Blockbuster tech IPOs to watch in 2019

It’s raining tech IPOs.

It’s raining tech IPOs.

After years of raising money on the private markets, companies from Uber to Pinterest to Slack are taking the plunge into the public markets in 2019 (Lyft already did). Together, the tech companies expected to go public this year have raised more than $50 billion from private investors, roughly equivalent to the market capitalization of General Motors. Many of their private valuations are enormous, with Uber last valued at $76 billion and The We Company (formerly known as WeWork) at $47 billion.

With so many private investors willing and able to provide capital, you might wonder, why bother going public at all? One reason is that an initial public offering can be seen as a sign of maturity in the lifecycle of a company. Another, perhaps more relevant, reason is that people who have invested their time and money into these companies are ready to get paid. An IPO is the main mechanism by which venture capitalists and employees with large stock grants convert their paper holdings into actual wealth. Also fueling the rush to IPO are concerns that with the economy edging closer to another recession, it’s better to beat the downturn to market then get stuck behind it.

To help you through the season, we’ve rounded up the most important technology IPOs to watch for this year. We’ll also continue to update this guide as new filings come out and companies complete their journeys into the public markets.

Table of contents

Airbnb • Casper • Cloudflare • Instacart • Jumia • Lyft • Palantir • Peloton • Pinterest • Postmates • Robinhood • Slack • Uber • The We Company • Zoom

Airbnb

Private valuation: $31 billion

Target public market valuation: Unknown

S-1: Not yet filed

Key executives: Brian Chesky, co-founder and CEO; Nathan Blecharczyk, co-founder and chairman of Airbnb China; Belinda Johnson, chief operating officer; Greg Greeley, president, home-sharing business; Chris Lehane, head of global policy

Notable shareholders: Brian Chesky, Joe Gebbia, Nathan Blecharczyk, Andreessen Horowitz, Sequoia Capital

Other stuff to know: Founded in 2008, Airbnb turned the business of renting a spare room or home to strangers into a global phenomenon. The company has raised $4.4 billion to date, and was last valued at $31 billion. It is said to be considering a direct listing, in which existing investors can sell their shares but new stock isn’t issued, as is typical in an IPO. The nontraditional format could work for Airbnb because it has strong brand recognition and, after two years of reported EBITDA profitability (earnings before interest, tax, depreciation, and amortization), the company has less need to raise additional funds. What Airbnb does need to do is give its employees a chance to sell their shares, as many are itching to cash out (paywall).

One risk for Airbnb as it heads toward a public debut is the legal status of its short-term home rentals. Airbnb spent nearly a decade fighting efforts to regulate this casual form of home rental, or “home sharing.” It adopted a more conciliatory attitude in late 2016 after some of its biggest markets—New York, San Francisco, Berlin, and Barcelona, to name a few—started issuing hefty fines to home-rental sites and hosts operating illegally. The company has cited regulatory conflicts as a risk to investors in private fundraising efforts, and it will likely flag a similar risk to would-be public shareholders. As its home rentals growth slows in mature markets and amid greater competition, Airbnb has sought to expand into an all-purpose travel firm, with services like guided tours and restaurant reservations, and to bolster the share of hotel rooms, actual bed and breakfasts, and other professionally managed listings available on its platform.

Read more on Quartz: What even is Airbnb?

Casper

Private valuation: $1.1 billion

Target public market valuation: Unknown

S-1: Not yet filed

Key executives: Philip Krim, co-founder and CEO; Gregory Macfarlane, chief financial and chief operating officer; Jeff Brooks, chief marketing officer

Notable shareholders: Ashton Kutcher, Kevin Spacey, Lerer Hippeau Ventures, New Enterprise Associates, Norwest Venture Partners, Target

Other stuff to know: Casper is a direct-to-consumer mattress company that aims to make mattress shopping a friendly experience. (CEO Philip Krim claims the company’s name has nothing to do with the friendly ghost.) Krim and his four co-founders got the idea in the summer of 2013 while seated together at a startup accelerator in New York City. Mattress-buying is a notoriously terrible experience. Krim and his team figured they could disrupt the roughly $15 billion industry by designing a single affordable mattress that consumers could buy online and have shipped to their homes, free of charge.

