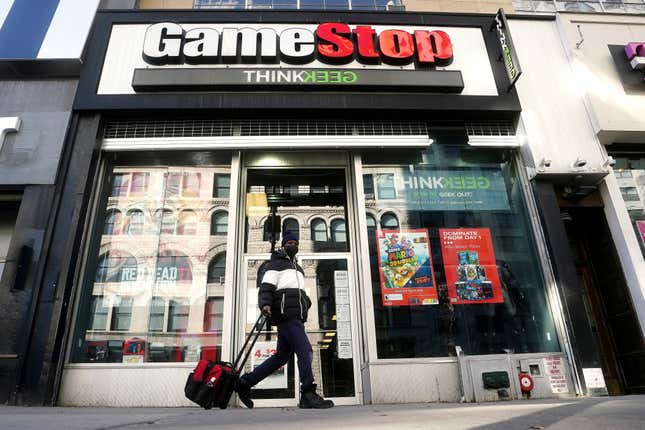

GameStop stock fell sharply on Wednesday morning following the news that the video game retailer is cutting jobs as sales decline. GameStop stock had already plummeted in after-hours trading on Tuesday after the release of its fourth-quarter earnings report.

The stock was down 14% shortly after markets opened Wednesday, to about $13 per share.

GameStop earnings miss Wall Street expectations

GameStop reported earnings of $0.22 per share and revenue of $1.79 billion. That fell short of analysts’ expectations of $0.30 in earnings per share and sales of $2.05 billion.

The company reported a profit of $63.1 million during its fiscal fourth quarter, an increase from the $48.2 million it reported during the same period a year ago.

GameStop’s net income increased for the fiscal year, but sales declined sharply. In fiscal year 2023, sales were $5.273 billion, compared to $5.927 billion in fiscal year 2022. In 2023, the company reported a net income of $6.7 million, compared to a loss of $313.1 million in fiscal year 2022.

And GameStop said it had to cut an unspecified numbers of jobs to reduce expenses.

What’s next for ‘meme stock’ GameStop?

GameStop has missed out on the explosion of the mobile gaming market and struggled to stay competitive. Now the video game retailer is trying to gain a foothold.

The meme stock reached its peak in 2021, when a group of small investors, encouraged by the Reddit community WallStreetBets and helped along by an Elon Musk tweet, skyrocketed its shares to $86.88 that January.

But it has struggled ever since. GameStop stock is down 20% so far this year and 42% over the last 12 months.

More markets news

The biggest financial frauds ever — from Sam Bankman-Fried to Bernie Madoff

Tesla stock kicks into gear on self-driving and Reddit pops again — but the market hits reverse