Binance doesn't think the US has jurisdiction over its crypto exchange

The embattled crypto firm is asking a judge to dismiss a lawsuit brought by federal regulators

The embattled crypto firm is asking a judge to dismiss a lawsuit brought by federal regulators

Binance CEO Changpeng Zhao is seeking the dismissal of a lawsuit by the US Commodity Futures Trading Commission (CFTC), arguing the regulatory body has exceeded its jurisdiction.

Binance—the world’s largest cryptocurrency exchange—filed a motion in Northern Illinois District Court that accuses federal regulators of operating extraterritorially. The CFTC is suing Zhao’s company for allegedly selling illegal cryptocurrency derivatives to retail investors in the United States.

The lawsuit argues that US regulators have failed to establish jurisdiction over the company and that the attempt to rein in Binance is part of a pattern of US regulators overstepping their authority. Zhao is Canadian and the company is based in the Cayman Islands.

“The CFTC seeks to regulate foreign individuals and corporations that reside and operate outside the United States—outstripping the limits of its statutory authority and treading on deep-rooted principles of comity with foreign sovereigns,” lawyers for Binance wrote.

Additionally, the lawsuit argues that regulators are attempting to apply antiquated commodity trade regulations to the emerging cryptocurrency market, saying that if the CFTC wants a broader scope, it should ask Congress to expand its powers.

The original lawsuit, first filed in March of this year, accuses Binance of encouraging users to to illegally use Virtual Private Networks (VPNs) to buy and sell crypto derivatives outside the purview of American regulators. Some Binance employees even allegedly directed customers to set up shell companies in foreign countries to avoid trade restrictions.

“Binance has instructed U.S. customers to evade such controls by using VPNs to conceal their true location,” the CFTC’s lawsuit alleges. “VPN use by customers to access and trade on the Binance platform has been an open secret, and Binance has consistently been aware of and encouraged the use of VPNs by U.S. customers.”

The CFTC also accused Binance of failing to implement routine processes meant to combat money laundering, failing to register as a futures commissions merchant, and generally doing a bad job of supervising its business. It took particular aim at the CEO’s alleged lawlessness, saying “Zhao answers to no one but himself.” Read the full lawsuit here.

Buying crypto derivatives works like buying a commodity (think gold or soybeans). Instead of purchasing crypto, an investor bets on the likelihood that the cost of a particular cryptocurrency will go up or down.

Trading crypto derivatives is completely illegal in some countries and heavily regulated in the US, due to the potential for market manipulation. Currently, the CFTC mandates a series of safeguards for crypto derivative trading, as well as stringent protections to stave off money-laundering.

🏦 US regulators sued Binance for encouraging customers to buy unregistered crypto commodities

🫰 Jack Dorsey’s fintech company Block is being accused of facilitating criminal activity

🪙 Sam Altman’s biometrics-based cryptocurrency Worldcoin is now live

The Japanese carmaker is the latest to pass on costs to consumers as a result of President Trump's trade policies

The price of Mitsubishi cars will rise 2.1% on average, effective Wednesday, the Japanese carmaker announced on Tuesday. The company said this was a result of 25% tariffs imposed by President Donald Trump on “Liberation Day” in April.

Mitsubishi temporarily suspended deliveries to U.S. dealers after Trump’s April announcement, but resumed doing so last week. It said the price hikes would not apply to any vehicles currently in dealers’ showrooms.

Mitsubishi has had a strong 18-month performance: Its 2024 sales were up 26%, to 110,000, its best performance since 2019. And 2025 looks just as promising, with sales up 11% in the first three months of the year. The company will soon reveal updates to the new Outlander model and a new EV scheduled for 2026.

Last week, Trump mused about hiking tariffs again, ostensibly to onshore more U.S. production. Yet auto tariffs have been enormously unpopular with the auto industry. Mitsubishi is not the first to hike prices: Both Subaru and Ford did so by as much as $2,000.

In March, the S&P Global downgraded its 2025 forecast for U.S. vehicle sales by 700,000.

Meanwhile, Fitch Ratings data shows that the number of subprime automobile borrowers who are at least 60 days past due on their loans rose to 6.56%, the highest number since the agency began collecting data in 1994.

The rising delinquencies point to fundamental economic weaknesses, according to Mariano Torras, an economics professor at Adelphi University. He says what is happening among subprime auto borrowers is the “canary in the coal mine” and that the problems in subprime auto loans are likely to spread to other parts of the economy.

