Microsoft has a sneak peek of Nvidia's hot new AI chips

Microsoft announced a private preview of Nvidia's Blackwell AI infrastructure on its Azure cloud computing platform

Microsoft announced a private preview of Nvidia's Blackwell AI infrastructure on its Azure cloud computing platform

Another Nvidia (NVDA) customer is ready to launch the chipmaker’s highly-anticipated new artificial intelligence platform.

Microsoft (MSFT) chief executive Satya Nadella announced the first cloud private preview of Nvidia’s Blackwell AI infrastructure on its cloud computing platform, Azure, during the company’s developers’ conference on Tuesday. The Azure ND GB200 V6 VM series is based on the Nvidia Blackwell platform.

“Blackwell is pretty amazing. It’s got this 72 GPUs on a single NVLink domain, and then you combine it with InfiniBand on the backend,” Nadella said during his keynote at Microsoft Ignite. “These racks are optimized for the most cutting-edge training workloads and inference workloads.”

New servers from Microsoft will also be equipped with its new in-house security chip, Azure Integrated HSM, or hardware security module, that uses encryption and signing keys for protection.

Meanwhile, Nvidia’s customers reportedly have been worried about delays for the Blackwell AI platform. The chipmaker repeatedly has asked its suppliers to change the design of its custom-designed server racks in recent months because its Blackwell AI chips are overheating when connected, The Information reported, citing unnamed people familiar with the matter. The server racks combine 72 of the AI chips in hopes that larger AI models can be trained faster with more GPUs, or graphics processing units.

The redesigns are being made later than usual in the production process, The Information reported, but Nvidia could still ship the server racks on schedule, which it set at the end of the first half of next year. Nvidia previously faced production and shipping delays for Blackwell due to a design flaw, Nvidia chief executive Jensen Huang said in October, after media reports surfaced in August.

“It was functional, but the design flaw caused the yield to be low,” Huang said. “It was 100% Nvidia’s fault.”

Microsoft also introduced new purpose-built AI agents in Microsoft 365 Copilot, including an interpreter agent that allows for real-time interpretation in up to nine languages in Microsoft Teams meetings, which will launch in preview early next year. It also rolled out a project manager agent, now in preview, that can automatically create plans and oversee projects.

In addition, the tech giant launched the autonomous AI agent capabilities that it announced in October. Customers can build their own autonomous agents in Copilot Studio that can “understand the nature of your work and act on your behalf,” Microsoft said.

Where you live can have a major impact on your longevity

Living a longer life is a goal on many people's minds, and while supplements and fitness routines often take center stage, one key factor is commonly overlooked: where you live. The typical life expectancy can vary widely from state to state, making your home address more influential than you might think.

Using data from the National Vital Statistics System, Caring.com ranked the states with the highest average annual life expectancies from birth.

Continue reading to see the 10 states where people live the longest.

Stewart Cohen / Getty Images

Yellow Dog Productions / Getty Images

Jon Lovette / Getty Images

Holcy / Getty Images

emholk / Getty Images

Allison Michael Orenstein / Getty Images

Jonathan Novack / Getty Images

Kate Stoupas

Image Source / Getty Images

Fly View Productions / Getty Images

Investors are betting big on CEO Lisa Su’s recent AI announcements — namely AMD's Helios platform and partnerships with top companies such as OpenAI

Advanced Micro Devices (AMD) surged nearly 10% by midday Monday, adding more than $20 billion to its market cap and marking one of its biggest single-day jumps in over a year — thanks to well-timed AI hype. Days earlier, AMD gave Wall Street a detailed product roadmap, some actual hardware, and a few well-placed clues about who’s buying its tech.

At its “Advancing AI” event in San Jose, California, AMD made it clear that it’s going after Nvidia. CEO Lisa Su rolled out the company’s next-gen Instinct MI350 accelerator chips and teased its coming “Helios” AI rack — an in-house server platform built to showcase AMD’s MI400 GPUs, which are due out in 2026. Su said Helios “will set a new benchmark for AI scalability.”

AMD is also pivoting away from Nvidia’s closed-link architecture. Su said on Thursday, “The future of AI is not going to be built by any one company or in a closed ecosystem. It's going to be shaped by open collaboration across the industry.”

The news out of California told Wall Street two things: AMD is closing its gap with Nvidia, and the company’s customers are real.

