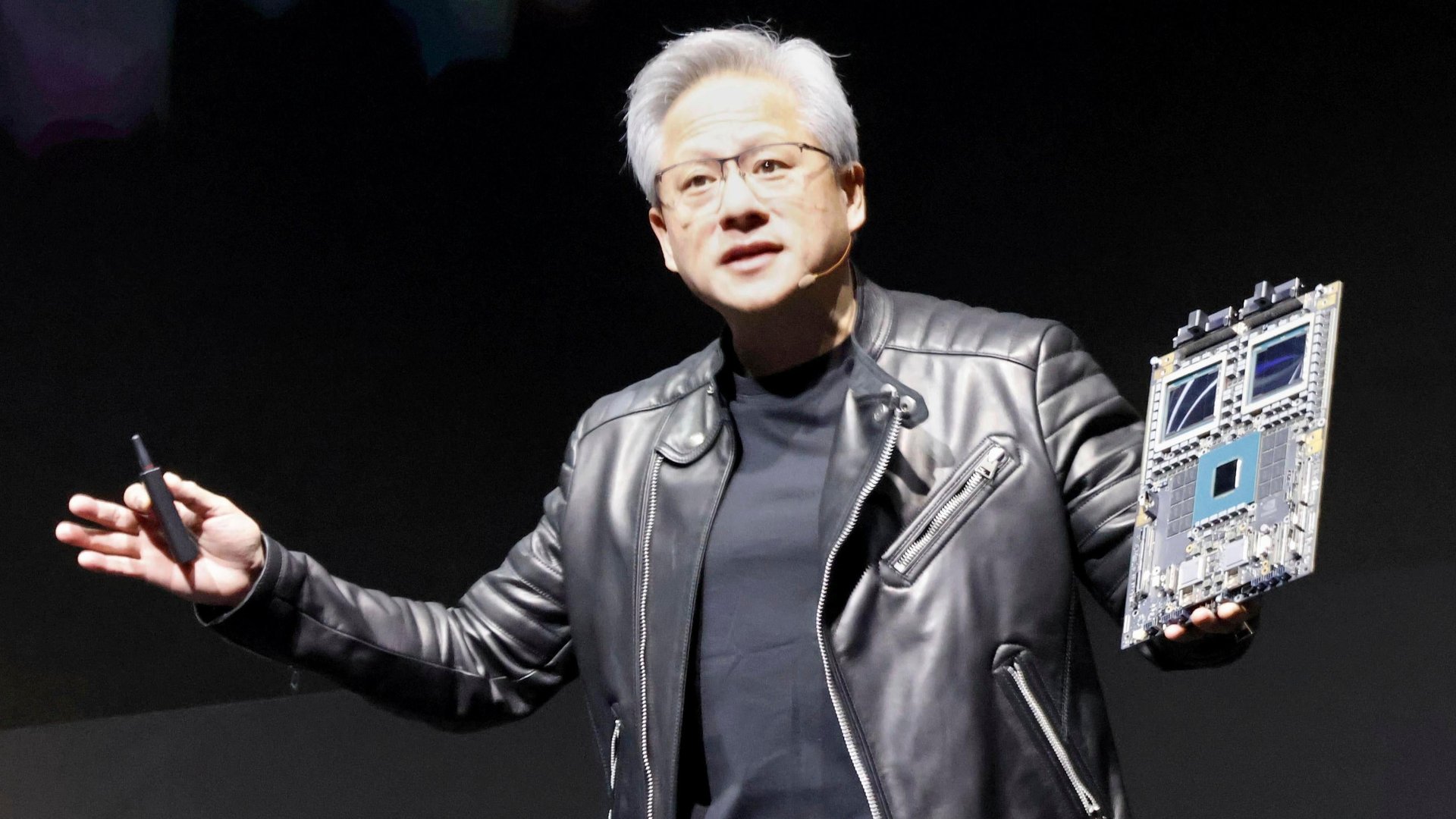

Nvidia is in for bigger earnings beats as Blackwell rolls out, analysts say

The chipmaker said its Blackwell AI platform is in full production and shipping to customers

The chipmaker said its Blackwell AI platform is in full production and shipping to customers

Despite Nvidia’s (NVDA) modest guidance for its fiscal fourth quarter, analysts are anticipating larger earnings beats on strong demand for its new artificial intelligence platform.