In May 2017, Casper received a $200 million investment from Target after reportedly rejecting a $1 billion acquisition offer. The following year, Casper announced its intent to open 200 brick-and-mortar stores (paywall) over the next three years to grow sales and fend off competition from online challengers like Leesa, and Tuft and Needle. One of those storefronts, a “Dreamery” in lower Manhattan, invites customers to take a 45-minute power nap for $25. Casper’s pivot toward more traditional retailing came, ironically, around the same time that mattress stalwart Mattress Firm filed for bankruptcy and said it planned to close 700 underperforming stores.

Cloudflare

Private valuation: $1.8 billion

Target public market valuation: $3.5 billion

S-1: Not yet filed

Key executives: Matthew Prince, co-founder and CEO; Michelle Zatlyn, co-founder and chief operating officer; Lee Holloway, co-founder and lead engineer

Notable shareholders: Alphabet, Microsoft, Baidu, Pelion, Union Square, Fidelity, New Enterprise Associates

Other stuff to know: Cloudflare plays a crucial but behind-the-scenes role in the internet’s infrastructure. Co-founders Matthew Prince and Lee Holloway previously worked together on a networking tool to track spam email called Project Honey Pot. They met Cloudfare’s third co-founder, Michelle Zatlyn, at Harvard Business School. Known as a content delivery network, or CDN, Cloudflare’s servers essentially sit between the website of its clients and the people trying to access those client sites. Cloudflare optimizes content for its clients’ users, and can mitigate cyberattacks on their sites, such as a distributed denial of service (DDoS) attack in which malicious traffic overwhelms a target and causes its site to crash.

The company’s biggest competitor is—surprise!—Amazon, and investors are surely wondering whether Cloudflare will be able to fend off the e-commerce behemoth. Microsoft, which has invested in Cloudflare, also operates competing CDNs. Both Cloudflare and Amazon’s similarly named CloudFront launched in 2009. CloudFront is sold by Amazon through Amazon Web Services (AWS), the massive cloud-computing business that generated $26 billion in 2018. Cloudflare took an early lead and landed a big contract in 2015, when it partnered with search giant Baidu to provide services in China, a notoriously tricky market for US internet companies to enter. But CloudFront, which has the advantage of marketing to websites already hosted on AWS, has since eclipsed it.

