🌏 Superpowers, assemble!

Plus: The global supply chain looks pretty OK, for now.

Good morning, Quartz readers!

Suggested Reading

Here’s what you need to know

Joe Biden and Xi Jinping met for the first time in a year. The US president called for the two global superpowers to avoid conflict, while his Chinese counterpart said that “turning our backs on each other is not realistic.” The two nations also agreed on some climate change initiatives that ignored coal and fossil fuels.

Related Content

The UK can’t send refugees to Rwanda. The country’s Supreme Court ruled yesterday that the plan, which has been largely condemned by humanitarian groups, is unlawful.

Elon Musk’s Starlink IPO may lift off as soon as next year. There are hints that the timeline may be pushed sooner than billionaire investor Ron Baron suggested last week.

OpenAI paused ChatGPT Plus sign-ups. After announcing premium-tier users can build their own chatbots, CEO Sam Altman says its Plus subscription exceeded capacity.

Global supply chains are dealing with new pressures

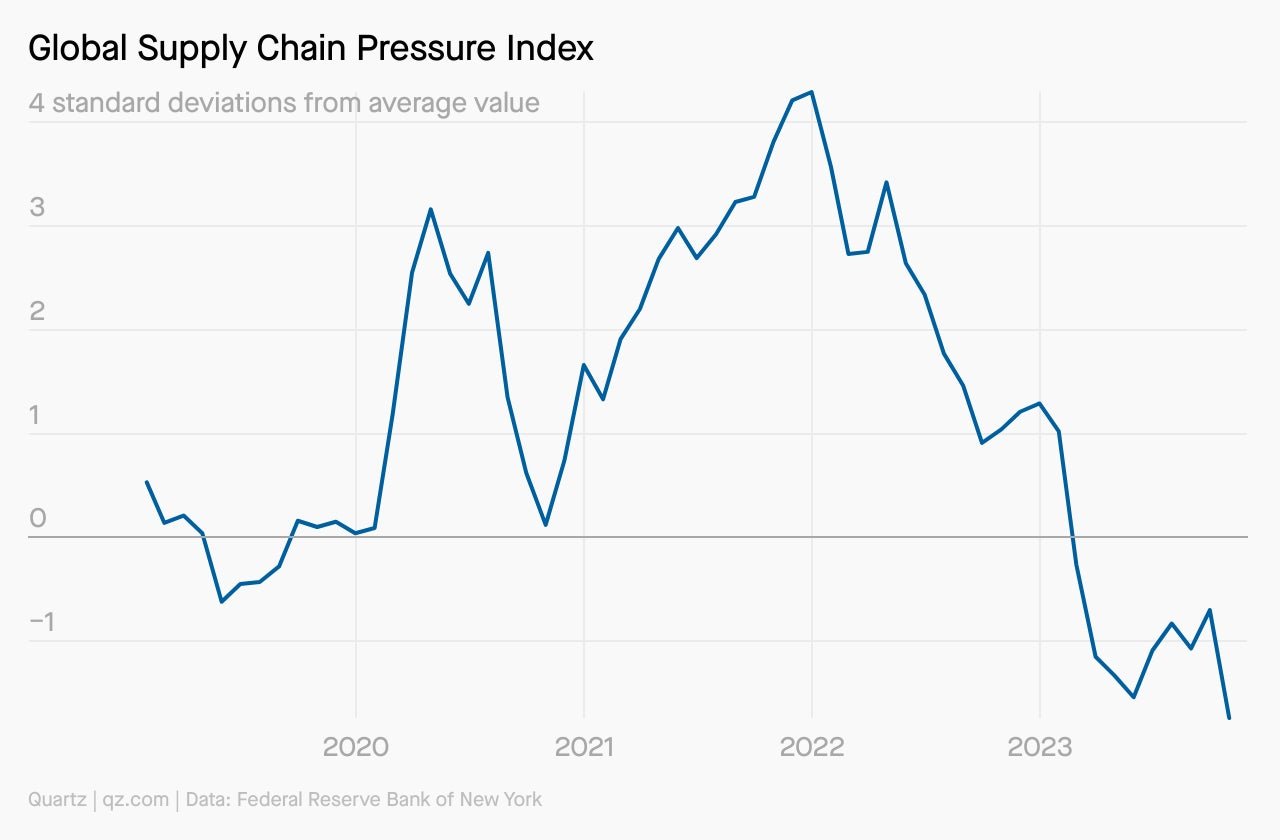

Compared to its mood in 2020, the global supply chain has reason to feel jolly. Disruptors like a global pandemic, Russia’s invasion of Ukraine, and ongoing US-China trade tensions have largely worked their way through the system and out the other side.