The chipmaker set its fiscal fourth quarter guidance at $37.5 billion, plus or minus 2% — slightly above expectations of $37.09 billion, according to analysts’ estimates compiled by FactSet (FDS). Nvidia’s expectations for the fiscal fourth quarter were “likely hampered by ongoing Blackwell shipment constraints,” Kunjan Sobhani, senior industry analyst at Bloomberg Intelligence, said in a note. Nvidia chief executive Colette Kress said both Blackwell and its predecessor, Hopper, are facing certain supply constraints, and that Blackwell demand is expected to exceed supply into fiscal year 2026. The modest guidance sent Nvidia’s shares slightly down in after-hours trading on Wednesday into Thursday morning.

“Unfortunately, market participants have become too short-term oriented,” Eric Clark, portfolio manager at the Rational Dynamic Brands Fund, said in a statement shared with Quartz. “Absolute good reports seem less interesting than relatively less good but still good. There is nothing wrong with NVDA, I suggest investors use any weakness to buy the stock because demand will be satisfied at some point and these slight misses will turn into big beats yet again.”

On the company’s earnings call, Nvidia chief executive Jensen Huang said production of its Blackwell AI platform “is in full steam” after a design flaw was fixed, and that the company expects to deliver more Blackwells in this quarter than previously estimated. In the fiscal third quarter, Nvidia said it shipped thirteen thousand Blackwell chips to customers.

“The supply chain team is doing an incredible job working with our supply partners to increase Blackwell, and we’re going to continue to work hard to increase Blackwell through next year,” Huang said.

Nvidia is likely “sold out” of Blackwell until the end of next year, and “has much better visibility in its forecasts than it is letting on,” Richard Windsor, founder of research firm Radio Free Mobile, said in a note.

“This allows it to offer guidance that it knows it can beat by a small margin, which will help the share price hold onto the massive rally it has enjoyed over the last 18 months,” Windsor said.

Nvidia’s shares are up over 198% so far this year.

Concerns with Blackwell’s commercial deliveries have not reflected in Nvidia’s earnings reports yet, likely because issues mostly center on data center infrastructure around the chips, and because customers don’t want “to lose their place in the queue” and are therefore buying Blackwell and fixing issues after, Windsor said.

Huang addressed a report that Blackwell chips are overheating in custom-designed server racks, saying “as you see from all the systems that are being stood up, Blackwell is in great shape.” He also said Nvidia plans “to execute on our annual road map” of producing new chips.

Jefferies (JEF) analysts said in a note that they “are not overly concerned with any of the issues on this call” and that they “see increasing beats as Blackwell ramps.”

But strong demand for Blackwell and Nvidia’s ability to deliver to customers despite production issues might not sustain growth in the long-term.

“Despite demand in the near-term continuing to be strong, we still believe a decline in demand for NVIDIA compute is inevitable as customers begin to scrutinize their ROI on AI compute,” analysts at D.A. Davidson said in a note.

Tesla stock jumped more than 7% after a smooth robotaxi rollout, as Wall Street weighs in on the most expensive beta test in tech

After years of ambitious promises and moving goalposts, Tesla finally turned the key on its decade-in-the-making robotaxi service this weekend, and Elon Musk’s autonomous dream got real — sort of. There’s no Cybercab. No nationwide launch. And certainly no fully autonomous fleet humming through city streets, unbothered by traffic or regulation.

But Wall Street didn’t seem to care. Tesla shares jumped more than 7% in early Monday trading — a welcome boost for the automaker, even as the stock remains down 8.8% year to date.

Behind the bump was a quietly executed, relatively successful soft launch of Tesla’s long-awaited ride-hailing service in Austin, Texas. A fleet of 10 to 20 camera-only Model Ys began operating over the weekend within a tightly geofenced 10-square-mile zone. The service charges a flat $4.20 per trip (yes, really), available exclusively to a handpicked group of influencers and Tesla diehards. Each ride comes with a Tesla safety monitor riding shotgun, a remote operator on standby, and a gentle reminder: Truly driverless Teslas are still a vision in progress.

The rollout wasn’t the robo-revolution Musk once teased, but it wasn’t nothing, either. The debut was as uneventful as Tesla probably hoped: no crashes, no viral disengagements, no dramatic footage — just a handful of smooth, influencer-captured rides that looked indistinguishable from an Uber.