One of those customers is OpenAI, which AMD confirmed is planning to use its next-gen chips and Helios platform. CEO Sam Altman spoke on stage with Su, remarking that initial specs for the MI400 were so ambitious he thought, “No way.” And major names such as Meta, Oracle, and xAI are already testing or deploying MI300X successors and supporting AMD’s modular approach. AI cloud provider Crusoe told Reuters that it’s planning to buy $400 million of AMD’s new chips.

While Nvidia still dominates the AI training market, the recent news signals that AMD is carving out a credible second-place lane in the AI arms race — and that partners aren’t waiting to place orders.

Wall Street liked what it saw.

Piper Sandler upgraded AMD to “Overweight” status and boosted its price target to $140 (from $125). Analyst Harsh Kumar said in a note that AMD is expected to see “a snapback” in the fourth quarter as it works through most of its China-related charges and sees some of its product announcements as key to scale the company’s AI infrastructure.

“Overall, we are enthused with the product launches at the AMD event this week, specifically the Helios rack, which we think is pivotal for AMD instinct growth,” he wrote. “We also note that the largest of the business units, namely client, is starting to see some pull-ins.”

AMD is signaling it wants to be the “other” full-stack AI company. It has quietly acquired a string of startups — Eno, Brium, Untether AI — to build a more vertically integrated AI portfolio. AMD’s moves come at a critical time for the company, which has watched rival Nvidia’s stock rocket over 150% in the past year. While AMD’s stock performance has lagged, its fundamentals have been quietly improving — especially in data center sales — and its ability to show tangible AI progress just gave investors a fresh reason to believe.

