The history of Elon Musk's Tesla

The 20-year-old electric vehicle maker has flirted with bankruptcy, dueled with regulators, and unleashed new innovations

The 20-year-old electric vehicle maker has flirted with bankruptcy, dueled with regulators, and unleashed new innovations

Sometimes it’s hard to remember that Tesla, Elon Musk’s electric vehicle giant, isn’t even old enough to legally drink.

Tesla is the 14th most valuable company in the world, with a market capitalization of $566 billion as of March 27 — despite experiencing a series of complications in 2024. The EV maker has factories across three continents, and its chief executive is the second richest person in the world (at least for now).

Tesla has gone through a lot in less than 21 years: It’s introduced six passenger vehicles and the Tesla Semi trucks, built several factories, flirted with bankruptcy, and battled federal regulators.

Here are 11 of the most important moments in Tesla’s history.

In July 2003, Silicon Valley engineers Martin Eberhard and Marc Tarpenning formally founded Tesla Motors, named after famous Serbian-American inventor and engineer Nikola Tesla. The duo would later be joined by Ian Wright, the company’s third employee.

Elon Musk would hop on board in February 2004 as the largest investor in the company, fueling Tesla through cash earned from selling his stake in PayPal two years earlier. J.B. Strausel would join in May 2004 as chief technical officer.

Due to a lawsuit settlement agreed to by Eberhard and Tesla in 2009, all five men are considered the company’s co-founders. Eberhard sued after he was ousted as CEO, alleging that his successor, Musk, was trying to “rewrite history.”

A prototype of the Lotus-based Tesla Roadster was first revealed by Tesla in July 2006, before deliveries began two years later; the first recipient of the Roadster was Musk in February 2008. By the next month, regular production was up and running

The Roadster was Tesla’s first-ever electric vehicle — or product in general — and was a major “milestone for the company and a watershed for the new era of electric vehicles,” according to then-CEO Ze’ev Drori. Drori took over as chief executive in 2007, after Musk pushed for Eberhard to step down.

Tesla sold 2,450 Roadsters for $109,000 each until the line was discontinued in January 2012. Known celebrity buyers include actors such as George Clooney and Matt Damon, musicians like Michael “Flea” Balzary of the Red Hot Chili Peppers and Will.i.am., and former California governor and movie star Arnold Schwarzenegger.

Tesla is set to unveil a second-generation Roadster by the end of the year, with production scheduled for 2025, according to Musk. He’s boasted that it will have “rocket technology” used by his other venture, SpaceX.

The late 2000s was a rough time for U.S. businesses, and the auto industry was no exception; Chrysler and General Motors were both forced into bankruptcy by the 2008-2009 financial crisis, while Ford Motor Co. barely avoided a similar fate.

Elon Musk briefly saved Tesla from bankruptcy through a $40 million investment, which he later followed up with a $40 million loan. That same year, he was named CEO, taking over for Ze’ev Drori.

But Tesla was still on the brink of falling apart. In June 2008, the Department of Energy gave the carmaker $465 million in low-interest loans, much of which was directed toward producing the newly-announced Model S luxury electric vehicle.

However, it was Daimler — now Mercedes-Benz — that bailed Tesla out. The German automaker took a nearly 10% stake in Tesla for $50 million, saving the company from death’s door.

“Daimler’s $50M investment in May 2009 was the crucial money that saved Tesla,” Musk said in a post on X last month. “We would have bounced payroll one month later.”

Tesla officially launched on the Nasdaq on June 28, 2010, becoming the first U.S. carmaker to go public since Ford Motor Co. in 1956. The automaker raised $226 million through its initial public offering, selling 13.3 million shares at $17 each.

Fast forward nearly 14 years and Tesla is one of the most valuable companies in the world with a $570 billion market capitalization. However, the electric vehicle maker is having a rough year, and remains the worst performer in the S&P 500 year to date.

In May 2020, Toyota agreed to invest $50 million in Tesla, which planned to takeover the NUMMi plant in Fremont, California, that had been jointly operated by the Japanese carmaker and General Motors since the 1980s. The facility would become Tesla’s flagship — and, for a time, only — factory in the U.S. The facility is the only production site for the Model S and Model X, but also produces the Model 3 and Model Y.

Tesla’s driver assistance system, Autopilot, was first introduced to the world with Model S sedans in October 2014, although it wasn’t active. About a year later, the automaker released software enabling Autopilot as a feature combining adaptive cruise control and Autosteer, a lane-centering function.

In a blog post, Tesla explicitly states that Autopilot is designed for convenience and “relieves drivers of the most tedious and potentially dangerous aspects of road travel.”