Instacart

Private valuation: $7.9 billion

Target public market valuation: Unknown

S-1: Not yet filed

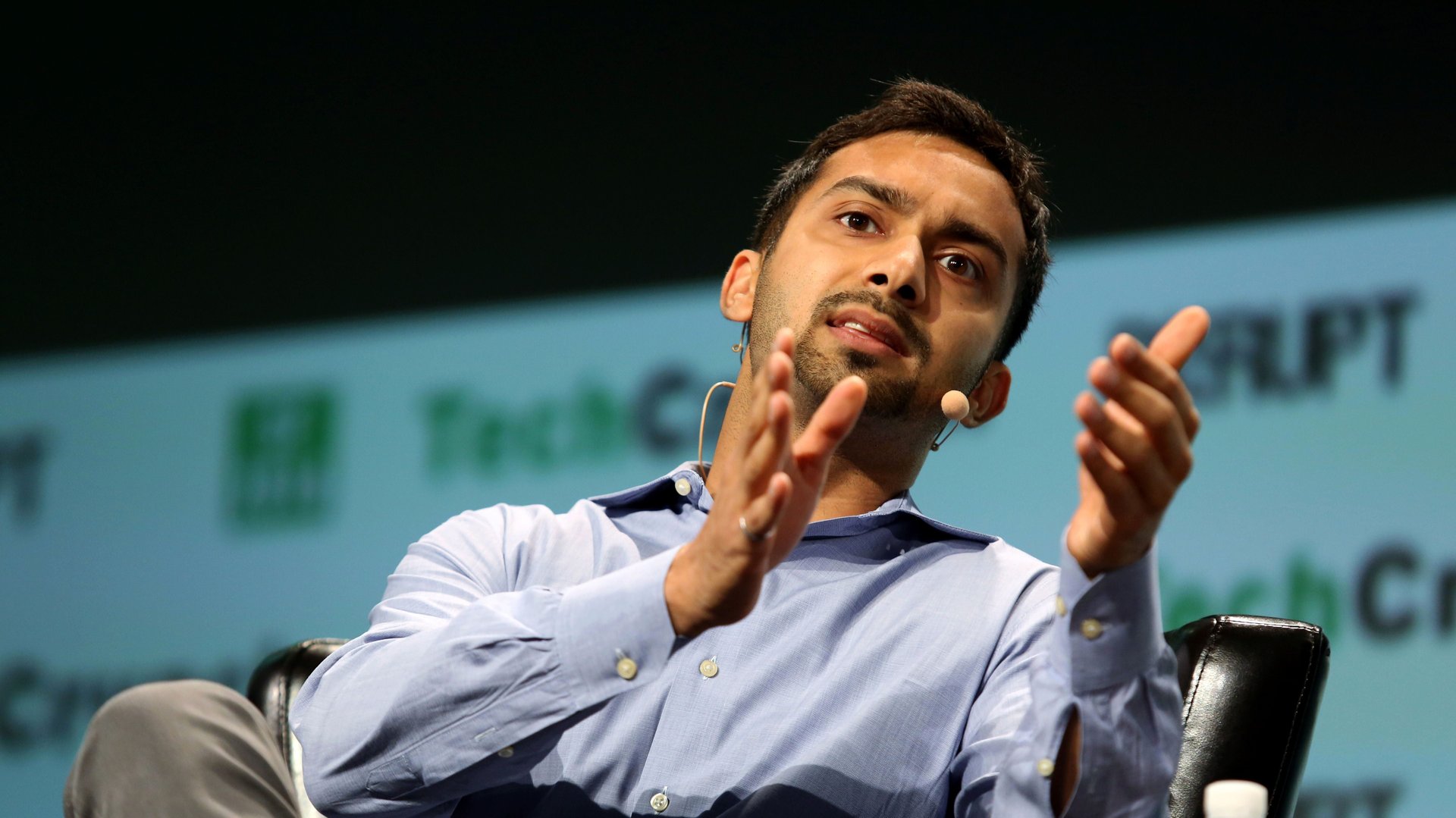

Key executives: Apoorva Mehta, co-founder and CEO; Ravi Gupta, chief financial officer and chief operating officer; Nilam Ganenthiran, chief business officer

Notable shareholders: Sequoia Capital, Kleiner Perkins, Khosla Ventures, Andreessen Horowitz

Other stuff to know: “An IPO is definitely on the horizon for us,” Instacart founder and CEO Apoorva Mehta told CNN Business in January. “As we think about building a long-term company, we think being a public company allows us to do that in the best possible way.” The grocery delivery startup has raised nearly $2 billion in funding to date, most recently in November 2018. Instacart smartly positioned itself as a tech-savvy ally for traditional brick-and-mortar grocers worried about fending off Amazon. That message paid dividends when Amazon bought Whole Foods Market in June 2017, a deal Mehta later likened to “a thermonuclear bomb against the entire grocery industry.”

Instacart has struggled to figure out the fundamentals of its business model. Grocery is a low-margin business, with the typical store keeping only 1% to 3% of what customers spend. With little fat to trim on actual grocery costs, Instacart has developed other revenue models, like revenue-sharing partnerships with stores and ads that help brands promote their products in its app. The company’s labor practices are also controversial. It hires many workers as independent contractors without benefits or minimum wage protection. In February, Instacart got caught using customer tips to subsidize worker wages, including one instance where it paid a worker $0.80 for 69 minutes of work because the customer left a $10 tip. Mehta apologized, calling the approach “misguided.”

Jumia

Private valuation: $1 billion

Target public market valuation: Unknown

S-1: Filed publicly March 12; read it here

Key executives: Sacha Poignonnec, co-founder and CEO; Jeremy Hodara, co-founder and CEO

Notable shareholders: Mastercard, MTN, Rocket Internet, Pernod Ricard SA, AXA, Millicom

Other stuff to know: Jumia, a conglomerate of e-commerce businesses including food delivery, real estate, and hotel and flight bookings, operates in 14 African countries including Nigeria, Kenya, Morocco, and Egypt, where it jointly boasts of 4 million active customers. After a decade of progressive growth in Africa’s tech ecosystems, Jumia’s IPO is a landmark event as, despite debates over Jumia’s definition as an African company, it represents the first major listing by an Africa-focused tech startup.