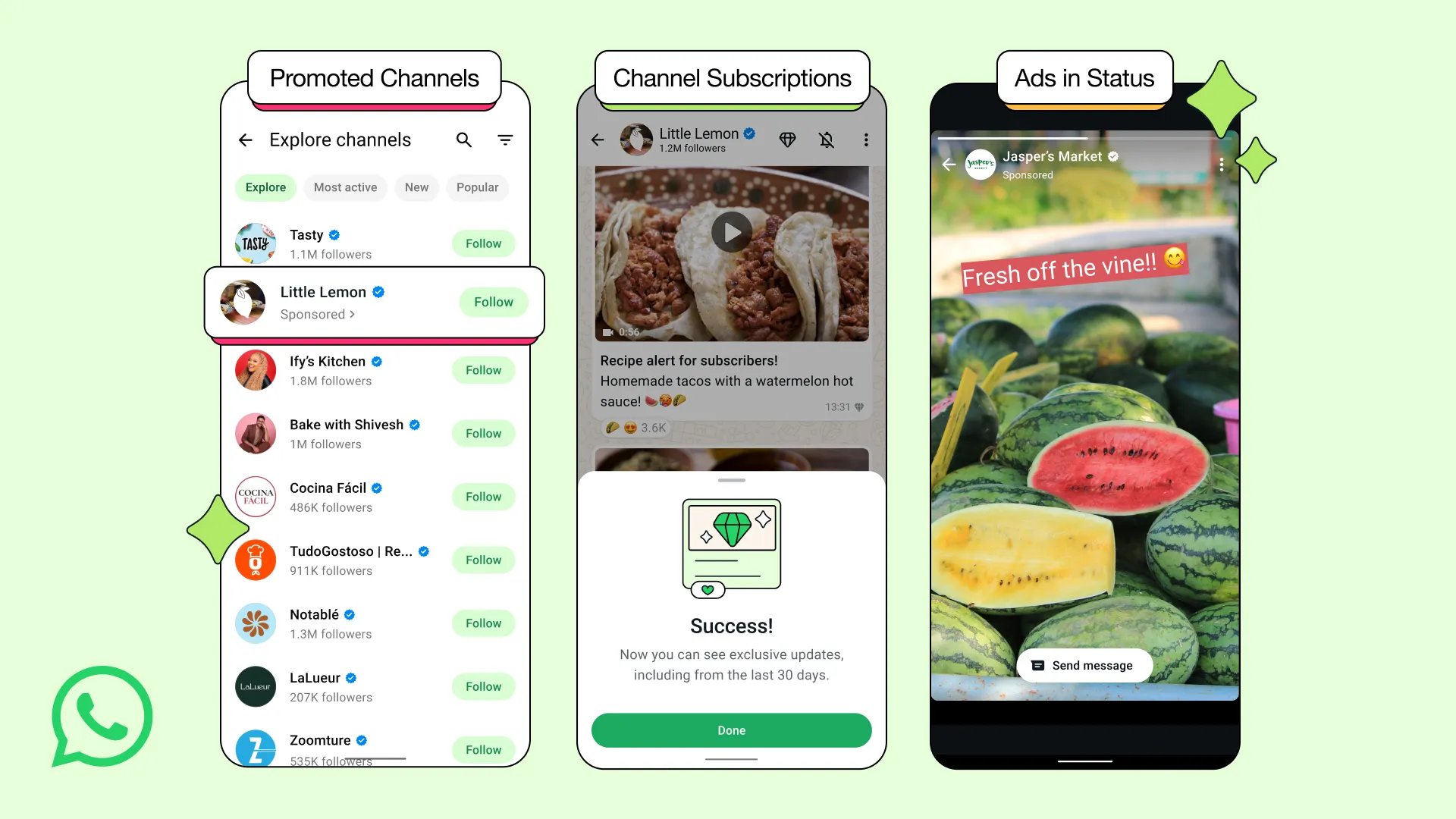

WhatsApp ads will only appear on the Updates page, Meta said, and don't jeopardize your messages privacy

Ads are finally coming to WhatsApp.

Meta said Monday that it will introduce ads to WhatsApp's Updates tab, “away from your personal chats.”

"This means if you only use WhatsApp to chat with friends and loved ones, there will be no change to your experience at all,” Meta said.

The news comes more than 10 years after Meta purchased WhatsApp for $19 billion in 2014 without a clear plan on how to make money from the service. WhatsApp is now used by two billion people.

Meta, which also owns Facebook and Instagram, said it is putting advertising on the platform in "the most privacy-oriented way possible.”

Personal messages, calls, and statuses will still be end-to-end encrypted, and the company said it will use limited personal data, like a person’s country, city of origin, and language, to target ads to individuals.

If a user's WhatsApp is linked to other Meta accounts, the company will use preferences from those platforms to inform WhatsApp marketing.

"We will never sell or share your phone number to advertisers,” Meta said. "Your personal messages, calls and groups you are in will not be used to determine the ads you may see."

The social media company was embroiled in a privacy scandal for years after it was revealed tens of millions of users had their data improperly shared with the former political consulting firm Cambridge Analytica in the U.K.

Ads in WhatsApp might prove needed to Meta's bottom line, as it invests billions on artificial intelligence.

The company said it doesn't plan to introduce ads within messages or chats.

The company is rolling out AI-powered ad tools designed to turn on-platform conversations into scalable marketing insights — with CVS on board.

Reddit is hoping to convince marketers that all the noise on its platform is, in fact, a signal. At the Cannes Lions ad festival this week, the company unveiled two tools under a “Reddit Community Intelligence” umbrella — part of an AI-powered push to mine its user-generated content for brand insights and marketing performance.

The announcement comes at a pivotal moment for Reddit, which is still trying to prove that it can be a serious contender in the ad business following its IPO earlier this year. The company’s stock was up 3.6% around midday Monday.

The first tool, Reddit Insights, is a scalable social-listening product that lets marketers analyze Reddit’s posts and comments for trends, sentiment, and cues. The second tool, Conversation Summary Add-ons, embeds positive user-generated posts into ad units. Reddit claims early tests (through companies such as Lucid and Jackbox Games) showed a 19% higher click-through rate than standard image ads.

This isn’t Reddit’s first foray into advertising, but it marks one of its most aggressive attempts yet to move from “hard to monetize” to “ad tech player.” While social platforms such as Facebook and TikTok rely on massive ad budgets and tightly controlled algorithms, Reddit is betting that the real-time, unfiltered nature of its communities — combined with some AI polish — can deliver a different kind of value: authenticity at scale.

CVS will be one of the first big partners to test that thesis.

Through a just-announced data-sharing deal, the retailer will combine insights from its 90 million-person loyalty program with Reddit’s 108 million daily users. Advertisers will be able to target CVS shoppers based on Reddit activity — and track whether those shoppers go on to make purchases online or in-store. The partnership reflects a broader push by retailers to stretch their media networks beyond their platforms, while giving Reddit a chance to tap into top marketing dollars typically reserved for companies such as Amazon and Walmart.