Elon Musk in January 2016 makes the first of many broken promises related to Autopilot, and later its Full Self-Driving driver assistance system, promising that Teslas will be able to drive better than humans within three years. He also pledged that owners can “summon” a Tesla “anywhere connected by land & not blocked by borders”; the feature has a distance limit of 213 feet, according to Tesla’s Model Y owner’s manual.

Later that year, multiple people would die in related incidents, including Joshua Brown of Canton, Ohio. The Tesla enthusiast was killed in Florida after his Model S crashed into a truck, which U.S. auto safety regulators later determined was caused by an over-reliance on Autopilot. The crash was the first Autopilot-related death in the U.S. and would lead to updates to the software.

Several crashes would occur in the future, some of which led to lawsuits. Last October, Tesla won its first U.S. jury trial over a fatal Autopilot crash. However, the company faces at least a dozen more cases in the U.S. Tesla has also found itself in hot water with regulators, consumers, and investors who say the company’s marketing of FSD and Autopilot is misleading and deceptive.

Elon Musk is known for many things. One of them is an obsession with posting on social media. Sometimes that’s a good thing — especially as he now owns X, formerly Twitter — but very often it has negative consequences.

“Am considering taking Tesla private at $420. Funding secured,” Musk wrote on Twitter on August 7, 2018. “Shareholders could either to sell at 420 or hold shares & go private.”

That tweet raised many questions — namely, who would fund his sudden push for privatization — and triggered suspicion from the SEC and shareholders. Subsequent lawsuits cost Tesla and Musk $40 million, and a settlement with the SEC forced Musk to step down as Tesla’s chairman and have his social media posts supervised by lawyers.

The Tesla CEO has since gone to court to remove the supervision requirements — which he has labeled a “muzzle — and most recently asked the U.S. Supreme Court to review his appeal after a lower court upheld the SEC’s order. Last week, the Department of Justice asked the court to dismiss the appeal.

Tesla launched the Model Y SUV in March 2019 as the final addition to the electric vehicle maker’s “sexy” lineup (Tesla sells the Model S, E, X, and Y). The Model Y entered production at the Fremont, California, in January 2020 and is now produced at three other factories. In the years since, the electric SUV has dominated the EV field, becoming the first electric model to claim the title of the world’s best-selling car.

China is, by and large, the largest auto market in the world. In May 2018, Tesla decided to cash in, launching a Shanghai-based subsidiary to carry out production in the country. Elon Musk later signed an agreement with the Shanghai regional government to build its third gigafactory, Giga Shanghai, which began operations in 2019. The factory currently builds Model 3 compact cars and has a production capacity of over 950,000 units per year.

Tesla decided to pick up the speed in 2022, opening two new gigafactories: Giga Texas and Giga Berlin-Brandenburg.

Construction on the gigafactory in Austin, Texas, began in July 2020, before it was completed in April 2022. The factory produces Tesla’s best-selling Model Y SUVs and the Cybertruck electric pickup (more on that later). It’s also Tesla’s modern-day corporate headquarters and employs more than 20,000 people.

Giga Berlin-Brandenburg was first announced by Elon Musk in November 2019 as Tesla’s first plant on the European continent, specifically in the Brandenburg state of Germany. The factory opened in March 2022 and assembles the Model Y and electric vehicle battery cells; Tesla claims it’s the first facility in Europe to make both vehicles and their batteries.

Elon Musk made a major promise in November 2019 when he introduced the Cybertruck, his vision for the “truck of the future” and said it would be entering production in 2021. The first model of the “trapezoid on wheels,” as it has been not-so-lovingly nicknamed, wouldn’t be built until last summer.

Then, in November 2023, Musk took the stage in Austin, Texas to deliver the first 10 models of the electric pickup truck.

The Cybertruck, unlike traditional pickups, is outfitted with a stainless steel body and sharp angles designed to imitate the appearance of the Starship spaceship developed by Musk’s SpaceX. The eccentric billionaire has long been obsessed with making the Cybertruck bulletproof; famously, the pickup’s window shattered when lead designer Franz Von Holzhausen chucked a steel ball at it (Musk stands with the damaged specimen, pictured above).

“If Al Capone showed up with a Tommy gun and emptied the entire magazine into the car door, you’d stay alive,” Musk told a crowd last November. “Why did you make it bulletproof?” he then asked himself, before stating, “Why not?”

Grudges between battery giants last longer than either of their products

Duracell and Energizer are back in court. This time it’s Duracell suing Energizer for claiming its batteries last longer. But the two battery giants have a long and litigious history, in an American corporate rivalry almost as old as Coke vs. Pepsi.