“Super congratulations to the Tesla AI software and chip design teams on a successful robotaxi launch!!” Musk posted on X, calling it the “culmination of a decade of hard work.” He emphasized that both the chip and software teams were built entirely in-house — one reason Tesla claims its approach can scale faster and cheaper than lidar-heavy competition such as Waymo and Zoox.

On the surface, Tesla’s launch was a win. But underneath all the noise, Wall Street is still deciding what exactly Tesla just proved — and whether it moves the needle at all.

The initial reactions were positive, if a bit curated. “This is the future,” wrote Wedbush analyst Dan Ives in a note. Others trip-takers described the rides as “smooth,” “great,” and “normal.” Bearded Tesla Guy described the app’s interface as “basically Uber” — although the service has been upgraded: Inside the robotaxis, passengers are greeted with personalized entertainment options built into Tesla’s app, including Spotify, Netflix, and Disney+.

But if the execution felt more like a proof-of-concept than a revolution, Wall Street wasn’t particularly rattled. “From our conversations with investors, feedback has been mostly neutral,” RBC Capital Markets analyst Tom Narayan said in a post-launch report, noting that expectations were already set for a geofenced Model Y rollout.

UBS analyst Joseph Spak bumped his price target to $215 from $190 but kept a “Sell” rating, writing, “The robotaxi opportunity… is already priced into shares.” Like many analysts, Spak sees the pilot as more of a long-tail thesis than a short-term catalyst.

Guggenheim analyst Ronald Jewsikow described Sunday’s launch as “a relatively uneventful Sunday in Austin, and uneventful is a good outcome.” In a Monday note, he wrote: “Based on our analysis of publicly available videos from the influencer community, the day was filled with almost entirely clean driving performance.” He kept his “Sell” rating and $175 price target, citing valuation.

Meanwhile, Tesla bull Ives, who attended the launch and took multiple rides, struck a predictably glowing tone. “Going into it, we expected to be impressed but walking away from it, all there is to say is that this is the future,” he wrote, calling it the beginning of Tesla’s “golden age” and reaffirming his “Outperform” rating and $500 price target. He added that the ride experience was “comfortable, safe, and personalized,” and praised Tesla’s vision-based system for handling narrow roads, traffic cones, and unpredictable human behavior.

Tesla’s current service operates within a mapped zone that excludes highways and airports, and the rides are available from 6 a.m. to midnight (weather permitting) and require safety monitors to verify rider identity and provide in-vehicle oversight. The company hasn’t said when — or whether — the service will be opened to the general public.

One major question hanging over Tesla’s plans: regulation. While Texas currently allows autonomous vehicle services without special permits, a law passed on June 22 — the same day as Tesla’s launch — will soon require companies to obtain approval from the Texas Department of Motor Vehicles before operating autonomous vehicles without a human driver. That rule takes effect on September 1 and could complicate any attempt by Tesla to scale its robotaxis.

For bulls, Tesla’s robotaxi strategy remains one of the company’s most important long-term bets. RBC Capital Markets has estimated that robotaxis could represent 60% of the company’s total valuation model — though it hasn’t assumed Tesla dominance in any particular regional market.

The bet is that Tesla’s vision-only, neural net-driven system will ultimately prove cheaper, more scalable, and more adaptable than any of the lidar- and radar-heavy approaches currently on the road. If Tesla’s approach works, the company could potentially activate autonomy features in its existing fleet via software updates, creating an on-demand robotaxi network without building new hardware from scratch.

Still, some analysts remain cautious.

Baird, a typically Tesla-friendly firm, warned that Musk’s timelines on scaling may be “a bit too optimistic.” And while Wedbush sees the robotaxi pivot as the start of a massive market shift, others are concerned about how quickly Tesla can navigate technical, regulatory, and reputational hurdles; the company’s stock is vulnerable to any sign that autonomy is slipping further down the road. Fairlead Strategies’ Katie Stockton told Barron’s that Tesla has strong support around $300 but upside resistance near $370-$380 — and the market could treat the robotaxi rollout as a “sell-the-news” moment if momentum stalls.

For now, the robotaxi rides in Austin appear to have gone off without major incident. Influencer videos posted over the weekend showed mostly uneventful trips: smooth braking, solid turns, no obvious errors. Riders were greeted by screens synced with their Tesla accounts and personalized entertainment options. Some noted long wait times for support, and others had difficulty locating their vehicles in real time — calling the experience “like Pokémon hunting.”