This push is also part of Reddit’s broader AI strategy.

The company recently launched Reddit Answers, a generative-AI product that summarizes community responses to user questions. Unlike its competitors’ AI products, Reddit’s attempt links back to original posts in an attempt at maintaining transparency and driving engagement within its ecosystem. Reddit is also forging secure data-licensing deals with Google and OpenAI (and notably not with Anthropic, which Reddit is suing for alleged unlicensed AI training).

Now that the ad stack is solid, and generative-AI staples such as headline generators and ad-review bots are live, the company is fast-tracking “community marketing” as its next big lever, Reddit COO Jen Wong told Axios.

“Reddit responds so quickly to new products and what’s happening in the world,” she said. “That’s why it’s so credible and valuable to businesses trying to make decisions in everything — how to market, how to find their customers, how they’re doing in customer service.”

Since its March 2024 IPO, Reddit’s stock has been on a rollercoaster — tripling at one point, then offloading about 30% in early 2025 amid concerns over how Google’s AI Overviews could overshadow Reddit’s traffic. The company reported $358.6 million in ad revenue in the fiscal first quarter, up 61% year-over-year, and while the platform faces pressure from macro factors (trade policy shifts, WPP’s trimming of global ad growth forecasts, and Google search volatility) its bet is straightforward: There’s lots of money in the global ad game.

And there’s broader industry momentum behind the push. Platforms such as Snap and Pinterest have already doubled down on AI-driven ad tools. A big part of the bull case for Reddit rests on its ability to translate high-intent conversations — particularly around categories such as health, tech, and finance — into advertiser value without alienating its opinionated user base.

Whether brands will embrace ads built from Reddit threads remains to be seen. But the company is making a clear pitch: In an era of algorithms, Reddit offers messy, human nuance — and now, a way to package that all up for marketers.

