft AI’s executive vice president and CEO. The hub will collaborate with Microsoft’s other AI teams and partners including OpenAI.

4 / 19

Tech IPOs are making a comeback. Last month, AI startup Astera Labs and social media site Reddit made successful debuts on the stock market and continue to trade well above their issue prices. Since then, several more tech companies have filed to go public: Ibotta, Reitar Logtech, Rubrik, and NetClass Technology, to name a few.

The biggest two upcoming tech IPOs of the bunch are Colorado-based Ibotta and Microsoft-backed Rubrik. They both said in their SEC filings that they’re looking to raise $100 million each, but they could end up raising a combined $750 million, according to Renaissance Capital.

5 / 19

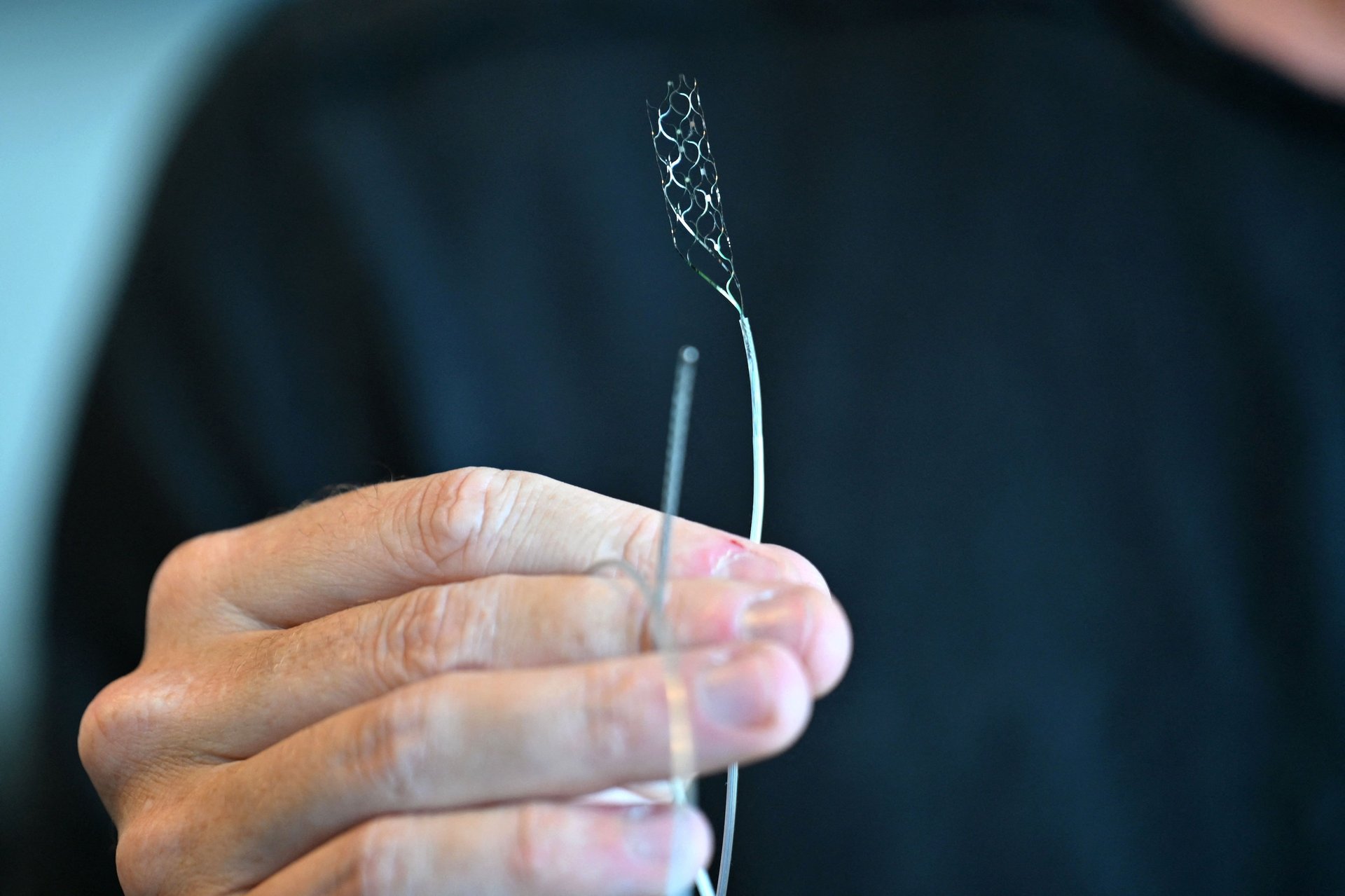

Brooklyn-based brain chip startup Synchron launched a registry to recruit patients and healthcare providers ahead of a planned large-scale clinical trial.

The company, a rival to Elon Musk’s Neuralink, produces a brain implant, known as brain-computer interface (BCI), that helps paralyzed patients control electronic devices like computers and smartphones with their thoughts.

6 / 19

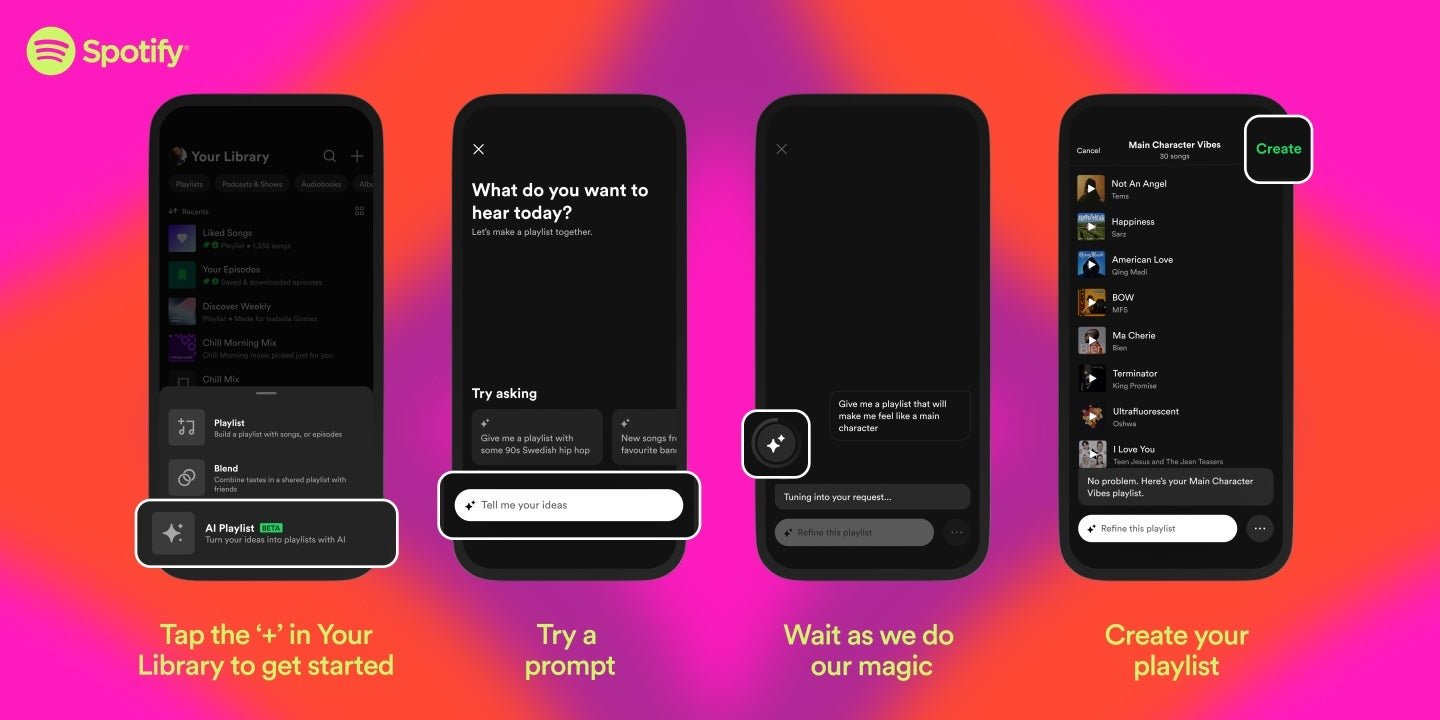

Spotify has a new AI tool that will create playlists for users from text prompts.