It’s especially notable given the difficulties e-commerce businesses across the continent face as they pursue scale and profits. While playing the long game offers future promise, present-day challenges are still significant. For its part, like many big-name tech companies set to launch IPOs this year, Jumia has gotten this far while racking up losses. Last year, its losses widened to $195.2 million on revenue of just $149.6 million, and as of Dec. 31, 2018, its S-1 filing showed the company had accumulated losses of nearly $1 billion since launch in 2012.

Read more on Quartz: What makes Africa’s largest e-commerce platform African? • Africa’s largest e-commerce company set to list on the New York Stock Exchange • Jumia’s IPO filing shows cost of cracking e-commerce across Africa • What it will cost to buy a share in Jumia for its $1.3 billion valuation • How AIG became Africa’s first billion-dollar e-commerce giant after overhauling its management

Lyft

Private valuation: $15 billion

Target public market valuation: $24 billion

S-1: Filed publicly March 1; read it here

Key executives: Logan Green, co-founder and CEO; John Zimmer, co-founder and president; Brian Roberts, chief financial officer

Notable shareholders: Rakuten, General Motors, Fidelity, Andreessen Horowitz, Alphabet, Ann Miura-Ko, Sean Aggarwal

Other stuff to know: Lyft operates only in the US, where it has always played second fiddle to Uber. In the beginning Lyft positioned itself as as the nice-guy alternative to Uber. It had riders greet their drivers with fist bumps and built a tipping option into its app long before Uber did the same. Lyft was less likely to cut fares than Uber, making drivers happier. And while Uber started as “everyone’s private driver,” shared rides were a priority from the outset at Lyft. Co-founders John Zimmer and Logan Green dabbled in shared rides with an earlier venture, Zimride, and liked to talk about their mission of putting more people into fewer cars.

Lyft debuted on the Nasdaq under the ticker “LYFT” on March 29, beating its chief rival to the public markets. The company’s IPO price of $72 a share valued it at up to $24 billion and it gained 8.7% in its first day of trading. The debut was a good sign for other money-losing consumer technology startups that plan to list in 2019. Lyft lost $911 million on $2.1 billion in revenue in 2018, up from a loss of $688 million on $1.1 billion in revenue the previous year. Company executives have reportedly told investors Lyft would be profitable faster if it weren’t investing in other transportation modes like scooters.

Read more on Quartz: Lyft warns it may never make money • Risk factors Lyft talks about that other companies don’t • The typical Lyft rider • How Lyft stacks up against Uber • How much it cost Lyft to double market share • Lyft drivers definitely aren’t getting rich off the company’s IPO • Lyft’s blockbuster IPO proves big losses are the new normal • The biggest winners of Lyft’s IPO

Palantir

Private valuation: $20.5 billion

Target public market valuation: Unknown

S-1: Not yet filed

Key executives: Alexander Karp, co-founder and CEO; Peter Thiel, co-founder and chairman; Stephen Cohen, co-founder and executive vice president

Notable shareholders: In-Q-Tel, Morgan Stanley, Fidelity, Founders Fund

Other stuff to know: Palantir is old for a “startup.” Founded in 2004 by billionaire investor Peter Thiel and some fellow PayPal alums, Palantir got its start parsing data for secretive government agencies like the CIA and NSA, and was rumored to have helped hunt down Osama bin Laden. It also works with corporate clients and civilian federal and state agencies. Palantir combs through financial documents, phone records, social media, airline reservations, and other data, then compiles digital dossiers on its targets. The company’s data mining capabilities have alarmed privacy advocates as much as they’ve wowed clients and investors. Palantir has raised $2.75 billion from more than 80 investors at a valuation topping $20 billion, according to research firm PitchBook. In January, the company discounted employee stock options after seven mutual funds slashed the value of their Palantir holdings.