A recent ad campaign for Energizer MAX batteries claims that they outlast Duracell Power Boost batteries by 10%, that this fact is “proven,” and concludes that Energizer’s products “last longer. ’Nuff said.” This, says Duracell’s lawsuit, caused irreparable harm and damaged customer goodwill. The ads ran on nationwide TV and online.

Duracell says Energizer is basing its claim of superiority on one comparison by the American National Standards Institute, based on personal grooming products, and does not apply to all Duracell batteries. Duracell believes Energizer is guilty of false advertising, and is seeking damages and “corrective advertising.”

This is not dissimilar to the last time the two companies showed up in court, just five years ago, over the exact same issue: whether Duracell Optimum or Energizer MAX batteries lasted longer. The two companies managed to talk that one out; in December 2020, both lawsuits were voluntarily dismissed.

Consumer comparisons split the difference: each battery is stronger for different purposes.

In 2022, it was Energizer that won a seven-year court case against Duracell in a Canadian court, arguing that Duracell packaging couldn’t claim its products lasted longer than Energizer products, because that contravened trademark law. However, it did allow that Duracell could use similar stickering claiming it was superior to “the bunny brand” or “the next leading competitive brand.”

Similarly, in 2016, Energizer successfully sued Duracell for using a pink bunny in ads — even though Duracell was using a pink bunny 16 years before Energizer’s iconic “just keeps going and doing” ad campaign that began in 1989.

The rivalry goes back almost 80 years, when Duracell entered the market in 1946. Energizer’s roots date back to the Ever Ready company of 1890; Ever Ready invented the AA battery in 1907. As a point of comparison, the soda wars started when Pepsi Cola, founded in 1893, first threatened Coca-Cola, founded in 1886.

Good morning, Quartz readers!

Interest-ing timing. Millions are facing plunging credit scores (some by over 150 points) as student loan collections resume after a five-year pause.

AMD is coming for Nvidia. AMD stock soared nearly 10% after Wall Street reacted favorably — see: an “overweight” status — to its recently announced Helios plans and partnerships.

No chip off this bloc. Chinese tech companies Huawei and SMIC found themselves on Taiwan’s blacklist as the U.S. continues to crack down on AI and semiconductors.

Bricks down, bills up. Despite continued government support, China’s housing slump remains in decline, but the country’s citizens are showing signs of increased consumer spending.

A pharma giant’s maple misstep. A $250 mistake — not paying a patent maintenance fee — will cost Novo Nordisk billions by giving Canadians generic versions of its weight-loss drugs.

Perk-formance review. JPMorgan Chase and American Express are kicking their luxury card rivalry up a notch, with both companies promising greater rewards after revamps.

Frank McCourt lost the Los Angeles Dodgers in a brutal divorce. Now, he wants to win TikTok — and, in his telling, save the internet while he’s at it. The billionaire real estate mogul is leading a $20 billion bid to buy the embattled platform from ByteDance, strip out its secretive algorithm, and rebuild TikTok atop a transparent, user-owned protocol he’s spent the past four years developing.

That vision — part digital utopia, part personal do-over — is powered by Project Liberty, a nonprofit McCourt launched to “re-decentralize” the web. He believes data is personhood, users should hold the keys, and platforms should serve people, not the other way around. He even met with TikTok’s top creators to pitch a world where followers and content are portable, analytics are accessible, and moderation comes with opt-in labels.

Critics say he doesn’t understand TikTok because he’s never used it. McCourt told Quartz that the algorithm isn’t the secret sauce — the app’s users are. Regardless, the billionaire isn’t the only one eyeing TikTok. Oracle’s Larry Ellison and others have reportedly circled. But so far, McCourt says his group is the only one to submit a formal bid. ByteDance hasn’t publicly responded. The clock is ticking: Under a law passed in 2024, TikTok must be sold or banned due to national security concerns over its Chinese ownership. President Donald Trump has extended the deadline multiple times — with the latest set for June 19.

Now in his seventies, McCourt is casting his TikTok play as a shot at digital redemption, both for himself and for a platform he sees as addictive, opaque, and dangerous for young users. (His 9-year-old daughter still isn’t allowed on the app.) Whether or not he succeeds, his bid offers a glimpse at a very different vision of the internet — one where users hold the power, not just the passwords. Quartz’s Catherine Baab has more on the billionaire who wants to open-source your FYP.

Reddit is making a play for ad budgets — and this time, it’s bringing AI. At Cannes Lions this week, the company announced “Reddit Community Intelligence,” a suite of tools designed to help marketers tap into the platform’s comment threads for insights.

The products include Reddit Insights, a social-listening tool that parses posts for sentiment and trends, and Conversation Summary Add-ons, which embed real Reddit user posts directly into ads. Early tests showed a 19% boost in click-throughs, suggesting that authenticity might just convert.