Behind the scenes, Tesla employees and engineers celebrated the launch with what appeared to be a live operations center monitoring camera feeds from dozens of vehicles. Ashok Elluswamy, head of Tesla’s Autopilot software, posted a photo of the team gathered in front of a bank of monitors on Sunday evening.

But even Musk has acknowledged the road ahead will be gradual. California, another key market, is expected to present a tougher regulatory path. And rivals aren’t waiting. Waymo currently operates more than 1,500 fully driverless vehicles across multiple U.S. cities, including Austin — with plans to expand to Washington D.C., Miami, and Atlanta in the coming year.

While Tesla didn’t launch a fully driverless future, it did put a version of it on the road. Whether this pilot is the beginning of a $2 trillion run or just another step in a long, slow climb depends on two things: whether Tesla’s AI-first, camera-only bet can actually work, and whether Wall Street is still willing to wait for it to pay off.

A Trump administration official said the administration will remain in "close coordination" with key oil producers

President Donald Trump on Monday pressured oil companies to keep a lid on prices in the wake of U.S. airstrikes on three Iranian nuclear facilities over the weekend.

"EVERYONE, KEEP OIL PRICES DOWN. I'M WATCHING! YOU'RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY," Trump said in a social media post. "DON'T DO IT!"

He followed up three minutes later with another post on Truth Social. "To The Department of Energy: DRILL, BABY, DRILL!!! And I mean NOW!!!"

A Trump administration official said the administration will remain in "close coordination" with key oil producers, adding that officials haven't detected a supply interruption so far.

"Key oil market factors and the many tools at our disposal alongside the President’s commitment to peace through strength should all be reassuring to the market," the administration official said.

Trump's comments illustrate the public and sometimes aggressive rhetoric he's employed to dictate the behavior of publicly traded firms. The president also lambasted Apple and Walmart for some decisions they took earlier this year to handle the effects of ongoing trade wars on their core operations.

Experts said the president's statement would do very little to sway crude oil prices. "This does nothing as oil prices aren't controlled by any entity, rather the market's assessment of what oil is worth," petroleum analyst Patrick de Haan said on X.

Trump isn't the first to lash out at oil companies: Former President Biden also did the same to prevent what he called "profiteering" at the gas pump.

At one point, Biden threatened to pursue higher taxes on the sizable profits of large oil companies in the weeks leading up to the 2022 midterm elections. "It’s time for these companies to stop war profiteering... give the American people a break and still do very well," Biden said at the time, as gas prices were spiking from Russia's war against Ukraine. Those taxes never materialized.

Oil prices have climbed 10% since the start of the Israeli military campaign against Iran's nuclear program on June 13. The U.S. military struck a trio of Iranian nuclear sites on Saturday, provoking fears of Iranian retaliation that disrupts oil markets particularly if it moves to block access to the Strait of Hormuz. It's one of the most critical global shipping lanes for crude oil. The Iranian government has said it reserves the right to respond to the U.S. attacks.

White House officials projected confidence that oil-producing nations had abundant reserves that would soften the blow of a possible Iranian counterattack. "There's a lot of room to adjust should we need to," White House National Economic Council Director Kevin Hassett told CNBC.

The termination, which means Wegovy will not longer be available on Hims & Hers, sent Hims & Hers stock down sharply

Novo Nordisk said Monday that it was ending its partnership with Hims & Hers, accusing the telehealth company of "deceptive promotion and selling of illegitimate, knockoff versions" of its weight loss drug Wegovy.

The termination, which means Wegovy will not longer be available on Hims & Hers, sent Hims & Hers stock plummeting, with shares down almost 27% in Monday morning trading. Novo Nordisk stock fell about 5%.

Novo Nordisk, the Danish pharmaceutical giant behind the weight loss drugs Ozempic and Wegovy, said Hims & Hers "has failed to adhere to the law which prohibits mass sales of compounded drugs under the false guise of 'personalization' and are disseminating deceptive marketing that put patient safety at risk."

"Novo Nordisk is firm on our position and protecting patients living with obesity," Dave Moore, Novo Nordisk's executive vice president for U.S. operations, said in a statement. "When patients are prescribed semaglutide treatments by their licensed healthcare professional or a telehealth provider, they are entitled to receive authentic, FDA-approved and regulated Wegovy. We will work with telehealth companies to provide direct access to Wegovy that share our commitment to patient safety — and when companies engage in illegal sham compounding that jeopardizes the health of Americans, we will continue to take action."

