Something funny is happening at the Hong Kong border.

Every month, billions of dollars worth of exports simply disappear on their way out of China, but they’re not vanishing into a wormhole. They never existed in the first place. In the first half of 2013 alone, nearly $100 billion sneaked into China in the form of faked export invoices, according to research by non-profit Global Financial Integrity.

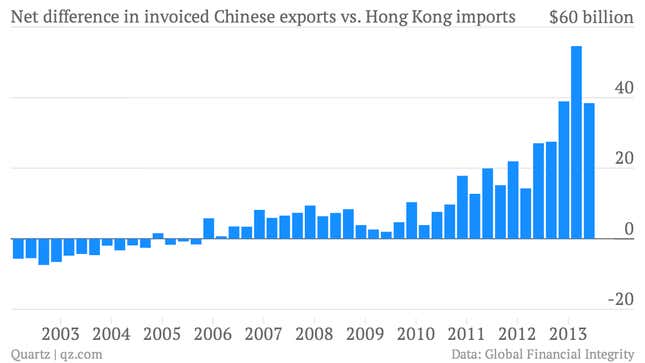

This chart shows GFI’s calculation of the difference between what Hong Kong reports receiving from mainland China and what the latter records as exports. The gap—the reflection of faked trade invoicing—has surged since 2010, to the degree that export invoicing masked $101 billion in hot money inflows into China in 2012, says GFI.

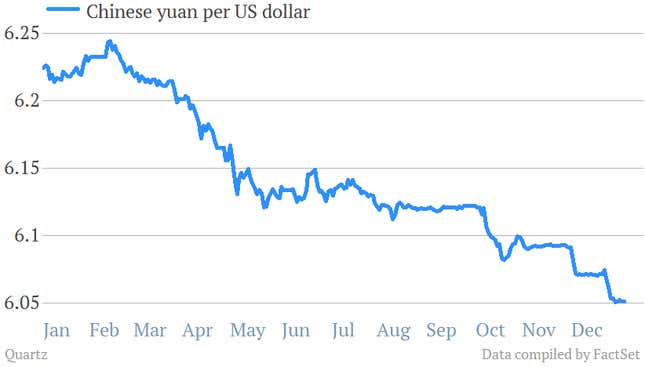

Why is this happening? There a few big reasons. First, currency speculation. China’s government, and not the market, manages the exchange rate of the yuan to the dollar. Many think it’s making the yuan cheaper than it otherwise would be, so borrowing dollars in Hong Kong and changing them into yuan is an easy way to whip up a profit.

And then there’s what you can do with that money once it’s in China.

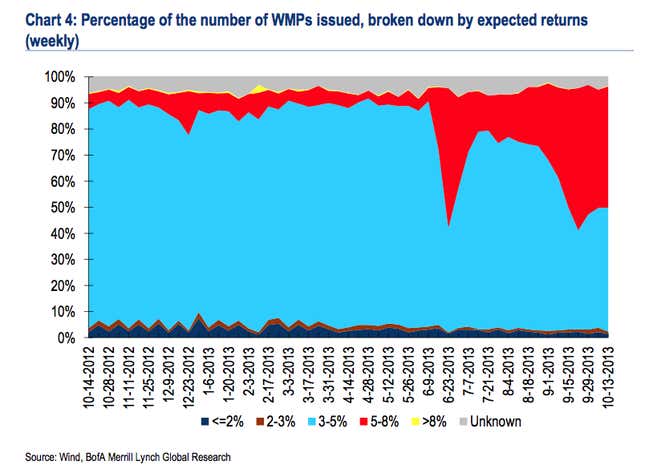

For one, there’s quick profits to be made in lending. The economy is slowing, companies need more cash to cover existing debt, and the central bank is trying to tether out-of-control lending. That should drive official rates up, but the government won’t let them rise. That means cash-desperate companies will pay exorbitant rates for unofficial loans, which often flow through China’s shadow banking channels, including those pesky wealth management products (WMPs) we’re always talking about. You can see the number of high-interest loans increasing in this chart:

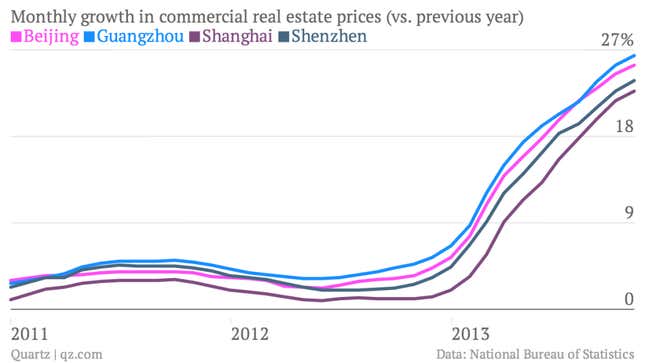

Until recently, another ticket to big bucks has been investing in real estate. The market’s on fire. Last year, on average, home prices grew 9.5%. But in major cities, prices were off the charts:

Where’s all this money coming from? It probably has something to do with the US Federal Reserve’s quantitative easing program, says Brian LeBlanc, an economist at GFI.

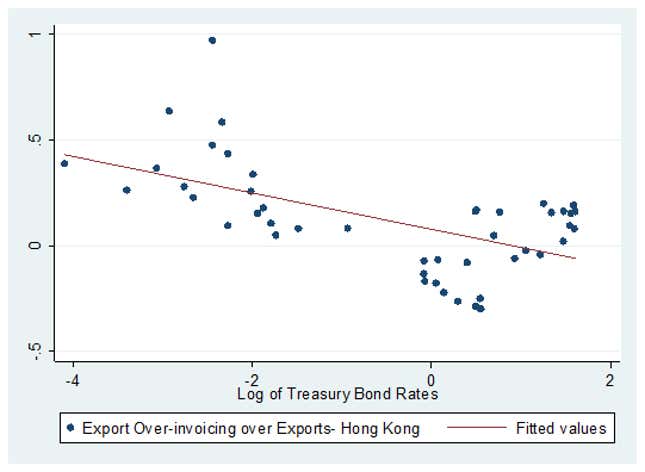

“Worryingly, there also appears to be a direct correlation between the amount of hot money entering China through export over-invoicing and the US Treasury bond rate,” says LeBlanc. “As rates have declined in the US due to the Fed’s monetary stimulus that began in 2009, export over-invoicing has increased in lock-step.”

As the Fed winds down QE, that hot money flow could reverse, says LeBlanc, as happened in 1997 when former Fed Chair Alan Greenspan started raising rates. China’s capital controls and considerable stash of foreign currency—$3.7 trillion at last count—mean it probably won’t be hit by a currency crises of the type that hobbled so many Asian countries in 1997 and are affecting other emerging markets today. But that’s certainly not good news for a financial system that’s addicted to liquidity.

One final thing: Every time China reports a bounce-back in exports, some read it as a sign of a “soft landing,” or that the economy is recovering from its increasingly wobbly state. GFI’s report doesn’t prove that’s not happening. But it also is another reminder that Chinese trade data can’t be trusted as a sign of what’s really going on in its economy.