This push comes as Reddit tries to prove it’s more than just memes and mayhem. Since its IPO in March, the company’s stock has whiplashed amid concerns about Google’s AI Overviews eating into traffic. Still, ad revenue climbed 61% year-over-year in the first quarter, and Reddit is betting that its communities can be monetized, regardless of the algorithm.

One of Reddit’s biggest tests? A partnership with CVS — a big step in Reddit’s plan to become a serious player in retail media. And Reddit’s moves are part of a broader AI strategy. The company already launched Reddit Answers, a generative-AI feature that summarizes community replies, and Reddit has struck licensing deals with OpenAI and Google, while suing Anthropic for allegedly training on Reddit content without permission. The message? This is a platform that wants to own its data — and monetize it thoroughly.

The real bet is that Reddit’s messiness is the value. While other platforms lean into algorithmic polish, Reddit is pitching raw signal: real people, real opinions, real time. Now, it’s just figuring out how to bottle that chaos and sell it — one ad unit at a time. Quartz’s Shannon Carroll has more on why Reddit thinks your hot take is worth 19% more.

💰 The Trump family is launching a phone service — and selling a gold phone

💬 WhatsApp will soon have ads, thanks to Meta

✈️ Southwest Airlines is adding cockpit alerts for pilots

⚖️ Some of the top budgeting hacks for DIY projects

🧒 These are the most expensive places in the U.S. to raise a kid

Our best wishes on a safe start to the day. Send any news, comments, and more to [email protected].

The best U.S. cities 'use their budgets most effectively to provide high-quality financial security, education, health, safety, and transportation,' one analyst said

Running a city is no easy job. And how effective local leadership is can shape nearly every aspect of daily life — from the quality of public services and infrastructure to safety, education, and economic opportunity.

In the U.S., some cities stand out for praiseworthy governance, while others struggle with more inefficiencies, budget shortfalls, and uneven outcomes. That's why WalletHub set out to pick the best- and worst-run cities in the U.S. in 2025.

It compared 148 cities in all 50 states by dozens of factors across six categories: financial stability, education, health, safety, economy, and infrastructure/pollution. It looked at some obvious metrics, such as rates of violent crime, high-school graduation, and unemployment. And some more out-of-the-box ones, like building-permit growth, bike scores, and residents' perception of safety.

“The best-run cities in America use their budgets most effectively to provide high-quality financial security, education, health, safety, and transportation to their residents,” said WalletHub analyst Chip Lupo. "Many of the top cities also have a very low amount of outstanding government debt per capita, which can prevent financial troubles in the future.”

Continue reading to see WalletHub's picks for the five best- and worst-run cities across the U.S.

.jpg)

DenisTangneyJr / Getty Images

Anna Gorin / Getty Images

DenisTangneyJr / Getty Images

knowlesgallery / Getty Images

DenisTangneyJr / Getty Images

Jon Lovette / Getty Images

Francesco Riccardo Iacomino / Getty Images

Thomas Winz / Getty Images

Photo by Mike Kline (notkalvin) / Getty Images

Alexander Spatari / Getty Images

Where you live can have a major impact on your longevity

Living a longer life is a goal on many people's minds, and while supplements and fitness routines often take center stage, one key factor is commonly overlooked: where you live. The typical life expectancy can vary widely from state to state, making your home address more influential than you might think.

Using data from the National Vital Statistics System, Caring.com ranked the states with the highest average annual life expectancies from birth.

Continue reading to see the 10 states where people live the longest.

Stewart Cohen / Getty Images

Yellow Dog Productions / Getty Images

Jon Lovette / Getty Images

Holcy / Getty Images

emholk / Getty Images

Allison Michael Orenstein / Getty Images

Jonathan Novack / Getty Images

Kate Stoupas

Image Source / Getty Images

Fly View Productions / Getty Images

Investors are betting big on CEO Lisa Su’s recent AI announcements — namely AMD's Helios platform and partnerships with top companies such as OpenAI

Advanced Micro Devices (AMD) surged nearly 10% by midday Monday, adding more than $20 billion to its market cap and marking one of its biggest single-day jumps in over a year — thanks to well-timed AI hype. Days earlier, AMD gave Wall Street a detailed product roadmap, some actual hardware, and a few well-placed clues about who’s buying its tech.

At its “Advancing AI” event in San Jose, California, AMD made it clear that it’s going after Nvidia. CEO Lisa Su rolled out the company’s next-gen Instinct MI350 accelerator chips and teased its coming “Helios” AI rack — an in-house server platform built to showcase AMD’s MI400 GPUs, which are due out in 2026. Su said Helios “will set a new benchmark for AI scalability.”