Users on Androids and iPhones need only type their prompts into a chat — “relaxing music to tide me over during allergy season” or “a playlist that makes me feel like the main character” are two examples of prompts Spotify suggests in its announcement — and poof!, a playlist.

7 / 19

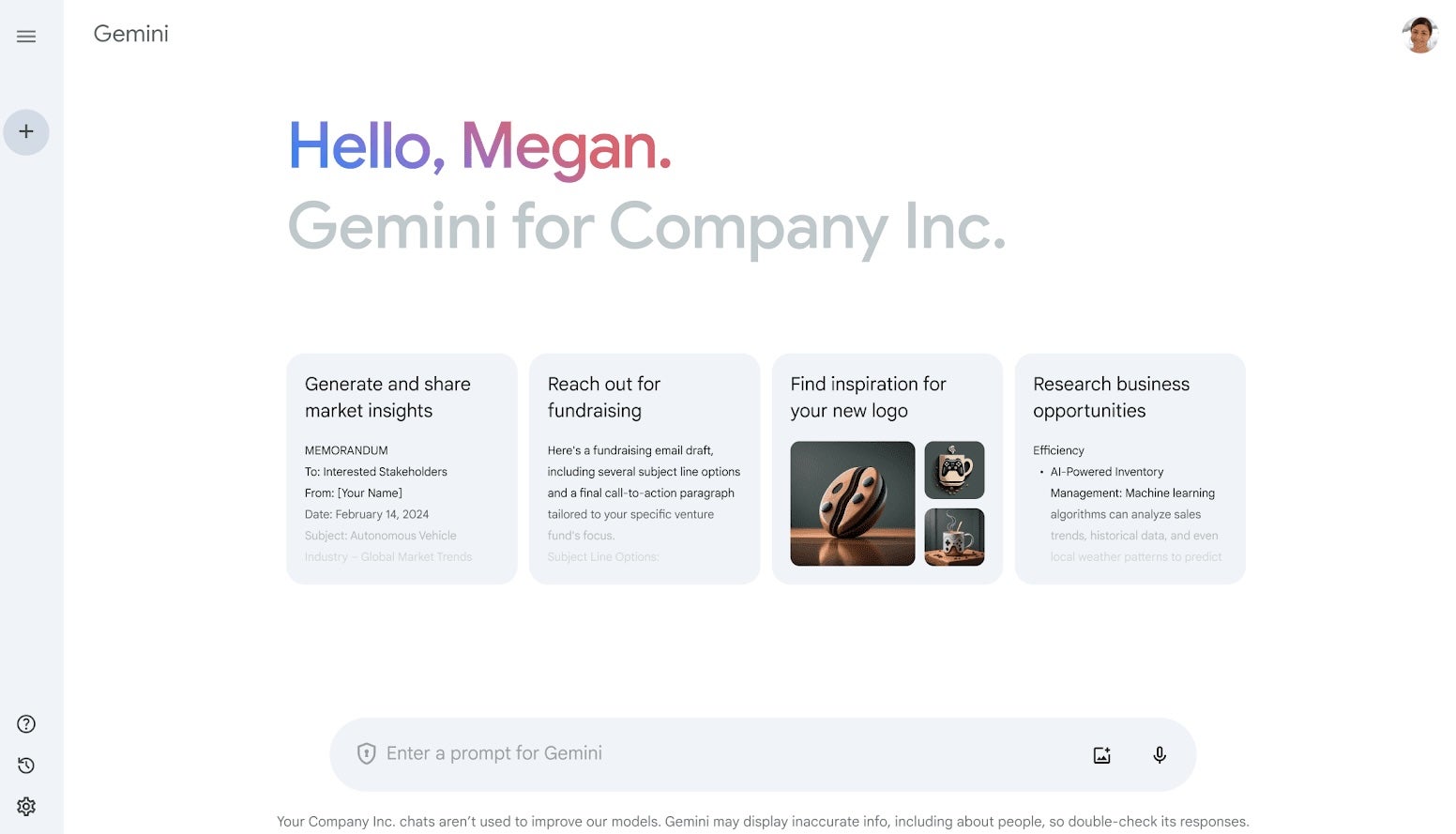

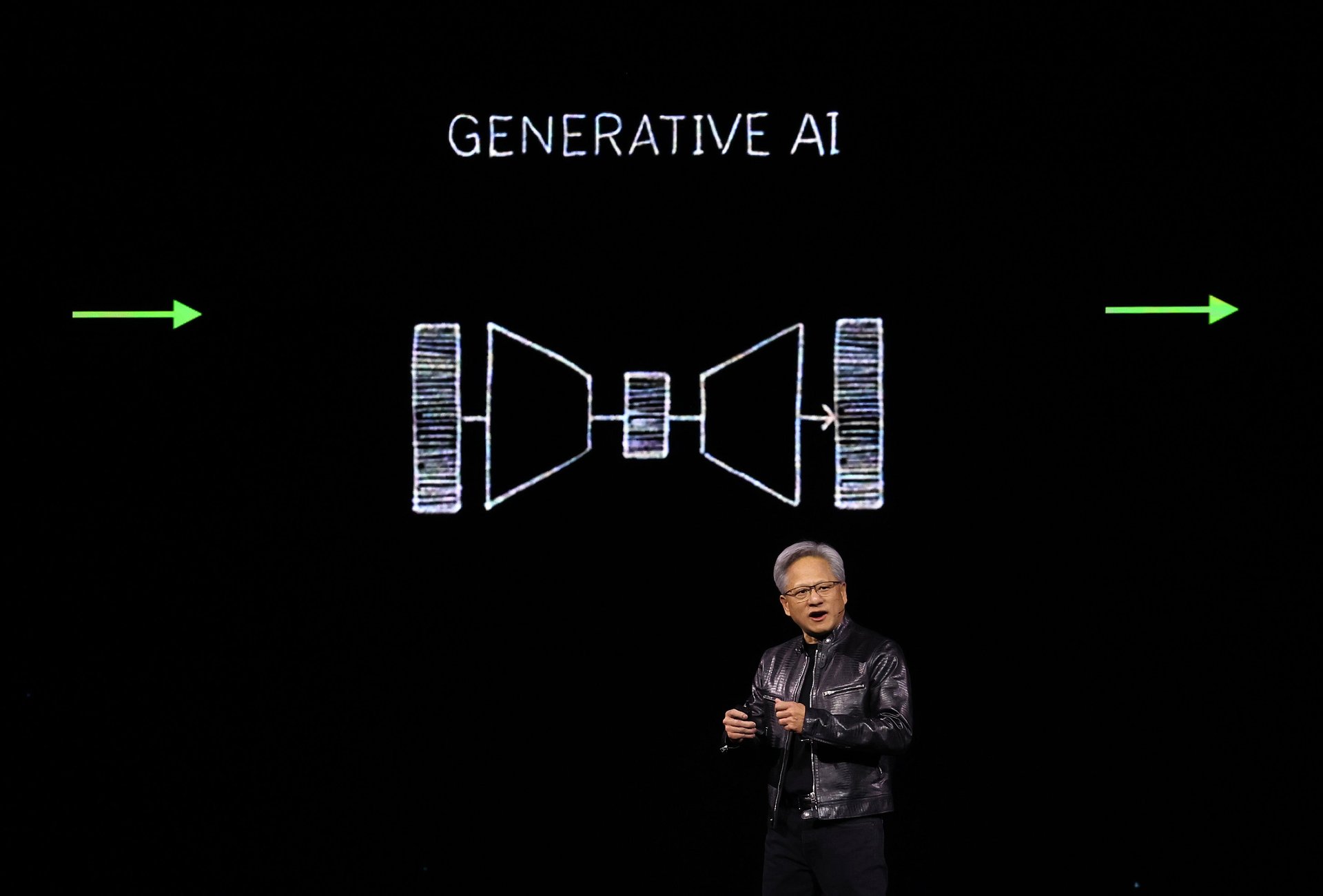

Google is trying to turn the page on its early AI mishaps. Keynote speakers at the tech giant’s annual Google Cloud Next conference in Las Vegas showed off new features of Gemini Pro 1.5, the latest version of its chatbot that’s now publicly available. Demonstrators highlighted its new tools — perhaps the most important of which is its ability to “ground” queries. “Grounding” means responses on Gemini Pro 1.5 are linked to “verifiable sources of information,” the company said.

