An airline built a hotel. It crashed and burned

Allegiant Air's troubled Sunseeker Resort Charlotte Harbor was one of the industry's more ambitious diversification attempts

Allegiant Air's troubled Sunseeker Resort Charlotte Harbor was one of the industry's more ambitious diversification attempts

A version of this article originally appeared in Quartz’s members-only Weekend Brief newsletter. Quartz members get access to exclusive newsletters and more. Sign up here.

CHARLOTTE HARBOR, Florida — At Sunseeker Resort Charlotte Harbor, sunburnt guests in Michigan and Ohio State gear — the unofficial uniforms of Southwest Florida tourism — wait at the poolside for long-delayed fruity cocktails. The scene captures the essence of a property that opened with grand ambitions but now finds itself on the selling block.

“I waited 45 minutes for my drink,” says Daniel from Bangor, Maine, nursing his finally arrived margarita at the resort’s rooftop bar on a February afternoon — squarely in the region’s peak tourist season when most Florida resorts operate at capacity with premium pricing. But Sunseeker had only a few bartenders and servers working, who were clearly overrun, even with only half the seats around the bar filled. When asked if he believes the property is understaffed as owner Allegiant Air tries to offload it, Daniel shrugs: “It sure seems like it.”

The massive complex rises incongruously from the modest Charlotte Harbor waterfront, its gleaming towers dwarfing the surrounding single-story businesses. Unlike the organically developed luxury scenes in nearby Naples or the barrier islands of Sanibel and Captiva, Sunseeker feels parachuted in — a Las Vegas company’s vision of Florida luxury that seems disconnected from its surroundings.

Inside, the 25,000-square-foot Harbor Yards Food Hall resembles an upscale airport concourse more than a resort amenity, complete with various food stalls under soaring ceilings. The cavernous space — often half-empty during February’s high season when restaurants throughout Southwest Florida have waiting lists — reinforces the sensation of still being in transit rather than having arrived at a destination.

Daniel represents Allegiant Travel Company’s ideal customer journey: He flew directly to Punta Gorda on an Allegiant flight and booked a stay at the company’s resort after seeing it advertised on the site. But this vertical integration strategy that once seemed brilliant is now being dismantled.

Las Vegas-based Allegiant announced last month that it expects to sell the 785-room Sunseeker Resort by early summer. CEO Greg Anderson said during a Feb. 4 conference call that the company is in discussions with “a high single-digit number of investors” interested in purchasing either all or a majority stake in the property.

Savanthi Syth, an analyst with investment firm Raymond James, maintains an “Outperform” rating on Allegiant stock. Syth noted in a recent analysis that the company has already written down Sunseeker’s carrying value and prepaid its $350 million construction loan. Syth expressed confidence that, “provided there are no hiccups, management’s base case is to complete a transaction (stake or total sale) by summer.”

The move comes as Raymond James increased its target price for Allegiant stock from $110 per share to $125, reflecting the airline’s potential for improved margins once freed from the Sunseeker burden.Syth noted that Allegiant is “the only U.S. airline expecting 2025 year-over-year RASM to outperform year-over-year CASM-ex,” industry metrics indicating better revenue performance relative to costs.

Allegiant’s hospitality venture represents one of the more ambitious airline diversification attempts, though not the first. Virgin Group famously expanded from airlines into hotels and cruise ships, while Pan Am once operated a hotel division. More recently, AirAsia launched a chain of airport hotels and food service businesses. Few airlines, however, have invested so heavily in a single destination property with such tenuous connections to their route network.

Sunseeker’s journey has been turbulent from the start. After breaking ground in 2019 on Charlotte Harbor land purchased for $30 million, the project faced multiple setbacks. Construction halted for 17 months during the pandemic. Hurricane Ian caused $35 million in damage when giant cranes crashed into the building in 2022. A fire in February 2023 further delayed progress.

By the time Sunseeker finally opened in December 2023, it was three years behind schedule and approximately $225 million over budget, with total costs exceeding $700 million. More recently, Hurricanes Helene and Milton last fall caused an additional $5.7 million in damage.

Financial results have disappointed investors. While occupancy improved from 54% in Q4 2024 to 60% in Q1 2025, with average room rates rising from $238 to $320 per night, the property recorded a staggering $321.8 million impairment charge in Q4 2024, dragging down Allegiant’s otherwise solid airline performance.

For Charlotte County, which lost approximately 250 hotel rooms to Hurricane Ian, Sunseeker initially appeared to be a tourism lifeline. But its scale and luxury positioning seem better suited to the established wealth of Naples or the tourist density of Fort Myers Beach than the working-class waterfront of Charlotte Harbor.