AMD is also pivoting away from Nvidia’s closed-link architecture. Su said on Thursday, “The future of AI is not going to be built by any one company or in a closed ecosystem. It's going to be shaped by open collaboration across the industry.”

The news out of California told Wall Street two things: AMD is closing its gap with Nvidia, and the company’s customers are real.

One of those customers is OpenAI, which AMD confirmed is planning to use its next-gen chips and Helios platform. CEO Sam Altman spoke on stage with Su, remarking that initial specs for the MI400 were so ambitious he thought, “No way.” And major names such as Meta, Oracle, and xAI are already testing or deploying MI300X successors and supporting AMD’s modular approach. AI cloud provider Crusoe told Reuters that it’s planning to buy $400 million of AMD’s new chips.

While Nvidia still dominates the AI training market, the recent news signals that AMD is carving out a credible second-place lane in the AI arms race — and that partners aren’t waiting to place orders.

Wall Street liked what it saw.

Piper Sandler upgraded AMD to “Overweight” status and boosted its price target to $140 (from $125). Analyst Harsh Kumar said in a note that AMD is expected to see “a snapback” in the fourth quarter as it works through most of its China-related charges and sees some of its product announcements as key to scale the company’s AI infrastructure.

“Overall, we are enthused with the product launches at the AMD event this week, specifically the Helios rack, which we think is pivotal for AMD instinct growth,” he wrote. “We also note that the largest of the business units, namely client, is starting to see some pull-ins.”

AMD is signaling it wants to be the “other” full-stack AI company. It has quietly acquired a string of startups — Eno, Brium, Untether AI — to build a more vertically integrated AI portfolio. AMD’s moves come at a critical time for the company, which has watched rival Nvidia’s stock rocket over 150% in the past year. While AMD’s stock performance has lagged, its fundamentals have been quietly improving — especially in data center sales — and its ability to show tangible AI progress just gave investors a fresh reason to believe.