—Kevin Williams contributed to this article.

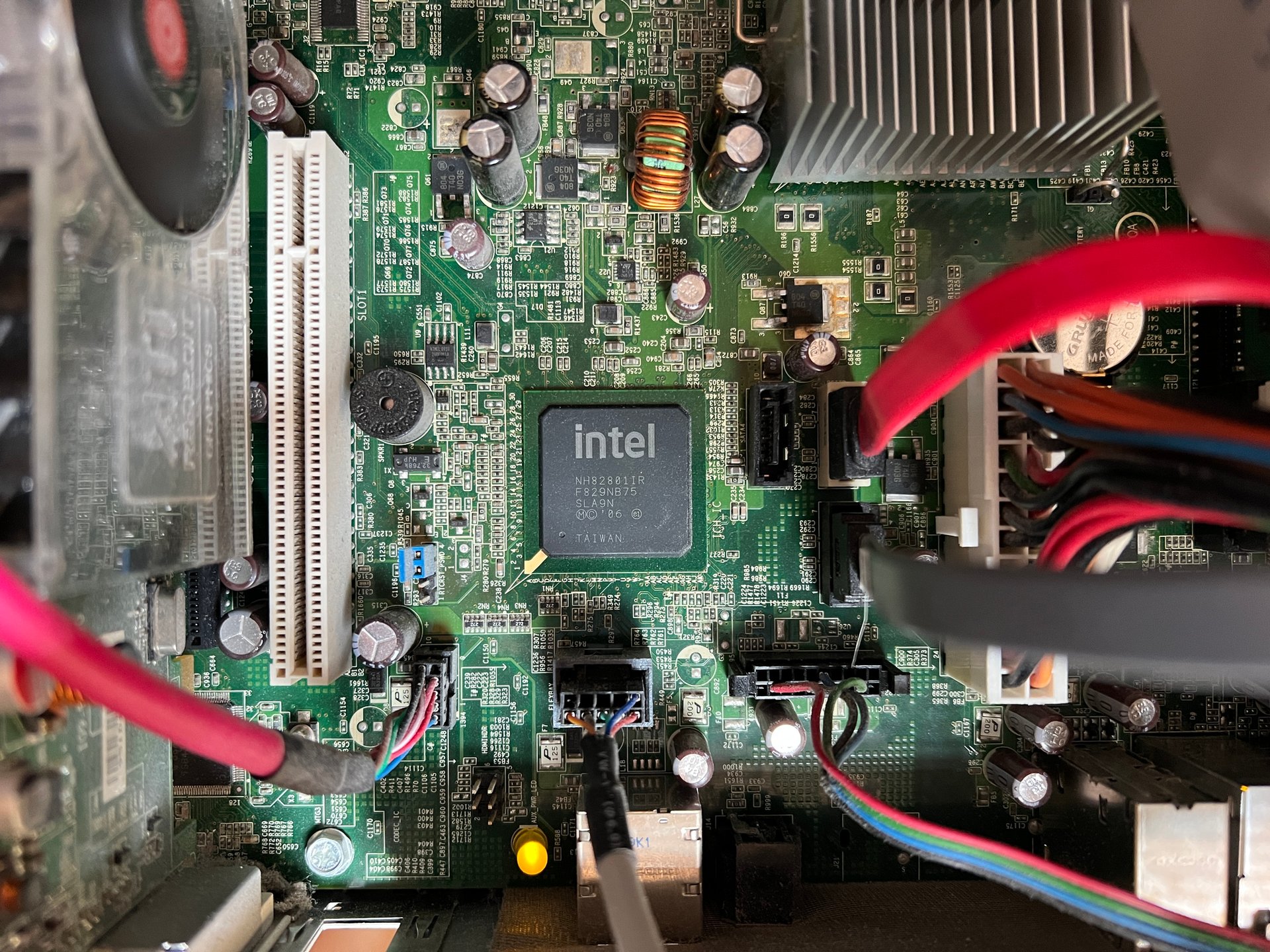

Intel called the layoffs an effort to begin "removing organizational complexity"

Intel is reported to be laying off up to 20% of its factory workforce as the struggling chipmaker tries to turn its business around.