As Anderson guides Allegiant back to its core competency in low-cost air travel, the Sunseeker experiment represents an expensive lesson in the challenges of airline diversification. For the future buyer, however, the property offers a ready-made luxury resort in a growing Florida market — albeit one requiring operational refinement and perhaps a better understanding of its place within the local ecosystem.

Good morning, Quartz readers!

A global mood swing. A survey from Bank America shows that investor sentiment is bouncing back to pre-Liberation-Day levels (but mostly overseas) and that recession fears are dropping.

AI’d like a lawyer? OpenAI is reportedly considering whether to accuse Microsoft of anticompetitive behavior as the future of their partnership hangs in the balance.

Enlisting OpenAI’s bots. The Defense Department just awarded a one-year, $200 million defense contract to the ChatGPT-maker for “frontier AI capabilities.”

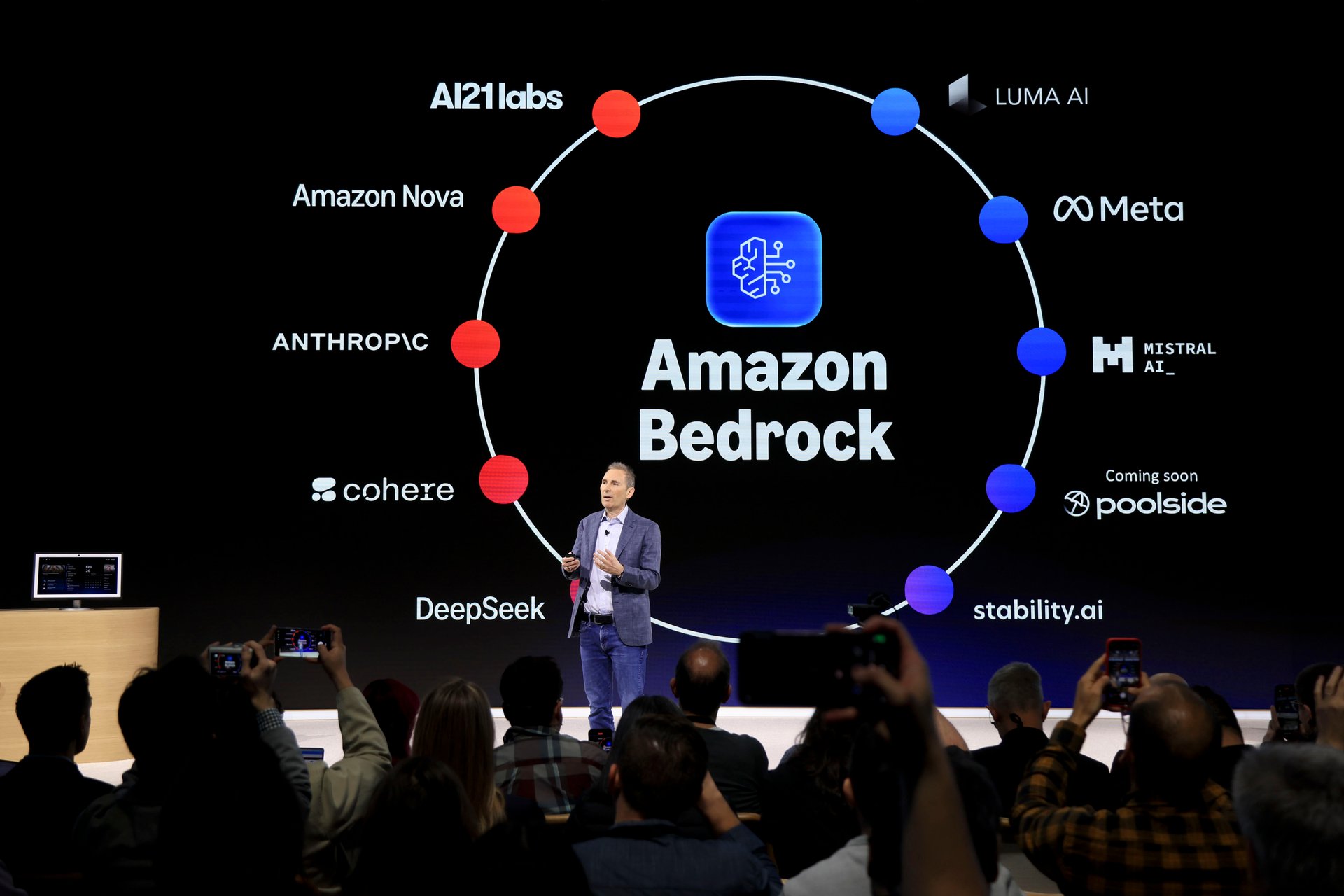

Prime cuts coming. Amazon CEO Andy Jassy said in a company-wide email that AI will bump up the company’s efficiency and productivity — but likely decrease its headcount.