Palantir has yet to report a profit. It brought in $880 million in revenue (paywall) in 2018, up from $600 million the year prior. The jump in revenue reflected significant growth in Palantir’s corporate business, which includes clients like Fiat Chrysler, Credit Suisse, and Morgan Stanley, and now accounts for roughly two-thirds of total revenue. Ahead of an IPO expected in the second half of the year, the company is building out a sales team and revamping Foundry, its data analytics software for large corporate clients. Foundry will likely prove more lucrative and less controversial than Palantir’s work for agencies like US Immigrations and Customs Enforcement. That could reassure investors in the absence of an official court ruling on whether Palantir’s methods are legal, or an unlawful intrusion under the US constitution.

Peloton

Private valuation: $4.2 billion

Target public market valuation: Unknown

S-1: Not yet filed

Key executives: John Foley, co-founder and CEO; Jill Woodworth, chief financial officer; Tom Cortese, co-founder and chief operating officer; Yony Feng, co-founder and chief technology officer

Notable shareholders: Fidelity, GGV, Tiger Global Management, True Ventures

Other stuff to know: New York-based Peloton makes stationary exercise bikes outfitted with video-streaming technology that retail for between $2,200 and $2,700. The company sells its bikes to consumers. Then on top of that it sells $39-a-month subscriptions to classes made with its own fitness instructors that can be streamed live at home. The company also recently launched a treadmill, and has a digital subscription offering that includes live and prerecorded classes for other types of exercise, such as yoga. It reportedly generated (paywall) more than $700 million in revenue for the fiscal year ended in February.

Peloton was founded in 2012 amid a boom in high-end boutique fitness programs. The company often draws comparisons to SoulCycle, which offers stationary biking classes with motivational instructors for around $35 a class. But Peloton has been more open in its pursuit of wealthy clientele, while SoulCycle long maintained its classes were for people of all backgrounds and income levels. SoulCycle filed for an IPO in 2015 but never completed the listing.

Private valuation: $12 billion

Target public market valuation: $9 billion

S-1: Filed publicly March 22; read it here

Key executives: Benjamin Silbermann, co-founder and CEO; Evan Sharp, co-founder and chief product officer; Paul Sciarra, co-founder

Notable shareholders: Benjamin Silbermann, Bessemer Venture Partners, FirstMark Capital, Andreessen Horowitz, Fidelity, Paul Sciarra, Valiant

Other stuff to know: Pinterest is a platform for design and ideas—the online equivalent of the bulletin board you once pinned pictures clipped from magazines to. It’s not quite a social network in that it doesn’t encourage chatter among users in the same way Facebook, Instagram, and Twitter do. Users can browse “pins”—picture-heavy posts searchable by topic and presented in no particular order—and save them to their personal “boards” for future reference.

Pinterest was founded in 2009 by Ben Silbermann, Evan Sharp, and Paul Sciarra. It primarily makes money from ads in the form of sponsored pins. The company has yet to become profitable, posting a net loss of $63 million in 2018 on $756 million in annual revenue. Pinterest had about 265 million monthly active users as of the fourth quarter of 2018. Its typical user is a millennial mom with above-average US household income, though lately its fastest growth has come from outside the US. Ahead of an IPO, Pinterest has tried to distance itself from social networks, which have struggled with how to moderate the content posted to their platforms. In February, Pinterest took the dramatic step of blocking all search results related to vaccinations (paywall) in order to halt the spread of misinformation on its site.

Read more on Quartz: Pinterest doesn’t want to be a social network • The average Pinterest user (spoiler, it’s a mom) • International growth is Pinterest’s biggest challenge • Pinterest’s Pinterest

Postmates

Private valuation: $1.9 billion

Target public market valuation: Unknown

S-1: Filed confidentially with the SEC in February

Key executives: Bastian Lehmann, co-founder and CEO; Kristin Schaefer, chief financial officer

Notable shareholders: Founders Fund, Spark Capital, Tiger Global Management

Other stuff to know: Postmates was founded in 2011 as a number of on-demand delivery companies were getting started. The company’s bread and butter is delivering takeout orders from restaurants, but it also delivers from pharmacies and grocery stores. Postmates’ couriers are classified as independent contractors. It generates revenue by padding orders with extra fees, such as a delivery fee and a separate service fee (tips are also separate). Such fees can easily make a Postmates order cost twice as much as a customer expected to pay. Postmates also offers a subscription product that costs $9.99 a month or $96 a year for free delivery on orders of more than $15.