“These are difficult actions but essential to meet our affordability challenges and current financial position of the company," Intel Vice President Naga Chandrasekaran wrote in a letter to employees obtained by Oregon Live, detailing that the company will make the 15% to 20% cut on factory jobs in July.

The company, which did not immediately return a request for comment, told the paper in a statement that “removing organizational complexity and empowering our engineers will enable us to better serve the needs of our customers and strengthen our execution." It did not comment on the specifics or reasons for the cuts.

In April, Intel had announced that it planned to purge 20% of its staff to pare back bureaucracy within the company, which would leave more than 20,000 people without a job. It wasn't immediately clear if the factory cuts are part of those plans or a separate downsizing initiative.

The previous layoff announcement was the first major action undertaken by chip veteran Lip-Bu Tan, who took the helm as Intel’s CEO earlier this year.

“Under my leadership, Intel will be an engineering-focused company. We will listen closely and act on your input. Most importantly, we will create products that solve your problems and drive your success,” Tan said in March.

The company has been struggling to keep pace with competitors like Nvidia, which replaced Intel on the Dow Jones Industrial Average in November 2024.

The company has also been the target of possible acquisitions and has been working with investment bankers at Morgan Stanley and Goldman Sachs to right its business, including by potentially splitting its foundry division.

The chipmaker’s struggles have even caught the eye of President Donald Trump, who, according to Bloomberg, reported that Taiwanese contract manufacturer TSMC (TSM) is considering taking a controlling stake in chipmaker Intel’s factories at the request of Trump.

Trump’s team raised the idea of a deal between the two firms in recent meetings with officials from TSMC, and they were receptive, Bloomberg reported, citing a person familiar with the matter.

—Kevin Williams and Ece Yildirim contributed to this article.

Travel demand is down and the domestic market is oversupplied, but premium experiences on prime routes are still the plan

JetBlue does not expect to break even this year due to falling travel demand. The company is also cutting costs by axing some off-peak flights.

CEO Joanna Geraghty told staff that “even a recovery won’t fully offset the ground we’ve lost this year and our path back to profitability will take longer than we’d hoped,” in an internal memo on Monday, CNBC reports. “That means we’re still relying on borrowed cash to keep the airline running.”

JetBlue is hardly alone; many airlines are citing a lack of consumer confidence in 2025 due to macro economic uncertainty, with fewer bookings even as fares plummeted. The domestic market is oversupplied, and several large airlines cut back their growth plans for the second half of the year.

JetBlue hasn’t posted a profit since 2019. Starting in 2021, it spent three years pursing a merger with Spirit Airlines, which was shot down in March 2024 when a federal judge blocked the deal. Geraghty had just stepped into the CEO job a month before; she called the Spirit affair a major “distraction.” Last August, JetBlue took on $2.75 billion in debt.

Cost-cutting measures will involve examining unprofitable routes, pausing plans to retrofit some older jets with new interiors, and reassess hiring plans, according to Geraghty’s memo. But the mid-range airline still plans to move ahead with offering premium experiences on high-demand flights to attract more business travelers.

Last month, a new partnership with United Airlines enabled cross-booking and shared frequent-flyer rewards.

Trump campaign promises for no taxes on tips and overtime pay are still in, with limits. The child tax credit got a modest increase

Senate Republicans released their tax portion of President Trump’s megabill on Tuesday afternoon, kicking off what’s expected to be an intense period of negotiations to send the final version of the measure through the House and onto the White House.

The 549-page bill would extend the bulk of the GOP’s 2017 signature tax cuts, financed with steep cuts to safety net programs like Medicaid and clean energy tax credits.

“It powers the economy by permanently extending critical pro-growth provisions and introduces new incentives for domestic investment, providing certainty for American job creators to spur domestic economic activity and invest in their workers,” Senate Finance Chair Mike Crapo said in a statement accompanying the legislation.

Republican senators are racing to pass their megabill using a party-line reconciliation process to overcome united Democratic opposition. Here are 5 takeaways.

The Senate GOP legislation includes Trump’s campaign promises to eliminate taxes on tips and overtime pay. It also would establish a tax deduction on auto loan interest and a larger standard deduction for seniors aged 65 and above. The latter is meant to replace a Trump promise to eliminate taxes on Social Security benefits. All would expire at the end of Trump’s term in 2028.