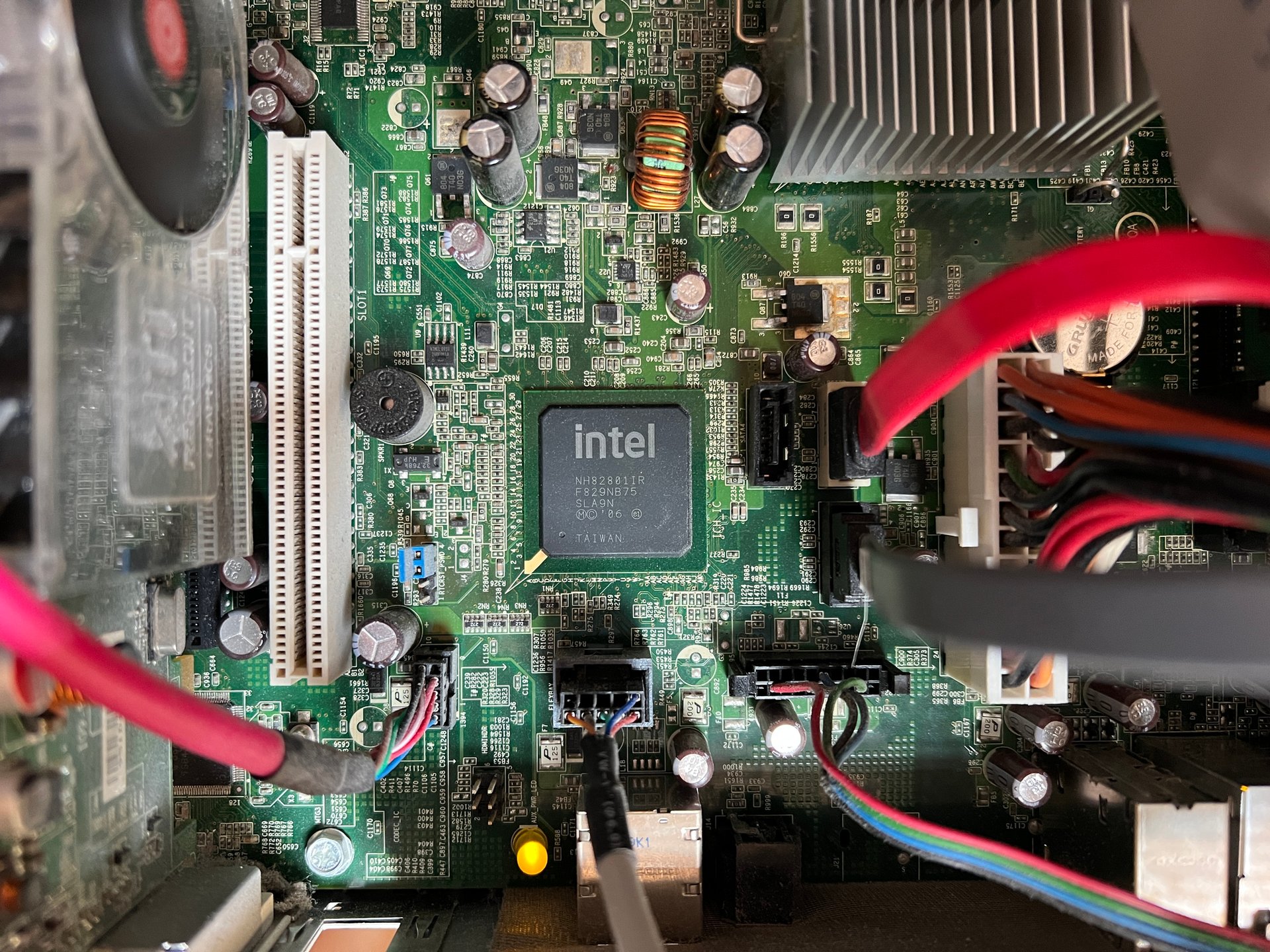

A factory reset. Chipmaker Intel will reportedly lay off up to 20% of its factory workforce in what the CEO called “difficult actions but essential to meet our affordability challenges.”

Tesla gets Cyberstuck again. The company’s stock slumped on news that Cybertruck and Model Y production will be suspended at its Austin plant for a week — the third pause in the past year.