The announcements about Gemini 1.5 Pro included a range of updates to the chatbot as part of Google’s push to sell its AI products to corporate customers. Gemini now includes further capabilities for something called “long context understanding,” which basically means it can process a lot more information. And it has multimodal capabilities — or the ability to process not just text but also audio, video, and other formats to generate responses.

8 / 19

Google said that one of the few alternatives to Nvidia’s popular AI chips is now available to developers — and took a shot at Microsoft and Amazon, too.

The tech giant’s latest AI chip, the Cloud TPU v5p, was first announced in December, the same day as its chatbot Gemini. The new TPU, or tensor processing unit, can train large language models almost three times faster than its predecessor, Google’s TPU v4, the company said. Large language models (LLMs) power AI chatbots like ChatGPT.

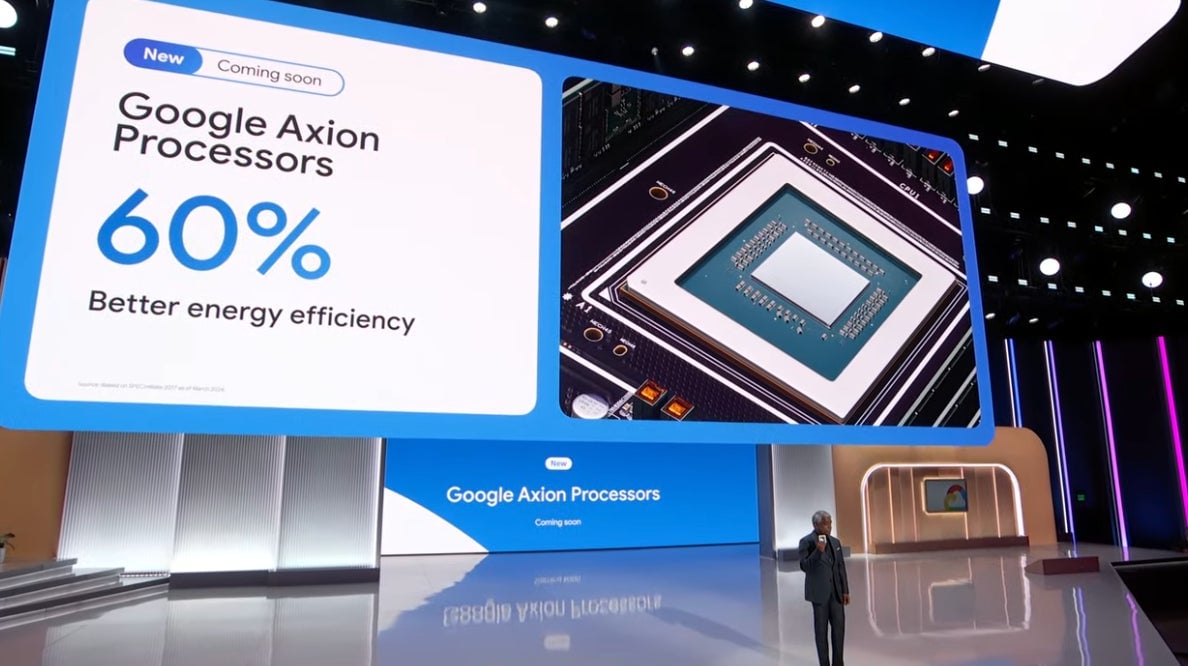

Google also unveiled its new, Arm-based central processing unit called Google Axion, a new rival to the CPUs of Microsoft and Amazon, which have already made their own Arm-based computing chips. The British tech company Arm licenses its chip infrastructure design for actual chip manufacturers to build upon. Google’s release of Axion marks the first time the company has used Arm’s chip infrastructure for a CPU.