Hims & Hers didn't immediately comment to CNBC and Reuters.

The telehealth company announced in April that it would begin offering Wegovy on its platform, with a price point starting at $599.

“Bringing our teams together and continuing to explore our shared commitment and focus on delivering the future of healthcare has been inspiring,” Hims & Hers founder and CEO Andrew Dudum said in a statement about the Novo Nordisk partnership at at the time. “We share a vision of what consumer-centered healthcare looks like, and this is just the first step towards delivering that future.”

Novo Nordisk framed deals with Hims & Hers and with other telehealth platforms as a way to expand its customer base as the federal government cracks down on compounded versions of Wegovy. Pharmacies can make customized versions of drugs that are considered by the Food and Drug Administration to be in shortage, but the FDA declared in February that the semaglutide shortage was over. Pharma companies including Novo Nordisk and Eli Lilly have taken legal action against compounding pharmacies since then.

—Kevin Ryan contributed to this article.

Amazon Prime Day is now double the length. Here's what you need to know about the retailer's biggest sales push of the year

Amazon Prime Day is a few weeks away, and the retail giant is already dropping deals.

Here's everything you need to know about Prime Day 2025

Amazon Prime Day runs from July 8 through July 11. This year marks the first time Amazon has made the event 96 hours instead of 48 hours. The company's splashiest sales push of the year originally lasted just one day, hence its name, but Amazon expanded it beyond 24 hours in 2017.

It comes as the Commerce Department reported last week that retail sales fell 0.9% in May, more than the 0.6% decline estimated. It’s a large drop-off from the 0.1% decrease in retail sales the country saw in April. Amazon seems to be hoping a longer event stacked with even more sales than usual can help it buck national trends.

To access Prime Day deals, you need to subscribe to Amazon Prime.

It costs $14.99 a month, or $139 a year, and gives you access to expedited shipping, among other perks.

Students and people ages 18-24 can get Prime for a discounted rate of $7.49 a month.

For this upcoming Prime Day, Amazon is introducing “Today’s Big Deals,” which will be themed daily price drops across the four-day sale.

Yes. Technically, Amazon has already kicked off the event with early deals. If you head to its website, you can access some sales.

While Prime Day is a great chance to get deals, it's not all sunshine and butterflies.

Amazon workers have said Prime Day creates difficult working conditions inside its warehouses. A report commissioned by Senator Bernie Sanders' office found last year that Prime Day is a "major source of injuries" for workers.

Take a second before ordering something that feels too good to be true.

Companies have been known to inflate prices of goods right before Prime Day, then offer major discounts during the event to make consumers think they're getting an incredible deal.

Gizmodo found many examples of companies hiking prices, including one that reportedly raised its prices by 750%, only to offer a 90% discount from the new, raised price.

Check other retailers' prices for the same product before you hit buy, if you think the deal seems too good be to true.

The money-losing, mid-range carrier will maintain its presence in Fort Lauderdale as it recalibrates routes

JetBlue is suspending all service to and from Miami starting Sept. 3. It will maintain a Florida presence in West Palm Beach and Fort Lauderdale. At the latter, it served 6.8 million passengers in 2024, despite cutting back flights there in March 2024, when its protracted attempt to merge with Spirit Airlines was squashed by federal regulators.

Spirit Airlines is the dominant carrier at Fort Lauderdale; JetBlue is No. 2. Spirit declared bankruptcy in November 2024, but emerged from Chapter 11 with financial restructuring in March.

JetBlue announced the Miami news to employees on Friday, in a memo leaked to AirlineGeeks.com. The memo cited the collapse of JetBlue’s partnership with American Airlines as a primary reason.

Currently, JetBlue only has one or two flights a day between Boston and Miami. Customers who have booked a Miami flight after Sept. 3 will be offered a refund or a ticket to Fort Lauderdale or West Palm Beach.

JetBlue had expanded to 14 daily flights to Miami in 2021, betting on pent-up, post-pandemic demand for travel to a state with loose Covid regulations. The airline began scaling back when demand was less than anticipated, with further cutbacks in the wake of the failed Spirit merger.

Beyond Florida, JetBlue plans seasonal cuts to its Caribbean destinations. Also on ice is a new route between New York and New Hampshire, and service to Grenada. Service between Boston and Seattle will not run during the winter.