The Federal Reserve began its June meeting Tuesday with interest rates expected to stay exactly where they are: elevated and immovable. Markets are betting on a less-than-1% chance of a cut.

The (likely) decision to hold rates steady puts the Fed squarely at odds with President Donald Trump, who has made his position on monetary policy characteristically loud and clear — calling Fed Chair Jerome Powell a “FOOL,” among other insults. But Powell, a Trump appointee, isn’t budging. Inflation may be down from its peak, but it’s still above the Fed’s 2% target. The Fed worries that if it cuts rates too soon, it could trigger another inflationary spiral… just as Americans are unclenching their wallets.

Meanwhile, the economic mood board is decidedly mixed. GDP dipped in Q1 and might do so again in Q2, job growth is slow, and consumer confidence is recovering from its April slump — a.k.a. “Liberation Day,” when Trump announced his wave of tariffs — but remains shaky.

The president wants rate cuts now — to stimulate growth, boost markets, and take pressure off his economy. But Powell is playing the long game. He’s reluctant to repeat the Fed’s 2021 mistake, when it underestimated inflation’s staying power and moved too slowly to correct course. This time, he’s doing the opposite: refusing to move too quickly.

It’s a delicate position.

Powell risks damaging the labor market if rates stay high for too long. But he could risk something bigger — the Fed’s credibility — if he caves to political pressure. When Trump last floated the idea of firing Powell, the market dropped 1,000 points. Investors, it seems, prefer a Fed that acts like it is above politics, even if it means sitting on its hands through some turbulence. Quartz’s Catherine Baab has more on how the Fed is holding firm while markets are holding their breath.

Senate Republicans just dropped their version of Trump’s sprawling tax-and-spending megabill — all 549 pages of it — setting off a phase of negotiations that could determine the size, shape, and shelf life of the next generation of GOP tax policy.

The proposal aims to extend Trump’s 2017 tax cuts and pay for them with steep reductions to safety net programs such as Medicaid and clean energy tax credits. The legislation leans into Trump’s campaign-season promises (No taxes on tips! Deductions for overtime! Bigger breaks for seniors!) — though most of those perks vanish in 2028, just as his term expires.

The Senate’s version includes stricter income phaseouts than the House-passed version and delegates enforcement details to the Treasury Department. Another key difference? Permanence. While the House bill took a short-term approach to tax extenders, Senate Republicans are aiming to make several key business breaks permanent, including immediate expensing of capital investments and full deductions for R&D.

In a departure from earlier GOP efforts, the Senate plan doesn’t entirely go scorched earth on Biden-era clean energy programs. Instead, the plan is giving solar, wind, nuclear, and geothermal projects more time before the plug is pulled — while quietly phasing out EV tax credits and adding protections to keep Chinese components out of clean-energy supply chains.

Negotiations with the House will be tense. The math is tight. The rhetoric will be looser. And if nothing else, this guarantees one thing: The next few weeks on Capitol Hill will be loud, long, and lousy with tax metaphors. Quartz’s Joseph Zeballos-Roig has more on how the tax bill became a policy Rorschach.

🚙 Mitsubishi is raising its prices (2.1%, on average) due to U.S. tariffs

✈️ JetBlue is cutting flights as it expects to lose big this year

💻 Microsoft says no more 9 to 5; hello, “infinite workday”

📦 Amazon is doubling Prime Days — as consumers pull back on spending

🔴 Kraft Heinz will remove artificial dyes from its U.S. food products by 2027

🏡 These states are where homeownership will be most out of reach in a decade

Our best wishes on a safe start to the day. Send any news, comments, and more to [email protected].

Production of Cybertruck and Model Y vehicles at Austin plant will be suspended for a week, the third pause in the past 12 months

Tesla’s Austin factory will pause production of its Cybertruck and Model Y vehicles the week of June 30, Business Insider reported. Workers were told the shutdown would be for maintenance on the production lines, to ensure future optimization.

Shares of the EV company slumped 4% on the news. While such a pause is routine for many automakers, particularly in summer, this is the third time Tesla has done so in the past 12 months: once in May, when workers attended seminars on company morale, and once in December, due to a battery shortage. For this latest pause, employees have the option of either taking paid time off or coming in for voluntary training — and to help with cleaning.

The production pause comes after Tesla’s first-quarter numbers were dismal. A new Model Y in January was expected to provide a boost, but sales were at their lowest since 2022, a 13% year-over-year decline. Some of the lower sales numbers are attributed to consumer boycotts in the wake of Elon Musk’s controversial role in President Donald Trump’s administration. Last month, Tesla shareholders wrote Musk an open letter demanding that he do his actual job.

