For Quartz members—What is this? An IPO for Ant?

Hi [%first_name | Quartz member%],

Hi [%first_name | Quartz member%],

Ant Group, a Chinese company named after a freakishly strong but diminutive insect, was on the verge of running the biggest IPO in history. Then the dual listing, which was expected to value Ant above Goldman Sachs and US fintech darling Square combined, turned into a soap opera.

The West has long been struck by a mixture of awe and dread when it comes to the Hangzhou, China-based financial conglomerate. Now it appears Beijing isn’t so sure either about the company, which was expected to be valued at $300 billion or more. Ant’s executives have been humbled, and its blockbuster IPO is on hold indefinitely.

But first, a recap: Depending on when you open this email, we’re still awaiting the results of the US presidential election, and that’s not the only lingering question. Can the US electoral college be reformed? What’s going to happen to the Affordable Care Act? Is stimulus still stimulus if people don’t spend it? Who will win the battle to replace Huawei in Europe? Was Sean Connery the best 007? Why can’t I find any Nikes? We’re answering as fast as we can.

Your most-read story this week: The 90-year-old strategy that could end the US unemployment crisis. And most relatable member goes to whoever viewed our presentation on the future of sleep. (Ideally this would be one slide and that slide would say: YES, TONIGHT.) Lastly, would you recommend Quartz membership to a friend? Why or why not? Help us improve by taking this two-minute survey.

Okay, put away your cash–that paper’s no good here. We’re talking about how China does money.

The everything app

Ant is what you would get if you rolled a digital payment company, a bank, a platform for investing and insurance, and a bunch of other stuff (marriage licenses? Why not?) into a single app called Alipay. It’s the Amazon of money. The West doesn’t have anything quite like Ant, and it doesn’t seem likely to create one anytime soon.

The idea that there could be an Amazon of finance—an internet-native supermarket for money—has been around since at least the late 1990s. Before Elon Musk started making rockets and electric cars, he founded X.com, which merged with PayPal, to do just that. More recently, so-called neobanks in Europe have said they have the same ambition.

But Ant is really the only company that has pulled it off at hyper-scale. The enterprise has brought millions of Chinese people into the financial system, giving them access to investments and insurance that used to be out of reach for the working class.

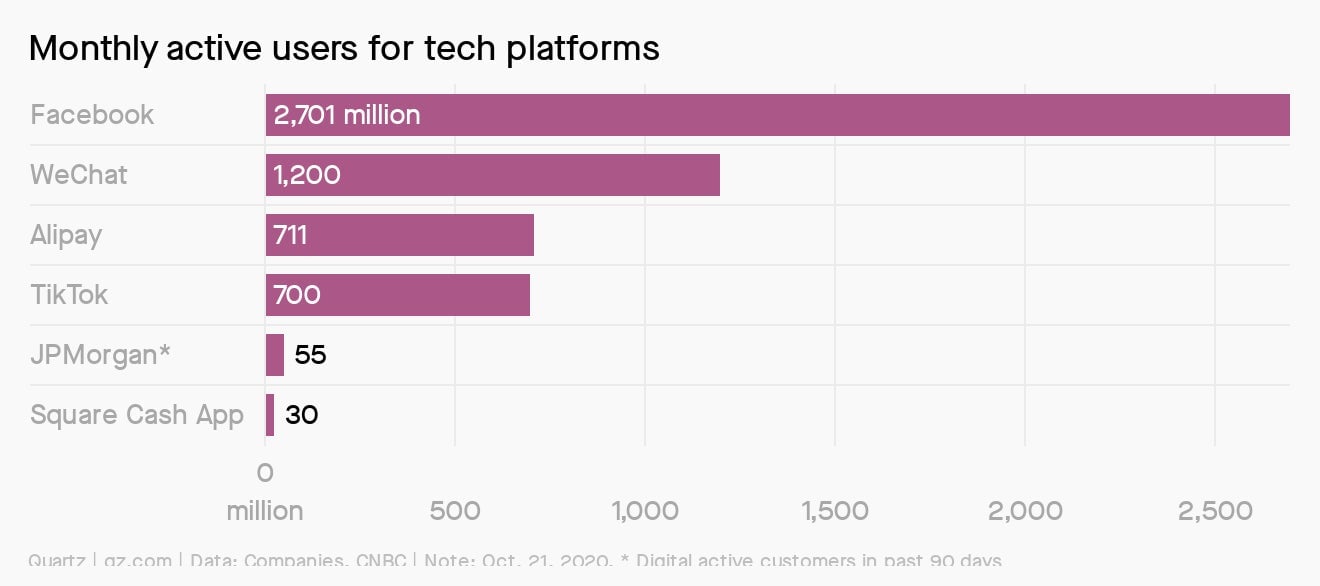

Ant has been able to do what startups in the US and Europe haven’t because it started from scratch. By contrast, the West has deeply entrenched incumbents like American banking stalwart JPMorgan, with roots that go back to the 18th century. Digital startups talk a big game, but they haven’t disrupted these companies.