The House-passed tax-and-spending bill had identical measures, but GOP senators put more limits, presumably to cut the final price tag. On getting rid of tax on tips, the GOP bill would set up a maximum $25,000 deduction that starts phasing out at $150,000 for singles and $300,000 for couples. It applies for occupations that usually receive cash tips, such as bartenders or waitresses. A list of specified jobs that apply for the tax break will be released by the Treasury Department within three months of the bill being signed into law.

When it comes to no tax on overtime pay, the GOP legislation establishes a deduction that peaks at $12,500 for singles, and $25,000 for those filing joint tax returns. It has a larger phase out that begins at $150,000 for singles and $300,000 for couples filing jointly.

GOP senators are keen to restore a set of business tax breaks that expired three years ago and make them permanent. Past efforts to revive them in bipartisan negotiations failed, despite the support the provisions also attracted from Democrats and influential business groups.

The three business tax provisions include extending rules allowing companies to deduct the capital expense costs immediately, instead of spreading them over years; establishing a bigger interest deduction; and restoring the ability for businesses to immediately write off research and development expenses.

“Holding the ultimate cost of the bill constant, making these three provisions permanent is critical to achieving the growth needed to bring in more revenue,” George Callas, once a senior tax aide to former House Speaker Paul Ryan and currently with advocacy group Arnold Ventures, wrote on X.

Other provisions such as scholarship tax credits are also made permanent, in contrast to the House GOP’s short-ladder approach. “It's not just the business extenders: there's a lot more permanency in the Senate tax bill across the board,” said Andrew Lautz, a tax expert at the Bipartisan Policy Center.

Some GOP senators are hesitant to immediately scrap clean energy tax credits that Democrats approved under former President Joe Biden. That skepticism was channeled into the Senate GOP tax bill.

Senate Republicans would give wind and solar projects more time to qualify for the credits and not shut them off abruptly. The bill is also friendlier to geothermal, nuclear, and hydropower projects, while imposing new limits to prevent Chinese products from entering U.S. supply chains.

Still, other clean energy measures are eliminated outright. The $7,500 clean vehicle credit expires six months after the bill is enacted.

One big GOP priority hasn’t been changed from the House bill. The Senate GOP bill would establish a tax-preferred savings account with a $1,000 contribution from the federal government for children born during Trump’s term, known as "Trump accounts." They’re able to access the cash for certain purposes after turning 18, and have full control of the money at the age of 30.

Senate Republicans would increase the child tax credit to $2,200 and make it permanent. It’s a modest increase from the current level of $2,000, which is set to revert back to $1,000 at the end of this year if Congress doesn’t step in.

Republican senators drastically scaled back a $40,000 limit on the state and local tax deduction, a provision allowing individuals or married couples to subtract the amount paid in state tax from their federal tax bill. Republicans put the limit in place to help finance the 2017 tax cuts, and most of the SALT deduction flows to high-earners in predominantly Democratic states.

SALT had been the center of tense negotiations in the lower chamber and the policy changes triggered anger among Republicans hailing from states like New York. GOP Rep. Mike Lawler of New York called the SALT changes “dead on arrival” in an X post.

Workers are logging on early and staying online late, with technology making it impossible to find time away from work, according to a new report

If you feel like you're working from the moment you wake up to the time you go to sleep, you aren't alone.

According to new analysis from Microsoft, more and more office workers are experiencing an "infinite workday," where they are online or doing some form of work from morning to night.

Analyzing data from the 365 suite, Microsoft found that the workday starts earlier than ever, with 40% of people already online and reviewing emails at 6 a.m. That's probably because the average worker using 365 receives 117 emails and 153 Teams messages per workday.

The company also found that it's hard for workers to get much done between 9 and 5, with 57% of meetings called in the moment without a calendar invite. Plus, most workers have only two minutes of focus time before being interrupted by a meeting, email, or message during those core work hours.

Microsoft revealed that "meetings hijack prime focus time," since 50% of meetings take place from 9-11 a.m. and 1-3 p.m., which is when research has shown people are mostly able to be productive.

And after 5 p.m., things aren't looking better, with the workday increasingly bleeding into evenings and weekdays. Data show that 29% of active employees check their emails again around 10 p.m. and the average worker sends or receives 50 Teams messages outside of core work hours each day.

Microsoft also saw a 16% year-over-year increase in evening meetings and reported that 20% of workers are actively working over the weekend.

The company said its data "points to a larger truth: the modern workday for many has no clear start or finish."

