Welcome to The Forecast, a new member email from Quartz. You can read more about our new member series here and look out for new stuff in your inbox every Monday, Thursday, Friday, and Saturday.

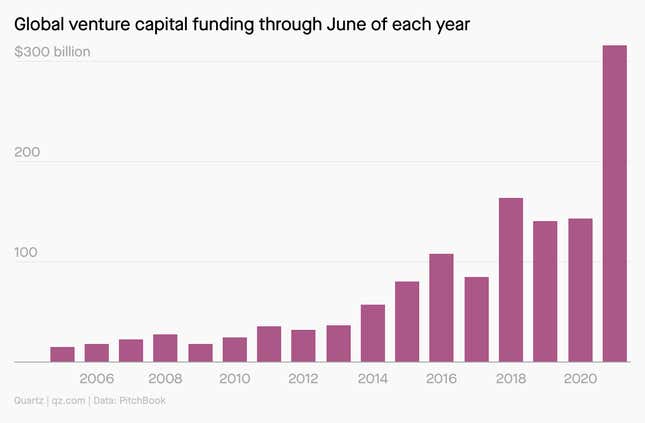

Seasons change, politicians come and go, the economy waxes and wanes, but the amount of money pouring into tech startups just keeps going up. The tech economy has grown steadily since the mid-2000s, barely pausing to register the financial crisis. Last year, tech shrugged off coronavirus, too. There are now more than 750 unicorns around the world, and 2021 is on pace to be the biggest year for venture capital funding ever.

Analysts have been periodically warning of a new tech bubble for two decades now. But it’s only a bubble if it bursts. Triumphalists in Silicon Valley see no reason for tech’s progress to slow: It’s a truism now that software is eating the world, and so, the thinking goes, the need for what tech companies are selling just keeps growing. As long as that’s true, why would startup funding go down? Yet bubble talk is alive and well. In July, the Financial Times ran a column warning of “echoes” between today’s tech market and dotcom mania. CNBC ran one headlined “This feels like 1999.”

So who’s right? Will tech’s fortunes continue to rise, or are they due to fall back down to earth?

📈 Charting the rise of VC investment

A little more than a decade ago, VC was a niche corner of finance. Its focus was on highly risky technology companies—mostly in computer hardware and software, biotech, and medical devices—with the potential to get really big. And the assumption was that not many companies fit the bill.

But since the Great Recession, VC has exploded. Globally, total VC investment is more than 10 times what it was just a 15 years ago. In the US, VC investment is now well above its dotcom-era peak.

With more and more money available, tech startups are challenging seemingly every industry, from consumer products to entertainment to banking to space travel. The question is how far the Silicon Valley model of starting and funding businesses can extend itself—and whether it’s due for another crash.

Supply and demand

To understand whether the tech boom can continue, it’s important to know why the post-Great Recession period saw such a massive increase in VC funding. To do that, it’s helpful to think about VC in terms of supply and demand (pdf).

The total number of startups that get funded depends on the amount of money available (supply of capital) and the number of startups looking to raise money (demand for capital). So why was so much more money available, and why were so many young tech companies looking for funds?

💸 Capital Supply

- Macro: Low interest rates, which the US and Europe have had since the financial crisis, make equity more valuable compared to debt and push pension funds toward riskier investments.

- FOMO: High returns in VC over the last 25 years convinced hedge funds, mutual funds, and corporations to start making venture investments.

- The “PayPal mafia” effect: When an IPO or acquisition mints a new batch of startup millionaires (and billionaires), many reinvest those dollars into new startups. The “[startup name] mafia” refers to cohorts of angel investors who got rich from a particular exit, like the recent Coinbase IPO.

🤖 Capital Demand

- Advances in technology: The spread of smartphones and cloud computing, among other trends, created new opportunities for would-be entrepreneurs.

- Lower startup costs: Cloud hosting services made it easier and cheaper to launch an internet business, and in many parts of the world the cost of registering a new business fell as regulations were eased. Success stories like Elon Musk and Jeff Bezos turned “tech entrepreneur” into a respectable career path.

- Accelerators: Programs like YCombinator, TechStars, and hundreds of others cropped up, combining “seed” investment with basic training and mentorship for entrepreneurs. And lots of that training got posted publicly: Plentiful tutorials (books, blogs, YouTube, podcasts, etc.) helped would-be founders avoid easy mistakes.

For / Against

➕ The tech boom will keep going

- There are way more internet users today than in the dotcom era. Bubble talk inevitably compares today to 2000, but that’s misleading because of how much more widely the internet is used. Today, over 4 billion people are online and more people than ever are willing to be early adopters of new tech. The total addressable market is huge and only a few companies (Facebook) are anywhere near its limits.

- The pandemic pushed firms and people to adopt new tech. Shifts that might have happened over a decade—like the rise of remote work—happened all at once and ahead of schedule. And pitch meetings over Zoom should make it easier for investors to fund companies headquartered outside of major startup hubs.