Postmates, like many on-demand companies, has struggled to make its business model work. Co-founder and CEO Bastian Lehmann said Postmates would achieve profitability in 2016, 2017, and 2018, but the company has yet to deliver on that promise. The competition in food delivery is also stiff. Postmates’ challengers include DoorDash, UberEats, Caviar, and established industry leader Grubhub, the parent company of Seamless. Postmates most recently raised $100 million in January in a deal some interpreted as a chance for existing investors to get out before a public offering.

Robinhood

Private valuation: $5.6 billion

Target public market valuation: Unknown

S-1: Not yet filed

Key executives: Vlad Tenev, co-founder and co-CEO; Baiju Bhatt, co-founder and co-CEO

Notable shareholders: GV (Alphabet), Calvin Broadus (Snoop Dogg), Jared Leto, Jason Calacanis, New Enterprise Associates, Anthony Saleh, Index Ventures, Tim Draper, Roc Nation

Other stuff to know: Founded in 2013, Robinhood is a zero-commission retail brokerage platform for mobile and desktop that targets millennial investors. Through Robinhood, investors can purchase stocks, exchange-traded funds (ETFs), options, and cryptocurrencies. The company has approximately 500 full-time employees and claims to have 6 million customers. To generate revenue, Robinhood earns interest on uninvested cash in customer accounts, charges for regulatory fees incurred by any trades, and sells premium subscriptions ($10 to $200) to users who want to trade on margin (from $2,000 to $50,000). The company also sells its order flow, a controversial practice which may account for nearly 50% of the company’s revenue and threatens to undermine its otherwise populist reputation. Robinhood is growing aggressively and investing in its own infrastructure and licensing to cut future costs.

Robinhood was one of the first financial services companies to offer commission-free trading. As investors become “increasingly cost-conscious” (paywall), legacy competitors like Fidelity and Charles Schwab have also made hundreds of ETFs free to trade. Many of Robinhood’s peers, though, still charge $4.95 or more per trade. Other rivals include Chase, TD Ameritrade, Betterment, and Wealthfront. Robinhood is currently working on an in-house clearing system, which may further reduce its fees. Last spring, the company last raised $363 million at a $5.6 billion valuation, bringing its total financing to date to just over $500 million.

Slack

Private valuation: $7.1 billion

Target public market valuation: Unknown

S-1: Filed confidentially with the SEC in February

Key executives: Stewart Butterfield, co-founder and CEO; Allen Shim, chief financial officer; Cal Henderson, co-founder and chief technology officer; Neil Shah, director of business strategy

Notable shareholders: Andreessen Horowitz, Accel, GV, IVP, Kleiner Perkins, Social Capital

Other stuff to know: Slack is a workplace messaging program that aspires to replace email. The interface is known for its bright colors, whimsical design, and quirky notification choices, like displaying when “several people are typing.” The company’s candid co-founder and CEO Stewart Butterfield made Slack an instant media darling, as did its popularity in white-collar workplaces, including many newsrooms. The company is also a favorite among venture capitalists, with more than $1 billion in financing and a valuation topping $7 billion. Slack had more than 10 million daily active users and 85,000 paid customers as of early 2019.

Slack plans to complete a direct listing, in which existing investors can sell their shares but the company doesn’t hire underwriters or create any new stock, as is typical during an IPO. Direct listings don’t help companies raise money like other public offerings do, but are a good option for companies that want to go public mainly to help their employees cash out. Slack picked (paywall) the New York Stock Exchange for its debut, the same exchange that hosted Spotify’s direct listing in April 2018. It’s expected to go public sometime this summer.