When Ant started as the payment arm of Alibaba some 16 years ago, there wasn’t much to disrupt. China’s state-owned banks mainly lent to state-owned businesses, meaning consumers and small businesses didn’t have a lot of great options. Ant has filled that void: It’s what you would get if you rebuilt consumer and small-enterprise finance in the smartphone age.

Ant-idote

About 48 hours before Ant shares were to start trading on Nov. 5, the Shanghai Stock Exchange said the offering had been suspended because of regulatory changes that could require additional disclosures. Ant later apologized in a posting on WeChat and said it was putting its Hong Kong offering on hold as well.

The surprise reversal comes after Jack Ma, Ant’s billionaire controlling shareholder, and two other top executives were hauled up in front of regulators for a supervisory meeting. There are signs that Ma had picked a fight with the wrong people, criticizing and clashing with top regulators.

Reports suggest Ant may need to hold more capital and could be subjected to the kinds of regulation and oversight that banks endure. That might cut into profits and lead investors to view Ant as more of a financial company and less of a technology one, meaning a lower valuation in the stock market and, perhaps, slower growth. (Until this summer, Ant Group was known as Ant Financial.)

Guo Wuping, the head of consumer protection at China’s banking regulator, recently called out companies like Ant in a highly critical article (link in Chinese). Guo said micro-loan products offered by fintech companies are not that different from the credit cards issued by banks, but the lack of clear regulation has given them an unfair advantage.

The Party-owned Economic Journal also took aim at fintechs, arguing that there are really only two types of fintech companies: licensed financial institutions, and “fake” ones. Although the article didn’t mention Ant specifically, it said there are some fintech companies that have changed their names so they can be called tech companies—a possible ploy to avoid regulatory scrutiny and get a lofty valuation. Ouch.

Invitation interlude

As a Quartz member, you’re invited to a special virtual event. In honor of our inaugural Members Week (that’s you!), we are for the first time bringing a beloved internal Q&A series—Between Two Derns—out into the wild. Join us on Friday, Nov. 12 from 11–11:30am ET, when executive editor Kira Bindrim will interview editor in chief Katherine Bell. We’ll learn where Katherine thinks the global economy is headed, what she wishes she knew about Quartz readers, and (why not?) if she’d rather be a dog or a ghost.

Ant by the numbers

$300+ billion: Ant’s proposed market capitalization.

$30+ billion: Amount of money Ant planned to raise in its IPO.

$17 trillion: Value of digital transactions that went through Alipay in 2019.

711 million: Alipay’s monthly active users.

6 months: The minimum delay on Ant’s IPO, sources told the Financial Times.

Ant started out as a trusted way for people to buy things on Alibaba, and digital payments are still at its core, pulling in users and generating data that can be used for analyzing creditworthiness in real time. Last year, Alipay handled more transactions than Visa and Mastercard combined.

These days Ant says it’s the biggest provider of online credit for consumers and small- and medium-size businesses, the largest online investment platform, with around $600 billion in assets under management, and the top online insurance platform in China. It partners with hundreds of banks and money management firms to offer these services.

Will investors lose faith?

“I fully expect to own it at some point in the portfolio. You can’t ignore it.” —David Ellison, a portfolio manager at Hennessy Funds in Boston

Ellison says the suspension of Ant’s IPO is a concern, but he still wants to buy a piece of a company that is growing in the fast-expanding Chinese economy. Bernstein analyst Kevin Kwek thinks the regulatory news is bad for Ant’s IPO, but not necessarily “that bad.” In a note to clients, he suggested that Ant will be given time to transition to new rules and standards, if needed. But the suspension does undermine any belief that the financial darling had a handle on regulatory concerns. Wrote Kwek, “Weakening this assumption does not bode well for Ant.”

Keep reading:

- All about Ant Financial: Jack Ma’s other company.

- A viral pun in China foreshadowed Ant’s IPO delay.

- China’s fancy fintechs are still beholden to state-owned banks.

- Beijing, not Washington, is the biggest challenge for fintechs like Ant.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or companies you want to know more about.

Best wishes for a humbling end to your week,