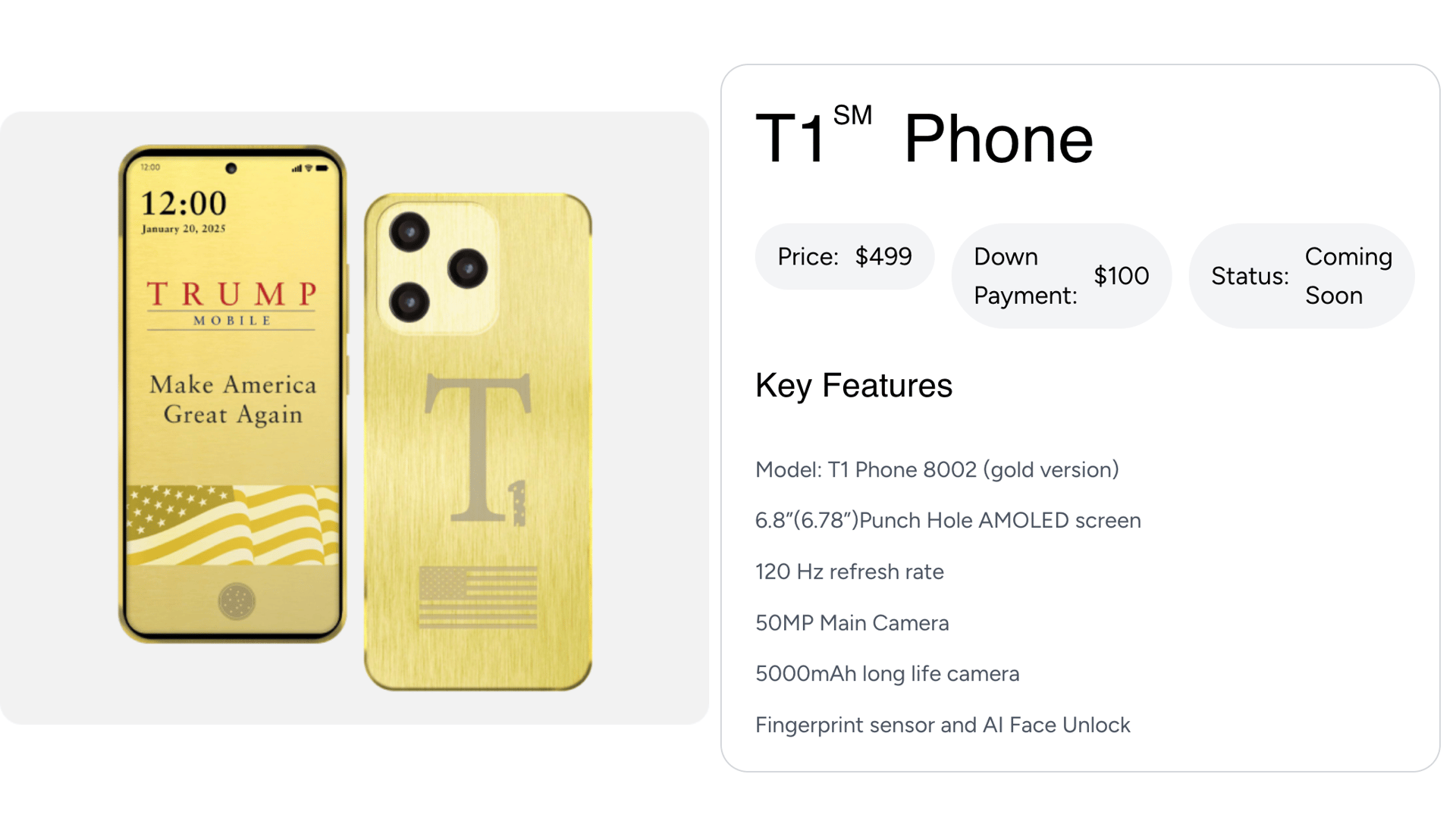

Trump Mobile will offer a wireless plan and a gold, Trump-branded Android smartphone under a licensing deal.

The Trump Organization announced Tuesday that it plans to launch a wireless phone service and a $499 gold smartphone in September.

The company, which is run by President Donald Trump's sons — Eric Trump and Donald Trump Jr. — called the upcoming mobile plan a “bold new wireless service for Americans."

Trump Mobile will offer a contract called "The 47 Plan," which provides unlimited talk, text, and data for $47.45 a month, among other features. The Trump Organization also said it will release the T1 Phone in August, a gold smartphone that resembles an iPhone in appearance and runs Android 15 — a version of Google's operating system that debuted in 2024.

The products are essentially licensing deals. In its press release for the announcement, Trump Mobile said its offerings were “not designed, developed, manufactured, distributed or sold by The Trump Organization or any of their respective affiliates or principals.”

It added that Trump Mobile uses the Trump "name and trademark pursuant to the terms of a limited license agreement," which can be terminated.

Trump Mobile is a mobile virtual network operator (MVNO), which means its service is powered by preexisting wireless infrastructure. In this case, the Trump family venture indicated it's buying capacity from all three major carriers — Verizon, AT&T, and T-Mobile. Competitive MVNO unlimited plans, such as those from Boost Mobile and Spectrum, can go for $30 per month or less.

Donald Trump Jr., the executive vice president of the Trump Organization, said Trump Mobile is part of a push to “put America first.”

“Our company is based right here in the United States because we know it’s what our customers want and deserve,” he added.

The mobile service is the most recent attempt by the president’s children to profit off the Trump name while he is in office; it follows crypto ventures, Trump gold clubs, and other licensing deals, many of which have increased greatly in value since the president’s reelection.

Many of the deals have sparked outrage from Democrats in Congress, who have said that the Trump Organization's business dealings happening alongside the president's time in office amount to corruption.

Democratic Sen. Richard Blumenthal of Connecticut, who is leading an investigation into Trump’s crypto ties, said recently that “Donald Trump is selling cryptocurrency like snake oil in the Wild West, and he’s put a for sale sign on the White House for his meme coin.”

—Shannon Carroll contributed to this article.

Both companies promise greater rewards with revamps of Sapphire Reserve and Platinum cards

JPMorgan Chase and American Express will launch new high-end credit cards later this year, giving consumers the luxury of choice.

The Sapphire Reserve card from JPMorgan Chase debuted in 2016 and quickly became popular for its dining and travel rewards program, especially among millennials. It was a bit too popular, actually: costing the bank $200 million in the final quarter of that year and straining relations with airlines. In response, the bank cut back on some of the perks.