Uber

Private valuation: $76 billion

Target public market valuation: $120 billion

S-1: Filed confidentially with the SEC in December 2018

Key executives: Dara Khosrowshahi, CEO; Nelson Chai, chief financial officer; Barney Harford, chief operating officer; Thuan Pham, chief technology officer; Tony West, chief legal officer

Notable shareholders: Softbank, Benchmark, Saudi Public Investment Fund, Travis Kalanick, co-founder and former CEO; Garrett Camp, co-founder

Other stuff to know: Uber is a ride-hail company that operates globally. It also has a large food delivery business, UberEats, and a driverless car research effort. Uber hires independent contractors as drivers and delivery people, who facilitate its services for riders and customers. The company has long maintained that it is not a taxi dispatch service, but simply a platform connecting two sides of a market. Uber co-founder and former chief executive Travis Kalanick, a pugnacious character, famously said he would take the company public as “late as humanly possible.” Kalanick was ousted in June 2017 over alleged sexual harassment at Uber and multiple businesses practices that triggered US federal probes. He was also sued by Benchmark, a venture-capital firm and major Uber investor.

Uber’s current CEO, Dara Khosrowshahi, took over in September 2017 and has received generally positive feedback from employees. Khosrowshahi set a goal for Uber to go public in 2019. After filing confidential draft paperwork in December, the company is expected to unveil its filing and begin an investor road show this month. To prepare for its debut, Uber has settled legal bills, reconciled with regulators, and cleaned up its accounting practices. Uber is pushing a narrative that it is more than a rides company: It has investments in electric bikes and scooters, a trucking platform, and a nascent on-demand staffing business. The company lost $870 million on $3 billion in revenue in the fourth quarter of 2018, according to unaudited financials it disclosed in February. It had $6.4 billion in cash on hand.

The We Company

Private valuation: $47 billion

Target public market valuation: Unknown

S-1: Not yet filed

Key executives: Adam Neumann, co-founder and CEO; Miguel McKelvey, co-founder and chief culture officer; Artie Minson, president and chief financial officer

Notable shareholders: Softbank, Benchmark, T. Rowe Price, Fidelity, JPMorgan Chase, Goldman Sachs, Harvard Management Company

Other stuff to know: The We Company, formerly known as WeWork, is a premium office-space rental company, catering to startups and millennials with amenities like fruit water and beer-on-tap. The company also operates WeLive, which rents and manages dorm-like apartments, and WeGrow, a nascent pre-K business. (The core office rental operation is still known as WeWork.) WeWork doesn’t own most of its office buildings, but rents them long-term from landlords and then sub-contracts them out to clients on a short-term basis. In New York City’s Manhattan borough, where WeWork is the biggest private tenant, prices start at $190 a month for a flexible “hot desk” arrangement and $690 a month for a small private office.

Founded in 2010, the We Company has raised $8.4 billion to date at a valuation of $47 billion. It was in talks to raise $16 billion from Softbank in a deal that would have given the Japanese tech conglomerate ownership of most of WeWork, but Softbank scrapped the plan (paywall) in January and invested $2 billion instead. WeWork lost $1.9 billion (paywall) in 2018, double its loss from the year before, even though revenue also more than doubled to $1.8 billion. The company said it had more than 400,000 clients, which it calls members, as of December 2018, though its occupancy rate dipped to about 80% from 84% in the third quarter.

Zoom

Private valuation: $1 billion

Target public market valuation: Unknown

S-1: Filed publicly March 22; read it here

Key executives: Eric Yuan, founder and CEO; Janine Pelosi, chief marketing officer; Kelly Steckelberg, chief financial officer

Notable shareholders: Emergence Capital Partners, Sequoia Capital, Digital Mobile Venture, Bucantini Enterprises, Eric Yuan, Qualcomm Ventures

Other stuff to know: Zoom licenses video-conferencing software to companies of all sizes, with prices that range from $14.99 per host, per month to $19.99 per host, per month (you can also get a free personal meeting with up to 100 participates and a 40-minute limit). Zoom reported a net profit of $7.6 million on $331 million in revenue for the fiscal year ended Jan. 31, making it the rare tech IPO that is profitable. The company credits its success to “viral enthusiasm,” because people just get so excited when the video-conferencing software they’ve paid for actually allows them to video conference. Zoom thinks it has room to grow as more companies embrace remote work and rely on video-chatting to facilitate personal bonds between their employees.

Read more on Quartz: Zoom the rare tech IPO that is profitable

Matthew De Silva, Dave Gershgorn, and Yomi Kazeem contributed.