The mid-range airline still plans to move ahead with offering premium experiences on high-demand flights to attract more business travelers.

On June 24, JetBlue signaled these cuts, saying it didn’t expect to turn a profit in 2025—again, for the sixth year in a row. CEO Joanna Geraghty told staff that “even a recovery won’t fully offset the ground we’ve lost this year and our path back to profitability will take longer than we’d hoped. That means we’re still relying on borrowed cash to keep the airline running.”

A collection of large insurers including Humana, Cigna, UnitedHealthcare, and Blue Cross Blue Shield are pledging to cut red tape

Several large health insurers said Monday that they will streamline a controversial process that critics have argued led to delays in medical treatments.

The so-called prior authorization practice compels health providers to get a green light from insurers before administering medical care. The process drew increased scrutiny in the wake of the murder of UnitedHealthcare executive Brian Thompson last year.

Now, a collection of large insurers including Humana, Cigna, UnitedHealthcare, and Blue Cross Blue Shield are pledging to cut red tape and shrink the burden of prior authorization on patients. They're aiming to complete the reforms over the next year and a half.

"Health plans are making voluntary commitments to deliver a more seamless patient experience and enable providers to focus on patient care, while also helping to modernize the system,” Mike Tuffin, the president and CEO of the trade group AHIP, formerly America's Health Insurance Plans, said in a statement.

The prior authorization changes include standardizing electronic submissions and reducing the scope of insurance claims subject to the process. Many doctors and hospitals still forgo electronic submissions in favor of paper.

Insurers also agreed to establish a smoother transition process so patients switching healthcare plans during treatment can still receive that treatment for at least three months.

The reforms will benefit 257 million Americans across insurance markets, including those on Medicaid and Medicare Advantage, AHIP said.

All the uncertainty that's been swirling around markets just got a bit more uncertain. Here's what it might mean for stocks, oil, the Fed, and more

Global markets are beginning the week on edge after President Donald Trump ordered military strikes on three Iranian nuclear sites over the weekend, escalating tensions in an already fraught region.

While the Trump administration framed the move as a push toward negotiations, it’s not clear how bombing deep into sovereign territory makes that outcome more likely. Instead, the strikes drew immediate warnings of retaliation and talk from Iran’s parliament about closing the Strait of Hormuz — a move that could choke off a fifth of the world’s oil supply.

Meanwhile, domestic historians and analysts are questioning the legality of Trump’s actions under both international law and the U.S. Constitution, which explicitly grants Congress — not the president — the authority to declare war. With no clear congressional authorization and little transparency around the administration’s rationale, critics warn the strike could mark a dangerous expansion of executive war powers.

For now, let’s look at possible short-term effects across major markets and the economy.

Stocks didn't move much at Monday's market open, with investors appearing to barely price in the risk of further escalation. The S&P 500, the Dow Jones Industrial Average, and the tech-heavy Nasdaq were all up slightly shortly after markets open.

The initial moves suggest investors are bracing for volatility but hardly panicking. In a memo released early Monday, Wedbush Securities analysts described the outlook this way: "We believe tech stocks should shake... jitters off with cyber security stocks in particular set to be front and center this week as investors anticipate some cyber attacks from Iran could be on the horizon as retaliation."

Any real disruption to oil flows through the Strait of Hormuz could drive prices toward $120 per barrel, analysts at JPMorgan warned recently. For now, the Strait remains open, and over the weekend, oil prices rose only about 1.5%, heading into Monday. Oil prices actually fell slightly on Monday morning.

Tanker traffic is reportedly moving with caution, and officials across the region are watching closely. With trust eroding and diplomacy sidelined, investors are left parsing intentions from missile strikes, which is hardly the ideal foundation for price discovery.

Trump took to social media Monday morning with a warning over oil prices whose target wasn't clear. "EVERYONE, KEEP OIL PRICES DOWN," Trump said on Truth Social. "I’M WATCHING! YOU’RE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DON’T DO IT!"

Rising oil prices could inject fresh inflation into the U.S. economy just as the Federal Reserve debates whether and when to cut interest rates, with the Fed’s most recent reasoning (released just last week) suggesting two possible rate cuts in the second half of 2025.

If sustained, a spike in energy prices could strengthen the case for staying on hold, or even for tightening measures. At the same time, some economists argue such sustained price moves could just as easily prompt the Fed to cut rates sooner than it otherwise might.

