The market starts slow but AI keeps hopes high

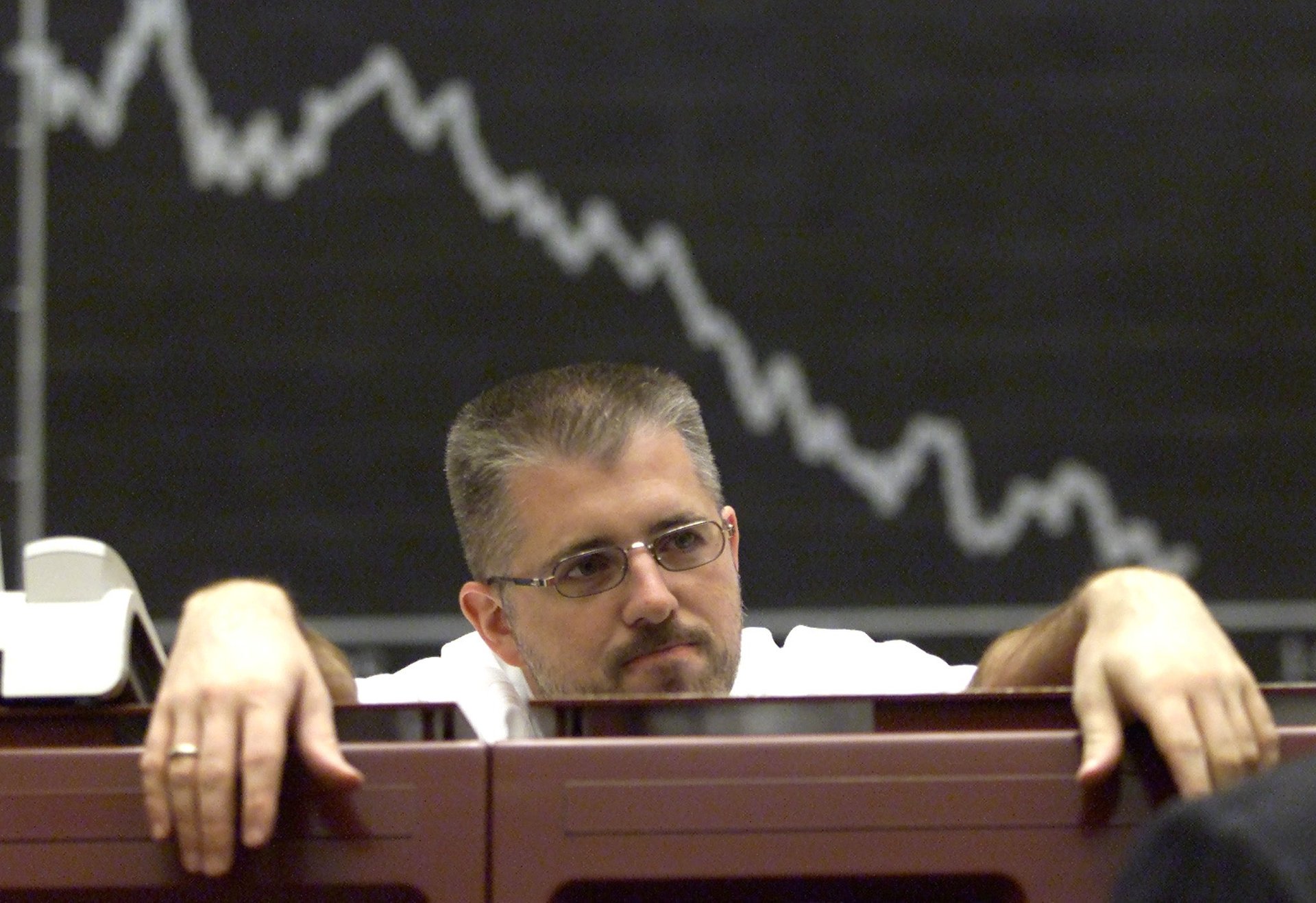

The market had a case of the Mondays as the Dow dipped along with other major stock indexes

The stock market had a case of the Mondays. The week kicked off on a slow note, with news from China that the country is banning Intel and AMD chips in its government computers.

Suggested Reading

All three major market indexes that saw record highs last week hit pause on Monday — and slipped a little.

Related Content

The Dow Jones Industrial Average, still shy of the 40,000 mark, fell 162 points, or 0.4%. The S&P 500 and the Nasdaq each dropped about 0.3%.

Donald Trump’s new stock soars

Shares of the Donald Trump-linked company Digital World Acquisition Corp (DWAC) soared more than 35%, closing at about $50 per share. Trump’s social media company Truth Social merged last week with Digital World Acquisition Corp, a shell company that was already listed on the Nasdaq. DWAC stock on Monday recovered what it lost on Friday.

The newly combined company will start trading Tuesday on the Nasdaq under the stock symbol DJT.

AI keeps hopping

Even though the market started sluggish, AI stocks were in demand as always. The AI chipmaker Nvidia took a day off today after being a star stock performer in recent weeks — this time rising less than 1% to close at $950.

Super Micro Computer stock closed up 7.2% to $1,042 per share. Micron Technology stock reached a record high and closed up 6.3% to $117.

And Constellation Energy Corp hit a new high, closing up 5% $187 per share.

Intel, AMD and United Airlines don’t recover

After Intel and AMD stocks dipped in the morning, they remained in the red zone at the end of the day. Intel stock closed down 1.75% to just under $42 per share, while AMD stock dropped 0.6% to about $178.

United Airlines, which is facing renewed federal scrutiny over a series of safety issues, also sunk on the day, closing down 3.4% to about $45 per share.