🌏 Now hiring: CAIOs

Plus: Disney’s proxy war of words.

Good morning, Quartz readers!

Suggested Reading

Here’s what you need to know

The AI hiring craze reached the U.S. government. All federal agencies will soon be required to have a chief AI officer and implement safeguards — or stop using the technology altogether.

Related Content

The short-sellers came for Reddit. Stock prices of the newly minted IPO continued to drop significantly yesterday as about 7% of Reddit’s free share float (or more) has been sold short.

Microsoft Copilot customers say ChatGPT is better. Microsoft’s response? Users just don’t really understand its tool.

Amazon stock surged. The e-commerce giant’s share price has climbed 85% over the past year — and that means some top managers won’t get cash pay raises.

SBF’s sentencing wasn’t enough for some crypto execs

“My useful life is probably over. It’s been over for a while now.”

That’s what Sam Bankman-Fried said before being sentenced to 25 years in prison yesterday. But many think that the penalty for the disgraced cryptocurrency executive who was convicted of fraud in the spectacular collapse of the crypto exchange FTX was too light.

Terrence Yang, managing director of the Bitcoin financial services firm Swan Bitcoin, put it his way: “Justice is not served. The damage SBF did was permanent and severe. He ruined a lot of families and lives with his felonious acts and put salt in the deep wounds with his total lack of remorse.”

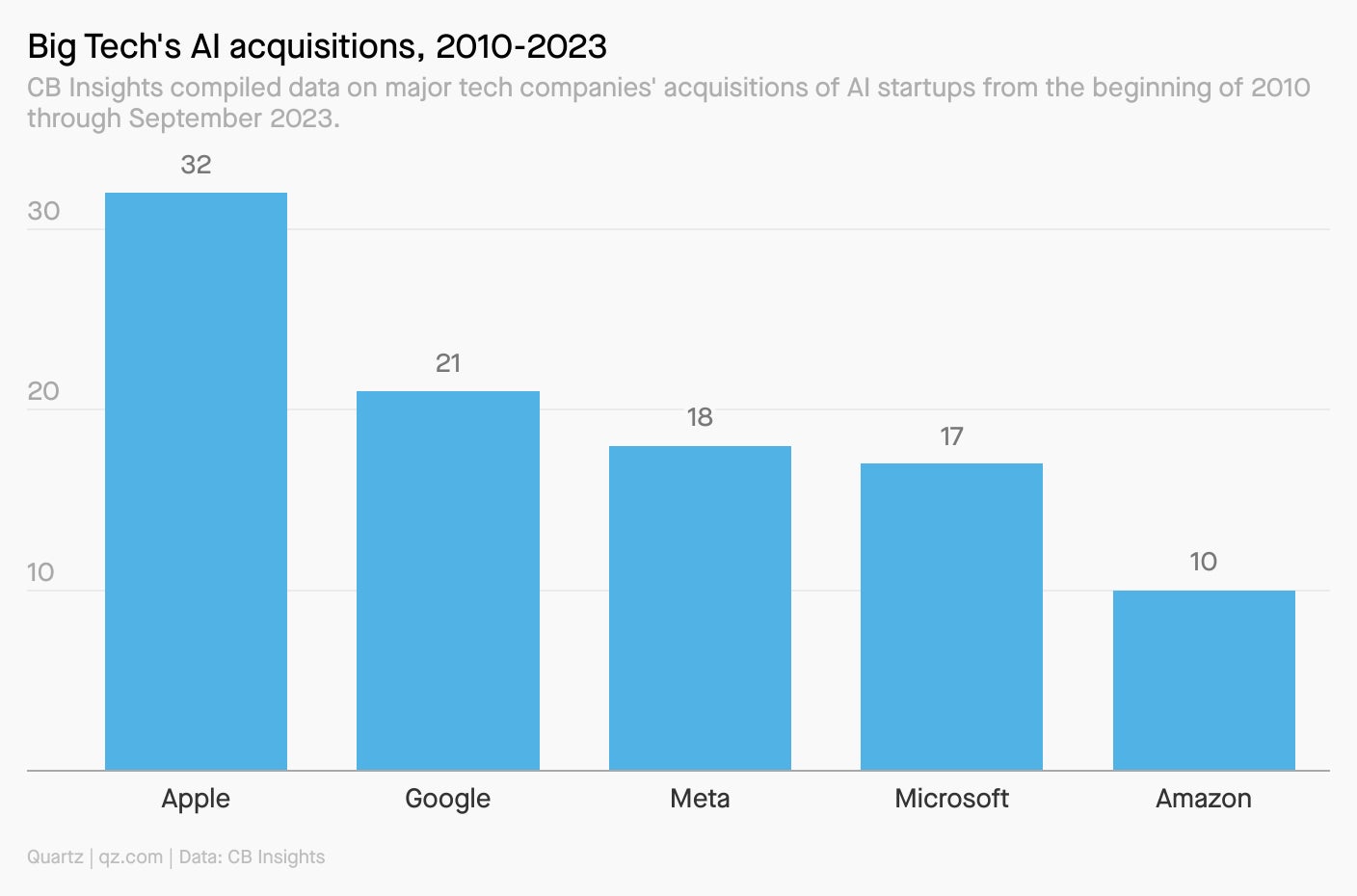

Big Tech is swallowing up AI

Antitrust regulators may be after tech giants, but that hasn’t stopped Apple, Amazon, and Microsoft from buying, investing in, or just poaching from AI firms.

$2.75 billion: Amount by which Amazon upped its stakes in AI startup Anthropic

$650 million: The licensing fee Microsoft paid the startup Inflection to use its AI models and hire most of its employees (and it may just be the new Big Tech playbook)

49%: Microsoft’s stake in OpenAI

Meanwhile, Apple hasn’t been as vocal about its AI deals, but it’s leading the pack:

Quotable: Disney’s proxy battle comes to a head next week

“The surest way to impede our creative progress is oversight from an 81-year-old hedge fund manager with no creative experience.” — Disney talking about activist investor Nelson Peltz during a presentation titled “Oh, Nelson” on March 25.

The media giant’s annual meeting is on April 3, where Disney shareholders will vote to fill 12 seats on Disney’s board of directors. Peltz’s investment firm controls $3.5 billion of Disney stock, and has nominated Peltz for a seat. It’s been a war of words leading up to the tally — read what Nelson has been saying.

Surprising discoveries

A Boston Dynamics Robot dog took bullets for humans and K9s in a real world scenario. Good boy, Roscoe!

Glasses could get chattier. That is if you want a pair of specs that uses AI from Meta to suggest things around you.

Home Depot just inked its biggest deal ever. And it was to buy a roofing company, not a deal with Tim Allen.

America’s top 1% added $2 trillion in wealth in the fourth quarter of 2023. Maybe that isn’t surprising?

And their kids are becoming “nepo-homebuyers.” Young people are taking cash gifts from their family to fund the purchase of their new abodes.

Did you know we have two premium weekend emails, too? One gives you analysis on the week’s news, and one provides the best reads from Quartz and elsewhere to get your week started right. Become a member or give membership as a gift!

Our best wishes for a productive day. Send any news, comments, robot Roscoes, and quiet glasses to [email protected]. Today’s Daily Brief was brought to you by Morgan Haefner.