"As business demands grow more complex and expectations continue to rise, time once reserved for focus or recovery may now be spent catching up, prepping, and chasing clarity," Microsoft said. "It's the professional equivalent of needing to assemble a bike before every ride. Too much energy is spent organizing chaos before meaningful work can begin. "

Kraft Heinz says it will replace dyes with natural colors, or reinvent new ones when natural ones are not available

Kraft Heinz will remove food coloring and artificial dyes from all its products by 2027, the food giant announced Tuesday.

The company says almost 90% of its U.S. products, including ketchup, do not have any artificial dyes at all. Some of those that do are fairly obvious: Kool-Aid, Jell-O, MiO and Crystal Light. The company’s announcement came with a critical caveat, however, promising to remove colors “where it is not critical to the consumer experience.”

Worry not: Kraft Heinz says it will replace dyes with natural colors, or reinvent new ones when natural ones are not available. The iconic Kraft Mac & Cheese, for example, has been devoid of artificial colors, preservatives, and flavors since 2016.

The move comes as the FDA has called for a phase-out of petroleum-based synthetic dyes. Though this has long been a crusade of current Health Secretary Robert F. Kennedy Jr., the process began during the Biden administration. Red No. 3 was banned in early January, citing a study that found it caused cancer in male rats. Companies were given until January 2028 to phase it out.

Shortly after taking office, Kennedy met with executives from many of the top processed food companies to further target the use of other artificial dyes. The FDA is revoking authorization for Citrus Red No. 2 and Orange B in the coming months, and is working with the industry to eliminate six more by the end of 2026. It has requested that companies pull Red No.3 in advance of the 2027-28 deadline previously required.

In April, FDA Commissioner Marty Makary said the agency is “asking food companies to substitute petrochemical dyes with natural ingredients for American children as they already do in Europe and Canada.” Seven of the eight additives in question are approved in Canada, however. But, in one of Kennedy's favorite examples, Froot Loops uses natural color in Canada but synthetic dyes in the U.S.

Some studies have linked synthetic dyes to ADHD in children, though that could also be related to the high sugar content of products that use them.

“We have a new epidemic of childhood diabetes, obesity, depression, and ADHD,” said Makary. “Given the growing concerns of doctors and parents about the potential role of petroleum-based food dyes, we should not be taking risks and do everything possible to safeguard the health of our children.”

The Defense Department said it wants to use OpenAI to explore “frontier AI capabilities to address critical national security challenges”

OpenAI just got its marching orders: On Monday, the U.S. Department of Defense awarded the company a one-year, $200 million contract to help prototype how “frontier AI capabilities” could be used for anything and everything from military healthcare to cyber defense systems.

The deal — the company’s first formal Pentagon contract — will be managed through a newly launched unit called “OpenAI for Government.” The Defense Department said the goal is to explore “frontier AI capabilities to address critical national security challenges” for both “warfighting and enterprise domains,” though details remain thin on what exactly that means.

What is clear: OpenAI is deepening its ties with the U.S. national security establishment — and formalizing work that’s already been underway. The company has been building a government portfolio that includes partnerships with NASA, the NIH, and the Treasury Department, as well as creating a product called ChatGPT Gov for federal employees.

Monday’s announcement seems to consolidate those efforts under a single banner, as OpenAI positions itself as the AI vendor of choice in Washington. The recently announced contract will be carried out by OpenAI Public Sector LLC and based largely in the Washington area.

This isn’t OpenAI’s first move toward the defense-industrial complex. In recent months, the company has partnered with defense startup Anduril to build AI-powered anti-drone systems, brought on a former Pentagon official to lead its national security policy team, and added ex-NSA head Paul Nakasone to its board. Nakasone recently interviewed OpenAI CEO Sam Altman at Vanderbilt, where Altman said the company was “proud to… engage in national security areas.”

The Department of Defense said the contract will focus on identifying and prototyping areas where advanced AI could improve military and internal operations — such as streamlining acquisition workflows, improving healthcare access for service members, or shoring up cybersecurity infrastructure.

According to OpenAI, all government use must comply with its internal usage guidelines — though where those guardrails begin and end in a defense context isn’t entirely clear. And the deal comes amid growing scrutiny over how AI companies are threading the needle between commercial opportunity, ethical risk, and government demand.