The Federal Reserve Bank of New York’s global supply chain pressure index, which accounts for transportation costs and manufacturing indicators, shows as much, with pressures returning to below pre-pandemic levels:

But don’t pop the bubbly just yet. Lurking around the corner are new threats to the global flows of trade and energy: the Israel-Hamas war, El Niño-induced extreme weather and, of course, interest rates. Mary Hui looked at how the latter is really crimping the supply chain’s resilience.

Warren Buffett is completely out of the GM game

Berkshire Hathaway no longer owns any General Motors stock. In the last five to six quarters, the Warren Buffett-led conglomerate has been gradually dumping stock of the Detroit-based automaker in troves, and has finally shed all of its remaining 22 million shares.

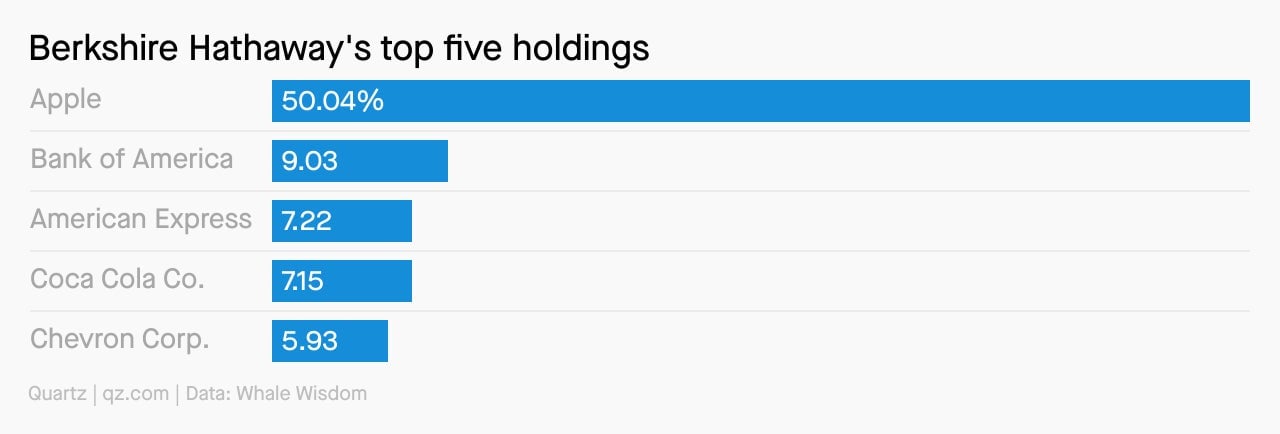

It’s not like GM was a portfolio star for Berkshire Hathaway, though. It accounted for less than 1% of Berkshire’s stock portfolio prior to the total exit. That’s a drop in the bucket compared to the following five companies:

Surprising discoveries

People want instant ramen so bad that Nissin Foods is investing $228 million to make more of it. A new plant in the US aims to meet an “unprecedented demand” for the noodles.

A weather AI model from Google DeepMind works really, really well. GraphCast can predict extreme conditions much faster and more accurately than technology used today.

Cheez-Its aren’t actually square. That’s right. Our latest Weekly Obsession took a deep dive into what might just be the greatest cracker of all time. Not a subscriber? Sign up for the free email today.

John Oliver helped the pūteketeke become New Zealand’s bird of the century. His endorsement: “They are weird puking birds with colorful mullets. What’s not to love here?”

NASA’s James Webb telescope found a planet that rains sand. Wasp-107b is 200 light years away and has been likened to candy floss.

Did you know we have two premium weekend emails, too? One gives you analysis on the week’s news, and one provides the best reads from Quartz and elsewhere to get your week started right. You can get those by becoming a member—and take 20% off!

Our best wishes for a productive day. Send any news, comments, Cheez-Its, and colorful mullets to [email protected]. Today’s Daily Brief was brought to you by Morgan Haefner.