The company also issued a massive recall of Cybertrucks in March because their exterior trim panels could easily be dislodged and cause traffic hazards.

Meanwhile, Tesla is preparing to launch its Model Y robotaxis in Austin on June 22, after almost a decade of Musk promising that such a launch was imminent.

Tesla’s second-quarter results are expected in July.

Andy Jassy wrote in a company-wide memo that he expects AI to reduce Amazon's corporate workforce but increase its efficiency

Amazon CEO Andy Jassy had a message for the company’s corporate workforce on Tuesday: The AI era is here — and while it’s going to make things faster and more efficient, it’s also going to mean fewer humans in the loop.

In a company-wide memo, Jassy said Amazon’s deepening investment in generative AI won’t just reinvent customer experiences — it will change the way the company operates internally. And, over time, that likely will mean fewer white-collar jobs.

“As we roll out more Generative AI and agents, it should change the way our work is done,” Jassy wrote. “We will need fewer people doing some of the jobs that are being done today and more people doing other types of jobs. It’s hard to know exactly where this nets out over time, but in the next few years, we expect that this will reduce our total corporate workforce as we get efficiency gains from using AI extensively across the company.”

Under Jassy, Amazon has already shown that it’s not afraid to make cuts. Since late 2022, the company has laid off more than 27,000 employees, part of a wave of post-pandemic belt-tightening that has swept across Big Tech. Now, even as revenue bounces back and capital spending surges, a hiring rebound hasn’t followed — especially not for corporate roles.

Jassy’s comments suggest that’s by design. Even beyond the office, Amazon’s workforce is flattening: The company now deploys more than 750,000 robots across its fulfillment network, and its latest model, “Vulcan,” is designed to handle heavier loads once managed by human hands.

At the same time, Amazon is rapidly embedding AI across nearly every part of its operations. More than 1,000 generative AI tools are already live or in development. Alexa is being retooled as “Alexa+,” a smarter assistant that can take action rather than just respond to prompts. On the shopping side, new features such as “Lens” (visual search), “Buy for Me” (cross-site purchasing), and automated sizing recommendations are being rolled out. The company’s generative AI shopping assistant is, according to Jassy, being used by tens of millions of customers.

Under the hood, AI is driving Amazon’s fulfillment strategy: managing inventory, forecasting demand, and working on robot efficiency. Customer service chatbots are getting an AI overhaul, and product listings are increasingly auto-generated. But the real breakthrough, according to Jassy, is the emergence of AI “agents” — software assistants capable of scouring the web, writing code, finding anomalies, and even handling research.

“There will be billions of these agents, across every company and in every imaginable field,” he wrote. “There will also be agents that routinely do things for you outside of work, from shopping to travel to daily chores and tasks. Many of these agents have yet to be built, but make no mistake, they’re coming, and coming fast.”

But perhaps the most telling part of Jassy’s vision is in an “agentic” future — one where AI software agents will handle much of the legwork that once filled certain jobs. The CEO thinks research, summarization, anomaly detection, translation, coding, and more will soon be delegated to bots that get smarter over time, leaving humans to “focus less on rote work and more on thinking strategically.”

“Agents will allow us to start almost everything from a more advanced starting point,” he wrote, adding that they’ll “change the scope and speed at which we can innovate for customers.”

Jassy encouraged employees to “get more done with scrappier teams,” attend training sessions, and adopt an AI-first mindset. In his words, those who embrace AI and help Amazon build its future will be “well-positioned to have high impact and help us reinvent the company.”

Jassy has floated this ethos before.

In his April shareholder letter, the CEO urged Amazon to operate like the “world’s largest startup” — prioritizing speed, invention, and risk-taking over headcount and hierarchy. Tuesday’s memo sharpened that idea: In an AI-driven workplace, fewer people may be part of the equation.

Amazon is far from alone. Microsoft and Google have both leaned into AI while slowing hiring and cutting thousands of roles. Startups like Harvey and Adept are pitching AI agents as the future of office work. And Anthropic CEO Dario Amodei recently warned AI could wipe out 50% of entry-level jobs and drive unemployment up by as much as 20% within five years. Others, including Nvidia’s Jensen Huang and billionaire Paul Tudor Jones, have argued that the shift will improve job quality and create new kinds of work — but even they acknowledge it will require significant retraining and regulatory oversight.

For now, Amazon is moving fast, scaling AI across its business — and signaling that headcount growth is no longer a prerequisite for progress.