OpenAI isn’t the only AI firm deepening its government ties. Rival company Anthropic is working with Palantir and Amazon to offer foundation models to intelligence and defense agencies. Anduril, OpenAI’s defense partner, landed a $100 million contract with the Defense Department late last year.

Altman, long considered a foil to Tesla CEO Elon Musk, has played nice with President Donald Trump and taken a notably more pragmatic approach to politics in recent months, working to build inroads in Washington. In January, Altman appeared alongside Trump at the White House to promote Stargate, a proposed $500 billion AI infrastructure initiative to build supercomputing capacity domestically, and the OpenAI CEO joined the president in Riyadh, Saudi Arabia, for an announcement of multibillion-dollar tech deals.

For OpenAI, the deal won’t meaningfully move the top line — the company is reportedly generating more than $10 billion in annualized revenue and recently raised a $300 billion valuation — but it does cement a more formal role in Washington’s AI strategy.

The decision to make Prime Day 96 hours instead of 48 comes as the Commerce Department reported a 0.9% decline in May retail sales.

Amazon is doubling the length of Prime Day to give consumers more time to spend, as government data shows people are scaling back their purchases.

The retail giant announced Tuesday that this year's Prime Day will last from July 8 until July 11, making it 96 hours instead of the usual 48 hours.

Amazon is also introducing “Today’s Big Deals,” which will be themed daily price drops happening each day of the four-day sale.

Shoppers need to have Amazon Prime to access the deals. It costs $14.99 a month, or $139 a year, and gives you access to expedited shipping, among other benefits.

The announcement comes as the Commerce Department reported Tuesday that retail sales fell 0.9% in May, more than the 0.6% decline estimated. It’s a large drop-off from the 0.1% decrease in retail sales the country saw in April.

The decline came as tariff-wary consumers appear to be cutting back — or are now purchasing less after stocking up before the levies took effect.

“Americans bought cars in March ahead of tariffs and stayed away from car dealerships in May. Families are wary of higher prices and are being a lot more selective with where they spend their money,” Heather Long, chief economist at Navy Federal Credit Union, told CNBC. “People are hunting for deals and aren’t eager to buy unless they see a good one.”

Amazon's extension of Prime Day could be seen as an attempt to buck the decline in retail sales. Last summer's Prime Day set records for the company and was its biggest Prime Day ever. It brought in billions of revenue a day, according to some estimates.

While the promotion is a boon for the company's bottom line, Amazon workers have said Prime Day creates difficult working conditions inside its warehouses. A report commissioned by Senator Bernie Sanders' office found last year that Prime Day is a "major source of injuries" for workers.

“Despite making $36 billion in profits last year and providing its CEO with over $275 million in compensation over the past three years, Amazon continues to treat its workers as disposable and with complete contempt for their safety and well-being," Sen. Sanders said upon releasing the report.

While inflation has cooled in recent months, it remains above the Fed’s 2% target and has remained persistently elevated for years