American Express, who pioneered the field by introducing its gold card almost 60 years ago, also announced on Monday that they were instituting major changes to their consumer and business platinum cards, claiming it will be “its largest investment ever in a card refresh,” and telling CNBC that it will offer “a whole bunch of new and exciting benefits and value that will far, far, far exceed the annual fee.”

Sapphire Reserve currently costs $550 a year plus $75 per user associated with the card. American Express Platinum costs $800 a year plus $250 for additional cards. Both cards are expected to raise their fees when new benefits are rolled out this fall.

Credit-card rewards programs have been immensely popular with younger consumers over the last decade. However, those same consumers are now facing a new credit crunch: the federal government is now cracking down on missed student-loan payments after a five-year pause.

The timing is especially challenging for younger borrowers. Unemployment among college graduates ages 20 to 24 has risen to 6.6%, the highest level in a decade outside of the pandemic. New graduates face stiff competitions for jobs, with many entry-level jobs now requiring years of experience. Even retail and restaurant jobs can be hard to come by.

Combined with proposed cuts to federal student aid in President Donald Trump’s broader budget plan, the resumption of collections signals a new era of aggressive enforcement — and growing financial strain for borrowers across the country.

Marketing a high-end credit card to that crowd might be a tough sell.

—Catherine Baab contributed to this article.

Honeywell technology aims to decrease runway incidents and monitor altitude and speed during takeoffs and landings

A cockpit-alert system has been added to nearly 800 Southwest Airlines planes, delivering verbal warning to pilots as they navigate runways, reports the Wall Street Journal.

Among other airline safety concerns in recent years, there have been a series of runway incidents lately affecting many airlines all over the world. Last August, a Southwest plane took off from the wrong runway, which was under construction. That same month, the FAA recommended that new planes come with a cockpit-alert system installed. Southwest decided to retrofit its Boeing 737 fleet, as well.

Designed by Honeywell, the cockpit alerts are similar to those found in modern cars, warning drivers about nearby obstacles or blind spots. Alaska Airlines and other carriers have also added Honeywell’s Runway Awareness and Advisory System, which will also monitor altitude and speed during runway approach.

The Honeywell website says runway incursions are "a leading cause of aviation accidents and fatalities, accounting for approximately $1 billion annually in damages.”

In 2018, the National Transportation Safety Board recommended their use after an incident at the San Francisco International Airport, when an Air Canada flight attempted to land on a taxiway where four planes filled with passengers awaited departure.

“It gets your attention,” Capt. Jody Reven, president of the Southwest Airlines Pilots Association, told the Wall Street Journal. “It’s not so important in Midland, Texas, but when you’re in Philly or L.A., it’s a great added tool.”

Last week at the Paris Air Show, Honeywell announced a new Surface Runway Traffic Awareness System, or SURF-A, which they hope will be certified in 2026. Honeywell Aerospace president and CEO Jim Currier told reporters the new tech is “poised to dramatically reduce potential runway accidents, essentially a third set of eyes in the cockpit that gives pilots both aural and visual alerts if there is unexpected traffic on the runway.”

Canada will get generic versions of the weight loss drug starting next year, all because the Danish pharmaceutical giant didn't pay a patent maintenance fee

Novo Nordisk is set to lose billions in profit in the coming years, all because it didn’t pay a bill for a few hundred dollars.

According to Science columnist Derek Lowe, the Ozempic and Wegovy maker made a costly mistake in Canada, where generic versions of its drugs are set to hit the market next year.

According to Lowe, Novo Nordisk did file a patent for semaglutide, the main component of their weight-loss and diabetes medicine, but failed to pay the annual maintenance fee on the patent.

Lowe unearthed a letter where the Danish company’s lawyers even asked for a refund in 2017 for its $250 maintenance fee because the company, now worth more than $350 billion, wasn’t sure if it wanted to pay it.

In 2019, the Canadian patent office sent Novo Nordisk a letter saying it hadn’t received their fee, and that it was now $450. Lowe discovered that ultimately the company never paid the maintenance fee, even within the one-year grace period, paving the way for the patent to lapse. Canadians' ability to get generic versions of the drugs starting in 2026 could cost the company a few billion dollars in profits, according to some projections.

The Canadian kerfuffle comes amid tough times for Novo Nordisk, which, until quite recently, had been virtually synonymous with a booming weight loss drug market that could hit $139 billion by 2030.