9 / 19

Google Cloud and German healthcare giant Bayer announced that they are working together to develop new AI tools for radiologists.

Bayer will use Google’s cloud computing technology to improve its AI-powered innovation platform with a focus on radiology applications— the branch of healthcare that uses imaging like CT scans, ultrasounds, and MRIs to help diagnose and treat illnesses. The companies hope the platform will help health and science organizations build large and safe AI tools.

10 / 19

Google was sure to mention privacy and security at its annual Google Next conference — right as it’s wrapping up past privacy issues with another product.

The tech giant touted the “enterprise grade security and privacy” on Gemini Pro 1.5. That includes an AI security add-on for Google Apps.

Google’s new AI security add-on is a nod to the wider conversation in the works about data privacy in the tech sector, as tech giants and startups alike race to develop generative artificial intelligence technologies. Chatbots have been under scrutiny for privacy failures. AI girlfriends pry “as much data as possible” from users, researchers have found, and non-girlfriend AI chatbots have collected and spilled their users’ secrets.

11 / 19

Intel unveiled its latest AI hardware, saying it has better performance and efficiency for training generative artificial intelligence models than industry alternatives — even Nvidia’s highly sought after chip.

12 / 19

SpaceX’s Starlink satellite internet terminals are showing up for sale on Russian online stores, being resold by Russian dealers, and being delivered to the front lines of Ukraine by Russian volunteer groups despite being in banned in the country, according to a new report.

13 / 19

As tech companies feel the rush from going all-in on AI, the chipmakers behind their success are cashing in.

Taiwan Semiconductor Manufacturing Co. reported sales of NT$592.6 billion, or $18.5 billion, for January through March — a 16.5% year-over-year increase in its March-quarter revenue, and its fastest monthly sales growth since 2022. Its revenue also beat expectations of NT$579.5 billion, or $18.1 billion. TSMC said its revenue for March was approximately NT$195.21 billion, or $6.1 billion — an increase of 7.5% from February, and an increase of 34.3% from the previous year.

14 / 19

Meta debuted a new model of its AI chip, which it said is three times more efficient than its first one.