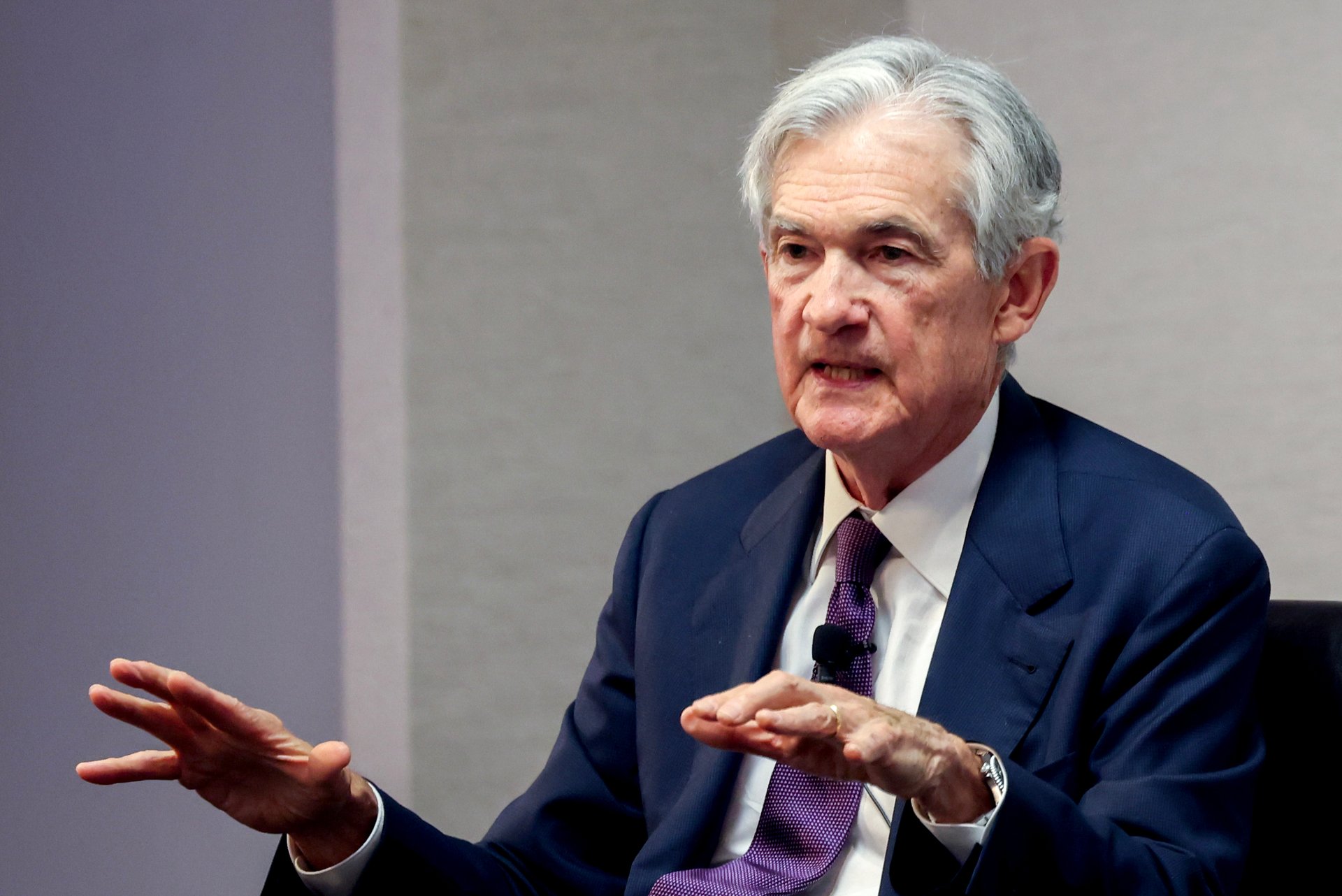

The Federal Reserve on Tuesday began its two-day June meeting in Washington, and no one expects an interest rate cut. In fact, futures traders see the odds of the Fed cutting its benchmark rate as less than 1%.

If the Fed leaves rates uncut as expected, it will be despite mounting political pressure from President Donald Trump, who has openly called Fed Chair Jerome Powell a “FOOL,” among many other epithets.

It comes down to inflation expectations.

While consumer inflation has cooled in recent months, it remains above the Fed’s 2% target and has remained persistently elevated for years. Trump’s second-term tariffs have introduced new uncertainty across the market and the globe, deeply affecting the U.S.’s most important trading relationships. Officials worry that tariff announcements and the chaos surrounding their implementation could drive prices higher, especially as Americans become more accustomed to trade-policy whiplash.

Fed Chair Powell, first appointed by Trump in 2017, has insisted he won’t move preemptively. “We don’t feel like we need to be in a hurry,” he said in May. “We feel like it’s appropriate to be patient.”

That puts the Fed in an increasingly awkward position. Trump wants cuts now to support his economy as tariff pressures build. But Powell is wary of repeating the Fed’s 2021 mistake, when it underestimated how long high inflation would last.

In effect, the Fed is choosing to wait and see, balancing the risk of rising unemployment if it holds rates too high against the risk of reigniting inflation if it cuts them too soon.

While the stock market has recovered from its April “Liberation Day” lows, U.S. GDP contracted slightly in Q1 and may contract again in Q2. Job growth is slow, and consumer sentiment appears to be improving but still shaky. Powell and his colleagues remain focused on credibility, underlining the Fed’s status as an independent, not political, body. Cutting rates too early, they reason, could damage the Fed’s reputation more than any presidential social-media post.

The larger market seemed to agree when, several months ago, Trump floated an attempt to fire Powell and stocks slid hard, with the Dow dropping 1,000 points in a single day. Such market moves suggest that the value of an independent Fed — one that sticks to its public-service mission and can't be forced to do politicians' bidding — runs into the trillions.