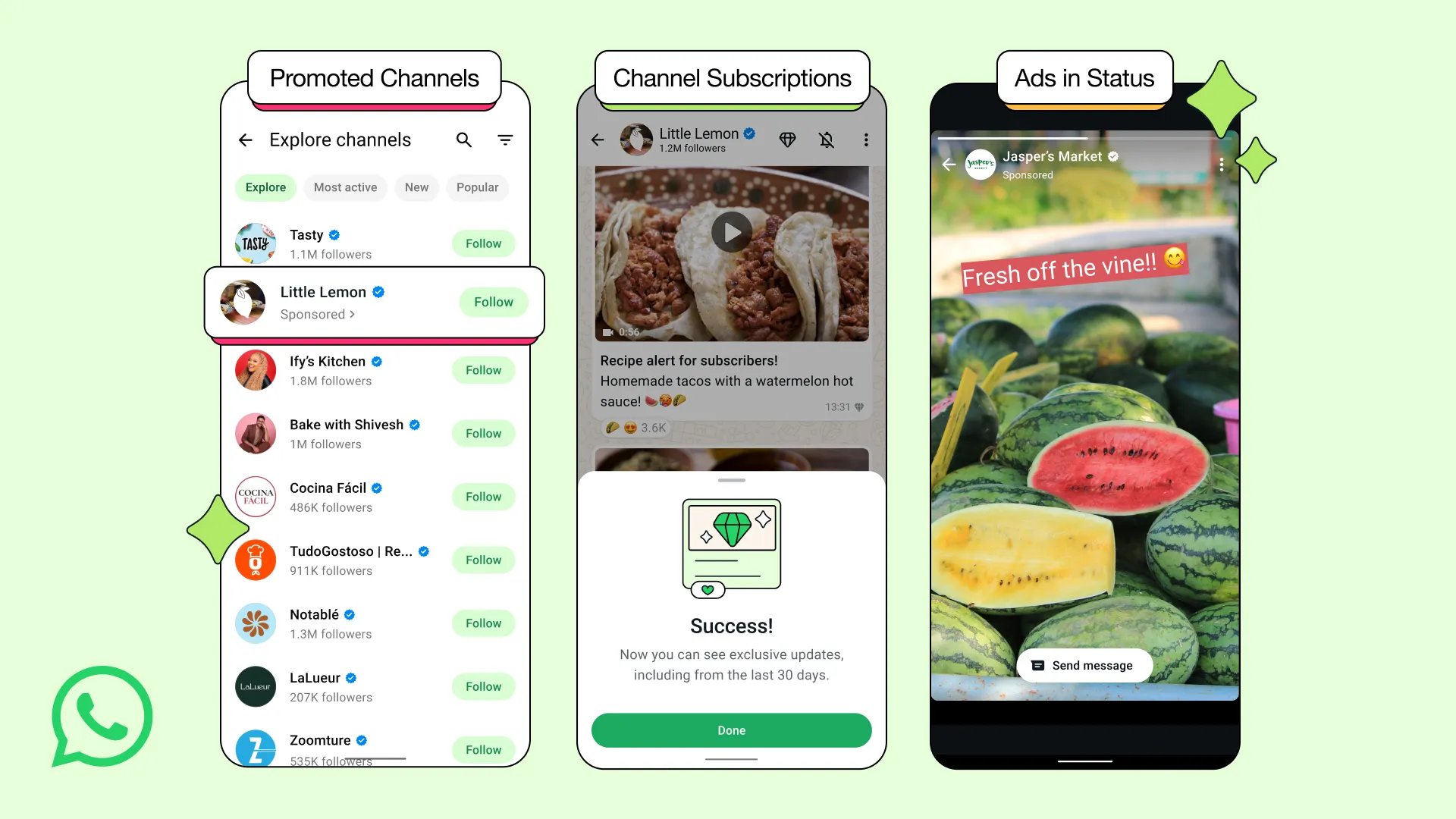

WhatsApp ads will only appear on the Updates page, Meta said, and don't jeopardize your messages privacy

Ads are finally coming to WhatsApp.

Meta said Monday that it will introduce ads to WhatsApp's Updates tab, “away from your personal chats.”

"This means if you only use WhatsApp to chat with friends and loved ones, there will be no change to your experience at all,” Meta said.

The news comes more than 10 years after Meta purchased WhatsApp for $19 billion in 2014 without a clear plan on how to make money from the service. WhatsApp is now used by two billion people.

Meta, which also owns Facebook and Instagram, said it is putting advertising on the platform in "the most privacy-oriented way possible.”

Personal messages, calls, and statuses will still be end-to-end encrypted, and the company said it will use limited personal data, like a person’s country, city of origin, and language, to target ads to individuals.

If a user's WhatsApp is linked to other Meta accounts, the company will use preferences from those platforms to inform WhatsApp marketing.

"We will never sell or share your phone number to advertisers,” Meta said. "Your personal messages, calls and groups you are in will not be used to determine the ads you may see."

The social media company was embroiled in a privacy scandal for years after it was revealed tens of millions of users had their data improperly shared with the former political consulting firm Cambridge Analytica in the U.K.

Ads in WhatsApp might prove needed to Meta's bottom line, as it invests billions on artificial intelligence.

The company said it doesn't plan to introduce ads within messages or chats.

The company is rolling out AI-powered ad tools designed to turn on-platform conversations into scalable marketing insights — with CVS on board.

Reddit is hoping to convince marketers that all the noise on its platform is, in fact, a signal. At the Cannes Lions ad festival this week, the company unveiled two tools under a “Reddit Community Intelligence” umbrella — part of an AI-powered push to mine its user-generated content for brand insights and marketing performance.

The announcement comes at a pivotal moment for Reddit, which is still trying to prove that it can be a serious contender in the ad business following its IPO earlier this year. The company’s stock was up 3.6% around midday Monday.

The first tool, Reddit Insights, is a scalable social-listening product that lets marketers analyze Reddit’s posts and comments for trends, sentiment, and cues. The second tool, Conversation Summary Add-ons, embeds positive user-generated posts into ad units. Reddit claims early tests (through companies such as Lucid and Jackbox Games) showed a 19% higher click-through rate than standard image ads.

This isn’t Reddit’s first foray into advertising, but it marks one of its most aggressive attempts yet to move from “hard to monetize” to “ad tech player.” While social platforms such as Facebook and TikTok rely on massive ad budgets and tightly controlled algorithms, Reddit is betting that the real-time, unfiltered nature of its communities — combined with some AI polish — can deliver a different kind of value: authenticity at scale.

CVS will be one of the first big partners to test that thesis.

Through a just-announced data-sharing deal, the retailer will combine insights from its 90 million-person loyalty program with Reddit’s 108 million daily users. Advertisers will be able to target CVS shoppers based on Reddit activity — and track whether those shoppers go on to make purchases online or in-store. The partnership reflects a broader push by retailers to stretch their media networks beyond their platforms, while giving Reddit a chance to tap into top marketing dollars typically reserved for companies such as Amazon and Walmart.

This push is also part of Reddit’s broader AI strategy.

The company recently launched Reddit Answers, a generative-AI product that summarizes community responses to user questions. Unlike its competitors’ AI products, Reddit’s attempt links back to original posts in an attempt at maintaining transparency and driving engagement within its ecosystem. Reddit is also forging secure data-licensing deals with Google and OpenAI (and notably not with Anthropic, which Reddit is suing for alleged unlicensed AI training).