15 / 19

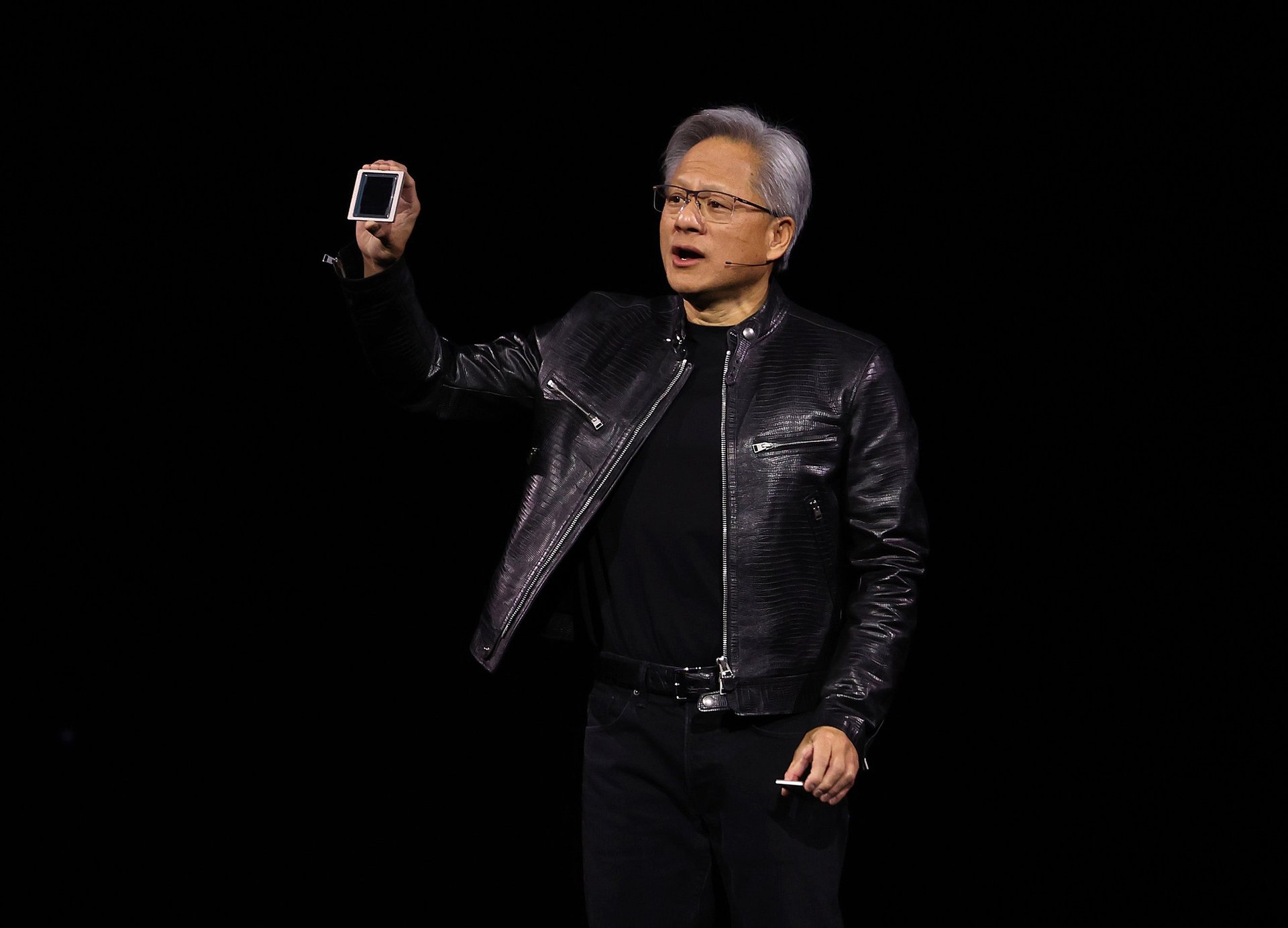

Demand for Nvidia’s chips led the company to become the first chipmaker to hit a $2 trillion market cap, and now it’s reportedly rewarding staff with a stock boost.

Nvidia employees are getting a one-time “Jensen special grant” of an additional 25% of the amount of stock units they received when joining the company.

16 / 19

Despite publicly warning that China’s AI efforts could be a strategic threat to the U.S., former Google CEO Eric Schmidt pursued connections with and invested in the country’s AI industry, according to a new report.

The nonprofit Tech Transparency Project found that in 2019, Schmidt’s private foundation invested $17 million into a feeder fund called Gaoling Feeder, which funds Hillhouse Capital, a Chinese private equity group that has Chinese AI companies in its portfolio.

17 / 19

Nvidia was named after the Latin word for envy, “invidia.” And there’s a lot to envy about the semiconductor giant. Companies have furiously gobbled up its very expensive AI chips in their race to develop new generative artificial intelligence technologies. Nvidia’s stock skyrocketed 220% over the last year as revenues went through the roof, making it the third most valuable company in the world.

Now other tech giants are introducing their own AI chips: Meta’s MTIA, Microsoft’s Maia, Amazon’s Trainium, and Google’s TPUs. Not to mention Intel and Advanced Micro Devices, semiconductor chip manufacturers that are direct competitors to Nvidia. In the span of two days this week, Google parent Alphabet, Facebook parent Meta, and Intel all showed off new AI hardware, part of a growing challenge to Nvidia’s dominance.

But Nvidia won’t go down easily.

18 / 19

Meta announced a new tool for Instagram direct messages to protect kids and teens from predators trying to elicit nudes and “sextort” them.

19 / 19

The company that transformed online retail wants in on the generative AI boom — and is optimistic much of it will be built on its cloud computing service.