In other words, all the "macro uncertainty" that's been swirling around markets just got a bit more uncertain.

After losing an appeal on a $4.7 billion antitrust charge, the search giant offers up space to its rivals

Google has offered to showcase its rivals in its search results, in a proposal to European regulators, according to a new report. This comes one day after losing an appeal in a European court, and facing a US$4.7-billion antitrust fine for violating the EU’s Digital Markets Act (DMA).

Three months ago, the EU accused Google of favoring its own services like Google Flights and Google Shopping, arguably limiting consumer choice and stifling competition, and accused it of violating the DMA's antitrust regulation.

Reuters, citing documents, reports that Google proposed a vertical search service (VSS) that would feature “objective and non-discriminatory criteria” at the top of its search page, containing links to hotels, airlines, and restaurants. “Other VSS, which are specialized search engines within Google, would be ranked below but without a box unless users click on them,” reported Reuters’ Foo Yun Chee.

The unspoken assumption there is that Google’s current search results are neither objective or non-discriminatory.

The company has been a target on the continent since 2018, when it was fined more than four billion euros for abusing the dominance of its Android operating system. Google has been fined more than eight billion euros since then. President Donald Trump has expressed concerns over the EU’s crackdown on American tech giants, calling it “overseas extortion” and threatening tariffs in response.

"We do not agree with the (Commission's) preliminary findings' position,” said Google in the recent proposal to the EU. “But, on a without prejudice basis, we want to find a workable solution to resolve the present proceedings."

Google’s rivals have a chance to respond to the proposal at a July 8 meeting, while Google is still awaiting a decision in another EU DMA case relating to its digital ad business.

Apple and Meta were fined a combined $800 million in April for violating the DMA. Both are appealing the decision, and on Thursday were not facing sanctions for missing a 60-day deadline to comply with obligations.

Bill Pulte, director of the Federal Housing Finance Agency, demanded Powell's resignation in a Fox Business interview

President Donald Trump's extraordinary offensive against Federal Reserve Chair Jerome Powell is drawing back-up from another administration official.

Bill Pulte, director of the Federal Housing Finance Agency, pushed for Powell's resignation in a Fox Business interview on Friday. It follows an identical string of attacks from Pulte against the central bank chief on social media.

"[Powell] still has interest rates way too high and they're not reflective of the great work that President Trump has done," Pulte said. "Fed Chair Jay Powell either lower the rates or he needs to resign."

Pulte, who oversees housing giants Fannie Mae and Freddie Mac, cited a weak housing market in his case for lower rates. A lower interest rate reduces the cost of a 30-year mortgage.

“As Chairman of Fannie Mae and Freddie Mac, I can tell you that Jay Powell is hurting the housing market by being Too Late to lower rates. He needs to resign, effective immediately,” Pulte said in a Wednesday post on X.

Pulte's attacks align him with Trump's escalating attacks on the Fed, the independent central bank tasked with setting interest rates. The Fed left benchmark interest rates unchanged on Wednesday for the fourth meeting in a row. That development triggered intense backlash from Trump, who mused about installing himself as Fed chair. The President also called Powell "a stupid person" the same day.

Other hardline conservatives such as Sens. Rick Scott of Florida and Tommy Tuberville of Alabama have also called for Powell to resign.

It's unclear whether Pulte, a former private equity executive, secured a green light from the White House to wage a Trump-like offensive against the Fed. The White House and the FHFA did not respond to a request for comment. A spokesperson for the Federal Reserve declined to comment.

William English, a former top Federal Reserve official who is now a finance professor at Yale University, called it "pretty unusual" for administration official to publicly lambast the Federal Reserve. It might not be unprecedented, however.

English added even the appointment of a Trump-friendly Fed chair may not be enough to secure lower interest rates. Powell's term concludes in May 2026, and many of the 12 voting members of the Federal Open Market Committee will remain in their posts.

"The folks voting on policy next spring will be mostly the same as those who voted to keep policy unchanged this week," he said. "So even a Chair wanting easier policy to satisfy the President may well find it hard to deliver."

Other observers echoed concerns about the Fed being able to safeguard its political independence. "It is absolutely nothing new for a president to be critical of what a Fed chair is doing," Claudia Sahm, chief economist at New Century Advisors and a former Federal Reserve economist said. "But typically, those criticisms are behind closed doors."