Now that the ad stack is solid, and generative-AI staples such as headline generators and ad-review bots are live, the company is fast-tracking “community marketing” as its next big lever, Reddit COO Jen Wong told Axios.

“Reddit responds so quickly to new products and what’s happening in the world,” she said. “That’s why it’s so credible and valuable to businesses trying to make decisions in everything — how to market, how to find their customers, how they’re doing in customer service.”

Since its March 2024 IPO, Reddit’s stock has been on a rollercoaster — tripling at one point, then offloading about 30% in early 2025 amid concerns over how Google’s AI Overviews could overshadow Reddit’s traffic. The company reported $358.6 million in ad revenue in the fiscal first quarter, up 61% year-over-year, and while the platform faces pressure from macro factors (trade policy shifts, WPP’s trimming of global ad growth forecasts, and Google search volatility) its bet is straightforward: There’s lots of money in the global ad game.

And there’s broader industry momentum behind the push. Platforms such as Snap and Pinterest have already doubled down on AI-driven ad tools. A big part of the bull case for Reddit rests on its ability to translate high-intent conversations — particularly around categories such as health, tech, and finance — into advertiser value without alienating its opinionated user base.

Whether brands will embrace ads built from Reddit threads remains to be seen. But the company is making a clear pitch: In an era of algorithms, Reddit offers messy, human nuance — and now, a way to package that all up for marketers.