The company has struggled to meet surging demand, ceding ground to both its Big Pharma rival Eli Lilly, and to smaller firms making compounded versions of weight loss drugs. Its pipeline of next-generation weight loss drugs has underwhelmed. And after the stock fell 50% in a year, Novo Nordisk CEO Lars Fruergaard Jørgensen resigned earlier this month.

—Harri Weber contributed to this article.

As the U.S. cracks down on China's AI and semiconductor dreams, it's getting help from the world's top chipmaking hub

Taiwan has blacklisted Huawei and SMIC — two of China’s most important tech companies — in a move that will likely escalate the global chip war and signals that the island is tightening its alignment with U.S. trade policy.

Taiwan’s International Trade Administration added the Chinese tech giants to its “Strategic High-Tech Commodities Entity List” over the weekend. Now, Taiwanese companies will need a government-issued license before sending any goods — from advanced chips to manufacturing materials — to Huawei, SMIC, or their global subsidiaries.

It’s not the first time either company has landed on a blacklist — both have been barred from U.S. tech exports for years (they’re on the U.S. Commerce Department’s Entity List). But the move is a significant one, perhaps designed to course correct after recent missteps.

Last fall, U.S. regulators were surprised when teardown specialists found a Huawei AI chip that had silicon from Taiwan Semiconductor Manufacturing Company (TSMC) — Taiwan’s crown jewel and the world’s top chipmaker (and a huge supplier to U.S. darling Nvidia). The revelation triggered a scramble: TSMC suspended shipments to certain Chinese clients, and the Commerce Department stepped in to block further exports. Now, TSMC could face a $1 billion fine tied to the incident.

Still, some believe Huawei might have acquired several million of the important silicon pieces before its restriction-skirting was discovered.

While TSMC’s direct business with Huawei and SMIC has already been mostly cut off under U.S. export rules since 2020, their additions to Taiwan’s government list will help formalize and enforce the policy more robustly. The blacklist also serves as a warning to Chinese companies accused of technology theft and talent poaching, which have long been sore spots for Taiwanese officials. And crucially, this embargo on critical plant technology, advanced packaging, and chip‑making supplies represents another major barrier to China’s AI and semiconductor dreams — to which Huawei and SMIC are key.

Huawei has been racing to build viable alternatives to Nvidia’s powerful GPUs, while SMIC has poured billions into manufacturing capacity to support China’s domestic chip ecosystem. The two companies surprised U.S. politicians last year when Huawei released a 7-nanometer AI processor powered by SMIC technology, triggering fresh scrutiny in Washington. Still, progress for the two has been slow, and Huawei's chips still lag behind Nvidia’s — largely as a result of export controls on Chinese tech and a lack of scale and capability in China’s chip ecosystem.

Nvidia, meanwhile, has become a central figure in the U.S.-China chip standoff, caught between skyrocketing global demand for its AI processors and intensifying export controls aimed squarely at Beijing.

In the past year, Washington has repeatedly tightened restrictions on Nvidia’s China-bound chips — first banning sales of its top-tier GPUs, then pulling back even on watered-down versions. (CEO Jensen Huang said the chip ban cost the company $15 billion.) While Nvidia has tried to engineer around the rules with export-compliant alternatives, the U.S. keeps narrowing the loopholes, and now even those lighter chips are off the table. As a result, China’s tech giants are scrambling for substitutes, and Nvidia is losing access to one of the world’s largest AI markets — at least for now — although the company keeps chugging along.

Huawei and SMIC’s addition to the entity list carries symbolic weight — a reminder that Taiwan’s position in the global semiconductor race isn’t just economic, it’s geopolitical.

Taiwan’s move doesn’t come in a vacuum. It lands as the U.S. expands bans on Nvidia’s China-facing AI chips and just weeks after Beijing staged another round of military drills off Taiwan’s coast. China’s top political adviser recently reaffirmed calls for reunification. Taiwan’s president, meanwhile, labeled China a “foreign hostile force” for the first time.

Against that backdrop, for Beijing, the export controls are yet another hurdle in a semiconductor arms race already littered with restrictions, tariffs, and blacklists. For Huawei and SMIC, they’re a sign that even the back doors are being locked. And for Taiwan, it’s a sign that the country is taking sides — and might be going all-in with its chips.