Good morning, Quartz readers!

Here’s what you need to know

Hyundai is mulling a $3 billion IPO for its India unit. If the South Korean car maker goes through with its plans, it would be India’s biggest IPO ever, according to Reuters.

King Charles III is stepping away from public-facing duties. The British monarch was diagnosed with an unspecified cancer.

Novo Nordisk’s CEO has been “surprised” at weight loss drug demand in Europe. Lars Fruergaard Jørgensen wasn’t expecting so many people to pay out of pocket for the very pricey Wegovy and Ozempic.

Snapchat got in on tech layoffs. The social media company’s parent company is cutting 10% of its global workforce.

Hertz is hitting the brakes on buying electric cars. The US-based rental company’s CEO said it is too hard to sell EVs when their time is up. In other car news, Stellantis is dismissing merger rumors with France’s Renault.

The robots are in the copper mines

When you hear the words Bill Gates, Jeff Bezos, and AI, the first thing that pops into your head probably isn’t a massive copper mine in Zambia that could help power the world. Or maybe it is! And if so, kudos to you.

California-based KoBold Metals, a mining startup backed by the aforementioned billionaires, just used artificial intelligence to find what it calls “one of the world’s biggest, high-grade large copper mines” in Zambia. “Using AI” in this case means feeding a computer satellite and drilling data to map out the Earth’s crust for more precise digging.

Copper is used in solar panels, wind turbines, and other equipment needed to transition the world toward energy that doesn’t pump greenhouse gasses into the atmosphere. So if AI has the potential to get critical minerals out of the ground and into products faster, that could be a good thing.

Elon Musk’s losses are more than most billionaires have

If you were a billionaire, and had $24 billion, you’d find yourself at the No. 72 spot on Bloomberg’s Billionaire Index, nestled between Swiss pharmaceuticals heir Ernesto Bertarelli and Facebook co-founder Dustin Moskovitz.

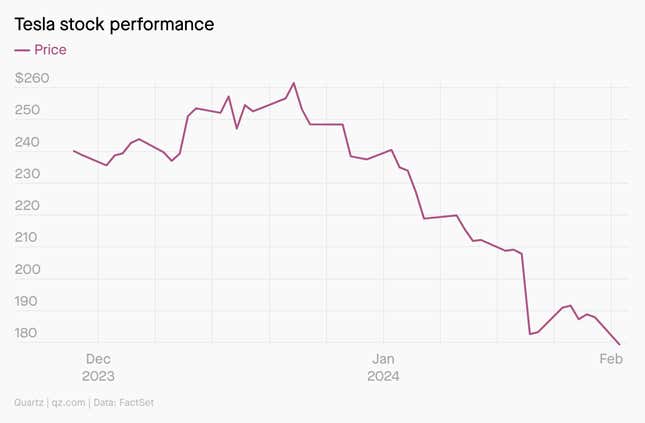

That figure is how much money Tesla CEO Elon Musk has lost so far this year—and counting, as his company’s stock continues to fall amid reports of his alleged drug use.

McDonald’s doesn’t want your billions anyways

The fast food chain would much prefer your dollar bills and cents, thank you very much. In 2023, it lost a good chunk of customers who make below $45,000 annually. They stayed away from stores after prices were hiked, and CEO Ian Borden told investors yesterday he wants to win them back.

He’ll have to juggle that goal with a huge global expansion that’s forging ahead despite war and inflation and figuring out the whole robot drive-thru situation. Seems like a lot to chew on.

More from Quartz

🥋 Mark Zuckerberg’s “high-risk activities” risk “serious injury and death,” Meta warns investors

👯 TikTok isn’t as popular among users as you’d think

🧐🧐 Big tech companies had big layoffs. Then they saw big profits

⭐ Microsoft CEO Satya Nadella caps a decade of change and tremendous growth

🍺 How much a 30-second Super Bowl ad costs this year

Surprising discoveries

The little pig that built the straw house may have been on to something. One is going up in West Yorkshire in England.

Dr. Seuss trees were real! An ancient species that was around before the dinosaurs was super tall and super skinny and super full of huge leaves—very Lorax vibes.

An organ performance in Germany is set to go on for 639 years. Its latest note change, made yesterday, will last for just two years.

Watch out for deepfake CFOs. A worker was duped during a video call with people who looked and sounded like his higher ups, and ended up paying $25 million to fraudsters.

Boeing’s stock hasn’t gone into a tailspin. Problems keep being revealed, but investors may have already priced in future delays.

Did you know we have two premium weekend emails, too? One gives you analysis on the week’s news, and one provides the best reads from Quartz and elsewhere to get your week started right. Become a member or give membership as a gift!

Our best wishes for a productive day. Send any news, comments, straw hats, and Seuss tree seeds to [email protected]. Today’s Daily Brief was brought to you by Morgan Haefner.