While 66% of respondents see a soft economic landing, 54% predict international stocks will outperform U.S. equities over the next five years

Investor sentiment is back — well, at least, among global fund managers. According to Bank of America’s June 2025 Global Fund Manager Survey, optimism has has swelled to pre‑tariff‑shock levels, wiping out the dips stirred by President Donald Trump’s “Liberation Day” tariffs.

The headline numbers pack a punch: 66% of fund managers now anticipate a “soft landing” for the global economy, up from 37% in April. And while 82% of respondents in April predicted weakening growth, only 46% hold that view in June. That’s the largest two-month sentiment swing since last year’s presidential election. Recession fears have diminished drastically — now, 36% of respondents think a downturn is "unlikely."

So what’s behind this mood swing? The survey, which was conducted from June 6 to June 12 and captures responses from 190 fund managers overseeing over $520 billion in assets, says diffusing trade tensions, rolled-back and somewhat stabilizing tariffs (expected by about 75% of investors to be an average of 15% or lower), and better-than-feared U.S. economic data are the big factors.

This resurgence in confidence is reflected in a significant shift in investment strategies. Fund managers are lowering cash allocations to a three‑month low while boosting positions in emerging‑market equities, energy, banks — and leaning especially into Eurozone stocks, supported by a recent Germany fiscal stimulus.

But there’s a twist.

While the world warms up, sentiment toward U.S. assets is increasingly bearish. The U.S. dollar is now the most underweighted currency in at least 20 years, making it one of the hottest “crowded trades,” alongside gold and tech. The dollar index has tumbled nearly 9.6 % this year, and more than half (54%) of fund managers predict international stocks will outperform U.S. equities over the next five years.

Concerns over the sustainability of U.S. fiscal policy are also prevalent, with 81% expecting recent spending bills to significantly add to national debt. Treasury yields are predicted to climb, possibly reaching 5%.

So while confidence largely rebounds abroad, it’s cooling off at home. The latest survey paints a clear picture: Global capital is rotating out of U.S. assets and chasing upside in Europe and emerging markets. Risk appetite is back — but it’s looking outward. Fund managers are shedding cash, leaning into higher-beta plays overseas. The bull case is building, but so are the tail risks — shaky fiscal paths, geopolitical sparks, and a market still on edge.

The Japanese carmaker is the latest to pass on costs to consumers as a result of President Trump's trade policies

The price of Mitsubishi cars will rise 2.1% on average, the Japanese carmaker said Tuesday.

Mitsubishi temporarily suspended deliveries to U.S. dealers after President Donald Trump's announcement of sweeping tariffs in April, but resumed doing so last week, Reuters reports. The company said the new price hikes, which take effect on Wednesday, would not apply to any vehicles currently in dealers’ showrooms.

A company spokesperson said that Mitsubishi "regularly reviews vehicle pricing in order to ensure we are in line with segment expectations and the latest market trends.

"Based on our most recent evaluation across the industry," the spokesperson said, Mitsubishi "will revise the Manufacturer’s Suggested Retail Price (MSRP) on select 2025 vehicles, effective June 18. There will be no adjustments to vehicles already in dealer inventory.”

Mitsubishi has had a strong 18-month performance: Its 2024 sales were up 26%, to 110,000, its best performance since 2019. And 2025 looks just as promising, with sales up 11% in the first three months of the year. The company will soon reveal updates to the new Outlander model and a new EV scheduled for 2026.

Last week, Trump mused about hiking tariffs again, ostensibly to onshore more U.S. production. Yet auto tariffs have been enormously unpopular with the auto industry. Mitsubishi is not the first to hike prices: Both Subaru and Ford did so by as much as $2,000.

In March, the S&P Global downgraded its 2025 forecast for U.S. vehicle sales by 700,000.

Meanwhile, Fitch Ratings data shows that the number of subprime automobile borrowers who are at least 60 days past due on their loans rose to 6.56%, the highest number since the agency began collecting data in 1994.

The rising delinquencies point to fundamental economic weaknesses, according to Mariano Torras, an economics professor at Adelphi University. He says what is happening among subprime auto borrowers is the “canary in the coal mine” and that the problems in subprime auto loans are likely to spread to other parts of the economy.

—Kevin Williams contributed to this article.

Correction: An earlier version of this story misstated what Mitsubishi said about price increases. The company said it "regularly reviews vehicle pricing," and that the price hikes were in line with its "most recent evaluation across the industry." Mitsubishi did not say it was raising prices as a result of tariffs.

Intel called the layoffs an effort to begin "removing organizational complexity"

Intel is reported to be laying off up to 20% of its factory workforce as the struggling chipmaker tries to turn its business around.