- “Alternative” VCs are here to stay. When the Covid-19 pandemic hit, some VCs warned that corporations, hedge funds, and mutual funds would stop investing in startups. It didn’t happen. Corporations and hedge funds stayed the course, and continue to make venture investments.

- Tech valuations are nowhere near as outrageous as in 2000. Today’s companies might be overvalued, but they’re mostly solid businesses with significant revenue.

- AI and crypto are as big a deal as mobile was. The current wave of tech startups is built on legitimate technological breakthroughs. And new areas of tech are showing promise, like mRNA vaccines and genetic medicine.

➖ The case for an eventual correction

- Tech valuations are too high. Sure, they’re not as bad as in 2000. But even tech CEOs appear skeptical of how their companies are currently valued.

- Interest rates will eventually go up. The Federal Reserve and ECB are still keeping rates low, but inflation could force a rate hike that could make tech investing less appealing.

- Regulation could put a damper on VC. Higher capital gains taxes, antitrust, trade wars, and new privacy laws all have the potential to lower returns.

- At some point there’ll be another financial crisis. The pandemic recession was well-suited for tech, since so many people had to stay home. The next recession might not be: a financial crisis could force mutual funds, hedge funds, and corporations to stop investing, which, combined with weak demand from worried consumers, could strand a generation of startups.

Quotable

Can the current boom continue? When I think about that question, I ask myself: “Will innovation continue to spread globally? Will technology continue to disrupt old industries? Are there countries and industries that are still early in the technology adoption lifecycle? Is the shift to cloud and big data continuing apace?” The answer to everyone of these is a resounding YES!

—Jeff Bussgang, general partner at Flybridge Capital Partners and a senior lecturer at Harvard Business School

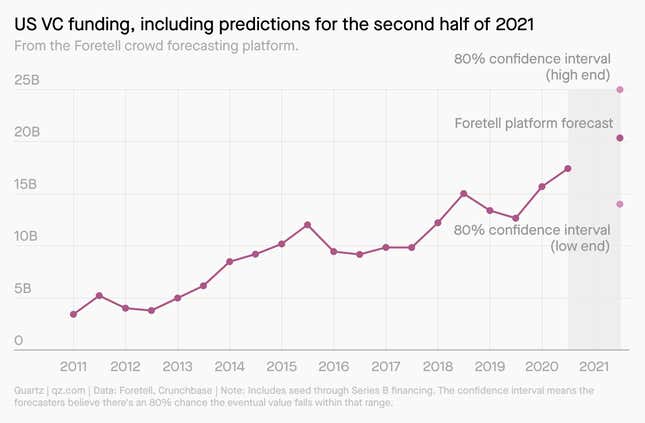

🎱 Prediction

For now, forecasters expect tech investment to keep booming. Participants in Georgetown’s crowd forecasting platform, Foretell, were asked to predict the level of US startup funding (seed through Series B deals) in the second half of 2021. Their “consensus forecast” was just over $20 billion, a 13% increase in funding over the second half to 2020.* They concluded the chance of a serious dip was remote, at least in the short term.

“The amount of [venture] capital looking at deals in the market right now is unprecedented. And that high figure of dry powder should continue the current pace for the near term,” says Kyle Stanford, a VC analyst at PitchBook. “Keeping up the current pace for the next five years seems like more of a long shot, but that same thing could have been said about the market’s growth five years ago.”

Sound off

What will happen to VC funding in the second half of 2021?

It’s due for a dip (decrease year-over-year)

It’ll go up a bit (20% increase or less)

It’ll go up a lot (over 20% increase)

Reading list

Go deeper…

- An inside look at how VC changed in the pandemic from investor Jeff Bussgang.

- The decade that completely transformed venture capital, from Quartz’s 2020 field guide.

- A data-driven look at how the 2010s transformed VC, from Pitchbook.

- Data on the proliferation of startup accelerators, from Brookings.

- 8 trends that will shape the next decade of venture capital, from Quartz.

- Even “seed” deals have gotten way bigger, according to Crunchbase.

- The silver linings of tech downturns, by journalist-turned-VC Om Malik.

- The changing geography of VC, from Quartz. (More here.)

Go wider…

- One analyst’s view of “What matters in tech” in 2021, from Benedict Evans.

- How and why financial bubbles form, from Quartz.

- For a look at startup culture from the inside, read Uncanny Valley, Anna Wiener’s recent memoir.

Have a great week,

—Walter Frick, executive editor, membership (and occasional amateur forecaster)

Additional contributions from Michael Coren and Alexandra Ossola.

One 🐳 Thing

Some experts argue that VC’s roots go all the way back to the whaling industry. Financiers pooled their money into partnerships and took risky bets on ship captains, each of whom was individually unlikely to succeed. But by spreading investments across several captains, these proto-VCs were able to take on that risk and make a (literal) killing.

*The “consensus forecast” is an average of everyone’s predictions, with some extra adjustments intended to make it more accurate. Forecasters make a range of predictions, to express their uncertainty; 13% is the expected value of those predictions.