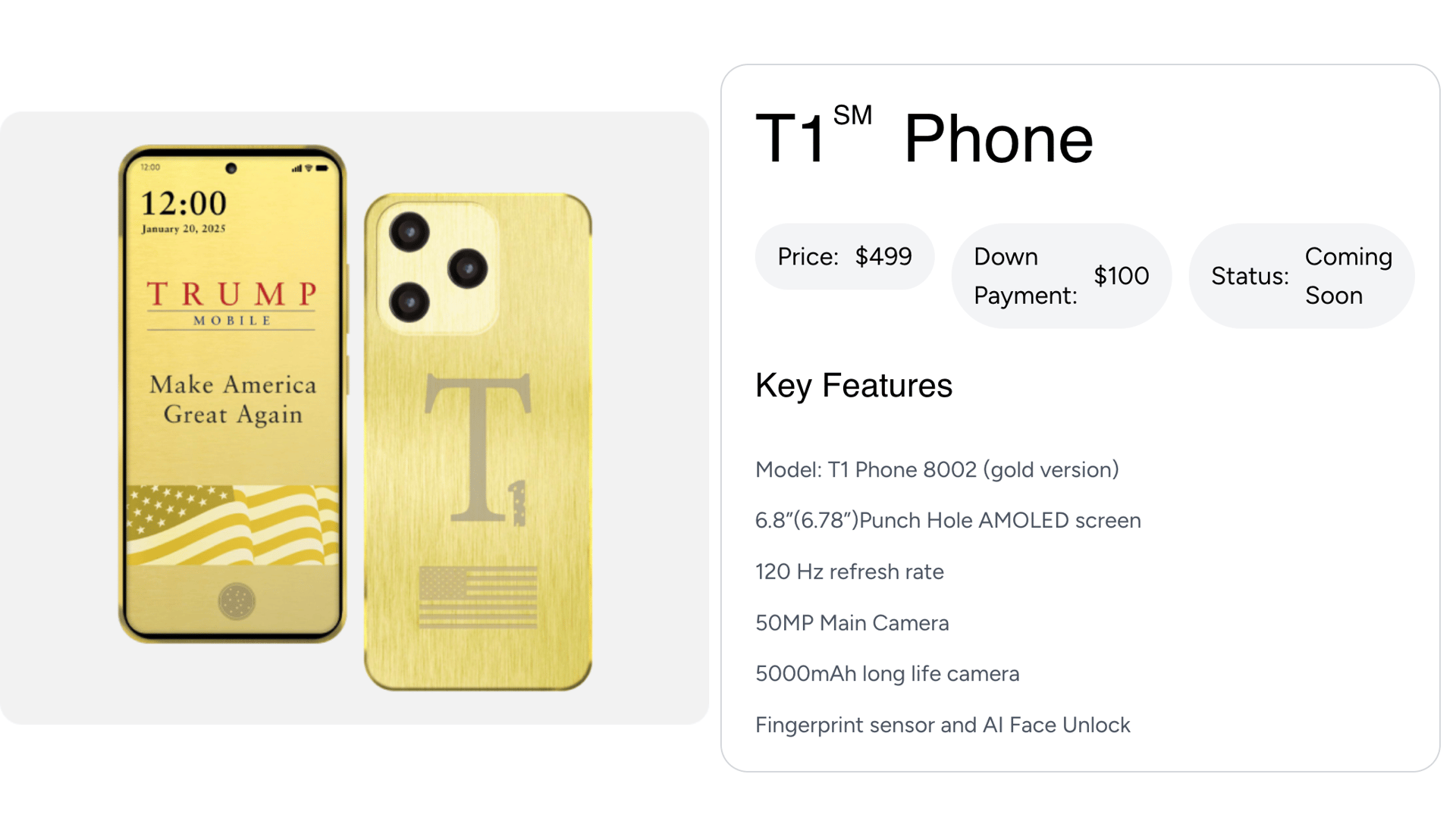

Trump Mobile will offer a wireless plan and a gold, Trump-branded Android smartphone under a licensing deal.

The Trump Organization announced Tuesday that it plans to launch a wireless phone service and a $499 gold smartphone in September.

The company, which is run by President Donald Trump's sons — Eric Trump and Donald Trump Jr. — called the upcoming mobile plan a “bold new wireless service for Americans."

Trump Mobile will offer a contract called "The 47 Plan," which provides unlimited talk, text, and data for $47.45 a month, among other features. The Trump Organization also said it will release the T1 Phone in August, a gold smartphone that resembles an iPhone in appearance and runs Android 15 — a version of Google's operating system that debuted in 2024.

The products are essentially licensing deals. In its press release for the announcement, Trump Mobile said its offerings were “not designed, developed, manufactured, distributed or sold by The Trump Organization or any of their respective affiliates or principals.”

It added that Trump Mobile uses the Trump "name and trademark pursuant to the terms of a limited license agreement," which can be terminated.

Trump Mobile is a mobile virtual network operator (MVNO), which means its service is powered by preexisting wireless infrastructure. In this case, the Trump family venture indicated it's buying capacity from all three major carriers — Verizon, AT&T, and T-Mobile. Competitive MVNO unlimited plans, such as those from Boost Mobile and Spectrum, can go for $30 per month or less.

Donald Trump Jr., the executive vice president of the Trump Organization, said Trump Mobile is part of a push to “put America first.”

“Our company is based right here in the United States because we know it’s what our customers want and deserve,” he added.

The mobile service is the most recent attempt by the president’s children to profit off the Trump name while he is in office; it follows crypto ventures, Trump gold clubs, and other licensing deals, many of which have increased greatly in value since the president’s reelection.

Many of the deals have sparked outrage from Democrats in Congress, who have said that the Trump Organization's business dealings happening alongside the president's time in office amount to corruption.

Democratic Sen. Richard Blumenthal of Connecticut, who is leading an investigation into Trump’s crypto ties, said recently that “Donald Trump is selling cryptocurrency like snake oil in the Wild West, and he’s put a for sale sign on the White House for his meme coin.”

—Shannon Carroll contributed to this article.

Both companies promise greater rewards with revamps of Sapphire Reserve and Platinum cards

JPMorgan Chase and American Express will launch new high-end credit cards later this year, giving consumers the luxury of choice.

The Sapphire Reserve card from JPMorgan Chase debuted in 2016 and quickly became popular for its dining and travel rewards program, especially among millennials. It was a bit too popular, actually: costing the bank $200 million in the final quarter of that year and straining relations with airlines. In response, the bank cut back on some of the perks.

American Express, who pioneered the field by introducing its gold card almost 60 years ago, also announced on Monday that they were instituting major changes to their consumer and business platinum cards, claiming it will be “its largest investment ever in a card refresh,” and telling CNBC that it will offer “a whole bunch of new and exciting benefits and value that will far, far, far exceed the annual fee.”

Sapphire Reserve currently costs $550 a year plus $75 per user associated with the card. American Express Platinum costs $800 a year plus $250 for additional cards. Both cards are expected to raise their fees when new benefits are rolled out this fall.

Credit-card rewards programs have been immensely popular with younger consumers over the last decade. However, those same consumers are now facing a new credit crunch: the federal government is now cracking down on missed student-loan payments after a five-year pause.

The timing is especially challenging for younger borrowers. Unemployment among college graduates ages 20 to 24 has risen to 6.6%, the highest level in a decade outside of the pandemic. New graduates face stiff competitions for jobs, with many entry-level jobs now requiring years of experience. Even retail and restaurant jobs can be hard to come by.

Combined with proposed cuts to federal student aid in President Donald Trump’s broader budget plan, the resumption of collections signals a new era of aggressive enforcement — and growing financial strain for borrowers across the country.

Marketing a high-end credit card to that crowd might be a tough sell.

—Catherine Baab contributed to this article.