“These are difficult actions but essential to meet our affordability challenges and current financial position of the company," Intel Vice President Naga Chandrasekaran wrote in a letter to employees obtained by Oregon Live, detailing that the company will make the 15% to 20% cut on factory jobs in July.

The company, which did not immediately return a request for comment, told the paper in a statement that “removing organizational complexity and empowering our engineers will enable us to better serve the needs of our customers and strengthen our execution." It did not comment on the specifics or reasons for the cuts.

In April, Intel had announced that it planned to purge 20% of its staff to pare back bureaucracy within the company, which would leave more than 20,000 people without a job. It wasn't immediately clear if the factory cuts are part of those plans or a separate downsizing initiative.

The previous layoff announcement was the first major action undertaken by chip veteran Lip-Bu Tan, who took the helm as Intel’s CEO earlier this year.

“Under my leadership, Intel will be an engineering-focused company. We will listen closely and act on your input. Most importantly, we will create products that solve your problems and drive your success,” Tan said in March.

The company has been struggling to keep pace with competitors like Nvidia, which replaced Intel on the Dow Jones Industrial Average in November 2024.

The company has also been the target of possible acquisitions and has been working with investment bankers at Morgan Stanley and Goldman Sachs to right its business, including by potentially splitting its foundry division.

The chipmaker’s struggles have even caught the eye of President Donald Trump, who, according to Bloomberg, reported that Taiwanese contract manufacturer TSMC (TSM) is considering taking a controlling stake in chipmaker Intel’s factories at the request of Trump.

Trump’s team raised the idea of a deal between the two firms in recent meetings with officials from TSMC, and they were receptive, Bloomberg reported, citing a person familiar with the matter.

—Kevin Williams and Ece Yildirim contributed to this article.

Travel demand is down and the domestic market is oversupplied, but premium experiences on prime routes are still the plan

JetBlue does not expect to break even this year due to falling travel demand. The company is also cutting costs by axing some off-peak flights.

CEO Joanna Geraghty told staff that “even a recovery won’t fully offset the ground we’ve lost this year and our path back to profitability will take longer than we’d hoped,” in an internal memo on Monday, CNBC reports. “That means we’re still relying on borrowed cash to keep the airline running.”

JetBlue is hardly alone; many airlines are citing a lack of consumer confidence in 2025 due to macro economic uncertainty, with fewer bookings even as fares plummeted. The domestic market is oversupplied, and several large airlines cut back their growth plans for the second half of the year.

JetBlue hasn’t posted a profit since 2019. Starting in 2021, it spent three years pursing a merger with Spirit Airlines, which was shot down in March 2024 when a federal judge blocked the deal. Geraghty had just stepped into the CEO job a month before; she called the Spirit affair a major “distraction.” Last August, JetBlue took on $2.75 billion in debt.

Cost-cutting measures will involve examining unprofitable routes, pausing plans to retrofit some older jets with new interiors, and reassess hiring plans, according to Geraghty’s memo. But the mid-range airline still plans to move ahead with offering premium experiences on high-demand flights to attract more business travelers.

Last month, a new partnership with United Airlines enabled cross-booking and shared frequent-flyer rewards.

Trump campaign promises for no taxes on tips and overtime pay are still in, with limits. The child tax credit got a modest increase

Senate Republicans released their tax portion of President Trump’s megabill on Tuesday afternoon, kicking off what’s expected to be an intense period of negotiations to send the final version of the measure through the House and onto the White House.

The 549-page bill would extend the bulk of the GOP’s 2017 signature tax cuts, financed with steep cuts to safety net programs like Medicaid and clean energy tax credits.

“It powers the economy by permanently extending critical pro-growth provisions and introduces new incentives for domestic investment, providing certainty for American job creators to spur domestic economic activity and invest in their workers,” Senate Finance Chair Mike Crapo said in a statement accompanying the legislation.

Republican senators are racing to pass their megabill using a party-line reconciliation process to overcome united Democratic opposition. Here are 5 takeaways.

The Senate GOP legislation includes Trump’s campaign promises to eliminate taxes on tips and overtime pay. It also would establish a tax deduction on auto loan interest and a larger standard deduction for seniors aged 65 and above. The latter is meant to replace a Trump promise to eliminate taxes on Social Security benefits. All would expire at the end of Trump’s term in 2028.

The House-passed tax-and-spending bill had identical measures, but GOP senators put more limits, presumably to cut the final price tag. On getting rid of tax on tips, the GOP bill would set up a maximum $25,000 deduction that starts phasing out at $150,000 for singles and $300,000 for couples. It applies for occupations that usually receive cash tips, such as bartenders or waitresses. A list of specified jobs that apply for the tax break will be released by the Treasury Department within three months of the bill being signed into law.

When it comes to no tax on overtime pay, the GOP legislation establishes a deduction that peaks at $12,500 for singles, and $25,000 for those filing joint tax returns. It has a larger phase out that begins at $150,000 for singles and $300,000 for couples filing jointly.

GOP senators are keen to restore a set of business tax breaks that expired three years ago and make them permanent. Past efforts to revive them in bipartisan negotiations failed, despite the support the provisions also attracted from Democrats and influential business groups.

The three business tax provisions include extending rules allowing companies to deduct the capital expense costs immediately, instead of spreading them over years; establishing a bigger interest deduction; and restoring the ability for businesses to immediately write off research and development expenses.

“Holding the ultimate cost of the bill constant, making these three provisions permanent is critical to achieving the growth needed to bring in more revenue,” George Callas, once a senior tax aide to former House Speaker Paul Ryan and currently with advocacy group Arnold Ventures, wrote on X.

Other provisions such as scholarship tax credits are also made permanent, in contrast to the House GOP’s short-ladder approach. “It's not just the business extenders: there's a lot more permanency in the Senate tax bill across the board,” said Andrew Lautz, a tax expert at the Bipartisan Policy Center.

Some GOP senators are hesitant to immediately scrap clean energy tax credits that Democrats approved under former President Joe Biden. That skepticism was channeled into the Senate GOP tax bill.

Senate Republicans would give wind and solar projects more time to qualify for the credits and not shut them off abruptly. The bill is also friendlier to geothermal, nuclear, and hydropower projects, while imposing new limits to prevent Chinese products from entering U.S. supply chains.

Still, other clean energy measures are eliminated outright. The $7,500 clean vehicle credit expires six months after the bill is enacted.

One big GOP priority hasn’t been changed from the House bill. The Senate GOP bill would establish a tax-preferred savings account with a $1,000 contribution from the federal government for children born during Trump’s term, known as "Trump accounts." They’re able to access the cash for certain purposes after turning 18, and have full control of the money at the age of 30.

Senate Republicans would increase the child tax credit to $2,200 and make it permanent. It’s a modest increase from the current level of $2,000, which is set to revert back to $1,000 at the end of this year if Congress doesn’t step in.

Republican senators drastically scaled back a $40,000 limit on the state and local tax deduction, a provision allowing individuals or married couples to subtract the amount paid in state tax from their federal tax bill. Republicans put the limit in place to help finance the 2017 tax cuts, and most of the SALT deduction flows to high-earners in predominantly Democratic states.

SALT had been the center of tense negotiations in the lower chamber and the policy changes triggered anger among Republicans hailing from states like New York. GOP Rep. Mike Lawler of New York called the SALT changes “dead on arrival” in an X post.

Workers are logging on early and staying online late, with technology making it impossible to find time away from work, according to a new report

If you feel like you're working from the moment you wake up to the time you go to sleep, you aren't alone.

According to new analysis from Microsoft, more and more office workers are experiencing an "infinite workday," where they are online or doing some form of work from morning to night.

Analyzing data from the 365 suite, Microsoft found that the workday starts earlier than ever, with 40% of people already online and reviewing emails at 6 a.m. That's probably because the average worker using 365 receives 117 emails and 153 Teams messages per workday.

The company also found that it's hard for workers to get much done between 9 and 5, with 57% of meetings called in the moment without a calendar invite. Plus, most workers have only two minutes of focus time before being interrupted by a meeting, email, or message during those core work hours.

Microsoft revealed that "meetings hijack prime focus time," since 50% of meetings take place from 9-11 a.m. and 1-3 p.m., which is when research has shown people are mostly able to be productive.

And after 5 p.m., things aren't looking better, with the workday increasingly bleeding into evenings and weekdays. Data show that 29% of active employees check their emails again around 10 p.m. and the average worker sends or receives 50 Teams messages outside of core work hours each day.

Microsoft also saw a 16% year-over-year increase in evening meetings and reported that 20% of workers are actively working over the weekend.

The company said its data "points to a larger truth: the modern workday for many has no clear start or finish."

"As business demands grow more complex and expectations continue to rise, time once reserved for focus or recovery may now be spent catching up, prepping, and chasing clarity," Microsoft said. "It's the professional equivalent of needing to assemble a bike before every ride. Too much energy is spent organizing chaos before meaningful work can begin. "